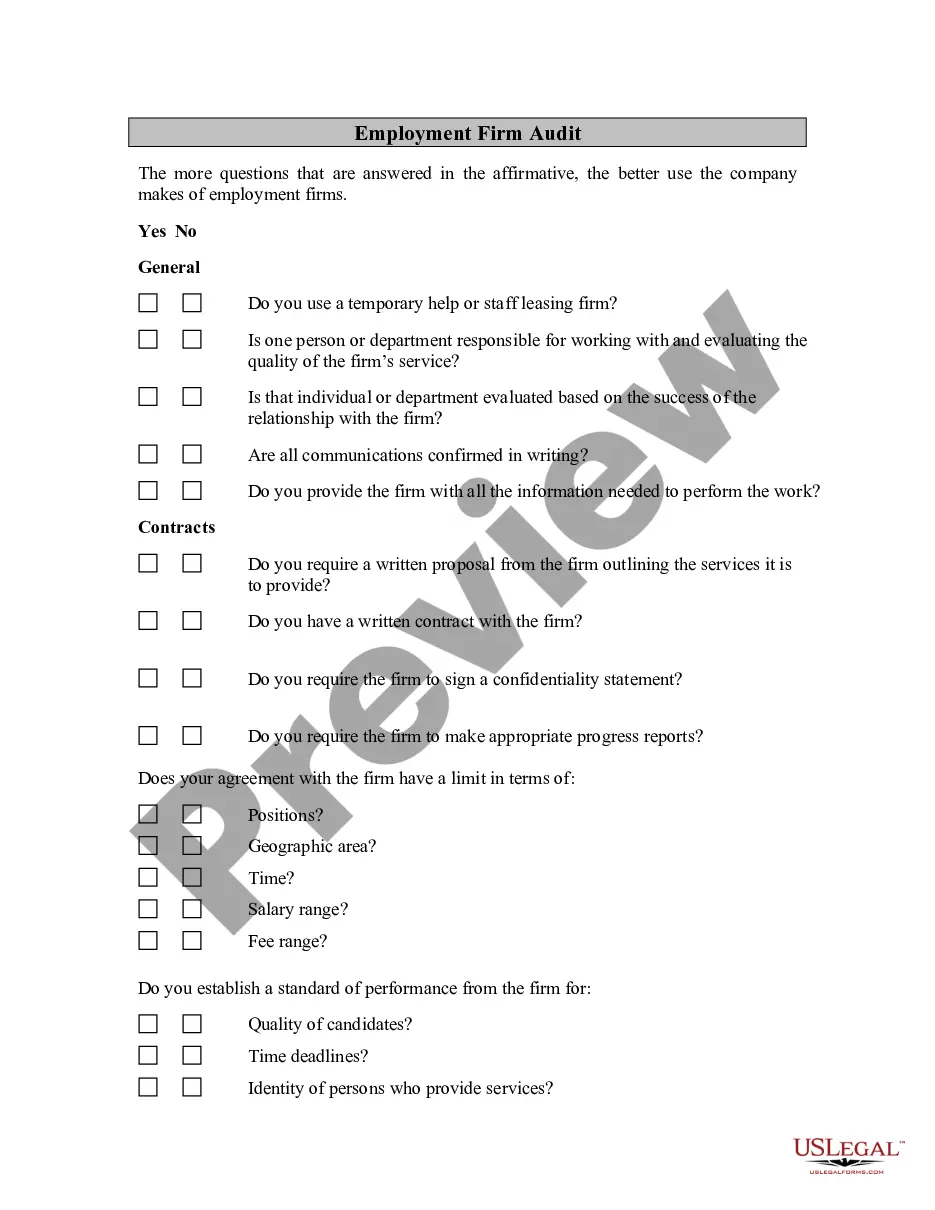

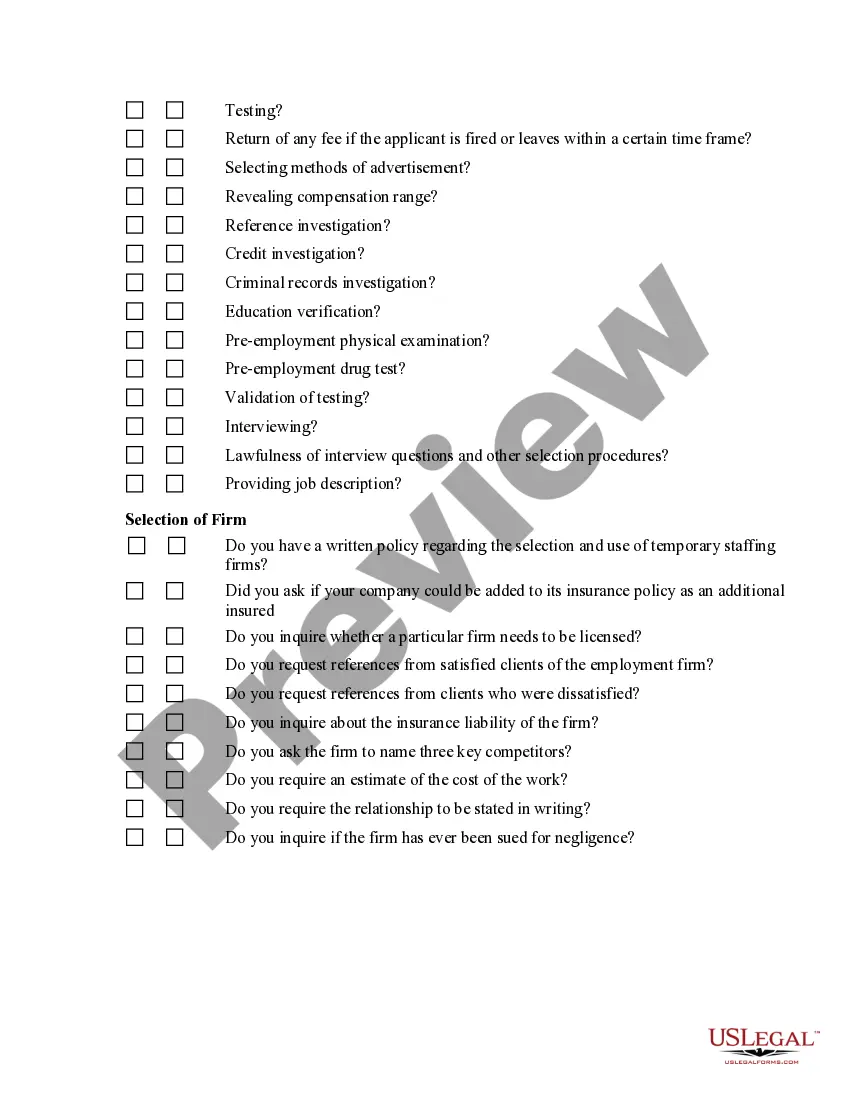

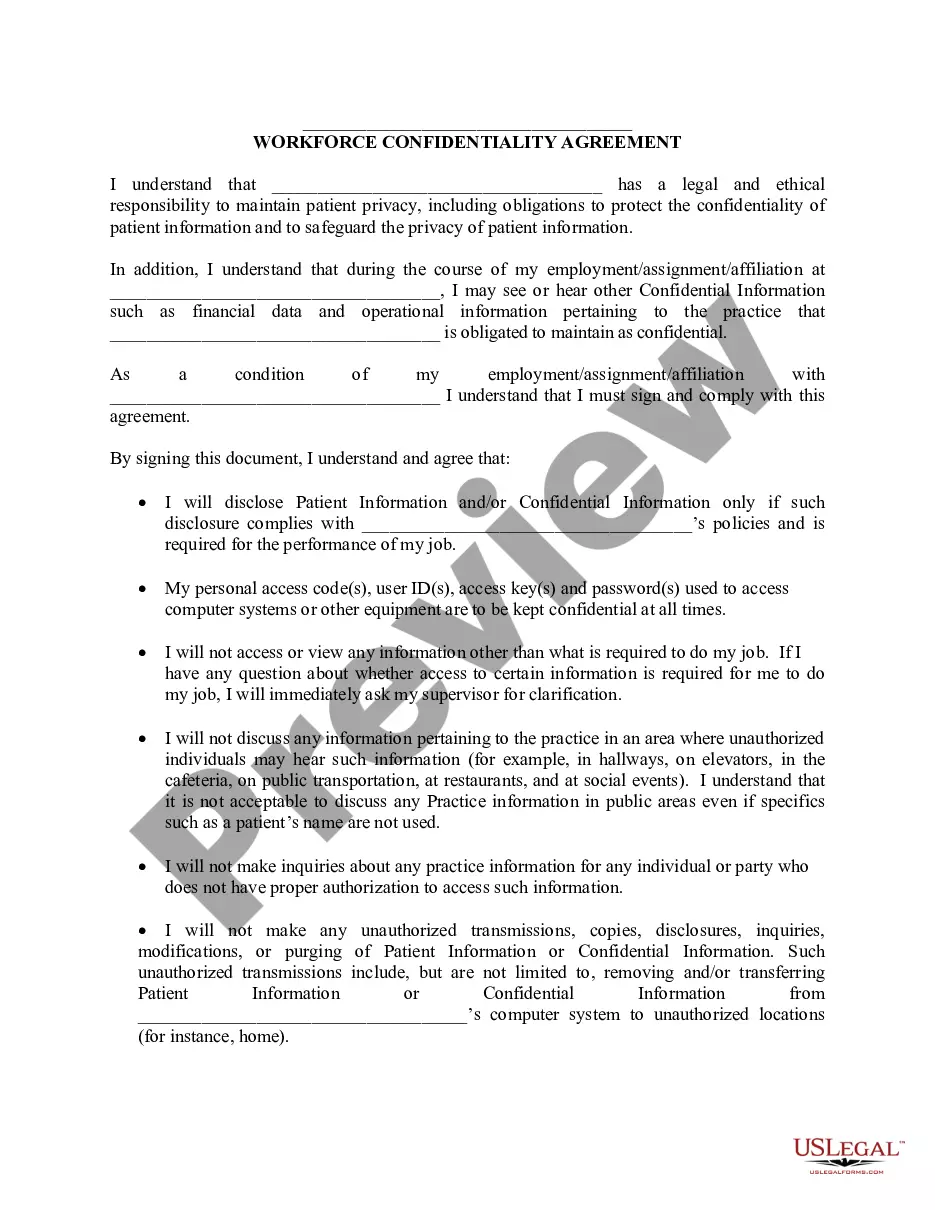

Minnesota Employment Firm Audit is a systematic examination and evaluation of the financial records, processes, and practices of an employment firm operating in the state of Minnesota. It aims to ensure compliance with local and federal laws, regulations, and industry standards, while also identifying areas of improvement and potential risks. Keywords: Minnesota, Employment Firm Audit, financial records, processes, practices, compliance, laws, regulations, industry standards, improvement, risks. 1. Types of Minnesota Employment Firm Audit: — Financial Audit: This type of audit focuses on examining the accuracy, completeness, and reliability of financial records, including income statements, balance sheets, cash flow statements, and related documentation. It ensures compliance with accounting principles and evaluates the overall financial health of the employment firm. — Tax Audit: A tax audit specifically targets the employment firm's tax-related records, including income tax returns, sales tax reports, payroll tax filings, and other relevant financial documents. It aims to determine if the firm is reporting and paying its taxes correctly and in adherence to Minnesota tax laws. — Compliance Audit: This type of audit evaluates the employment firm's compliance with local, state, and federal employment laws, such as the Fair Labor Standards Act (FLEA), Occupational Safety and Health Administration (OSHA) regulations, Equal Employment Opportunity Commission (EEOC) guidelines, and Minnesota-specific employment regulations. — Internal Control Audit: An internal control audit assesses the effectiveness and efficiency of the internal control systems in place within the employment firm. It focuses on evaluating the firm's processes, policies, and procedures to identify any weaknesses or deficiencies that could lead to fraud, errors, or misuse of resources. — IT Audit: An IT audit examines the information technology systems, infrastructure, and security measures within the employment firm to assess their reliability, confidentiality, integrity, and availability. It ensures that the firm's data, networks, and IT controls are adequately protected against unauthorized access or potential cyber threats. Each type of audit, whether financial, tax, compliance, internal control, or IT, plays a crucial role in ensuring the employment firm's operational efficiency, legal compliance, financial integrity, and risk mitigation in Minnesota. Employing the services of qualified auditors or audit firms specialized in each of these areas is essential to successfully navigate the audit process.

Minnesota Employment Firm Audit

Description

How to fill out Minnesota Employment Firm Audit?

Discovering the right legal record web template can be a struggle. Obviously, there are tons of templates available on the Internet, but how can you discover the legal form you will need? Utilize the US Legal Forms site. The support gives 1000s of templates, for example the Minnesota Employment Firm Audit, that you can use for enterprise and personal requirements. Every one of the types are checked out by pros and satisfy federal and state requirements.

If you are presently registered, log in in your accounts and then click the Download key to have the Minnesota Employment Firm Audit. Make use of your accounts to check from the legal types you may have purchased previously. Proceed to the My Forms tab of your own accounts and get another backup in the record you will need.

If you are a fresh consumer of US Legal Forms, listed here are easy instructions that you can comply with:

- Very first, ensure you have selected the correct form to your metropolis/area. You may look through the shape utilizing the Review key and read the shape description to ensure it is the right one for you.

- In case the form does not satisfy your preferences, make use of the Seach industry to get the proper form.

- Once you are certain the shape is proper, go through the Buy now key to have the form.

- Select the prices strategy you desire and type in the needed details. Design your accounts and pay money for your order utilizing your PayPal accounts or Visa or Mastercard.

- Pick the file structure and acquire the legal record web template in your device.

- Complete, edit and produce and signal the acquired Minnesota Employment Firm Audit.

US Legal Forms will be the most significant collection of legal types in which you can find different record templates. Utilize the company to acquire skillfully-made paperwork that comply with status requirements.