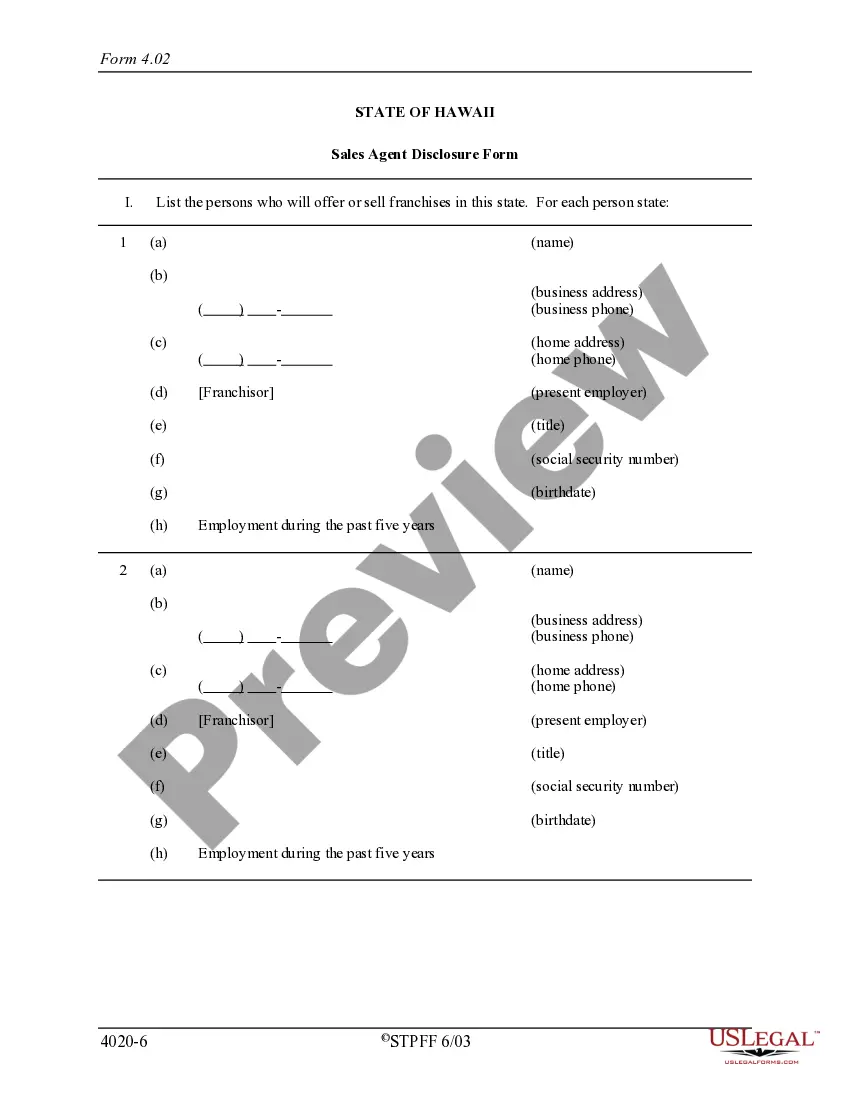

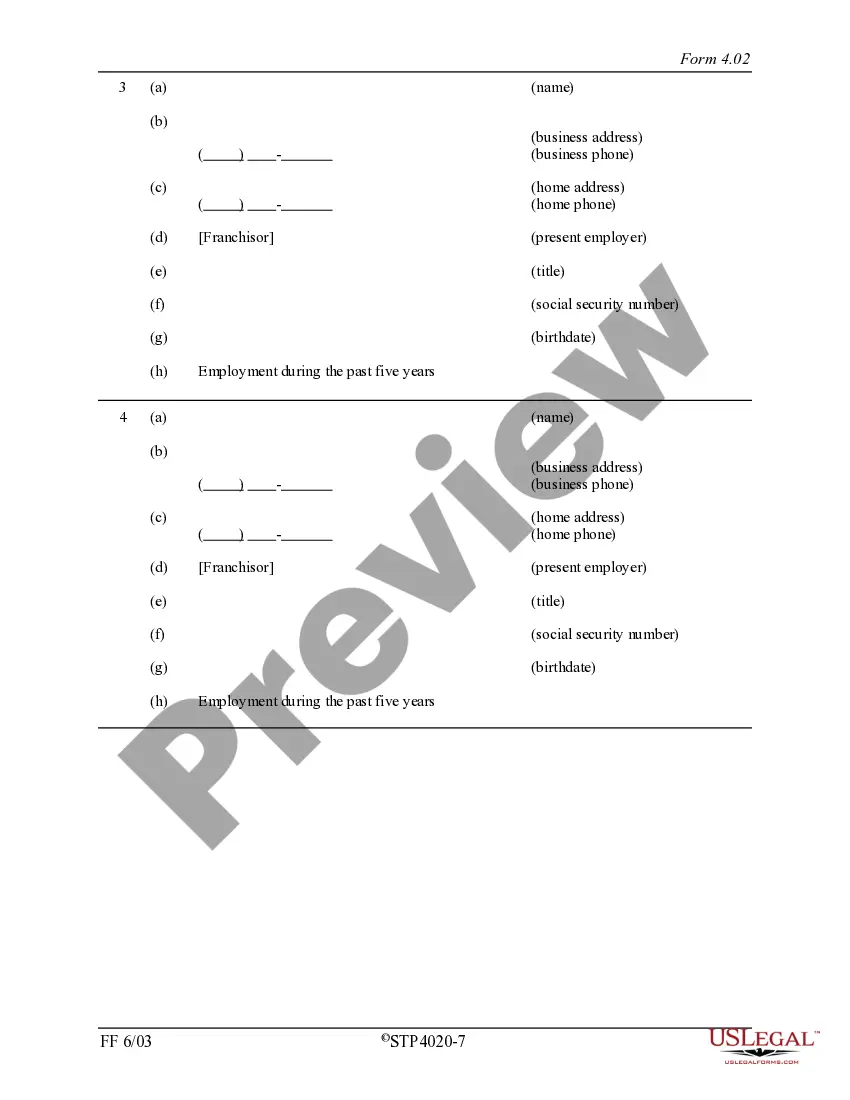

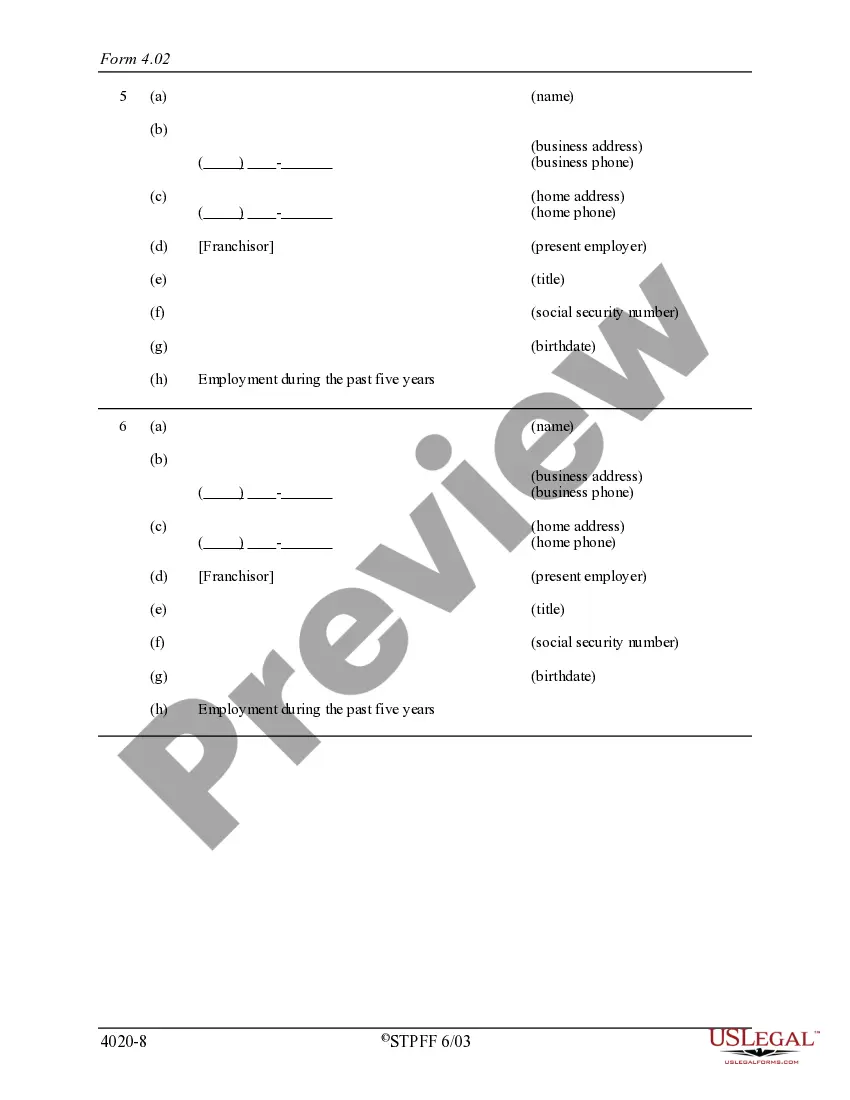

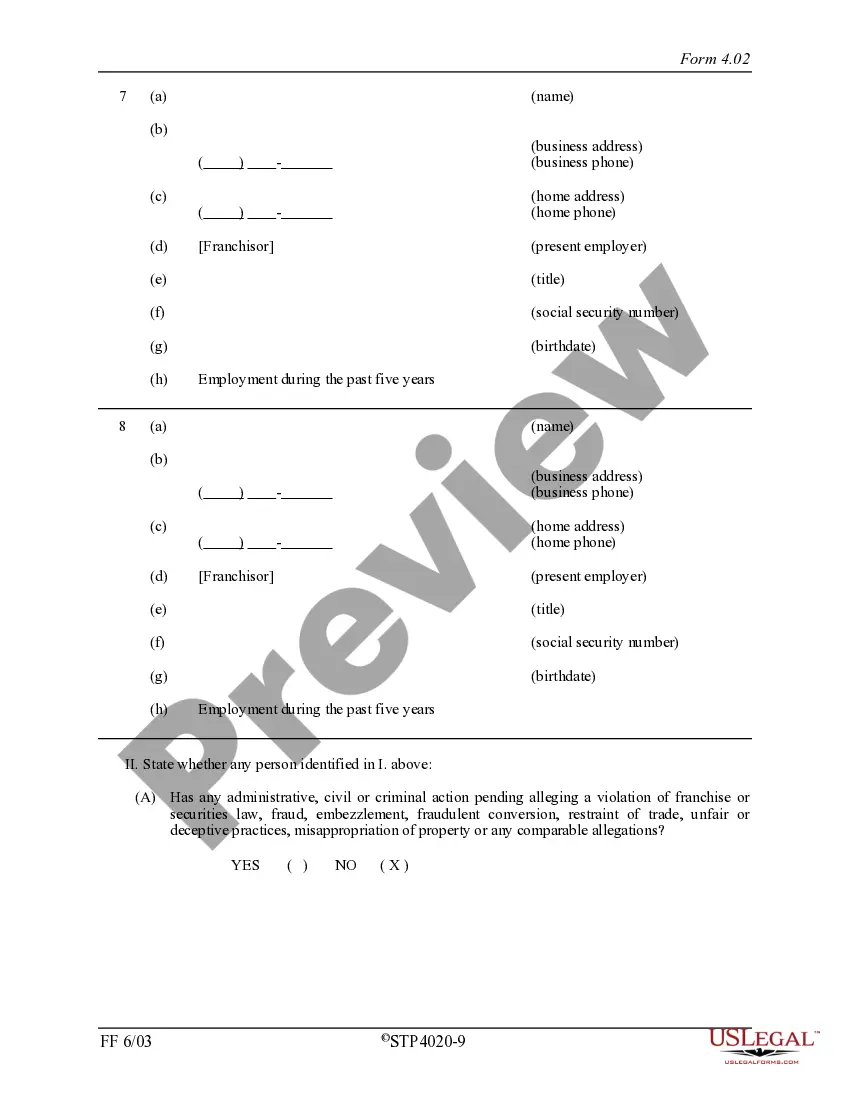

Title: Understanding Minnesota and Hawaii Registration for Offer Sale of Franchise or Supplemental Report to Registration Statement Introduction: The process of offering franchises for sale in different states requires businesses to comply with specific regulations and registration requirements. In this article, we will explore the detailed description of Minnesota and Hawaii's registration for the offer and sale of franchises, along with supplemental reports to registration statements. Understanding these regulations is crucial for businesses to successfully expand their franchise operations in these states. 1. Minnesota Registration for Offer and Sale of Franchise: Minnesota, like many other states, requires franchisors to register their franchise offerings before selling or offering franchises within the state. Here are a few key points to consider: a. Registration Process: Franchisors must file a franchise registration application with the Minnesota Department of Commerce, which includes disclosure documents and an application fee. The documents typically include Franchise Disclosure Document (ADD), financial statements, and other supporting materials. b. Franchise Disclosure Document (ADD): Minnesota follows the federal requirement of presenting a comprehensive ADD to potential franchisees. The ADD should include necessary information regarding the franchisor, its financial condition, obligations of both parties, terms, and conditions of the franchise agreement, etc. Compliance with the Federal Trade Commission's Franchise Rule is essential. c. Specific Filing Requirements: It is important to ensure that the required forms, fees, and supplemental materials are submitted accurately and timely. Failure to meet these requirements may result in delays or rejection of the registration application. 2. Supplemental Report to Registration Statement: In addition to the initial registration, both Minnesota and Hawaii require franchisors to file a supplemental report annually. This report serves as an update to the registration statement and must reflect any material changes in the franchise offering. a. Material Changes: Franchisors are obliged to report any changes that could affect the franchisees' decision-making process. This includes alterations in management, significant litigation, bankruptcies, modifications to the franchise agreement, the introduction of new franchise models, etc. b. Timeline and Filing Process: The annual supplemental report must be filed within a specific period, usually 90 days after the close of the franchisor's fiscal year. Ensuring accuracy and compliance with the filing process is crucial to maintain a valid registration. c. Penalties for Non-compliance: Failure to file the supplemental report within the specified timeframe can lead to penalties, fines, and potential suspension of franchise operations in the respective state. Conclusion: Minnesota and Hawaii have specific registration requirements for franchisors offering franchises for sale or operating within their jurisdictions. Adhering to these regulations is essential for businesses to establish a strong legal foundation and ensure compliance. Franchisors must carefully navigate the registration process and diligently file supplemental reports to maintain a valid and legally compliant franchise registration.

Minnesota Hawaii Registration for Offer Sale of Franchise or Supplemental Report to Registration Statement

Description

How to fill out Minnesota Hawaii Registration For Offer Sale Of Franchise Or Supplemental Report To Registration Statement?

US Legal Forms - one of several largest libraries of legitimate varieties in the States - gives an array of legitimate record templates you are able to obtain or printing. Making use of the web site, you may get a large number of varieties for company and personal uses, categorized by groups, suggests, or keywords and phrases.You will discover the latest versions of varieties much like the Minnesota Hawaii Registration for Offer Sale of Franchise or Supplemental Report to Registration Statement within minutes.

If you already have a subscription, log in and obtain Minnesota Hawaii Registration for Offer Sale of Franchise or Supplemental Report to Registration Statement from your US Legal Forms library. The Download key can look on each and every type you look at. You have access to all earlier acquired varieties inside the My Forms tab of the profile.

In order to use US Legal Forms the first time, listed below are straightforward instructions to help you get began:

- Make sure you have picked out the right type for your area/region. Click the Preview key to review the form`s articles. Read the type outline to actually have chosen the appropriate type.

- If the type does not satisfy your requirements, make use of the Lookup field at the top of the display to discover the one that does.

- If you are pleased with the form, validate your option by clicking the Buy now key. Then, opt for the prices prepare you want and offer your qualifications to sign up on an profile.

- Approach the purchase. Use your Visa or Mastercard or PayPal profile to perform the purchase.

- Choose the structure and obtain the form on the device.

- Make modifications. Complete, change and printing and indication the acquired Minnesota Hawaii Registration for Offer Sale of Franchise or Supplemental Report to Registration Statement.

Each design you put into your bank account lacks an expiration day and it is your own forever. So, if you want to obtain or printing an additional backup, just go to the My Forms area and click on on the type you require.

Obtain access to the Minnesota Hawaii Registration for Offer Sale of Franchise or Supplemental Report to Registration Statement with US Legal Forms, one of the most substantial library of legitimate record templates. Use a large number of expert and express-distinct templates that meet your business or personal demands and requirements.