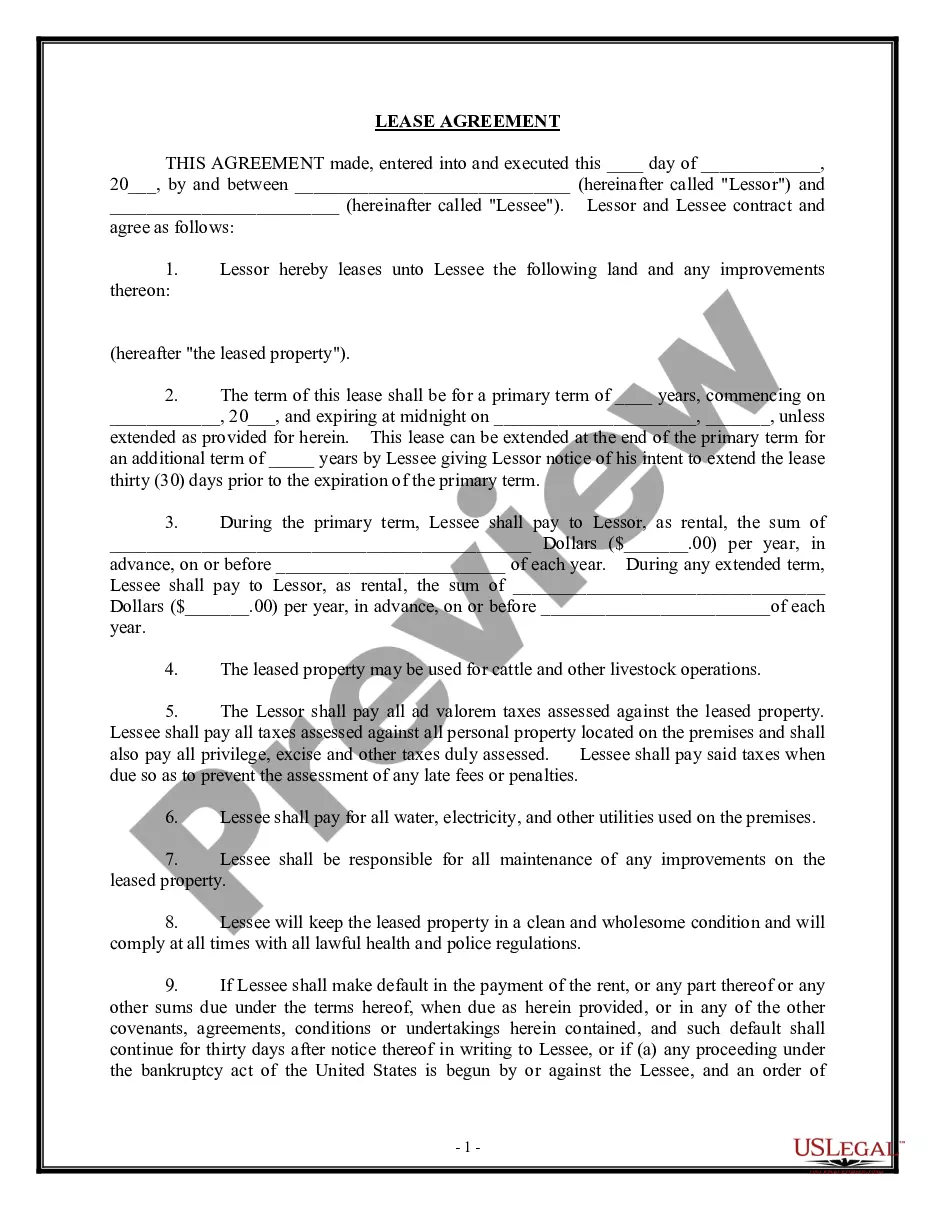

Minnesota Farm Lease or Rental — General refers to a legal agreement between a landowner or property owner (lessor) and a tenant or farmer (lessee) in the state of Minnesota. This written agreement outlines the terms and conditions under which the land is leased or rented for agricultural purposes. The Minnesota Farm Lease or Rental — General is designed to protect the interests of both parties involved and is used for various types of agricultural operations, such as crop production, livestock farming, dairy farming, poultry farming, or a combination of these activities. This lease can be either short-term or long-term, depending on the specific needs and objectives of the landowner and lessee. The agreement typically covers important aspects such as rental payments, lease duration, land use restrictions, maintenance responsibilities, insurance requirements, and termination clauses. It is essential for both parties to carefully negotiate and document each detail to avoid any potential conflicts or misunderstandings in the future. Different types of Minnesota Farm Lease or Rental — General may include: 1. Cash Rent Lease: This type of lease involves the tenant paying a fixed amount of money, referred to as cash rent, to the landowner as compensation for using the land. The tenant assumes the risks and benefits associated with farming, including market volatility and crop yield variations. 2. Crop Share Lease: In this arrangement, the landowner and lessee share the risks and returns of the agricultural enterprise. The tenant pays a portion of the harvested crops to the landowner as rent, rather than a fixed monetary amount. The crop share can be a percentage or a predetermined amount. 3. Flexible Cash Rent Lease: This type of lease provides flexibility in rental payments, where the tenant and landowner agree on a base cash rent amount but allow for adjustments based on factors such as commodity prices, crop yields, or input costs. 4. Pasture Lease: Specifically for grazing or raising livestock, this lease enables the tenant to use the land for grazing purposes while specifying the number of animals allowed, grazing periods, grazing methods, and maintenance obligations. 5. Farm Custom Work Agreement: This agreement entails a landowner hiring a tenant to perform specific farming tasks or services, such as tilling, planting, harvesting, or custom feeding. The compensation is typically in the form of cash or a percentage of the value of the work performed. It is important for landowners and tenants to consult legal advisors or agricultural experts to ensure compliance with Minnesota state laws and regulations when drafting and executing a Farm Lease or Rental — General contract. Local resources such as Minnesota University Extension or the Minnesota Department of Agriculture can provide additional guidance and templates for these agreements.

Minnesota Farm Lease or Rental - General

Description

How to fill out Minnesota Farm Lease Or Rental - General?

US Legal Forms - one of several greatest libraries of authorized forms in the USA - offers a variety of authorized papers templates you can acquire or printing. Utilizing the web site, you can get a large number of forms for company and personal functions, categorized by classes, claims, or search phrases.You will find the most recent versions of forms just like the Minnesota Farm Lease or Rental - General within minutes.

If you currently have a subscription, log in and acquire Minnesota Farm Lease or Rental - General from the US Legal Forms catalogue. The Acquire option will show up on every form you view. You gain access to all in the past downloaded forms from the My Forms tab of your own bank account.

In order to use US Legal Forms the first time, allow me to share straightforward recommendations to help you started off:

- Make sure you have picked the best form for the town/state. Select the Review option to analyze the form`s content. Look at the form outline to ensure that you have chosen the appropriate form.

- In the event the form does not match your requirements, make use of the Lookup area on top of the screen to get the the one that does.

- In case you are happy with the shape, verify your decision by clicking on the Purchase now option. Then, pick the costs program you want and supply your qualifications to register for the bank account.

- Method the deal. Utilize your bank card or PayPal bank account to finish the deal.

- Choose the file format and acquire the shape on your own system.

- Make modifications. Complete, edit and printing and indicator the downloaded Minnesota Farm Lease or Rental - General.

Every single design you added to your money does not have an expiry date and it is your own forever. So, if you want to acquire or printing yet another duplicate, just go to the My Forms segment and then click around the form you want.

Get access to the Minnesota Farm Lease or Rental - General with US Legal Forms, by far the most considerable catalogue of authorized papers templates. Use a large number of skilled and condition-distinct templates that meet your small business or personal demands and requirements.