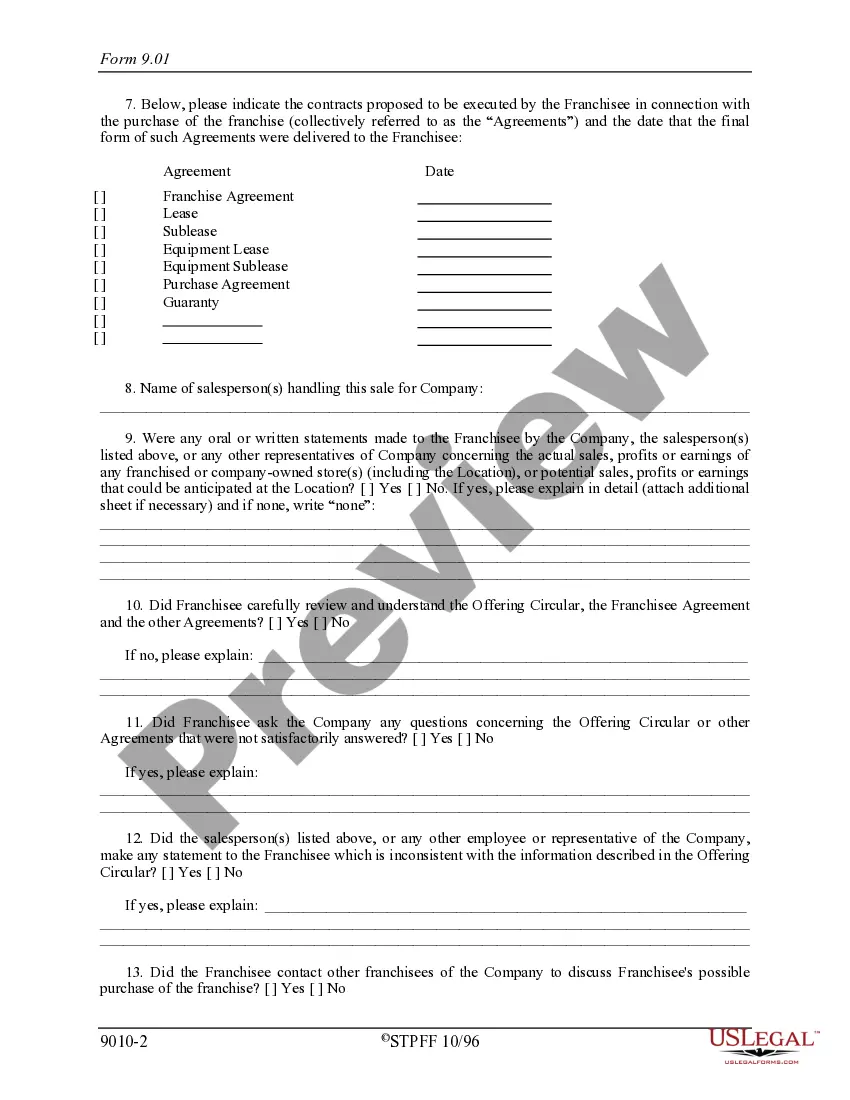

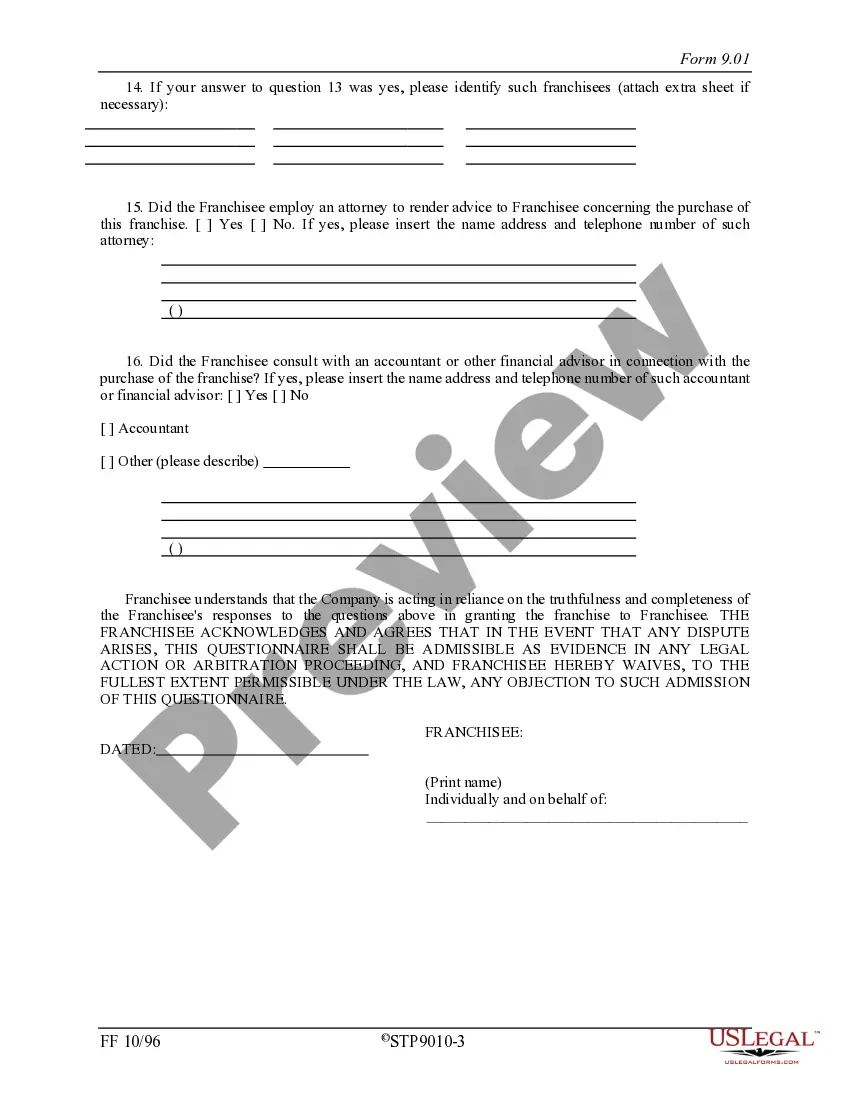

The Minnesota Franchisee Closing Questionnaire is a comprehensive document that serves as a tool for gathering important information and assessing the state of affairs when a franchisee decides to close their business in Minnesota. This questionnaire aims to provide a structured framework to capture relevant details pertaining to the franchisee's decision, as well as evaluate the overall performance and operations of the franchise. The Minnesota Franchisee Closing Questionnaire covers various aspects of the closure process, including financial matters, legal obligations, and operational considerations. In order to ensure a smooth and efficient closure, franchisees are required to complete this questionnaire to the best of their abilities and provide accurate information. Key areas of the Minnesota Franchisee Closing Questionnaire include: 1. Financial Information: This section seeks detailed financial data such as sales figures, profit/loss statements, outstanding debts, inventory valuation, and obligations to suppliers or creditors. 2. Lease and Tenancy: Franchisees are required to disclose lease agreements, conditions, and any pending obligations related to the premises. This includes details on property owners, lease expiration dates, and potential sublease opportunities. 3. Intellectual Property and Contracts: Franchisees must outline any contracts, licenses, or agreements related to intellectual property, trademarks, patents, or proprietary information that may have been granted or signed during the tenure of the franchise. 4. Staffing and Employee Matters: This section addresses workforce-related concerns, including the number of employees, their roles, employment contracts, outstanding salaries, benefit plans, and any potential severance obligations. 5. Inventory and Assets: Franchisees must provide a comprehensive inventory list, highlighting the current stock, equipment, and assets owned by the franchise. 6. Compliance and Legal Obligations: This section focuses on regulatory compliance, including licenses, permits, tax obligations, and pending legal matters involving any disputes or litigation. 7. Marketing and Advertising: The questionnaire aims to capture information on advertising agreements, outstanding marketing expenses, and any pending campaigns or promotional activities scheduled to conclude after the closure. It is important to note that depending on the specific franchisor or the nature of the franchise business, there might be variations or additional sections in the Minnesota Franchisee Closing Questionnaire tailored to specific industry requirements. However, the focus remains the same — to gather a comprehensive overview of the franchisee's situation to ensure compliance with all legal and financial obligations and facilitate a smooth transition throughout the closure process.

Minnesota Franchisee Closing Questionnaire

Description

How to fill out Minnesota Franchisee Closing Questionnaire?

Have you been inside a situation where you will need papers for both enterprise or person functions virtually every day? There are tons of lawful file web templates available online, but discovering kinds you can trust is not easy. US Legal Forms delivers a huge number of form web templates, much like the Minnesota Franchisee Closing Questionnaire, that are created to satisfy federal and state demands.

If you are presently familiar with US Legal Forms site and also have a merchant account, merely log in. After that, you can download the Minnesota Franchisee Closing Questionnaire template.

Unless you provide an bank account and would like to start using US Legal Forms, follow these steps:

- Discover the form you need and make sure it is for the correct town/area.

- Use the Review option to examine the form.

- See the description to ensure that you have chosen the proper form.

- In case the form is not what you are looking for, use the Lookup discipline to discover the form that meets your requirements and demands.

- Once you find the correct form, click on Purchase now.

- Pick the prices program you would like, submit the desired information and facts to generate your money, and pay money for the order utilizing your PayPal or bank card.

- Pick a hassle-free paper structure and download your backup.

Get all the file web templates you possess bought in the My Forms food selection. You may get a extra backup of Minnesota Franchisee Closing Questionnaire whenever, if possible. Just click the required form to download or produce the file template.

Use US Legal Forms, by far the most comprehensive selection of lawful forms, to save lots of time as well as prevent mistakes. The service delivers skillfully manufactured lawful file web templates that can be used for a range of functions. Make a merchant account on US Legal Forms and start creating your life easier.