Minnesota Information Sheet — When are Entertainment Expenses Deductible and Reimbursable: Keywords: Minnesota, information sheet, entertainment expenses, deductible, reimbursable. Description: The Minnesota Information Sheet — When are Entertainment Expenses Deductible and Reimbursable is a comprehensive guide that outlines the rules and regulations regarding the deduction and reimbursement of entertainment expenses in the state of Minnesota. 1. Types of Entertainment Expenses: — Business Meetings: Expenses incurred for entertainment directly related to the conduct of business meetings, such as meals, can be deductible and reimbursable. — Client Entertainment: Expenses for entertaining clients or potential business partners may be deductible if they are directly related to the promotion or generation of revenue for your business. — Employee Entertainment: Expenses incurred during employee entertainment, such as celebrations or team-building events, may qualify for deduction and reimbursement under certain conditions. 2. Deductible Entertainment Expenses: — The Minnesota Department of Revenue allows businesses to deduct expenses that are ordinary and necessary for the operation of the business. Deductible entertainment expenses must meet specific requirements. These may include meetings held at a restaurant, food and beverages provided during a business discussion or negotiation, and tickets to events that are directly related to the business discussion. 3. Reimbursable Entertainment Expenses: — In accordance with the Minnesota Department of Revenue guidelines, businesses can also reimburse employees for legitimate entertainment expenses. It is important to maintain proper documentation, including receipts and a clear business purpose, for these expenses to be reimbursable. 4. Reducibility Limitations: — Minnesota imposes certain limitations on the reducibility of entertainment expenses. The IRS allows for a deduction of up to 50% of the entertainment expense, but the state of Minnesota may have additional limitations or disallowances. It is crucial to consult with a tax professional or refer to the official Minnesota Information Sheet for the most up-to-date information regarding deduction limitations. 5. Record-Keeping Requirements: — To ensure threducibilityty and reimbursement of entertainment expenses, businesses must maintain accurate records. This includes keeping receipts, invoices, or other written evidence of the expenses, as well as documentation that establishes the business relationship or purpose for the entertainment. The Minnesota Information Sheet — When are Entertainment Expenses Deductible and Reimbursable serves as a valuable resource for businesses and individuals in Minnesota who need guidance on properly accounting for and maximizing deductions and reimbursements related to entertainment expenses. Always consult with a tax professional or refer to official state documents for the most accurate and updated information.

Minnesota Information Sheet - When are Entertainment Expenses Deductible and Reimbursable

Description

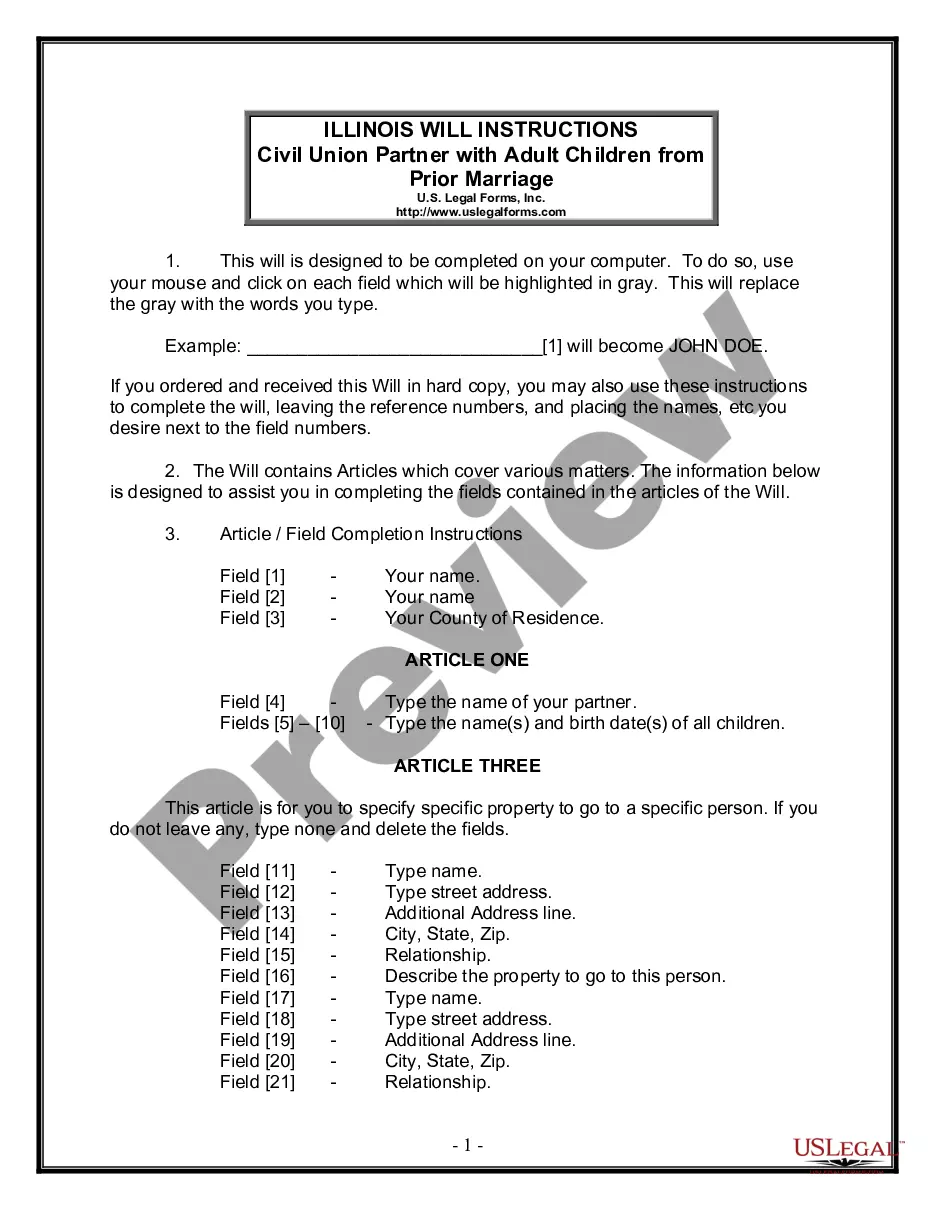

How to fill out Minnesota Information Sheet - When Are Entertainment Expenses Deductible And Reimbursable?

If you want to total, down load, or print out legitimate document templates, use US Legal Forms, the greatest variety of legitimate types, that can be found on-line. Use the site`s basic and convenient research to obtain the papers you need. A variety of templates for organization and person purposes are sorted by classes and says, or search phrases. Use US Legal Forms to obtain the Minnesota Information Sheet - When are Entertainment Expenses Deductible and Reimbursable with a few click throughs.

If you are currently a US Legal Forms consumer, log in to the bank account and click on the Down load option to find the Minnesota Information Sheet - When are Entertainment Expenses Deductible and Reimbursable. You can even access types you earlier saved inside the My Forms tab of your bank account.

Should you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have chosen the form for that proper metropolis/country.

- Step 2. Make use of the Preview solution to check out the form`s content material. Never neglect to read the outline.

- Step 3. If you are unhappy with all the type, take advantage of the Search area on top of the screen to locate other models in the legitimate type web template.

- Step 4. When you have located the form you need, go through the Acquire now option. Opt for the prices strategy you like and add your credentials to register for an bank account.

- Step 5. Approach the purchase. You may use your Мisa or Ьastercard or PayPal bank account to perform the purchase.

- Step 6. Choose the format in the legitimate type and down load it on the device.

- Step 7. Full, modify and print out or indicator the Minnesota Information Sheet - When are Entertainment Expenses Deductible and Reimbursable.

Every legitimate document web template you purchase is yours forever. You possess acces to every type you saved in your acccount. Go through the My Forms section and pick a type to print out or down load once again.

Remain competitive and down load, and print out the Minnesota Information Sheet - When are Entertainment Expenses Deductible and Reimbursable with US Legal Forms. There are thousands of skilled and status-distinct types you can use for your organization or person demands.