Minnesota FCRA Disclosure and Authorization Statement

Description

How to fill out FCRA Disclosure And Authorization Statement?

If you want to complete, acquire, or print authentic document templates, utilize US Legal Forms, the largest assortment of lawful forms available online. Take advantage of the site's straightforward and user-friendly search to find the documents you need.

Various templates for corporate and personal purposes are organized by categories and claims, or keywords. Use US Legal Forms to obtain the Minnesota FCRA Disclosure and Authorization Statement with a few clicks.

If you are already a US Legal Forms client, Log Into your account and click the Get button to acquire the Minnesota FCRA Disclosure and Authorization Statement. You can also access forms you've previously purchased in the My documents section of your account.

Every legal document template you purchase is yours forever. You have access to every form you acquired within your account. Check the My documents section and choose a form to print or download again.

Be proactive and obtain, and print the Minnesota FCRA Disclosure and Authorization Statement with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

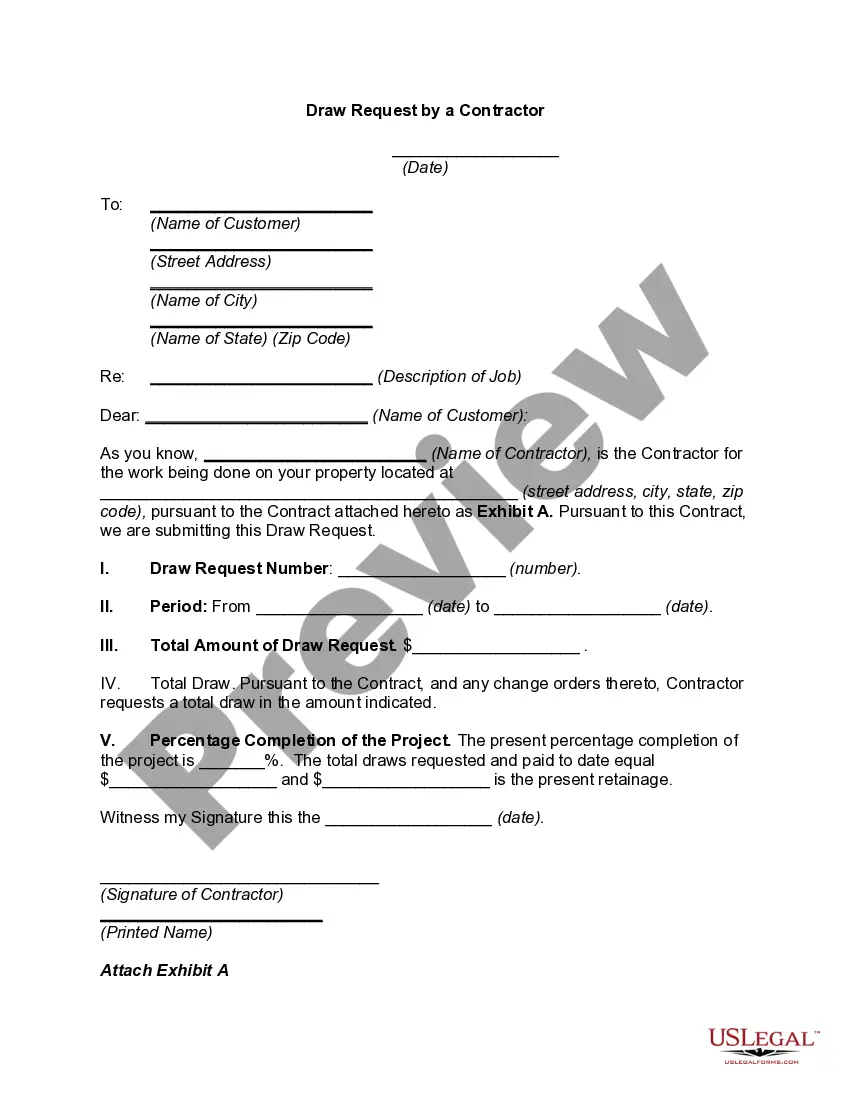

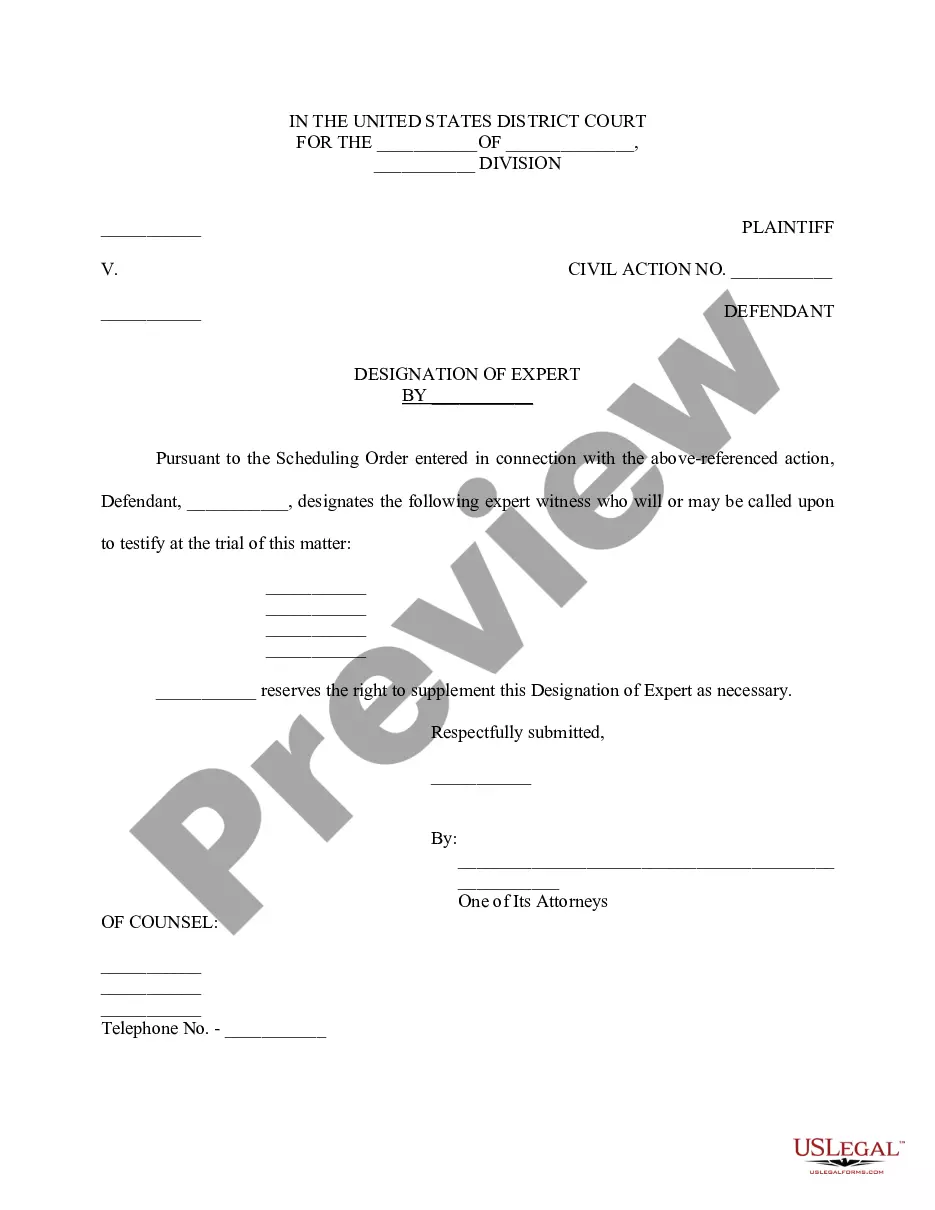

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Don’t forget to check the description.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find alternative versions of your legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Select the pricing plan you prefer and provide your information to register for an account.

- Step 5. Process the payment. You can use your Visa or Mastercard or PayPal account to complete the transaction.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Minnesota FCRA Disclosure and Authorization Statement.

Form popularity

FAQ

Four Basic Steps to FCRA ComplianceStep 1: Disclosure & Written Consent. Before requesting a consumer or investigative report, an employer must:Step 2: Certification To The Consumer Reporting Agency.Step 3: Provide Applicant With Pre-Adverse Action Documents.Step 4: Notify Applicant Of Adverse Action.

The primary law is the Fair Credit Reporting Act (FCRA). Among other things, the FCRA limits who can access your credit reports and for what purposes. Here are some of the rights provided to consumers under the FCRA: 1. Credit bureaus must provide your credit report to you when you ask for it.

FCRA Authorization: Obtain Permission for a Background Check A compliant FCRA authorization form is an acknowledgement that a pre-employment background check will be conducted. It can be presented as a self-contained document or jointly with an FCRA disclosure form.

Specifically, the FCRA requires that you must provide a clear and conspicuous written notice that consists solely of the disclosure. In other words, the disclosure must be (1) clear and conspicuous; and (2) exist as a standalone document.

FCRA compliance is required for any employer that partners with a background screening company to conduct pre-employment checks. Ironically, some of the simplest requirements of the FCRA are most often mishandled and become the basis of litigation.

613a Letter FCRA Purpose A 613 Letter serves as a notification that derogatory information was found in a criminal database background check that could influence their ability to be hired. Normally it is used to save time and money in verifying a record at the county court.

A Summary of Your Rights Under the Fair Credit Reporting Act. The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of. information in the files of consumer reporting agencies.

The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and. privacy of information in the files of consumer reporting agencies.

The Fair Credit Reporting Act (FCRA) is a federal law that helps to ensure the accuracy, fairness and privacy of the information in consumer credit bureau files. The law regulates the way credit reporting agencies can collect, access, use and share the data they collect in your consumer reports.