Minnesota Performance Evaluation for Exempt Employees

Description

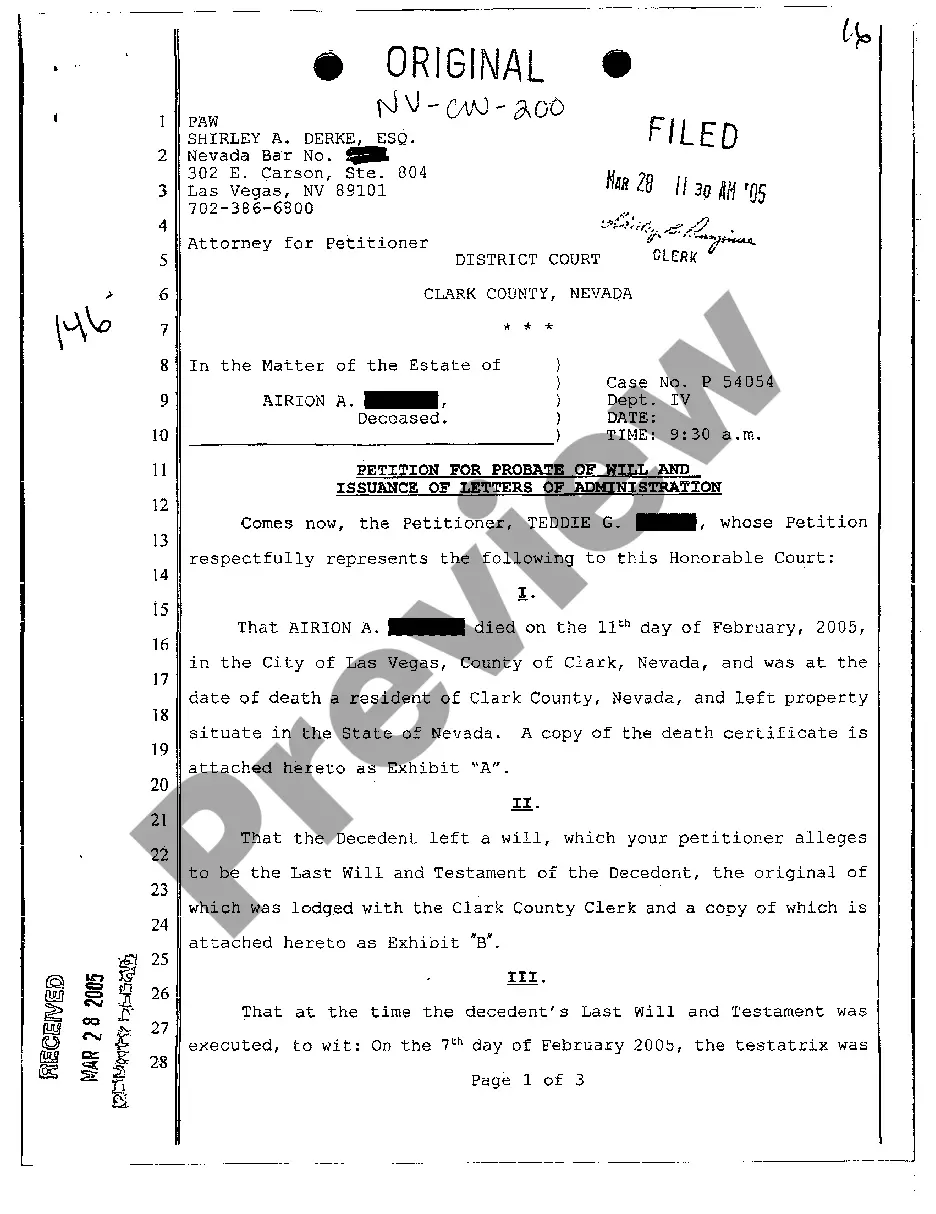

How to fill out Minnesota Performance Evaluation For Exempt Employees?

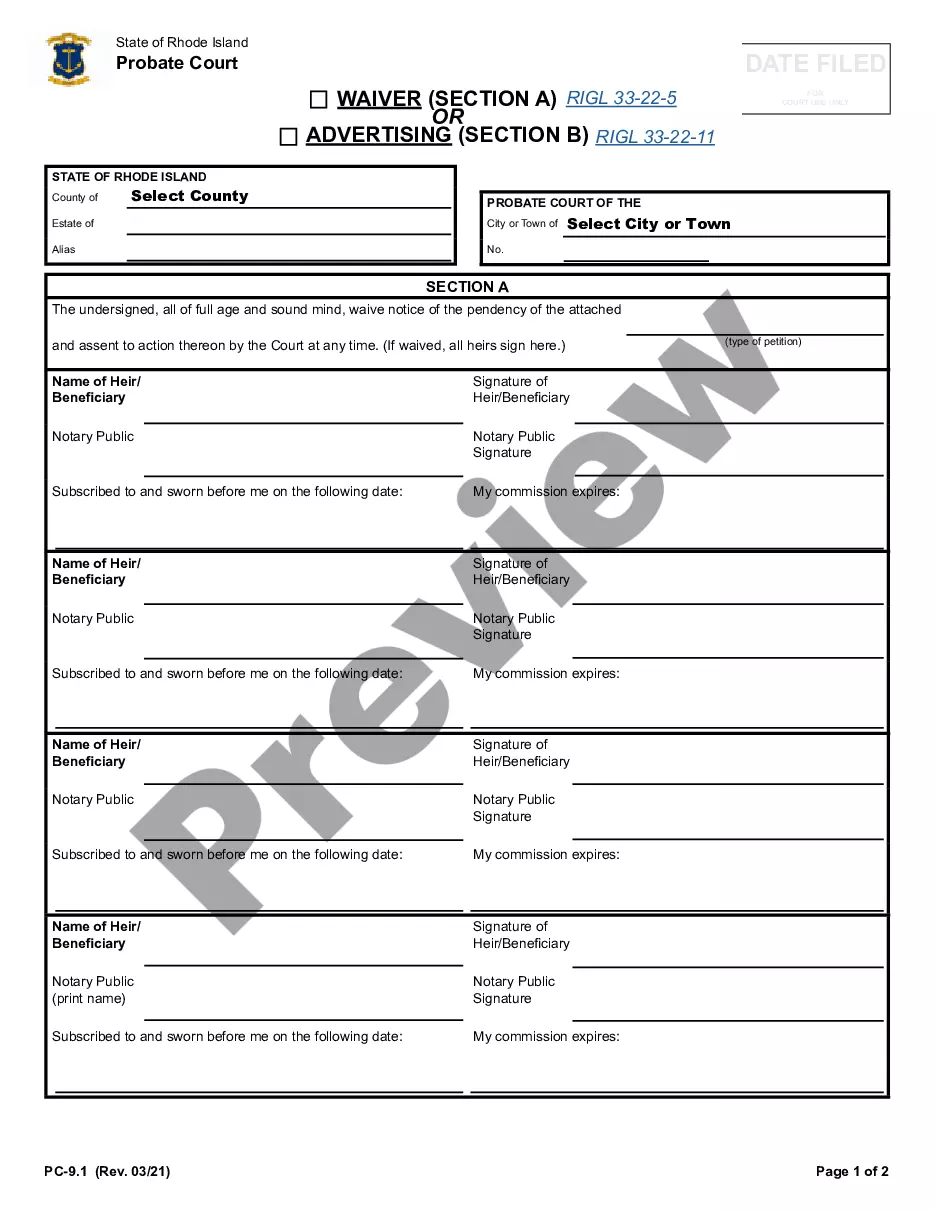

If you want to full, down load, or print authorized file templates, use US Legal Forms, the most important variety of authorized kinds, which can be found online. Utilize the site`s simple and practical search to obtain the paperwork you will need. A variety of templates for organization and individual uses are sorted by types and suggests, or keywords. Use US Legal Forms to obtain the Minnesota Performance Evaluation for Exempt Employees within a few click throughs.

If you are presently a US Legal Forms buyer, log in to your accounts and click the Acquire option to have the Minnesota Performance Evaluation for Exempt Employees. You can also access kinds you previously saved inside the My Forms tab of the accounts.

If you are using US Legal Forms the first time, follow the instructions beneath:

- Step 1. Make sure you have selected the form for that right town/land.

- Step 2. Use the Preview method to look through the form`s information. Don`t overlook to learn the description.

- Step 3. If you are not satisfied with the kind, make use of the Look for area at the top of the screen to locate other models from the authorized kind web template.

- Step 4. Upon having identified the form you will need, click the Get now option. Select the rates program you prefer and put your references to sign up for an accounts.

- Step 5. Procedure the deal. You can use your Мisa or Ьastercard or PayPal accounts to accomplish the deal.

- Step 6. Pick the file format from the authorized kind and down load it on your own system.

- Step 7. Full, revise and print or indicator the Minnesota Performance Evaluation for Exempt Employees.

Each authorized file web template you purchase is yours permanently. You possess acces to every kind you saved inside your acccount. Click on the My Forms portion and select a kind to print or down load yet again.

Be competitive and down load, and print the Minnesota Performance Evaluation for Exempt Employees with US Legal Forms. There are thousands of specialist and status-specific kinds you may use for your personal organization or individual needs.

Form popularity

FAQ

Employees will not be entitled to overtime where a contract pays an annual salary and the contract requires staff to be flexible. That being said employers need to be careful and ensure they are paying at least the National Minimum Wage according to the hours worked.

The federal exempt salary amount was increased to $684 a week Jan. 1, 2020. Additionally, while federal law allows some additional partial-day salary deductions for missed work hours due to FMLA leave, illness or disability, Minnesota law does not allow these same salary deductions.

Executives, administrators, and other professionals earning at least $455 per week do not have to be paid overtime under Section 13(a)(1) of the Fair Labor Standards Act. External salespeople (who often set their own hours) are also exempted from MN overtime requirements, as are some types of computer-related workers.

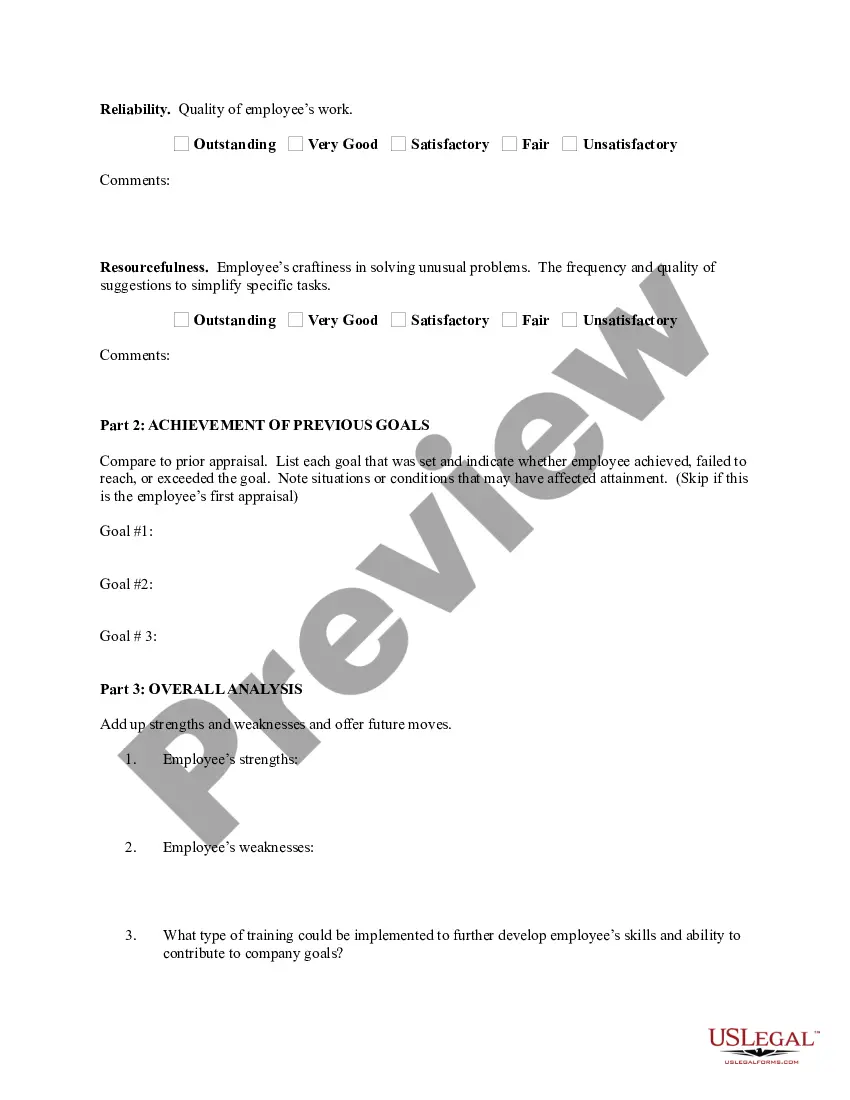

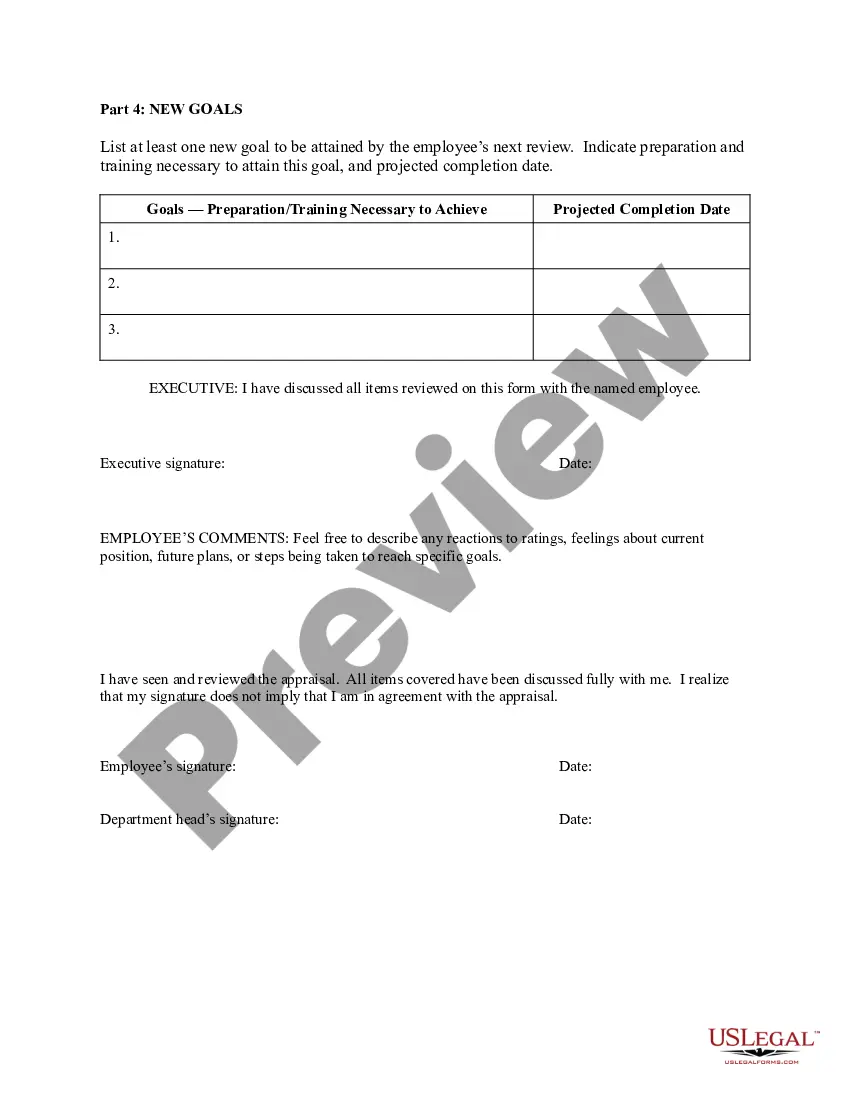

Whilst there is no legal requirement to carry out appraisals, it is good practice to do so as they enable employers to monitor and feedback on all employees' performance (not just those who are underperforming). They can also be used to evaluate pay increases and bonuses.

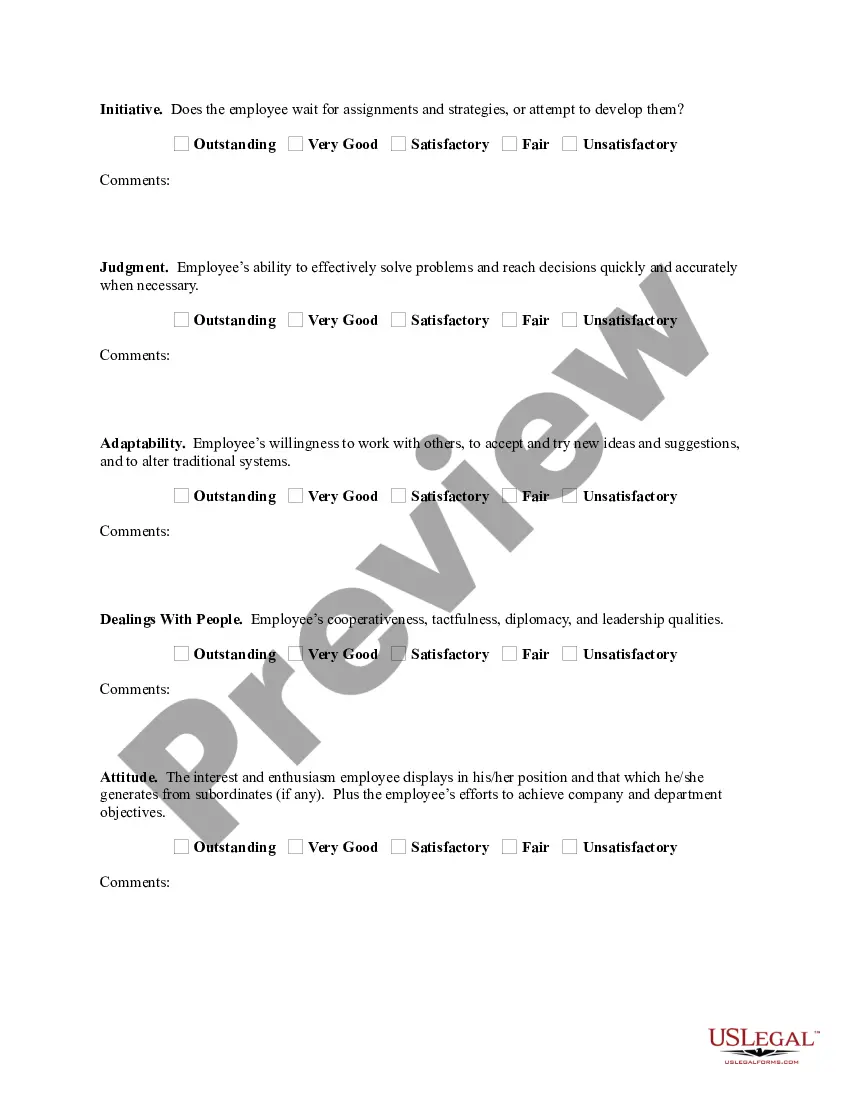

Performance evaluations benefit both employee and employer. It is a time to provide feedback, recognize quality performance and set expectations for future job performance. It is also a time to have candid conversations about performance that is lacking and how performance can be improved.

Your evaluation should focus on how well the employee performs their job, rather than their personality traits. When you make judgements about the employee's personality, they can feel attacked and the conversation can turn hostile.

The Fair Labor Standards Act (FLSA) does not require performance evaluations. Performance evaluations are generally a matter of agreement between an employer and employee (or the employee's representative).

An employee performance evaluation, also known as a performance review, is a process used by organizations to give employees feedback on their job performance and formally document that performance. Although companies determine their own evaluation cycles, most conduct employee performance evaluations once per year.

I am an employer and I want to put my employees on salary. Do I still have to pay overtime? Yes, overtime must be paid unless the worker is employed in agriculture or qualifies for exemption from minimum wage and overtime by the salary and duty tests for the executive, administrative or professional exemptions.

Appraisals should not be used to discriminate against employees on the basis of race, religion, age, gender, disability, marital status, pregnancy, or sexual preference. 3. Performance appraisal results should be fair, accurate and supported by evidence and examples.