Minnesota Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust

Description

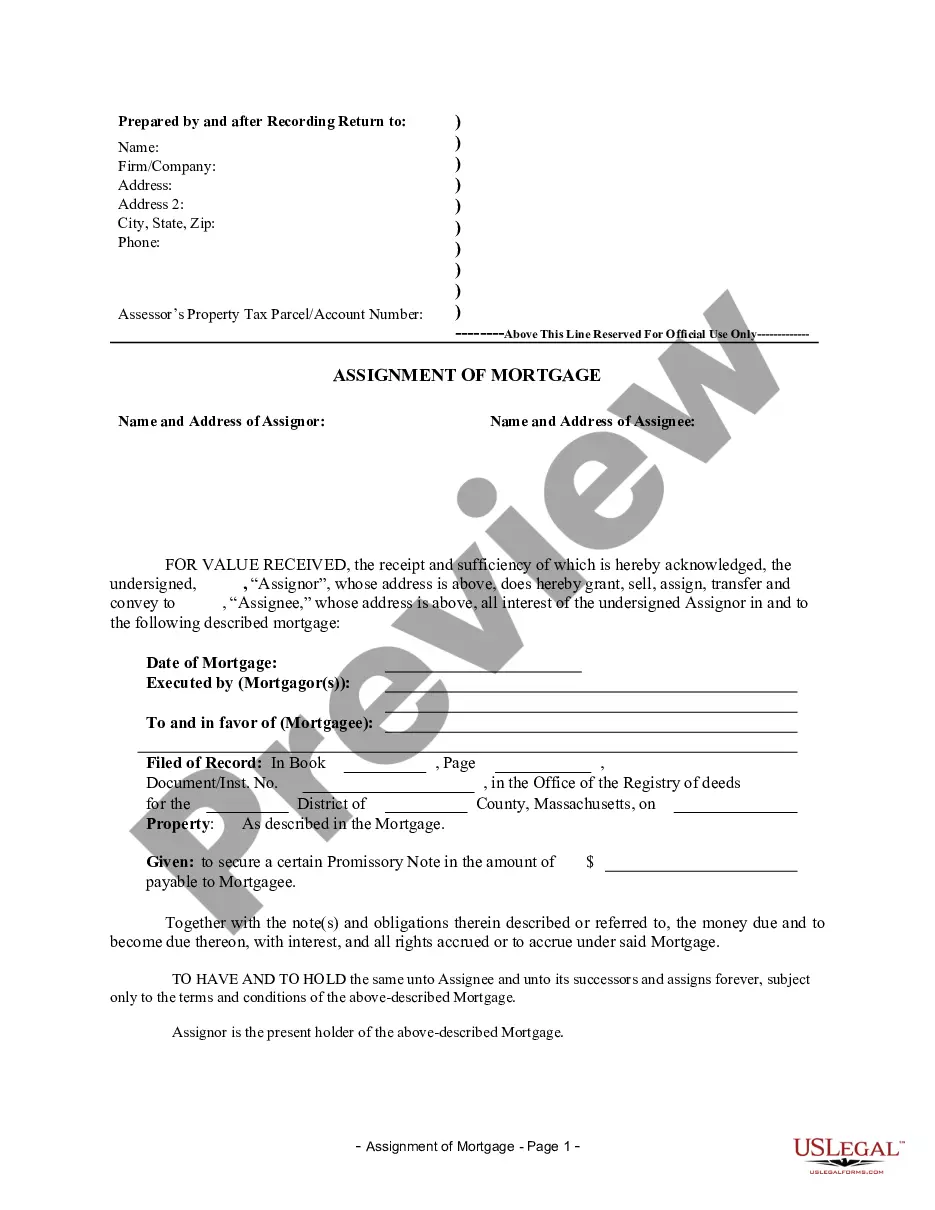

How to fill out Agreement And Plan Of Merger For Conversion Of Corporation Into Maryland Real Estate Investment Trust?

Discovering the right legal papers design might be a have difficulties. Naturally, there are a variety of web templates accessible on the Internet, but how will you obtain the legal kind you want? Utilize the US Legal Forms internet site. The assistance delivers a large number of web templates, like the Minnesota Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust, that can be used for enterprise and personal requires. Each of the kinds are checked out by specialists and fulfill federal and state needs.

When you are previously listed, log in to your accounts and click on the Down load option to get the Minnesota Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust. Use your accounts to check through the legal kinds you might have ordered formerly. Visit the My Forms tab of your accounts and have an additional copy in the papers you want.

When you are a new customer of US Legal Forms, listed here are simple directions for you to stick to:

- Very first, make sure you have chosen the proper kind for your area/state. You can check out the shape using the Preview option and read the shape explanation to guarantee it will be the best for you.

- In the event the kind will not fulfill your requirements, take advantage of the Seach area to obtain the proper kind.

- Once you are sure that the shape would work, select the Purchase now option to get the kind.

- Opt for the prices prepare you want and enter the necessary info. Create your accounts and pay money for the order with your PayPal accounts or Visa or Mastercard.

- Opt for the file structure and download the legal papers design to your gadget.

- Full, change and print and signal the received Minnesota Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust.

US Legal Forms is definitely the greatest library of legal kinds for which you will find numerous papers web templates. Utilize the service to download expertly-produced paperwork that stick to condition needs.