The Minnesota Agreement and Plan of Merger, established between Cascade Financial, Cascade Bank, Am first Ban corporation, and American First National Bank, is a critical legal document that outlines the terms and conditions of a merger between these financial institutions. This merger enables the participating banks to consolidate their operations, resources, and expertise to serve their customers better and achieve mutual growth. The Minnesota Agreement and Plan of Merger is a comprehensive agreement that covers various aspects of the merger, including the financial terms, exchange ratios, management structure, and governance. It outlines the procedures for combining the assets, liabilities, and shareholders' equity of the merging entities, ensuring a seamless transition. The agreement also defines the roles and responsibilities of the management teams from each institution during and after the merger. It establishes the framework for the board of directors and executive leadership, as well as the integration of employees and systems. The agreement emphasizes the need for a harmonious integration process, while respecting the existing culture and values of the merging banks. Additionally, the Minnesota Agreement and Plan of Merger addresses regulatory compliance, ensuring that all necessary approvals from relevant authorities are obtained. It also covers any potential disputes that may arise during the integration and provides mechanisms for dispute resolution. There might be different types of Minnesota Agreement and Plan of Merger introduced by Cascade Financial, Cascade Bank, Am first Ban corporation, and American First National Bank, which could include: 1. "Minnesota Agreement and Plan of Merger for Consolidation": This type of agreement is used when the merging banks decide to consolidate their operations, combining their assets, liabilities, and shareholders' equity into a single entity. 2. "Minnesota Agreement and Plan of Merger for Acquisition": In this case, one bank acquires another, assimilating its operations, assets, liabilities, and shareholders' equity while the acquired bank ceases to exist as an independent entity. 3. "Minnesota Agreement and Plan of Merger for Joint Venture": In a joint venture merger, the participating banks establish a new entity that operates independently, leveraging the strengths and resources of each partner. Each type of merger agreement has its distinct provisions, tailored to the specific circumstances and goals of the merging banks. The overall objective remains the same — to create a stronger and more competitive financial institution capable of serving its customers effectively and driving sustainable growth.

Minnesota Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank

Description

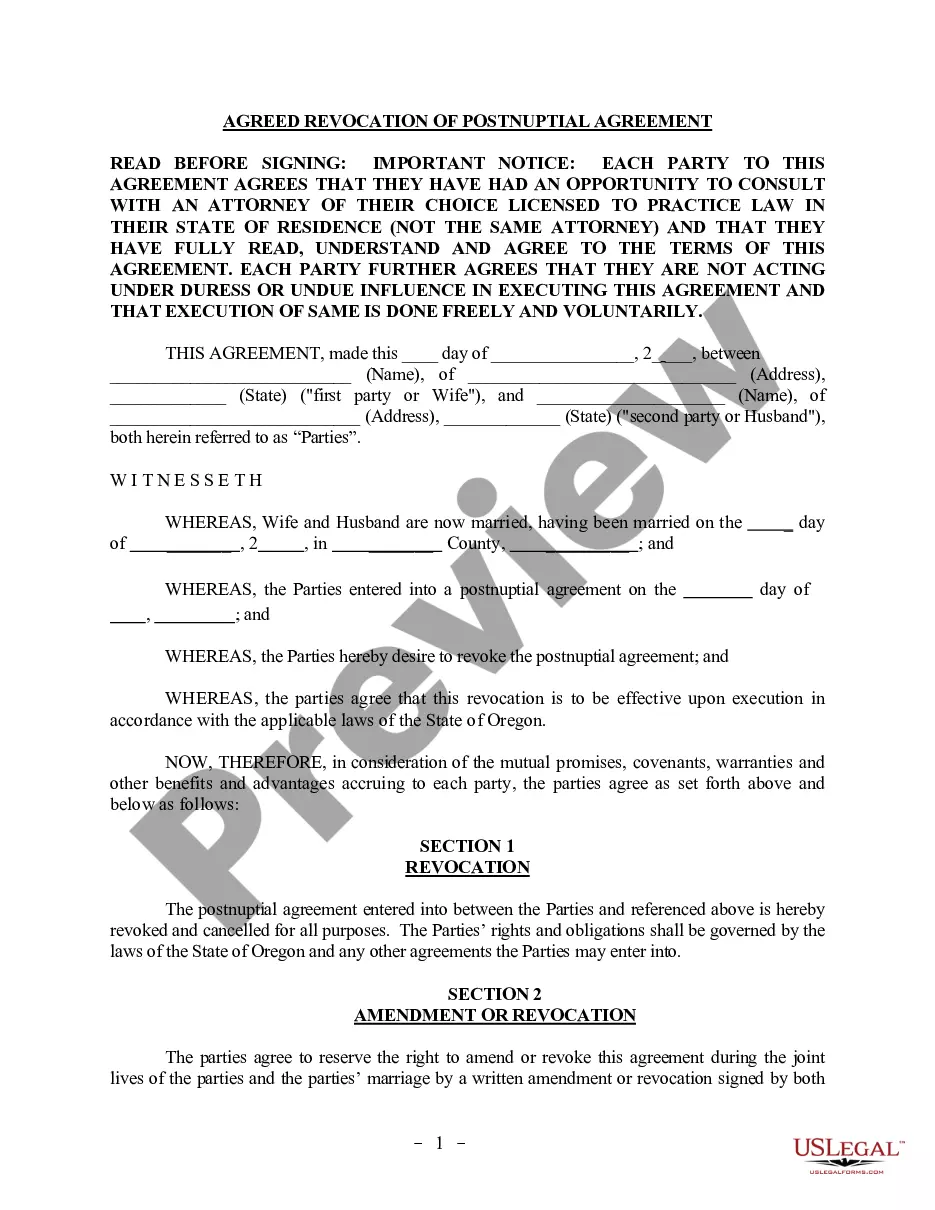

How to fill out Minnesota Agreement And Plan Of Merger By Cascade Financial, Cascade Bank, Amfirst Bancorporation, And American First National Bank?

US Legal Forms - one of many largest libraries of authorized kinds in the USA - offers a variety of authorized document layouts you can obtain or print. Utilizing the site, you can get a large number of kinds for business and individual functions, sorted by types, claims, or search phrases.You can get the most recent versions of kinds much like the Minnesota Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank within minutes.

If you have a subscription, log in and obtain Minnesota Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank from the US Legal Forms collection. The Obtain switch can look on each type you see. You gain access to all previously downloaded kinds from the My Forms tab of your respective profile.

If you want to use US Legal Forms the first time, listed here are simple guidelines to help you began:

- Ensure you have selected the right type for your city/county. Click the Review switch to review the form`s content. Read the type information to ensure that you have chosen the appropriate type.

- When the type does not suit your specifications, use the Look for discipline at the top of the display screen to get the one who does.

- Should you be happy with the shape, confirm your selection by clicking on the Get now switch. Then, opt for the pricing strategy you prefer and supply your accreditations to sign up on an profile.

- Method the financial transaction. Make use of credit card or PayPal profile to complete the financial transaction.

- Select the file format and obtain the shape on your device.

- Make adjustments. Fill up, modify and print and indication the downloaded Minnesota Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank.

Every design you included with your account does not have an expiry date and it is your own property for a long time. So, if you would like obtain or print an additional backup, just go to the My Forms section and then click on the type you require.

Get access to the Minnesota Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank with US Legal Forms, by far the most extensive collection of authorized document layouts. Use a large number of specialist and state-distinct layouts that meet up with your company or individual requires and specifications.