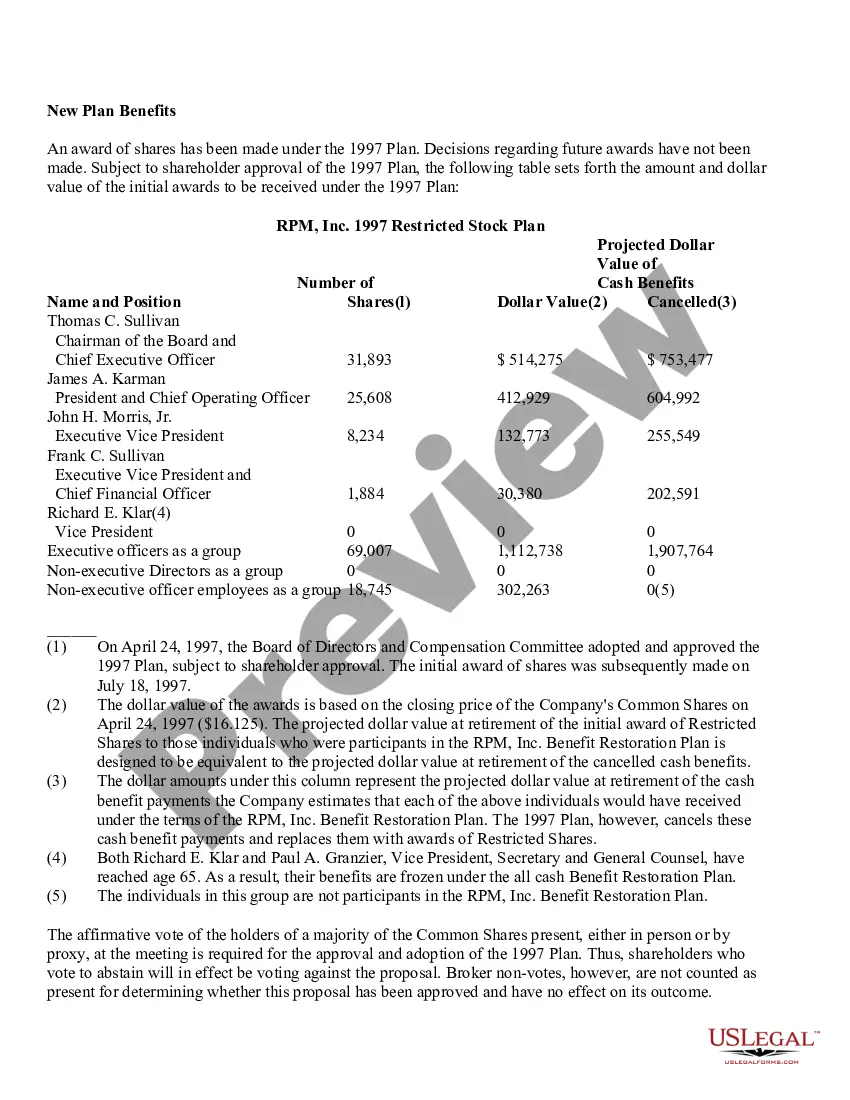

The Minnesota Adoption of Restricted Stock Plan is an essential aspect of RPM, Inc.'s compensation and retention strategies. This plan is specifically designed to attract and retain top talent by offering employees an opportunity to acquire ownership in the company and align their interests with the long-term success of RPM, Inc. Under the Minnesota Adoption of Restricted Stock Plan, eligible employees are granted restricted stock units (RSS) as a form of compensation. This RSS represents a specific number of shares of RPM, Inc.'s common stock. However, unlike traditional stock options, RSS are subject to certain restrictions and vesting requirements. The primary goal of the Minnesota Adoption of Restricted Stock Plan is to motivate employees to stay with the company for a longer period of time. This plan encourages employees to contribute to the company's growth and profitability, as they will only fully benefit from the RSS once they have satisfied the vesting conditions. There are different types of restricted stock plans that RPM, Inc. can adopt under Minnesota law. The most common types include time-based vesting and performance-based vesting. 1. Time-Based Vesting: This type of plan requires employees to remain with the company for a specific period, usually a few years, before they are eligible to receive the full ownership of the RSS. Typically, the RSS vest on a predetermined schedule, such as annual or quarterly increments. Time-based vesting ensures employee loyalty and encourages them to contribute to the company's long-term success. 2. Performance-Based Vesting: This plan incorporates specific performance metrics that employees need to achieve before the RSS can fully vest. These metrics can be financial targets, such as revenue growth or profitability, or non-financial goals, such as operational efficiency or customer satisfaction. Performance-based vesting aligns employee incentives with the company's strategic objectives, encouraging them to excel and create value. It's important to note that the Minnesota Adoption of Restricted Stock Plan of RPM, Inc. should comply with applicable laws, regulations, and guidelines, including those set by the Minnesota Department of Commerce and the Securities and Exchange Commission. The plan should also outline provisions regarding stock ownership rights, transferability restrictions, and any tax implications for the participants. In conclusion, the Minnesota Adoption of Restricted Stock Plan is a crucial tool for RPM, Inc. to attract, retain, and motivate talented individuals. By granting RSS and incorporating vesting conditions, this plan ensures the alignment of employee interests with the long-term success of the company. Whether through time-based or performance-based vesting, RPM, Inc. can design a plan that suits its specific needs and objectives while complying with relevant laws and regulations.

Minnesota Adoption of Restricted Stock Plan of RPM, Inc.

Description

How to fill out Minnesota Adoption Of Restricted Stock Plan Of RPM, Inc.?

Finding the right authorized file format can be quite a struggle. Needless to say, there are tons of templates available online, but how would you obtain the authorized type you want? Utilize the US Legal Forms web site. The services delivers a large number of templates, including the Minnesota Adoption of Restricted Stock Plan of RPM, Inc., that you can use for organization and personal requirements. All of the varieties are inspected by pros and meet state and federal demands.

Should you be presently registered, log in for your profile and click the Obtain option to obtain the Minnesota Adoption of Restricted Stock Plan of RPM, Inc.. Make use of your profile to look from the authorized varieties you have ordered formerly. Proceed to the My Forms tab of your own profile and have an additional duplicate from the file you want.

Should you be a whole new end user of US Legal Forms, listed here are straightforward recommendations that you can comply with:

- First, make certain you have selected the appropriate type for your city/region. It is possible to look over the form utilizing the Preview option and read the form explanation to make certain this is basically the best for you.

- In the event the type will not meet your preferences, use the Seach field to discover the proper type.

- When you are sure that the form is proper, click the Get now option to obtain the type.

- Opt for the rates plan you would like and type in the required information and facts. Design your profile and purchase your order with your PayPal profile or credit card.

- Pick the file formatting and download the authorized file format for your system.

- Complete, edit and produce and sign the attained Minnesota Adoption of Restricted Stock Plan of RPM, Inc..

US Legal Forms may be the most significant local library of authorized varieties in which you can find different file templates. Utilize the service to download appropriately-manufactured papers that comply with express demands.