Minnesota Proposal to approve material terms of stock appreciation right plan

Description

How to fill out Proposal To Approve Material Terms Of Stock Appreciation Right Plan?

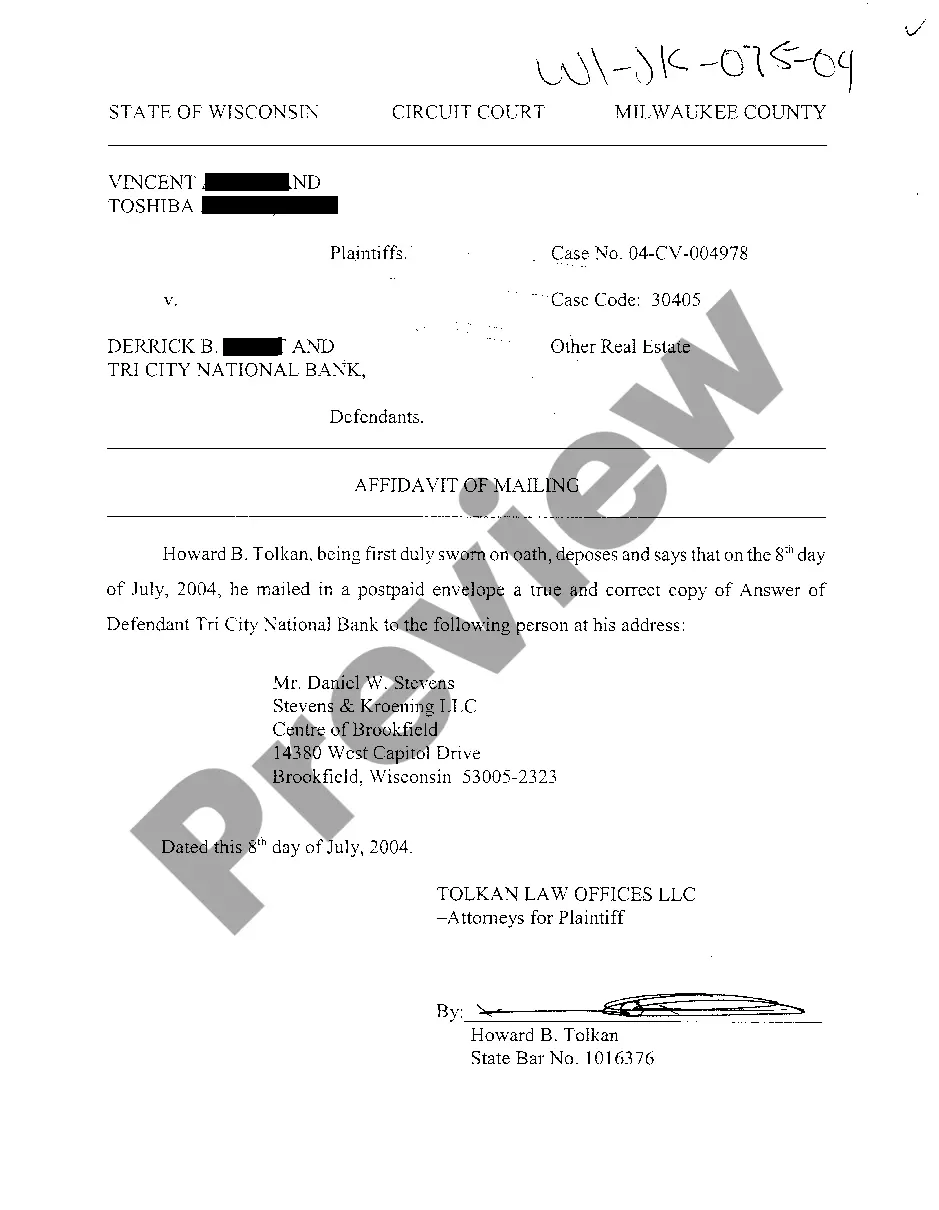

Have you been in a position the place you will need documents for sometimes business or personal reasons virtually every time? There are tons of legitimate file web templates available on the net, but discovering kinds you can rely isn`t easy. US Legal Forms delivers thousands of kind web templates, like the Minnesota Proposal to approve material terms of stock appreciation right plan, that are composed to fulfill state and federal needs.

In case you are previously acquainted with US Legal Forms internet site and get an account, simply log in. Next, it is possible to obtain the Minnesota Proposal to approve material terms of stock appreciation right plan template.

Should you not offer an account and would like to begin to use US Legal Forms, follow these steps:

- Obtain the kind you want and make sure it is for the proper metropolis/state.

- Utilize the Preview button to check the shape.

- Look at the outline to ensure that you have chosen the correct kind.

- When the kind isn`t what you are searching for, utilize the Lookup industry to discover the kind that fits your needs and needs.

- If you get the proper kind, click Get now.

- Opt for the rates program you want, complete the specified information to make your account, and pay for your order making use of your PayPal or credit card.

- Pick a handy document file format and obtain your backup.

Discover each of the file web templates you possess bought in the My Forms menu. You can get a additional backup of Minnesota Proposal to approve material terms of stock appreciation right plan anytime, if required. Just select the required kind to obtain or print out the file template.

Use US Legal Forms, the most extensive selection of legitimate types, in order to save time and avoid faults. The service delivers professionally manufactured legitimate file web templates that can be used for a variety of reasons. Produce an account on US Legal Forms and start creating your life a little easier.

Form popularity

FAQ

A Stock Appreciation Right (SAR) refers to the right to be paid compensation equivalent to an increase in the company's common stock price over a base or the value of appreciation of the equity shares currently being traded on the public market.

The key difference between an ESOP and a direct issue of shares, is that under a direct issue of shares, the employee receives stocks upfront. Under an ESOP, the employee is only granted options, which can be converted into stocks once they have satisfied their vesting conditions.

In accounting, the process that the company uses to record SAR agreements is to accrue a liability and recognize expense over the term of service. At the end of the service period, the liability is settled in cash or stock (or both).

Stock Appreciation Rights (SARs) SARs differ from ESOPs in that they do not grant direct ownership to employees, but rather give them the right to receive a cash payout equal to the value of the stock appreciation.

For purposes of financial disclosure, you may value a stock appreciation right based on the difference between the current market value and the grant price. This formula is: (current market value ? grant price) x number of shares = value.

For example, let's say you were granted stock appreciation rights on 10 shares of your company ABC's stock, valued at $10 per share. Over time, the share price increases from $10 to $12. This means you'd receive $2 per share since that was the increased value.

The main difference is that under an ESOP (Employee Stock Option Plan), an employee receives real business shares at a certain point in time. In a VSOP (Virtual Stock Option Plan), the employee only receives a contractual right to a payout in the event of certain events (usually the exit).

A SAR is very similar to a stock option, but with a key difference. When a stock option is exercised, an employee has to pay the grant price and acquire the underlying security. However, when a SAR is exercised, the employee does not have to pay to acquire the underlying security.