The Minnesota Employees' Stock Deferral Plan is a unique investment opportunity offered by Nor west Corp. to its employees based in Minnesota. This plan allows employees to defer a portion of their compensation, specifically in the form of company stocks, for a set period of time. The primary objective of the Minnesota Employees' Stock Deferral Plan is to provide employees with a flexible and tax-advantaged way to grow their retirement savings. By deferring a portion of their salary or bonus, employees have the ability to acquire shares of Nor west Corp. at a favorable price, thereby creating an opportunity for long-term wealth accumulation. One key advantage of participating in this plan is the potential for stock appreciation over time. By deferring compensation into company stocks, employees can benefit from any potential increase in Nor west Corp.'s stock price. This means that as the company grows and prospers, employees who have invested wisely can reap substantial financial rewards. Furthermore, the Minnesota Employees' Stock Deferral Plan offers employees the option to choose from different types of deferral plans. These include fixed-dollar contributions, fixed-percentage contributions, and combinations thereof. This flexibility allows participants to tailor their deferral strategy based on their individual preferences and financial goals. Another noteworthy aspect of this plan is the tax advantage it offers employees. By deferring a portion of their salary or bonus, participants can potentially defer the associated income tax until they receive the deferred amount in the future. This can lead to substantial tax savings and allows employees to minimize their current tax liabilities. It is important to note that the Minnesota Employees' Stock Deferral Plan is subject to certain eligibility requirements and restrictions. It is typically offered to full-time employees of Nor west Corp. in Minnesota who meet specific tenure criteria. Additionally, there may be limitations on the amount that can be deferred based on the Internal Revenue Service (IRS) guidelines and plan-specific rules. In summary, the Minnesota Employees' Stock Deferral Plan for Nor west Corp. is a unique investment opportunity that allows employees to defer a portion of their compensation into Nor west Corp. stocks. This plan offers various types of deferral options and aims to provide employees with long-term wealth accumulation and potential tax advantages.

Minnesota Employees' Stock Deferral Plan for Norwest Corp.

Description

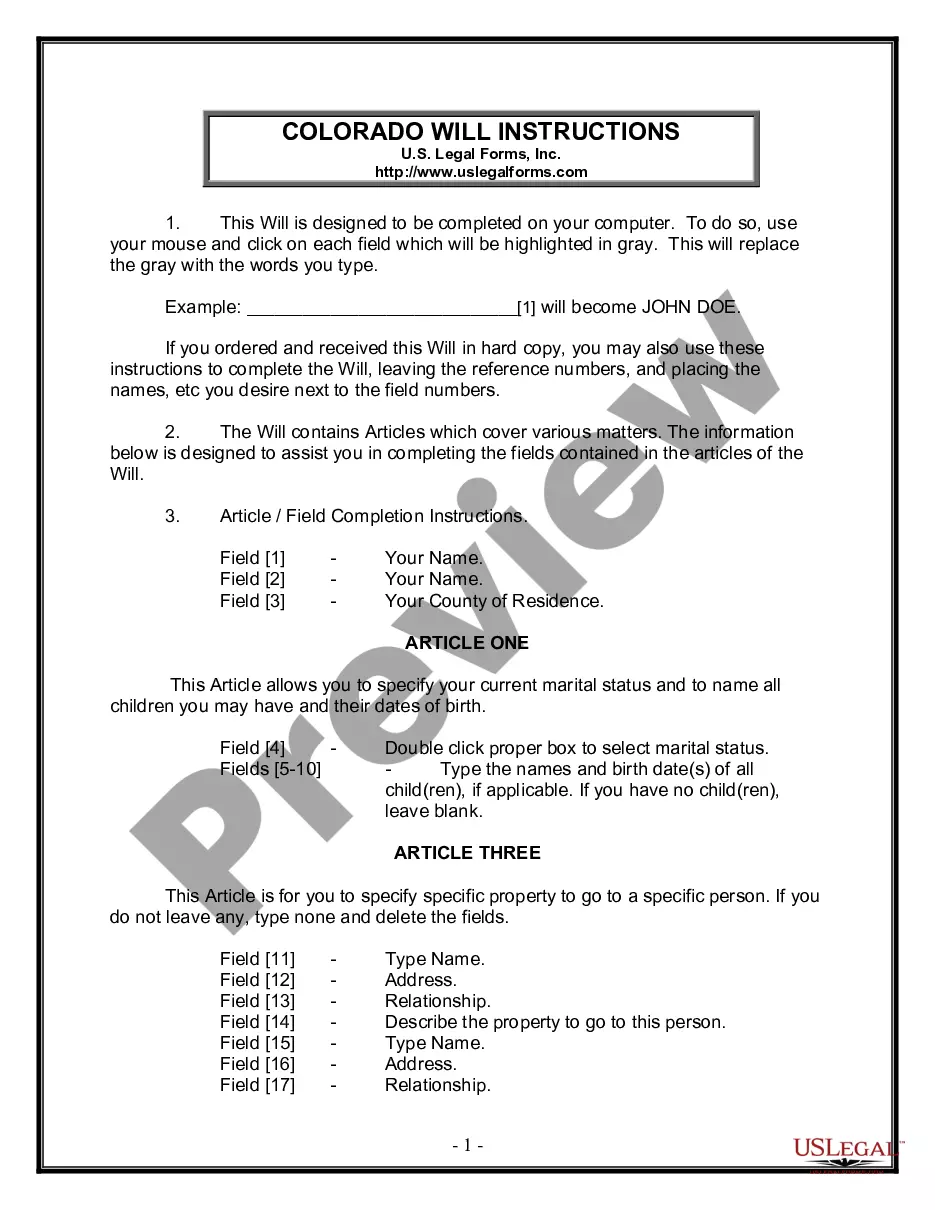

How to fill out Minnesota Employees' Stock Deferral Plan For Norwest Corp.?

Choosing the right legitimate document design might be a have a problem. Needless to say, there are a variety of templates available online, but how do you find the legitimate form you require? Use the US Legal Forms web site. The services gives a huge number of templates, including the Minnesota Employees' Stock Deferral Plan for Norwest Corp., that can be used for enterprise and personal requires. Every one of the varieties are checked out by professionals and fulfill state and federal demands.

Should you be currently authorized, log in to the accounts and then click the Acquire option to obtain the Minnesota Employees' Stock Deferral Plan for Norwest Corp.. Make use of accounts to appear throughout the legitimate varieties you possess acquired previously. Go to the My Forms tab of your respective accounts and acquire an additional backup of your document you require.

Should you be a whole new end user of US Legal Forms, listed here are simple guidelines for you to follow:

- Initial, be sure you have selected the right form for your personal town/state. You are able to check out the shape utilizing the Preview option and read the shape description to guarantee this is the best for you.

- If the form does not fulfill your needs, utilize the Seach field to get the appropriate form.

- Once you are certain the shape is proper, select the Buy now option to obtain the form.

- Pick the prices program you would like and enter the needed info. Design your accounts and buy an order making use of your PayPal accounts or credit card.

- Select the data file file format and acquire the legitimate document design to the gadget.

- Total, revise and produce and signal the acquired Minnesota Employees' Stock Deferral Plan for Norwest Corp..

US Legal Forms is the biggest library of legitimate varieties where you can find different document templates. Use the service to acquire expertly-made paperwork that follow state demands.

Form popularity

FAQ

A deferred compensation plan withholds a portion of an employee's pay until a specified date, usually retirement.

The plans carry some inherent risk for the employees in that the deferred payments are unsecured and not guaranteed. So if the organization faces bankruptcy and creditor claims, the employees may not receive their promised funds. (In contrast, qualified plans such as 401(k)s are protected from bankruptcy creditors).

You can take out small or large sums anytime, or you can set up automatic, periodic payments. If your plan allows it, you may be able to have direct deposit which allows for fast transfer of funds.

Key Differences Deferred compensation plans tend to offer better investment options than most 401(k) plans, but are at a disadvantage regarding liquidity. Typically, deferred compensation funds cannot be accessed, for any reason, before the specified distribution date.

Key Takeaways. Deferred compensation plans allow employees to withhold a certain amount of their salaries or wages for a specific purpose. Deferred compensation plans can be qualified or non-qualified. Qualified plans fall under the Employee Retirement Income Security Act and include 401(k)s and 403(b)s.

The purpose of the Plan is to allow a select group of management and highly-compensated employees to defer receipt of compensation. The Plan is a non-qualified deferred compensation plan under the Internal Revenue Code.