The Minnesota Stock Bonus Plan of First West Chester Corp is a company-sponsored employee benefit plan that aims to reward and incentivize employees by providing them with stock bonuses. This plan helps employees to build wealth and secure their financial future. One type of Minnesota Stock Bonus Plan offered by First West Chester Corp is the Traditional Stock Bonus Plan. Under this plan, eligible employees receive annual contributions in the form of company stock. These contributions are based on the employee's salary or a predetermined formula decided by the company. The stock is typically non-transferable until a certain specified period, giving the employees an incentive to stay with the company for the long term. Another type of Minnesota Stock Bonus Plan available for employees of First West Chester Corp is the Performance-Based Stock Bonus Plan. This plan is designed to reward employees based on their individual or team performance. The bonus is awarded in the form of company stock, which not only recognizes their hard work but also aligns their interests with the company's success. The stock bonuses received by employees under the Minnesota Stock Bonus Plan provide them with an opportunity to benefit from the company's growth. As the company performs well, the value of the stock increases, potentially resulting in significant financial gains for the employees. Additionally, any dividends paid on the stock are also credited to the employees' accounts, further increasing their potential earnings. Participating employees in the Minnesota Stock Bonus Plan can enjoy various tax advantages. The contributions made by the company to the employee's account are typically tax-deductible for the employer, and the stock bonuses received by employees are generally tax-deferred until they decide to sell or transfer the stock. In conclusion, the Minnesota Stock Bonus Plan of First West Chester Corp is a valuable employee benefit program that rewards employees with company stock bonuses. By offering different types of plans, such as the Traditional Stock Bonus Plan and the Performance-Based Stock Bonus Plan, the company aims to motivate and retain its workforce while helping them build wealth and potentially benefit from the company's success.

Minnesota Stock Bonus Plan of First West Chester Corp.

Description

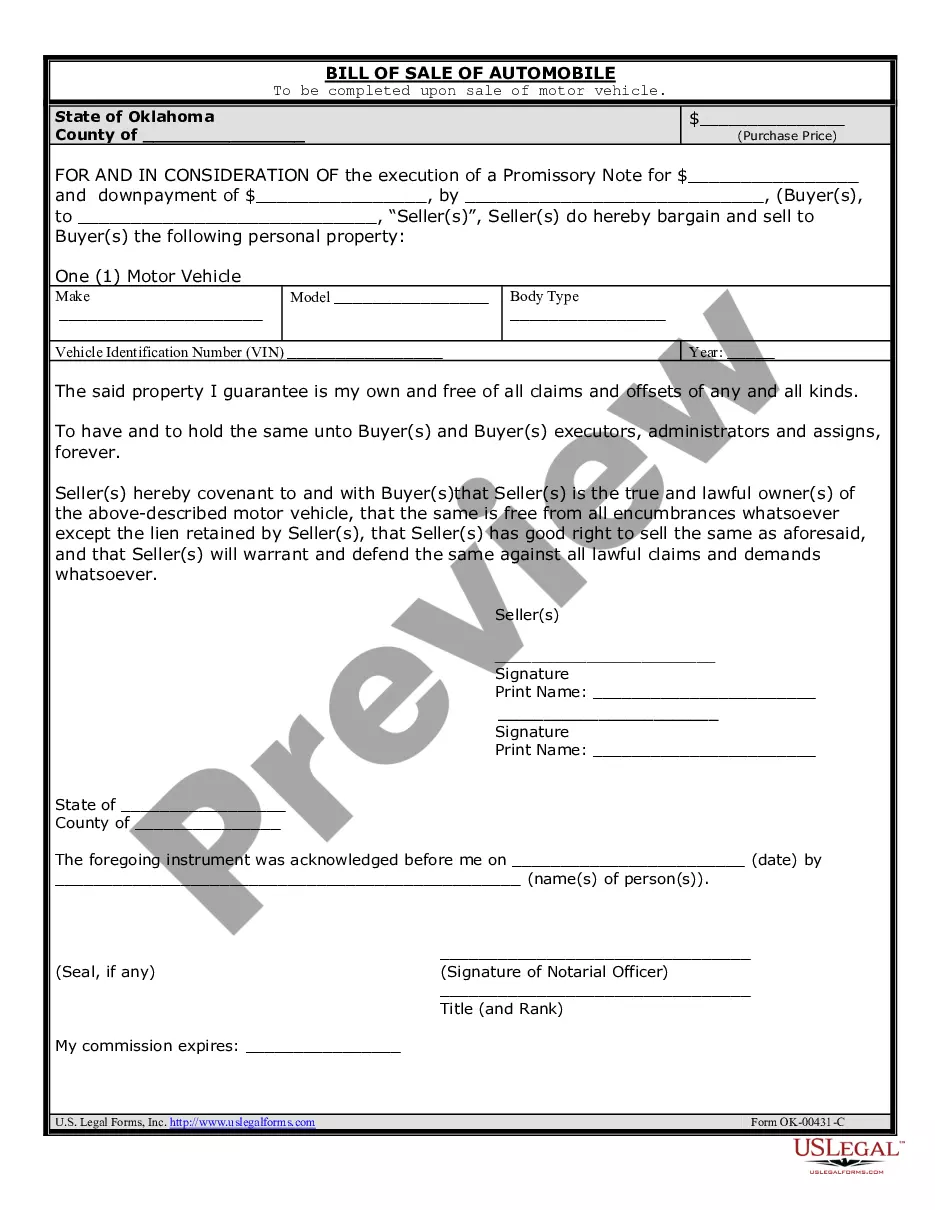

How to fill out Minnesota Stock Bonus Plan Of First West Chester Corp.?

Choosing the right legitimate file format might be a battle. Of course, there are tons of layouts available online, but how can you obtain the legitimate type you require? Use the US Legal Forms site. The support offers 1000s of layouts, such as the Minnesota Stock Bonus Plan of First West Chester Corp., that can be used for company and personal requires. Every one of the kinds are checked by specialists and meet up with state and federal demands.

If you are currently listed, log in for your bank account and click on the Obtain key to have the Minnesota Stock Bonus Plan of First West Chester Corp.. Utilize your bank account to appear throughout the legitimate kinds you possess ordered earlier. Check out the My Forms tab of your bank account and get one more copy in the file you require.

If you are a fresh user of US Legal Forms, listed below are easy directions that you can follow:

- Very first, ensure you have chosen the appropriate type for the metropolis/state. It is possible to look over the form making use of the Review key and study the form outline to make certain it is the right one for you.

- In case the type is not going to meet up with your preferences, make use of the Seach industry to discover the right type.

- Once you are positive that the form is acceptable, click the Get now key to have the type.

- Opt for the pricing plan you desire and enter in the necessary information and facts. Create your bank account and pay money for your order making use of your PayPal bank account or charge card.

- Opt for the file formatting and acquire the legitimate file format for your system.

- Complete, modify and print and indication the received Minnesota Stock Bonus Plan of First West Chester Corp..

US Legal Forms may be the largest library of legitimate kinds that you can see different file layouts. Use the company to acquire appropriately-manufactured paperwork that follow condition demands.