The Minnesota Stock Option Plan for Nonemployee Directors of Cameo International, Inc. is an incentivized compensation program designed to reward and attract talented individuals serving as nonemployee directors for the company. This stock option plan provides these directors with an opportunity to acquire company stocks at a predetermined price, allowing them to participate in the company's growth and success. As an important component of the company's overall compensation package, the Minnesota Stock Option Plan for Nonemployee Directors helps align the interests of directors with those of the shareholders. By granting stock options, the company motivates its nonemployee directors to contribute towards the long-term success and profitability of Cameo International, Inc. Under the plan, nonemployee directors receive a specific number of stock options, which grant them the right to purchase company stocks within a defined time frame. These options are generally subject to vesting requirements, ensuring that directors remain committed to the company for a certain period before fully exercising their options. The Minnesota Stock Option Plan may include different types of stock options, depending on the specifics of the plan agreed upon by Cameo International, Inc. and its nonemployee directors. These may include: 1. Nonqualified Stock Options (SOS): These are the most common type of stock options offered to nonemployee directors. SOS provide flexibility in terms of exercise price, exercise period, and taxation. Directors holding SOS can exercise their options at any time after they vest, regardless of the stock's market value. 2. Incentive Stock Options (SOS): SOS are another type of stock options that may be included in the plan. However, SOS are subject to more strict requirements imposed by the Internal Revenue Code. They offer potential tax advantages for nonemployee directors if certain conditions are met, such as holding the shares acquired through the options for a specific period before selling them. 3. Restricted Stock Units (RSS): Although not technically options, RSS are an alternative type of equity compensation that may be part of the Minnesota Stock Option Plan. RSS grant nonemployee directors the right to receive company shares outright once specified vesting requirements are met. Unlike options, RSS do not require any exercise price. It is crucial to note that the specifics of the Minnesota Stock Option Plan for Nonemployee Directors, including the types of options and vesting schedules, would be detailed in the official plan documents provided by Cameo International, Inc. to its directors.

Minnesota Stock Option Plan for Nonemployee Directors of Camco International, Inc.

Description

How to fill out Minnesota Stock Option Plan For Nonemployee Directors Of Camco International, Inc.?

US Legal Forms - one of several greatest libraries of legal varieties in the United States - gives a variety of legal papers web templates you may obtain or print out. While using site, you may get a huge number of varieties for enterprise and personal functions, sorted by classes, says, or keywords and phrases.You can find the most up-to-date variations of varieties like the Minnesota Stock Option Plan for Nonemployee Directors of Camco International, Inc. within minutes.

If you already have a subscription, log in and obtain Minnesota Stock Option Plan for Nonemployee Directors of Camco International, Inc. in the US Legal Forms catalogue. The Obtain switch can look on every kind you see. You have access to all earlier delivered electronically varieties inside the My Forms tab of your own bank account.

In order to use US Legal Forms for the first time, here are easy guidelines to help you started out:

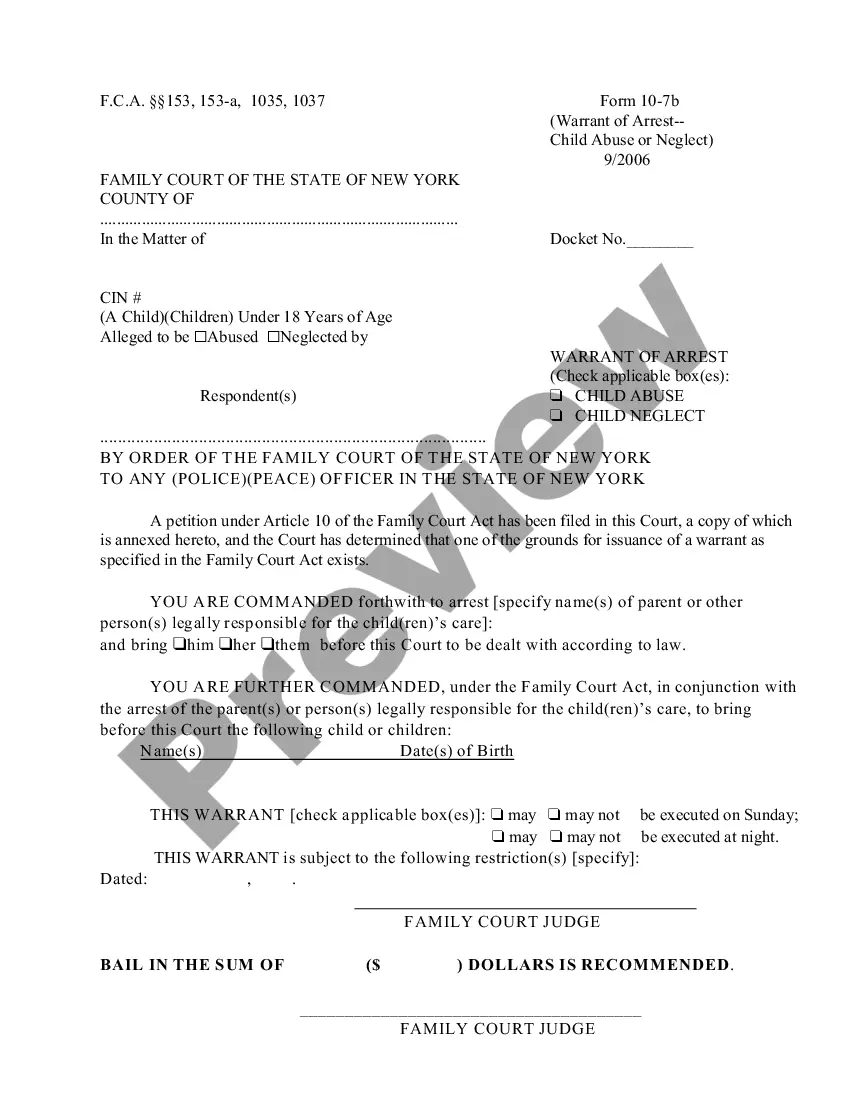

- Be sure you have selected the best kind for your personal area/area. Select the Preview switch to examine the form`s content. See the kind information to ensure that you have chosen the correct kind.

- When the kind does not suit your requirements, take advantage of the Search industry on top of the screen to get the one who does.

- When you are pleased with the form, verify your selection by clicking on the Acquire now switch. Then, pick the prices strategy you want and give your references to sign up on an bank account.

- Method the transaction. Make use of your charge card or PayPal bank account to perform the transaction.

- Select the file format and obtain the form on your system.

- Make changes. Fill up, modify and print out and sign the delivered electronically Minnesota Stock Option Plan for Nonemployee Directors of Camco International, Inc..

Every design you included with your bank account does not have an expiration time and it is yours for a long time. So, if you would like obtain or print out one more version, just go to the My Forms section and click about the kind you want.

Get access to the Minnesota Stock Option Plan for Nonemployee Directors of Camco International, Inc. with US Legal Forms, probably the most extensive catalogue of legal papers web templates. Use a huge number of professional and condition-distinct web templates that fulfill your small business or personal needs and requirements.