The Minnesota Proposal to Amend Certificate of Incorporation to Effectuate a One for Ten Reverse Stock Split is a crucial decision that companies may undertake to restructure their stock ownership. This proposal involves altering the company's certificate of incorporation, the foundational document that outlines its structure and operations, in order to implement a reverse stock split. A reverse stock split is conducted by a company to reduce the number of outstanding shares while increasing their individual value. In the case of a one for ten reverse stock splits, every ten shares of outstanding stock would be exchanged for a single share. This consolidation aims to enhance the marketability of the company's stock, attract potential investors, and boost shareholder confidence in the company's financial position. By amending the certificate of incorporation, the company formally decides to implement this reverse stock split and sets the ratio at which the shares will be consolidated. This process typically requires approval from the board of directors followed by a majority vote from the company's shareholders. The Minnesota Proposal to Amend Certificate of Incorporation to Effectuate a One for Ten Reverse Stock Split can be further categorized into different types based on their specific objectives or circumstances. These may include: 1. Financial Restructuring Proposals: — When a company is experiencing financial difficulties or a decline in stock value, a reverse stock split may be proposed to increase the stock's perceived value and stabilize the company's market position. 2. Compliance Proposals: — In certain situations, exchanges or regulatory bodies may impose minimum stock price requirements for continued listing or compliance. A reverse stock split can help a company meet those requirements and maintain its stock's eligibility for trading. 3. Strategic Investment Proposals: — Companies looking to attract strategic investors or institutions often propose a reverse stock split to increase the stock's attractiveness by reducing the number of outstanding shares. This consolidation may create a perception of a higher-priced and more valuable investment opportunity. 4. Capital Restructuring Proposals: — Companies planning a significant capital restructuring to optimize their capital structure or prepare for a merger or acquisition might propose a reverse stock split as part of the overall capital restructuring plan. In conclusion, the Minnesota Proposal to Amend Certificate of Incorporation to Effectuate a One for Ten Reverse Stock Split offers companies the opportunity to reconfigure their stock ownership, enhance shareholder value, and meet specific market or regulatory requirements. This decision can be categorized into different types based on the objectives and circumstances of the proposed reverse stock split.

Minnesota Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split

Description

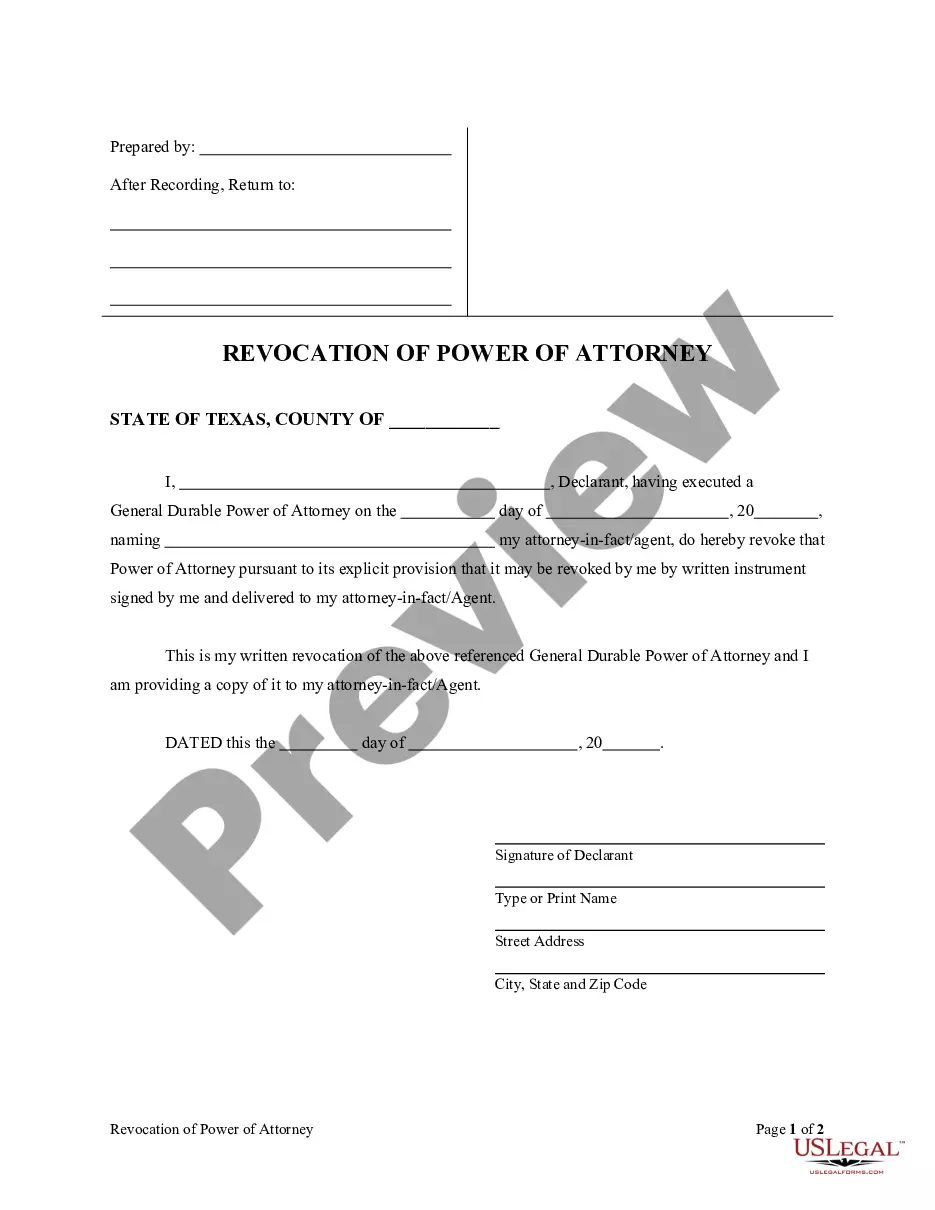

How to fill out Minnesota Proposal To Amend Certificate Of Incorporation To Effectuate A One For Ten Reverse Stock Split?

It is possible to spend hrs online trying to find the legitimate record template that meets the state and federal demands you will need. US Legal Forms provides a large number of legitimate varieties which are examined by professionals. It is possible to acquire or printing the Minnesota Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split from my assistance.

If you already possess a US Legal Forms accounts, you may log in and click the Obtain key. Afterward, you may full, edit, printing, or indicator the Minnesota Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split. Every single legitimate record template you purchase is your own property eternally. To have yet another duplicate of the obtained type, proceed to the My Forms tab and click the related key.

If you use the US Legal Forms website the first time, adhere to the easy guidelines beneath:

- First, ensure that you have selected the correct record template for the state/town that you pick. Look at the type description to ensure you have selected the appropriate type. If readily available, take advantage of the Preview key to check throughout the record template too.

- If you want to get yet another version of your type, take advantage of the Lookup area to get the template that meets your requirements and demands.

- After you have identified the template you desire, just click Purchase now to carry on.

- Choose the prices program you desire, enter your accreditations, and sign up for a merchant account on US Legal Forms.

- Comprehensive the deal. You may use your bank card or PayPal accounts to purchase the legitimate type.

- Choose the file format of your record and acquire it in your device.

- Make changes in your record if required. It is possible to full, edit and indicator and printing Minnesota Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split.

Obtain and printing a large number of record web templates making use of the US Legal Forms website, which provides the biggest variety of legitimate varieties. Use skilled and status-specific web templates to deal with your organization or personal demands.