Minnesota Form of Revolving Promissory Note

Description

How to fill out Form Of Revolving Promissory Note?

Have you been in the place where you need paperwork for both company or personal purposes nearly every day time? There are tons of lawful record layouts accessible on the Internet, but discovering versions you can depend on is not effortless. US Legal Forms offers 1000s of develop layouts, much like the Minnesota Form of Revolving Promissory Note, that happen to be published to fulfill state and federal requirements.

If you are already acquainted with US Legal Forms web site and have a free account, merely log in. After that, it is possible to acquire the Minnesota Form of Revolving Promissory Note format.

If you do not provide an profile and wish to start using US Legal Forms, adopt these measures:

- Discover the develop you require and ensure it is for the appropriate area/state.

- Make use of the Review button to check the form.

- Browse the explanation to ensure that you have chosen the appropriate develop.

- If the develop is not what you are seeking, take advantage of the Research field to get the develop that meets your needs and requirements.

- When you discover the appropriate develop, simply click Purchase now.

- Opt for the pricing plan you want, fill out the required information to produce your account, and buy the transaction making use of your PayPal or Visa or Mastercard.

- Choose a hassle-free paper structure and acquire your duplicate.

Locate each of the record layouts you have bought in the My Forms food selection. You can aquire a further duplicate of Minnesota Form of Revolving Promissory Note anytime, if needed. Just select the needed develop to acquire or printing the record format.

Use US Legal Forms, the most extensive selection of lawful forms, to conserve efforts and stay away from mistakes. The services offers skillfully made lawful record layouts which can be used for an array of purposes. Create a free account on US Legal Forms and begin making your life a little easier.

Form popularity

FAQ

A promissory note is a form of debt that companies and individuals sometimes use, like loans, to raise money. The issuer, through the notes, promises to return the buyer's funds (principal) and to make fixed interest payments to the buyer in exchange for borrowing the money.

There are three types of promissory notes: unsecured, secured and demand.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

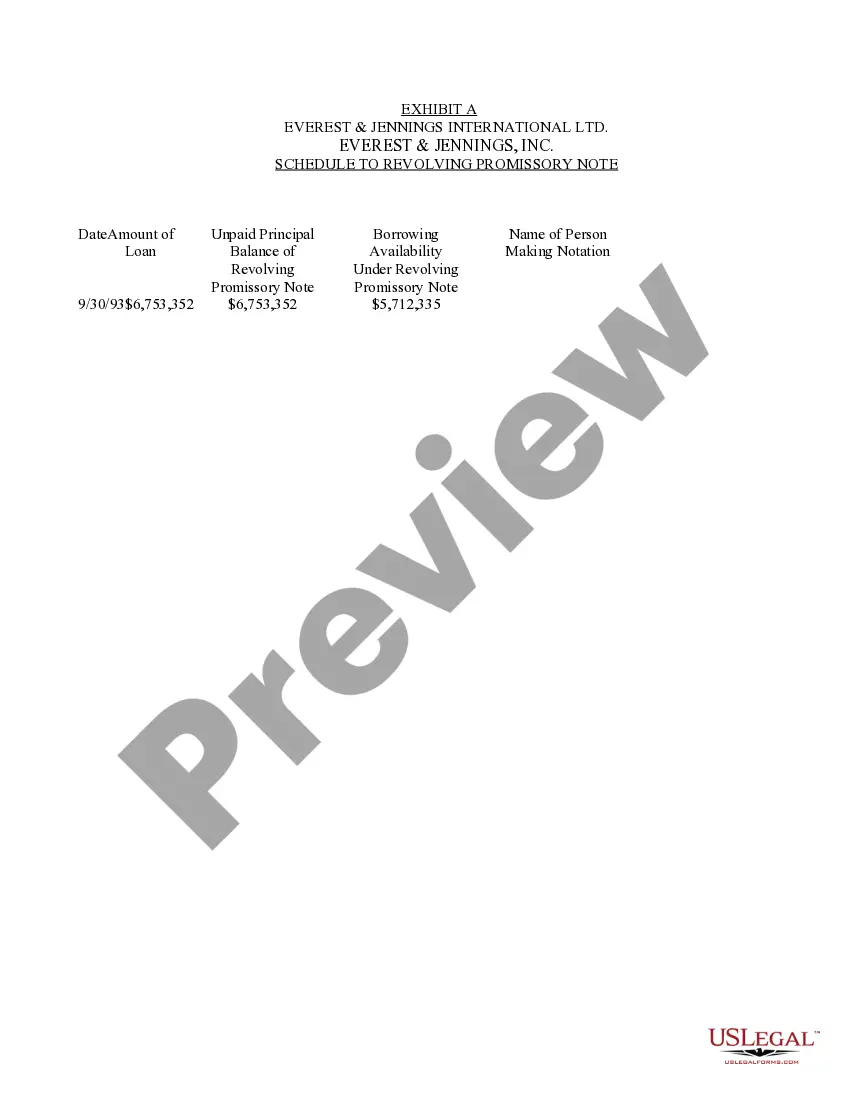

A revolving promissory note is a form of business financing that allows the company to borrow more money when needed. The process starts with an initial loan and then can be used as collateral for future loans that are paid back over time.

A promissory note typically contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of issuance, and issuer's signature.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Types of Promissory Notes Simple Promissory Note. ... Student Loan Promissory Note. ... Real Estate Promissory Note. ... Personal Loan Promissory Notes. ... Car Promissory Note. ... Commercial Promissory note. ... Investment Promissory Note. ... Installment Payments.

No. There's no law that a promissory note in Minnesota has to be notarized. It just has to be dated and signed by all parties.