Minnesota Sample Stock Purchase Agreement regarding acquisition by Finova Capital Corp. of all outstanding shares of Fremont Financial Corp.

Description

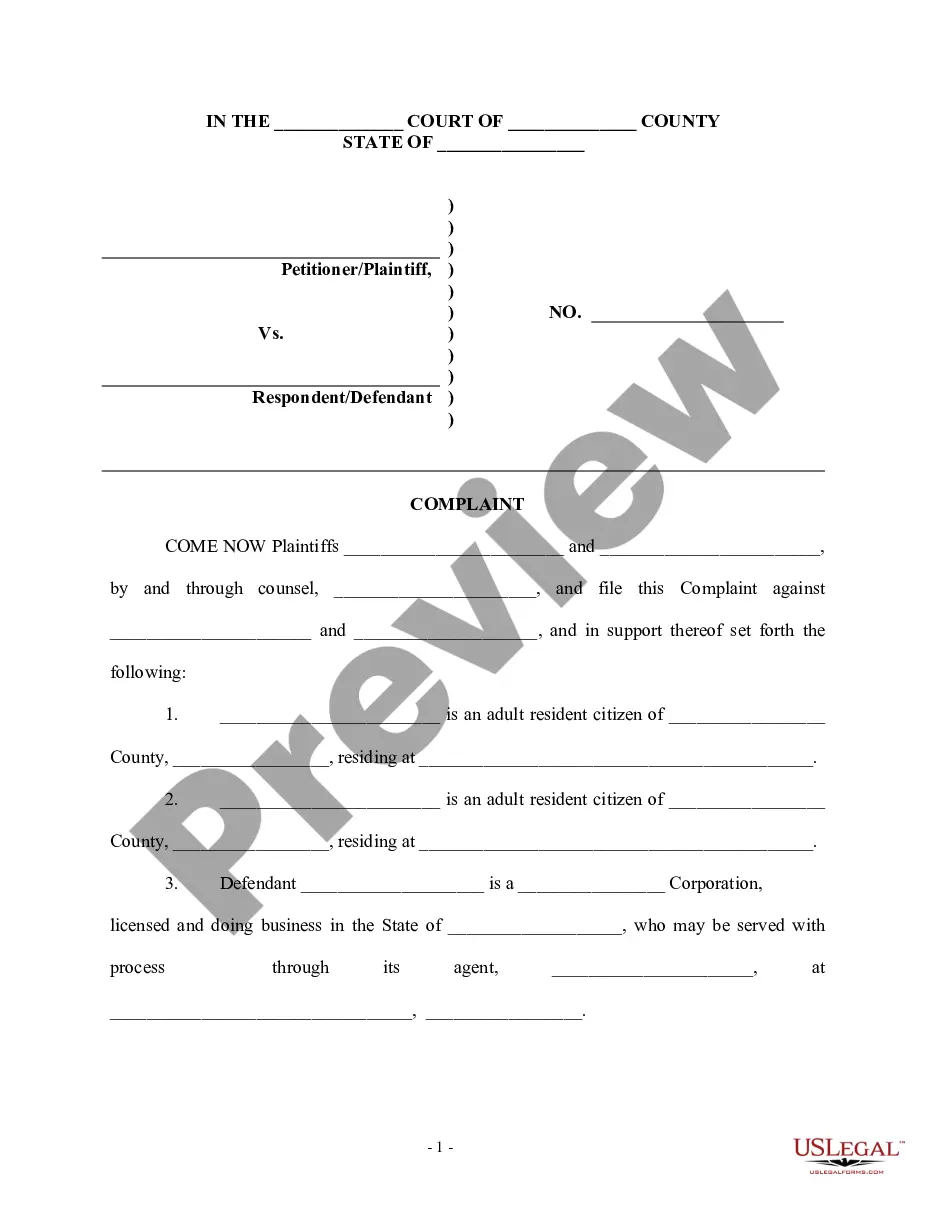

How to fill out Sample Stock Purchase Agreement Regarding Acquisition By Finova Capital Corp. Of All Outstanding Shares Of Fremont Financial Corp.?

If you wish to full, obtain, or produce legal file web templates, use US Legal Forms, the greatest collection of legal types, that can be found online. Use the site`s simple and hassle-free search to obtain the papers you require. A variety of web templates for organization and specific functions are sorted by types and says, or search phrases. Use US Legal Forms to obtain the Minnesota Sample Stock Purchase Agreement regarding acquisition by Finova Capital Corp. of all outstanding shares of Fremont Financial Corp. within a couple of click throughs.

If you are currently a US Legal Forms customer, log in to your profile and click the Down load button to have the Minnesota Sample Stock Purchase Agreement regarding acquisition by Finova Capital Corp. of all outstanding shares of Fremont Financial Corp.. You may also gain access to types you previously delivered electronically inside the My Forms tab of your respective profile.

If you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape to the proper metropolis/nation.

- Step 2. Use the Review solution to look over the form`s articles. Don`t forget to read through the description.

- Step 3. If you are unhappy using the kind, use the Search discipline at the top of the display screen to locate other versions of your legal kind template.

- Step 4. After you have identified the shape you require, select the Buy now button. Choose the rates plan you choose and add your accreditations to sign up for the profile.

- Step 5. Process the transaction. You can utilize your charge card or PayPal profile to accomplish the transaction.

- Step 6. Find the formatting of your legal kind and obtain it on your own gadget.

- Step 7. Full, modify and produce or sign the Minnesota Sample Stock Purchase Agreement regarding acquisition by Finova Capital Corp. of all outstanding shares of Fremont Financial Corp..

Every single legal file template you get is your own property for a long time. You have acces to every single kind you delivered electronically in your acccount. Click the My Forms section and select a kind to produce or obtain once again.

Remain competitive and obtain, and produce the Minnesota Sample Stock Purchase Agreement regarding acquisition by Finova Capital Corp. of all outstanding shares of Fremont Financial Corp. with US Legal Forms. There are thousands of expert and state-specific types you can use for your personal organization or specific demands.

Form popularity

FAQ

A SPA should specify the sale price for the shares, specify the currency and timescale for the sale, and list any other conditions like staged payments. Usually, payment is made in cash, although sometimes the buyer may offer the seller some of its shares, or issue loan notes to the seller.

A Share Purchase Agreement generally includes information about: The person selling the shares. The person buying the shares. The number of shares being sold and their value. The company the shares are being transferred from. The number of shares being sold and their value.

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.

How to draft a purchase agreement Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

Some of the key items that are listed in a stock purchase agreement are: Name of the company whose shares are being bought and sold; Name of the buyer and seller of shares; The number of shares being sold and the par value of those shares; The date and place of the transaction;

This means that the Seller is entitled to the cash on the balance sheet on the closing date of the transaction, and that the Seller is responsible for debts owed by the company (defined as Indebtedness).

In an asset acquisition, the buyer is able to specify the liabilities it is willing to assume, while leaving other liabilities behind. In a stock purchase, on the other hand, the buyer purchases stock in a company that may have unknown or uncertain liabilities.