Minnesota Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc.

Description

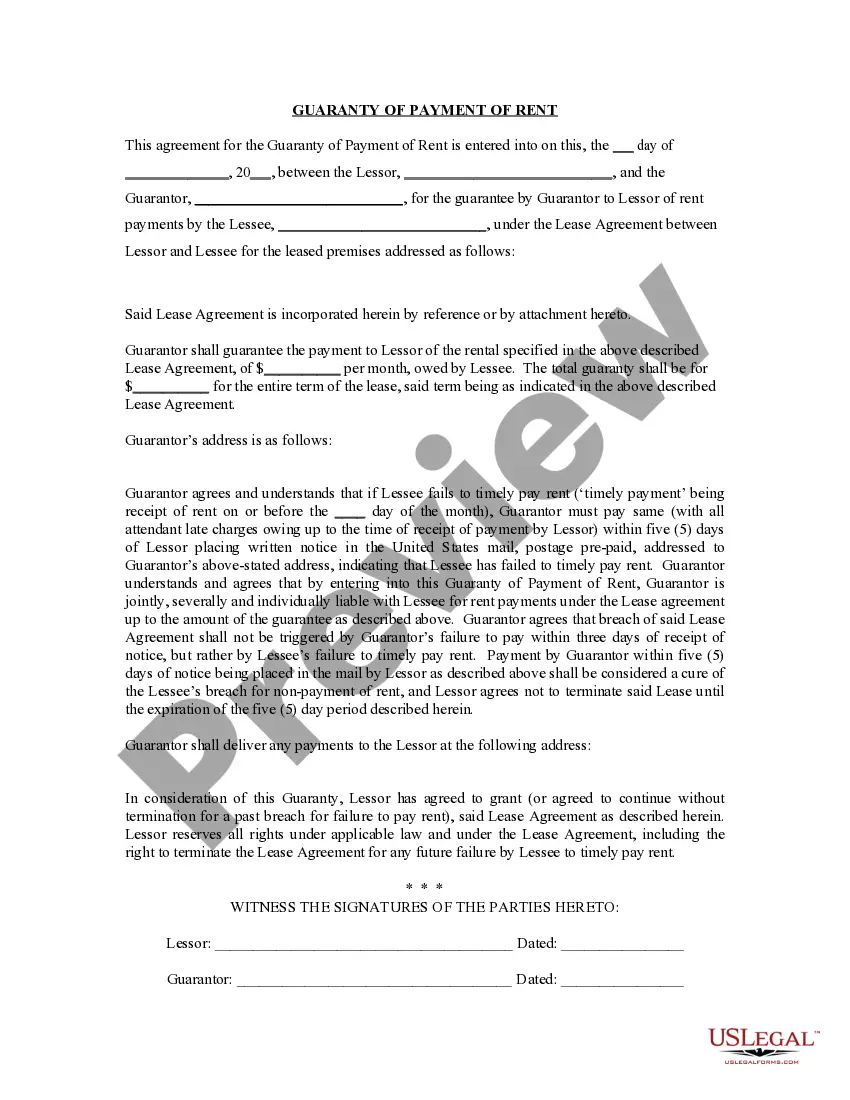

How to fill out Pooling And Servicing Agreement Of Ameriquest Mortgage Securities, Inc.?

If you need to total, obtain, or printing legal document templates, use US Legal Forms, the greatest selection of legal types, that can be found on-line. Take advantage of the site`s simple and easy handy research to find the paperwork you will need. Various templates for organization and personal functions are sorted by categories and suggests, or key phrases. Use US Legal Forms to find the Minnesota Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. in a couple of clicks.

In case you are already a US Legal Forms buyer, log in to the account and click the Acquire key to obtain the Minnesota Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc.. You can even access types you in the past delivered electronically in the My Forms tab of your own account.

If you are using US Legal Forms for the first time, follow the instructions below:

- Step 1. Ensure you have chosen the form for your correct area/country.

- Step 2. Utilize the Preview option to look through the form`s content material. Don`t forget about to read through the information.

- Step 3. In case you are not satisfied together with the kind, take advantage of the Research field on top of the display to find other models in the legal kind design.

- Step 4. Once you have identified the form you will need, click the Acquire now key. Select the prices program you like and add your credentials to register to have an account.

- Step 5. Process the financial transaction. You should use your charge card or PayPal account to perform the financial transaction.

- Step 6. Find the formatting in the legal kind and obtain it on the product.

- Step 7. Full, revise and printing or indication the Minnesota Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc..

Each legal document design you acquire is the one you have forever. You may have acces to every kind you delivered electronically with your acccount. Select the My Forms area and pick a kind to printing or obtain yet again.

Compete and obtain, and printing the Minnesota Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. with US Legal Forms. There are millions of specialist and status-distinct types you can utilize for the organization or personal needs.

Form popularity

FAQ

The Pooling and Servicing Agreement can be a stand-alone document or it can be part of another paper, usually called the ?Prospectus.? If the securitization is public, these documents must be filed with the Securities and Exchange Commission (SEC), and will be available to the public at .sec.gov.

Status: CLOSED. Long Beach was closed by Washington Mutual in 2007. History: Originally a California-based savings and loan, founded in 1979, Long Beach Bank became a federally chartered thrift institution in 1990. In October 1994, it became Long Beach Mortgage Co.

On September 1, 2007, Citigroup completed its acquisition of Argent Mortgage and AMC Mortgage Services, shutting down Ameriquest Mortgage.

Employer Identification No.) 1100 TOWN & COUNTRY ROAD, SUITE 1100 ORANGE, CALIFORNIA 92868 (Address of principal executive offices) (Zip Code) Registrant's Telephone Number, Including Area Code: (714) 541-9960 Item 5.