Minnesota Sample Subsequent Mortgage Loan Purchase Agreement of Ameriquest Mortgage

Description

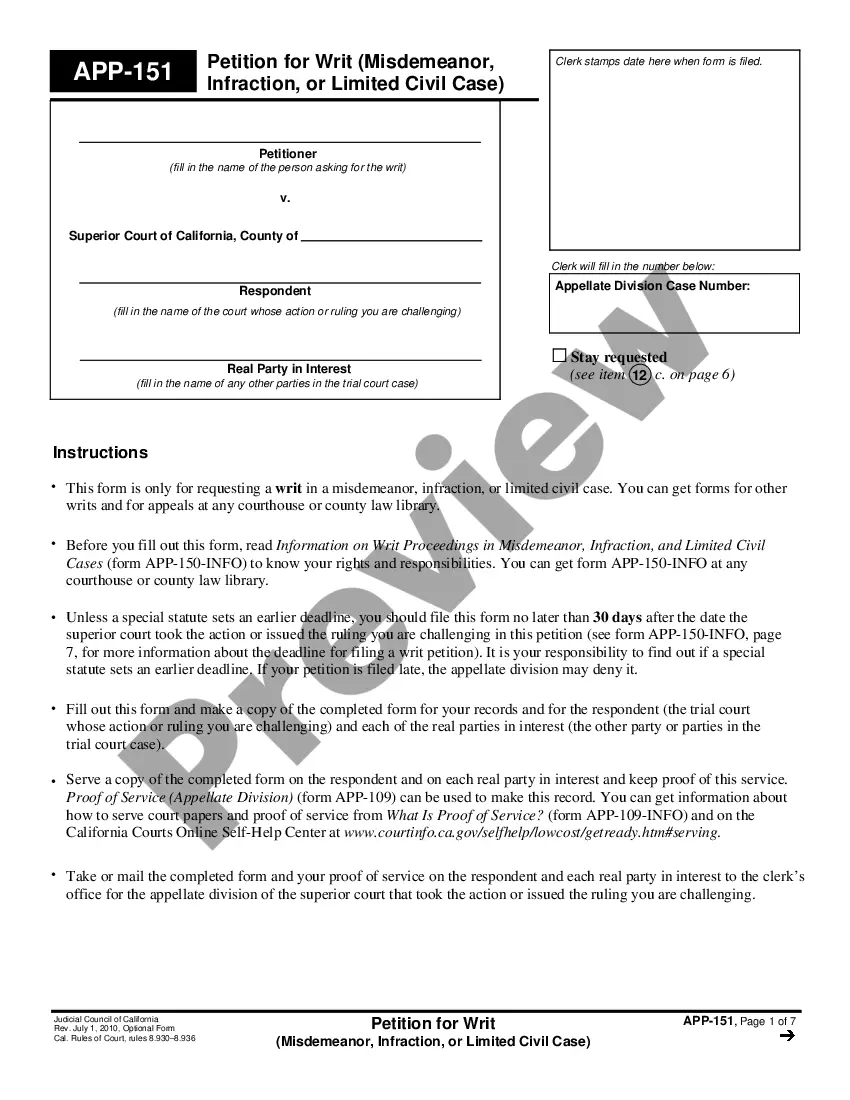

How to fill out Sample Subsequent Mortgage Loan Purchase Agreement Of Ameriquest Mortgage?

You may devote hours on-line attempting to find the authorized record design which fits the federal and state requirements you need. US Legal Forms gives a huge number of authorized varieties that happen to be analyzed by experts. It is simple to obtain or printing the Minnesota Sample Subsequent Mortgage Loan Purchase Agreement of Ameriquest Mortgage from your assistance.

If you currently have a US Legal Forms profile, you are able to log in and click on the Acquire key. Next, you are able to total, edit, printing, or indication the Minnesota Sample Subsequent Mortgage Loan Purchase Agreement of Ameriquest Mortgage. Each and every authorized record design you get is your own for a long time. To acquire one more backup for any acquired kind, visit the My Forms tab and click on the corresponding key.

Should you use the US Legal Forms website initially, stick to the straightforward directions listed below:

- Very first, be sure that you have chosen the proper record design to the state/metropolis that you pick. Look at the kind information to ensure you have picked out the right kind. If accessible, use the Review key to check throughout the record design as well.

- In order to find one more version of the kind, use the Look for discipline to find the design that meets your requirements and requirements.

- After you have found the design you desire, simply click Get now to carry on.

- Select the prices plan you desire, enter your accreditations, and register for a merchant account on US Legal Forms.

- Total the purchase. You may use your Visa or Mastercard or PayPal profile to pay for the authorized kind.

- Select the format of the record and obtain it to the system.

- Make changes to the record if needed. You may total, edit and indication and printing Minnesota Sample Subsequent Mortgage Loan Purchase Agreement of Ameriquest Mortgage.

Acquire and printing a huge number of record themes while using US Legal Forms website, which provides the biggest assortment of authorized varieties. Use professional and state-specific themes to handle your organization or individual demands.

Form popularity

FAQ

A loan purchase agreement is an agreement between a lender and borrower that states how a secured financial asset, such as real estate or equipment, will be purchased. The buyer of this type of security agrees to buy the asset at some point for an agreed-upon price. Loan Purchase Agreement: Definition & Sample - Contracts Counsel contractscounsel.com ? loan-purchase-agree... contractscounsel.com ? loan-purchase-agree...

The term ?loan? can be used to describe any financial transaction where one party receives a lump sum and agrees to pay the money back. A mortgage is a type of loan that's used to finance property. Mortgages are ?secured? loans.

Signing a PSA does not complete the sale of the home. Signing a purchase agreement, however, does complete the home sale. Where the PSA lays out the details of the transaction leading up to the closing date, the purchase agreement is what you sign to finalize the transaction.

Citigroup On September 1, 2007, Citigroup completed its acquisition of Argent Mortgage and AMC Mortgage Services, shutting down Ameriquest Mortgage. Ameriquest Mortgage - Wikipedia wikipedia.org ? wiki ? Ameriquest_Mortgage wikipedia.org ? wiki ? Ameriquest_Mortgage

A loan agreement is a formal contract between a borrower and a lender. These counterparties rely on the loan agreement to ensure legal recourse if commitments or obligations are not met. Sections in the contract include loan details, collateral, required reporting, covenants, and default clauses.

A purchase agreement is a type of contract that outlines terms and conditions related to the sale of goods. As a legally binding contract between buyer and seller, the agreements typically relate to buying and selling goods rather than services. They cover transactions for nearly any type of product.