Minnesota Escrow Agreement between The TriZetto Group, Inc., the Finserv Securityholders, Stuart Schloss and Bankers Trust Co.

Description

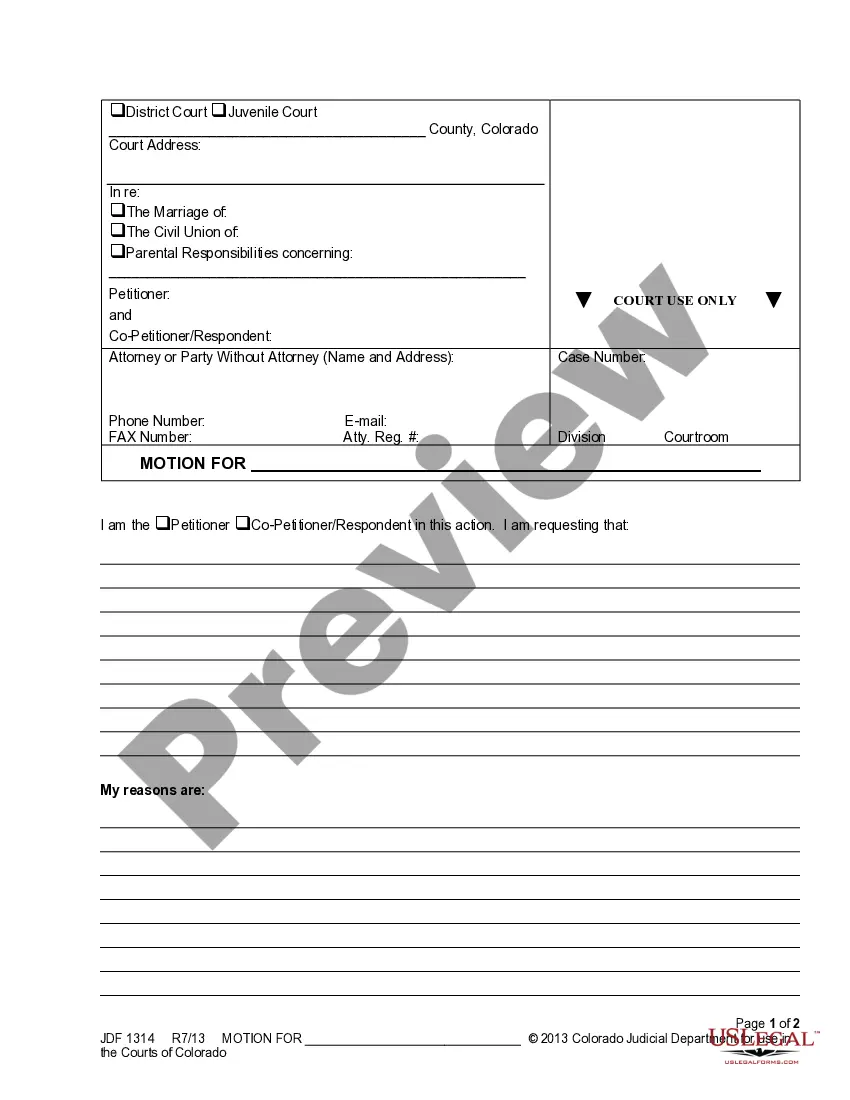

How to fill out Escrow Agreement Between The TriZetto Group, Inc., The Finserv Securityholders, Stuart Schloss And Bankers Trust Co.?

Discovering the right legitimate document web template could be a battle. Needless to say, there are tons of web templates accessible on the Internet, but how would you obtain the legitimate kind you want? Take advantage of the US Legal Forms web site. The assistance provides a large number of web templates, for example the Minnesota Escrow Agreement between The TriZetto Group, Inc., the Finserv Securityholders, Stuart Schloss and Bankers Trust Co., which can be used for company and personal demands. Each of the varieties are inspected by experts and meet up with state and federal specifications.

Should you be currently signed up, log in in your account and click on the Down load option to have the Minnesota Escrow Agreement between The TriZetto Group, Inc., the Finserv Securityholders, Stuart Schloss and Bankers Trust Co.. Make use of your account to look from the legitimate varieties you may have purchased earlier. Proceed to the My Forms tab of your own account and acquire another backup in the document you want.

Should you be a whole new end user of US Legal Forms, allow me to share straightforward directions that you should comply with:

- Initially, make certain you have chosen the proper kind for the city/state. It is possible to look through the form making use of the Preview option and look at the form explanation to guarantee this is basically the right one for you.

- In case the kind does not meet up with your expectations, use the Seach discipline to discover the right kind.

- Once you are sure that the form would work, click on the Acquire now option to have the kind.

- Opt for the pricing strategy you would like and enter in the essential information. Create your account and purchase an order making use of your PayPal account or Visa or Mastercard.

- Choose the document file format and obtain the legitimate document web template in your system.

- Comprehensive, modify and produce and indicator the attained Minnesota Escrow Agreement between The TriZetto Group, Inc., the Finserv Securityholders, Stuart Schloss and Bankers Trust Co..

US Legal Forms may be the most significant collection of legitimate varieties where you can discover numerous document web templates. Take advantage of the service to obtain skillfully-produced paperwork that comply with condition specifications.