Minnesota Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc.

Description

How to fill out Plan Of Merger Between Stamps.Com, Inc., Rocket Acquisition Corp. And Iship.Com, Inc.?

US Legal Forms - one of the most significant libraries of legitimate kinds in the States - delivers an array of legitimate papers templates you can obtain or print out. While using site, you can find a large number of kinds for company and individual purposes, sorted by groups, states, or keywords.You will find the newest versions of kinds like the Minnesota Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc. in seconds.

If you already have a monthly subscription, log in and obtain Minnesota Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc. from the US Legal Forms collection. The Acquire switch can look on each develop you look at. You get access to all formerly acquired kinds within the My Forms tab of the profile.

If you would like use US Legal Forms initially, here are straightforward recommendations to help you started:

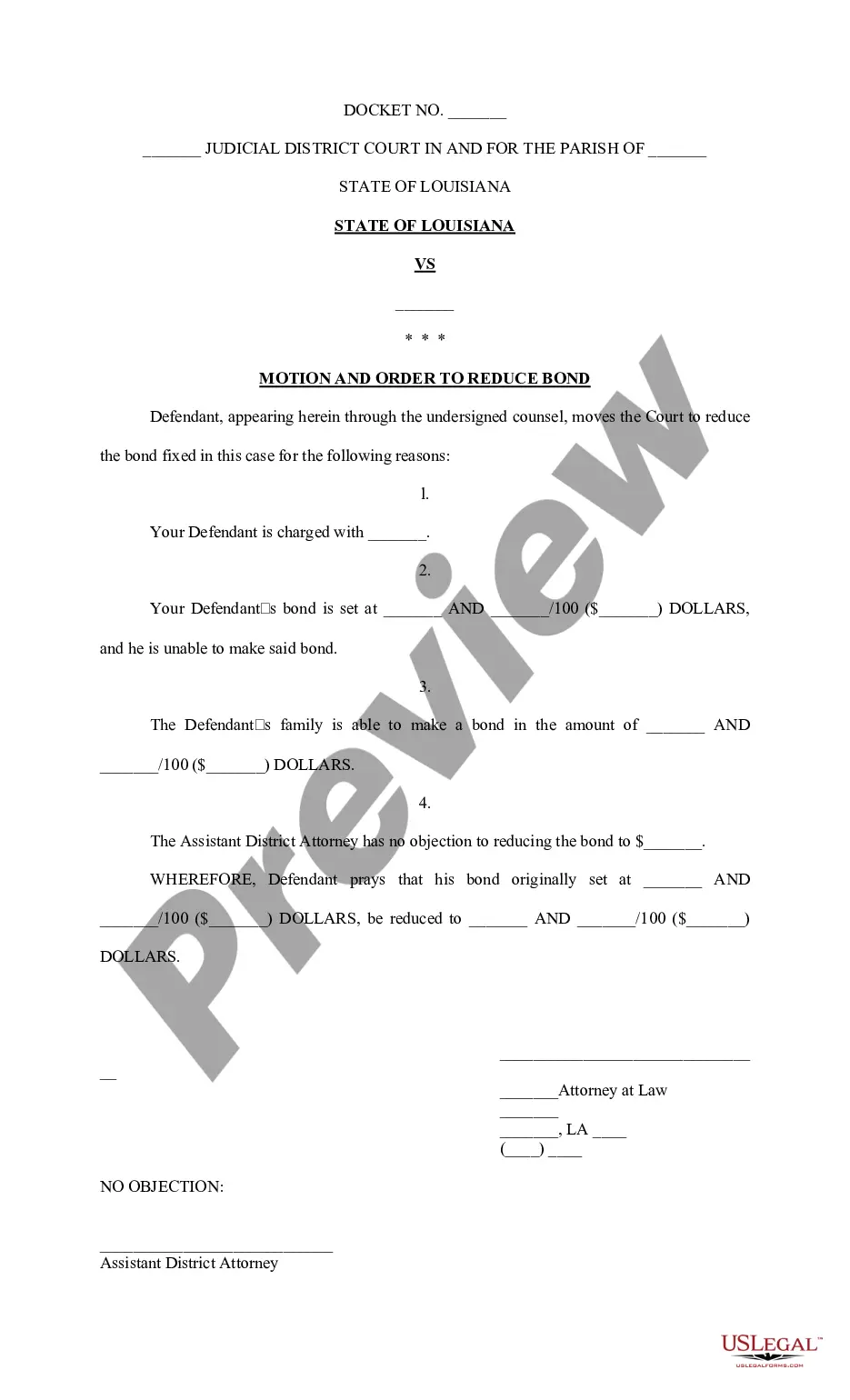

- Ensure you have chosen the right develop for your personal town/area. Click on the Preview switch to check the form`s articles. Browse the develop explanation to ensure that you have selected the right develop.

- In the event the develop doesn`t fit your requirements, make use of the Lookup industry on top of the screen to obtain the one who does.

- In case you are happy with the form, validate your option by simply clicking the Get now switch. Then, select the rates strategy you like and give your credentials to register for an profile.

- Approach the purchase. Use your Visa or Mastercard or PayPal profile to perform the purchase.

- Find the file format and obtain the form on your own device.

- Make modifications. Complete, edit and print out and indication the acquired Minnesota Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc..

Each and every design you included in your account does not have an expiry date and it is your own property for a long time. So, if you wish to obtain or print out an additional backup, just check out the My Forms portion and click about the develop you will need.

Obtain access to the Minnesota Plan of Merger between Stamps.Com, Inc., Rocket Acquisition Corp. and Iship.Com, Inc. with US Legal Forms, one of the most comprehensive collection of legitimate papers templates. Use a large number of expert and status-distinct templates that meet your company or individual demands and requirements.