Minnesota Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association

Description

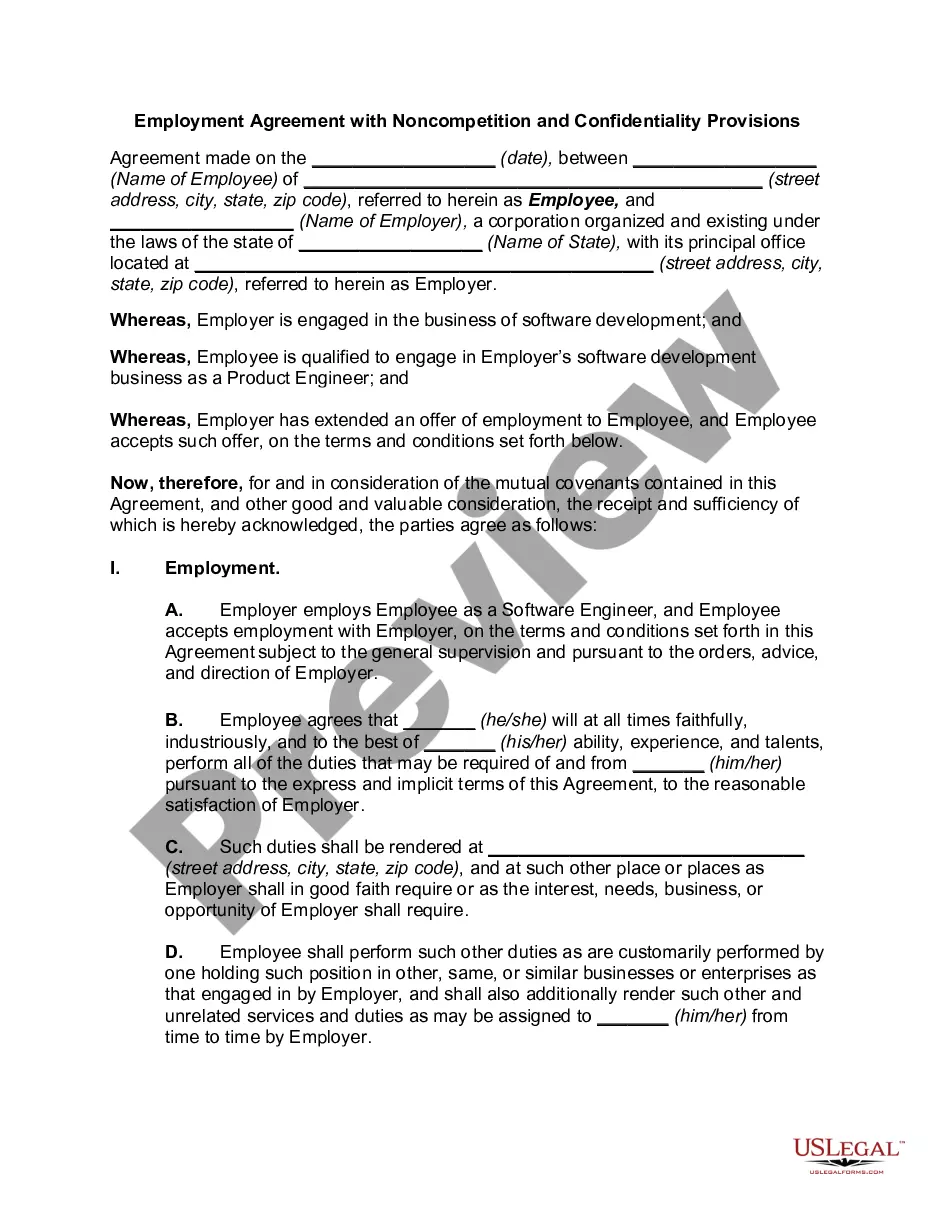

How to fill out Pooling And Servicing Agreement Between Greenpoint Credit, LLC And Bank One, National Association?

Finding the right authorized document template can be quite a have difficulties. Naturally, there are a lot of themes available on the net, but how do you discover the authorized form you require? Use the US Legal Forms site. The services gives 1000s of themes, including the Minnesota Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association, which can be used for organization and personal requirements. All of the forms are examined by specialists and meet state and federal specifications.

If you are currently signed up, log in in your account and then click the Acquire key to find the Minnesota Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association. Utilize your account to appear from the authorized forms you have acquired in the past. Proceed to the My Forms tab of your own account and acquire yet another copy of your document you require.

If you are a whole new customer of US Legal Forms, allow me to share straightforward guidelines that you can follow:

- First, make certain you have chosen the proper form for your area/county. You may check out the form utilizing the Review key and browse the form description to make certain it is the best for you.

- If the form will not meet your preferences, use the Seach discipline to obtain the right form.

- When you are certain the form would work, click the Get now key to find the form.

- Choose the costs plan you would like and type in the essential information. Design your account and buy the order utilizing your PayPal account or credit card.

- Select the submit file format and acquire the authorized document template in your system.

- Total, modify and print out and indication the attained Minnesota Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association.

US Legal Forms is definitely the most significant local library of authorized forms in which you can see various document themes. Use the service to acquire expertly-manufactured documents that follow status specifications.

Form popularity

FAQ

PSA is used primarily to derive an implied prepayment speed of new production loans. 00% PSA assumes a prepayment rate of 2% per month in the first month following the date of issue, increasing at 2% percentage points per month thereafter until the 30th month. PSA Prepayment Rate Definition - Nasdaq nasdaq.com ? glossary ? psa-prepayment-rate nasdaq.com ? glossary ? psa-prepayment-rate

An MBS is made up of a pool of mortgages purchased from issuing banks and then sold to investors. An MBS allows investors to benefit from the mortgage business without needing to buy or sell home loans themselves. What Are Mortgage-Backed Securities? rocketmortgage.com ? learn ? mortgage-bac... rocketmortgage.com ? learn ? mortgage-bac...

What is a Pooling Agreement? A pooling agreement is a type of contract where corporate shareholders create a voting trust by pooling their voting rights and transferring them to a trustee. This is also called a voting agreement or shareholder-control agreement since it is used to control the affairs of the corporation. Pooling Agreement: Definition & Sample - Contracts Counsel contractscounsel.com ? pooling-agreement contractscounsel.com ? pooling-agreement

Homeowners are often transferred to SPS once they become delinquent on their mortgage payments. Many lenders try to protect their brand when it comes to foreclosing on homeowners.

A mortgage pool is a group of home and other real estate loans that have been bundled so they can be sold. A mortgage pool is a group of home and other real estate loans that have been bundled so they can be sold. What Is a Mortgage Pool? - The Balance thebalancemoney.com ? what-is-a-mortgage... thebalancemoney.com ? what-is-a-mortgage...

The ?Pooling and Servicing Agreement? is the legal document that contains the responsibilities and rights of the servicer, the trustee, and others over a pool of mortgage loans.