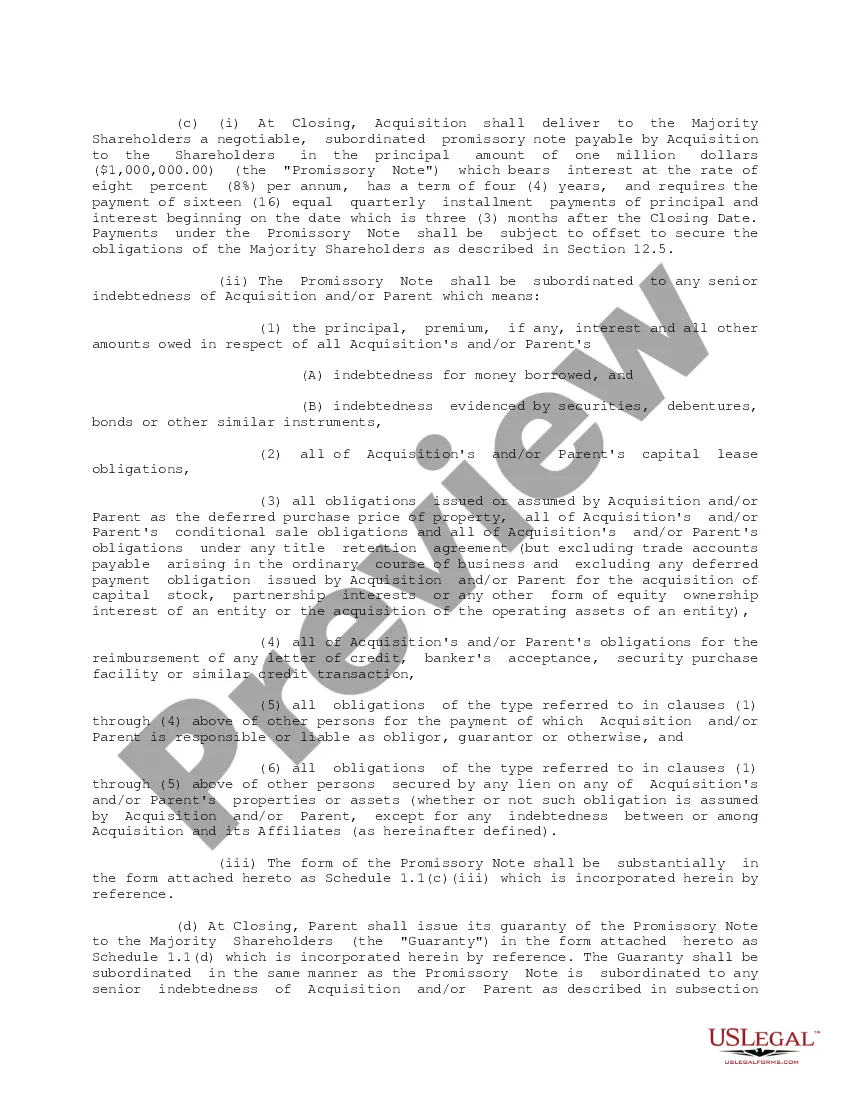

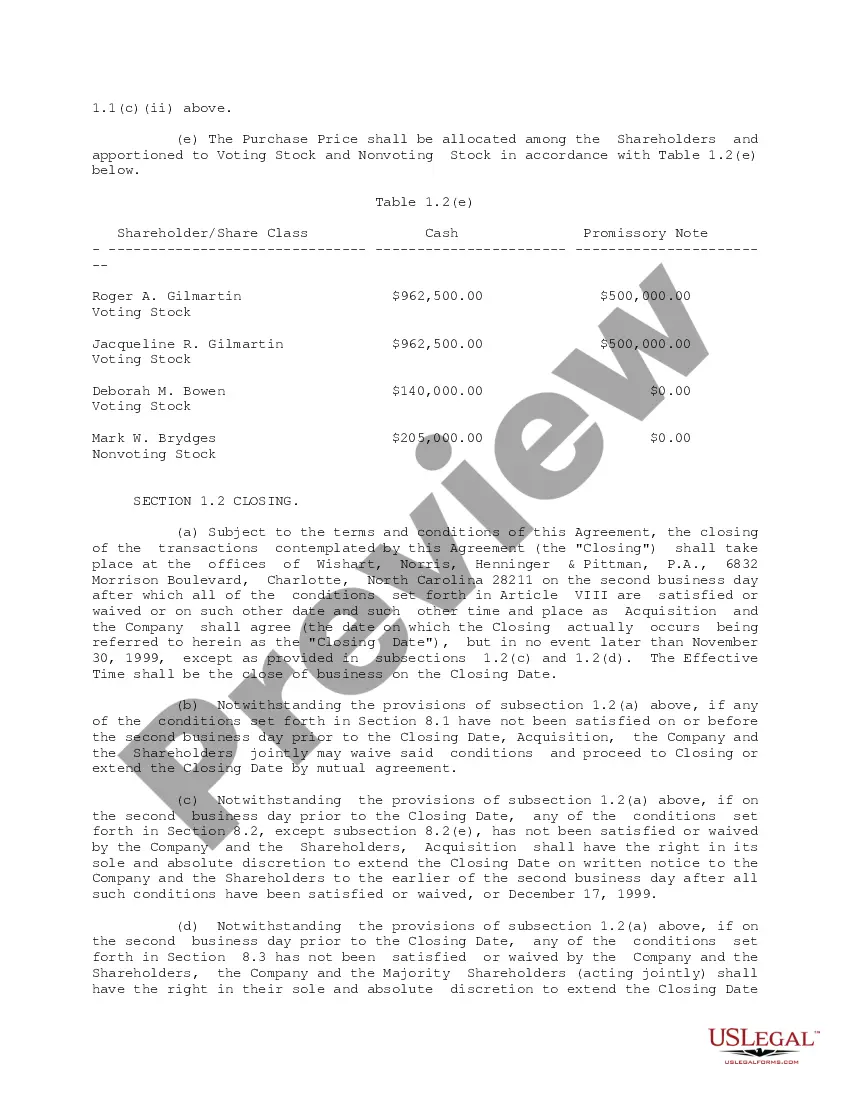

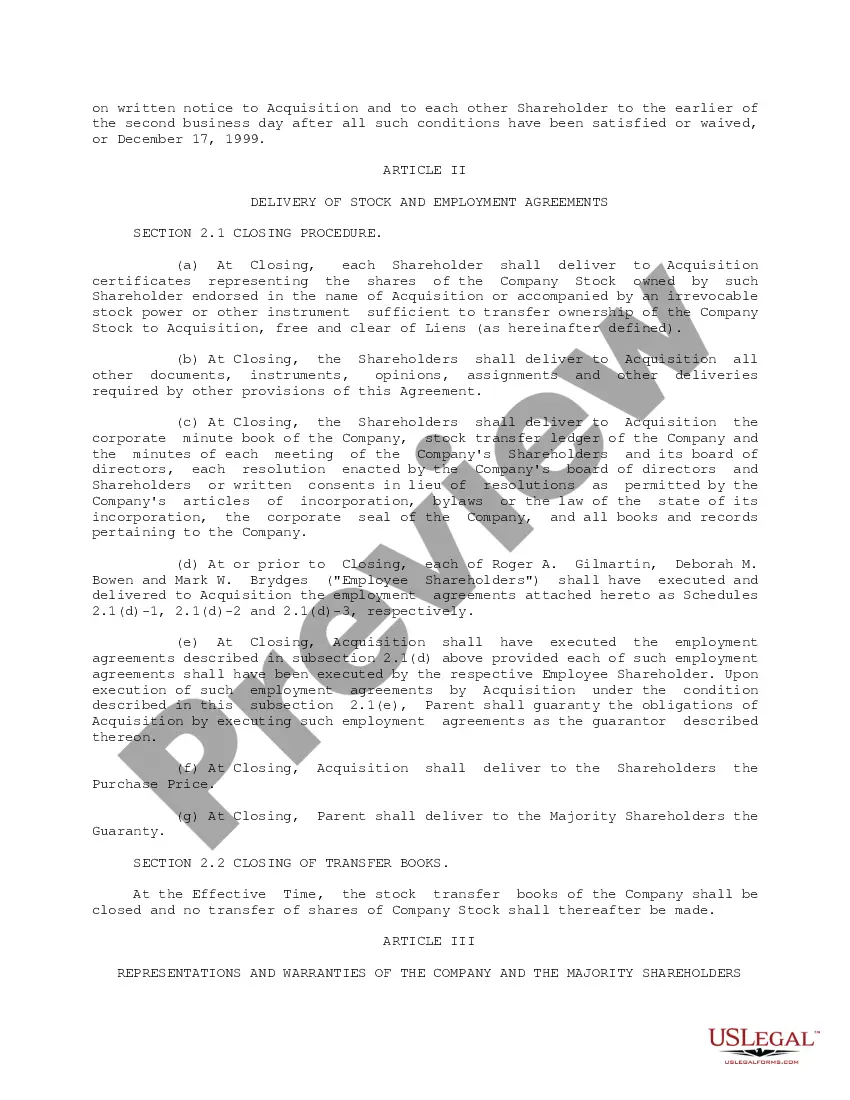

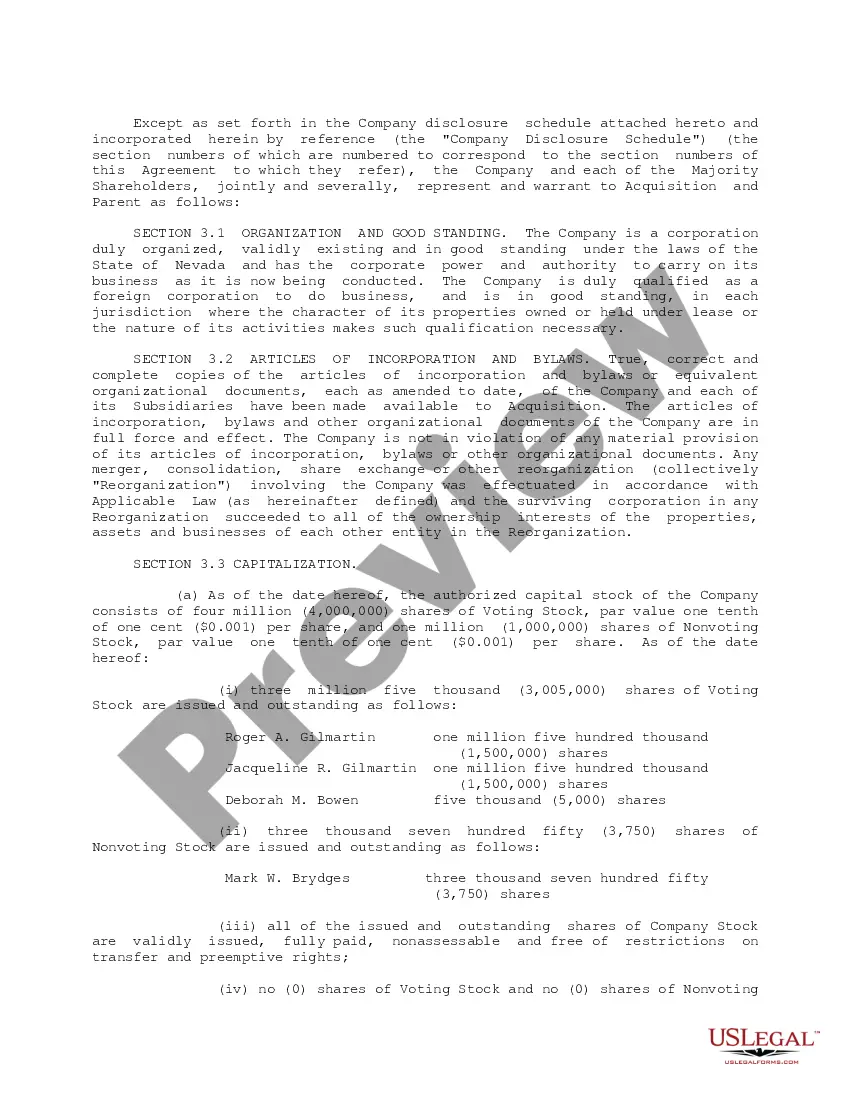

Minnesota Sample Purchase and Sale Agreement Purchase and Sale of Stock between GET Acquisition Corp., Exigent International, Inc., GET North America Corp. Introduction: A Minnesota Sample Purchase and Sale Agreement for the Purchase and Sale of stock is a legally binding document that outlines the terms and conditions associated with the transfer of stock ownership between GET Acquisition Corp., Exigent International, Inc., and GET North America Corp. By executing this agreement, all parties ensure a smooth and regulated transaction while protecting their respective rights and interests. Key Elements of the Agreement: 1. Parties Involved: The agreement will clearly state the parties involved in the transaction, including the buyer (GET Acquisition Corp.), the seller (Exigent International, Inc.), and any other relevant parties. 2. Purchase Price and Payment Terms: The agreement will specify the purchase price of the stock and the terms of payment, including any installments or milestones. It may also mention any adjustments to the purchase price based on due diligence findings or other agreed-upon factors. 3. Stock Transfer: The agreement will detail the stock being transferred, including the type, number of shares, and any applicable restrictions or conditions surrounding the transfer. It will also address the delivery of stock certificates or electronic book-entry transfers. 4. Representations and Warranties: Both the buyer and the seller will provide representations and warranties pertaining to their legal and financial authority to execute the agreement. This section ensures that both parties are aware of any potential risks or liabilities associated with the stock being sold. 5. Due Diligence: The agreement will specify the timeframe and obligations for conducting due diligence on the stock being sold. This may include reviewing financial records, legal obligations, and any other relevant documents. 6. Confidentiality and Non-Disclosure: To protect sensitive information exchanged during the transaction, the agreement may include provisions regarding confidentiality and non-disclosure between the parties involved. 7. Indemnification: The agreement will outline the indemnification obligations of each party, ensuring that any losses, damages, or liabilities resulting from the transaction are appropriately allocated between the buyer and the seller. Additional Types of Minnesota Sample Purchase and Sale Agreements: 1. Asset Purchase Agreement: A different type of purchase agreement that involves the transfer of specific assets, such as equipment, inventory, and intellectual property, rather than the sale of stock. 2. Merger Agreement: This type of agreement outlines the terms and conditions for merging two companies into one entity, often involving a mix of stock and cash as consideration. 3. Share Purchase Agreement: Similar to the agreement in question, a share purchase agreement involves the transfer of shares between companies or individuals, but may not necessarily involve all parties mentioned. Conclusion: The Minnesota Sample Purchase and Sale Agreement for the Purchase and Sale of Stock between GET Acquisition Corp., Exigent International, Inc., and GET North America Corp. is a comprehensive legal document that governs the transfer of stock ownership. It covers various aspects such as purchase price, payment terms, stock transfer, due diligence, representations and warranties, confidentiality, and indemnification. Different types of purchase agreements, like asset purchase agreements and merger agreements, can also be used for specific situations.

Minnesota Sample Purchase and Sale Agreement Purchase and Sale of stock between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp.

Description

How to fill out Minnesota Sample Purchase And Sale Agreement Purchase And Sale Of Stock Between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp.?

US Legal Forms - among the largest libraries of lawful kinds in the United States - provides a variety of lawful file templates you can acquire or printing. Utilizing the web site, you can find a huge number of kinds for business and person purposes, sorted by classes, states, or key phrases.You can find the most up-to-date models of kinds just like the Minnesota Sample Purchase and Sale Agreement Purchase and Sale of stock between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp. in seconds.

If you already possess a subscription, log in and acquire Minnesota Sample Purchase and Sale Agreement Purchase and Sale of stock between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp. from your US Legal Forms local library. The Down load button can look on each develop you look at. You gain access to all formerly delivered electronically kinds from the My Forms tab of your own profile.

In order to use US Legal Forms the very first time, listed here are simple recommendations to obtain started:

- Be sure you have picked the correct develop to your city/county. Click the Preview button to examine the form`s articles. Browse the develop information to actually have selected the right develop.

- When the develop does not satisfy your needs, take advantage of the Search discipline near the top of the monitor to discover the the one that does.

- When you are satisfied with the form, confirm your decision by clicking the Acquire now button. Then, select the prices prepare you want and give your references to register on an profile.

- Procedure the purchase. Use your credit card or PayPal profile to finish the purchase.

- Find the format and acquire the form on the gadget.

- Make modifications. Fill up, modify and printing and sign the delivered electronically Minnesota Sample Purchase and Sale Agreement Purchase and Sale of stock between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp..

Every single web template you added to your account does not have an expiration time and is the one you have for a long time. So, if you want to acquire or printing one more backup, just visit the My Forms portion and click on on the develop you require.

Gain access to the Minnesota Sample Purchase and Sale Agreement Purchase and Sale of stock between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp. with US Legal Forms, one of the most substantial local library of lawful file templates. Use a huge number of expert and status-particular templates that fulfill your business or person requires and needs.