Minnesota Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC

Description

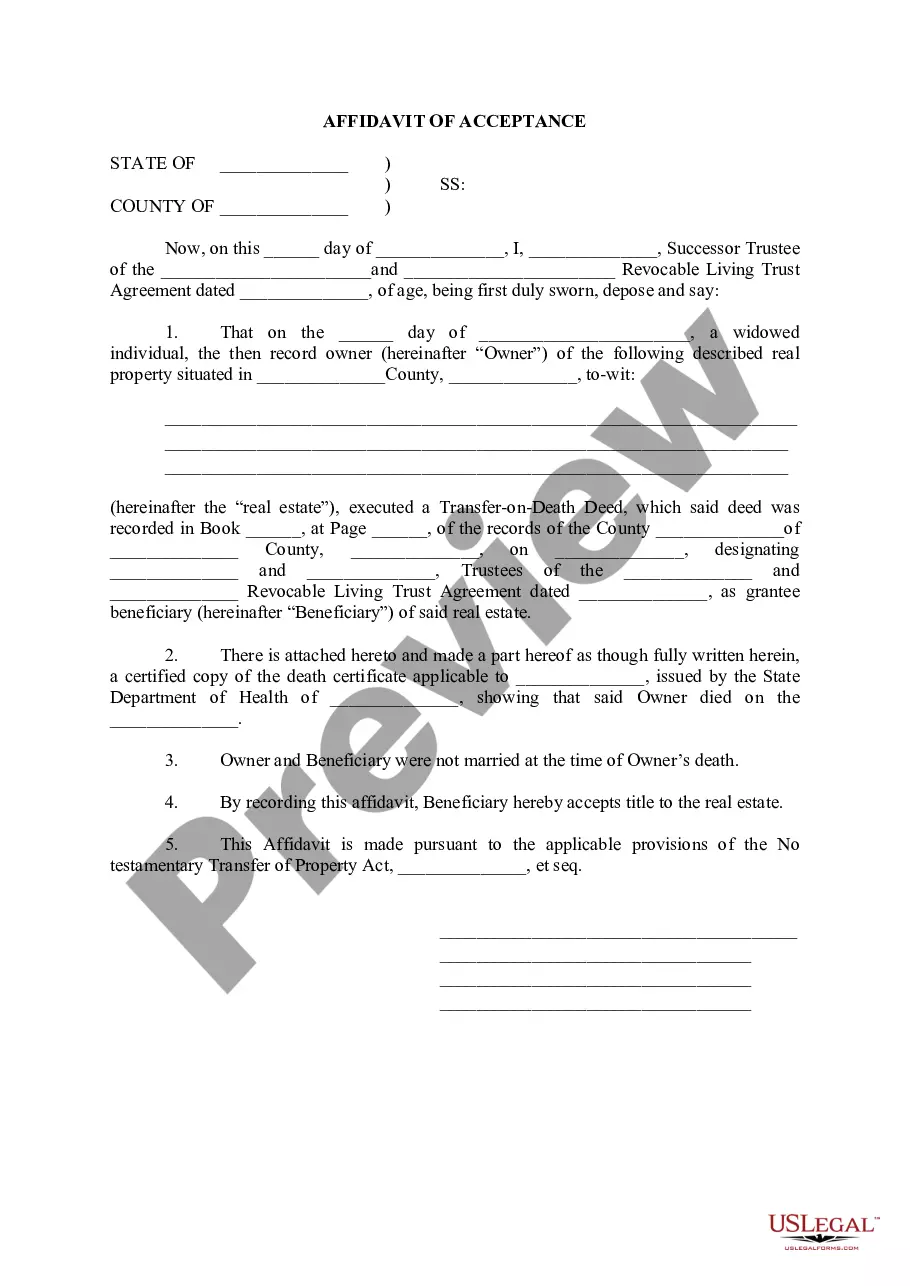

How to fill out Plan Of Merger Between Berkshire Energy Resources, Energy East Corporation And Mountain Merger, LLC?

US Legal Forms - one of several most significant libraries of legitimate types in the United States - offers a wide array of legitimate record templates you may download or produce. Using the site, you will get thousands of types for enterprise and personal uses, categorized by classes, claims, or keywords.You can find the newest types of types like the Minnesota Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC within minutes.

If you already possess a membership, log in and download Minnesota Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC in the US Legal Forms collection. The Down load button can look on each type you look at. You have access to all formerly acquired types within the My Forms tab of your respective bank account.

If you would like use US Legal Forms the very first time, listed below are basic directions to help you get started:

- Be sure to have picked out the correct type for the town/state. Go through the Review button to review the form`s content material. Read the type explanation to ensure that you have chosen the appropriate type.

- If the type does not fit your needs, utilize the Lookup industry towards the top of the display screen to discover the one which does.

- When you are pleased with the shape, affirm your selection by visiting the Buy now button. Then, pick the prices program you favor and supply your accreditations to register on an bank account.

- Method the purchase. Use your credit card or PayPal bank account to complete the purchase.

- Choose the structure and download the shape on your own product.

- Make adjustments. Fill up, edit and produce and indication the acquired Minnesota Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC.

Every format you included in your bank account does not have an expiration day and is also your own property permanently. So, in order to download or produce an additional copy, just check out the My Forms segment and click on on the type you want.

Get access to the Minnesota Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC with US Legal Forms, by far the most extensive collection of legitimate record templates. Use thousands of skilled and state-distinct templates that fulfill your business or personal requires and needs.