Minnesota Subscription Agreement - 6% Series G Convertible Preferred Stock - between ObjectSoft Corp. and Investors regarding issuance and sale of preferred stock

Description

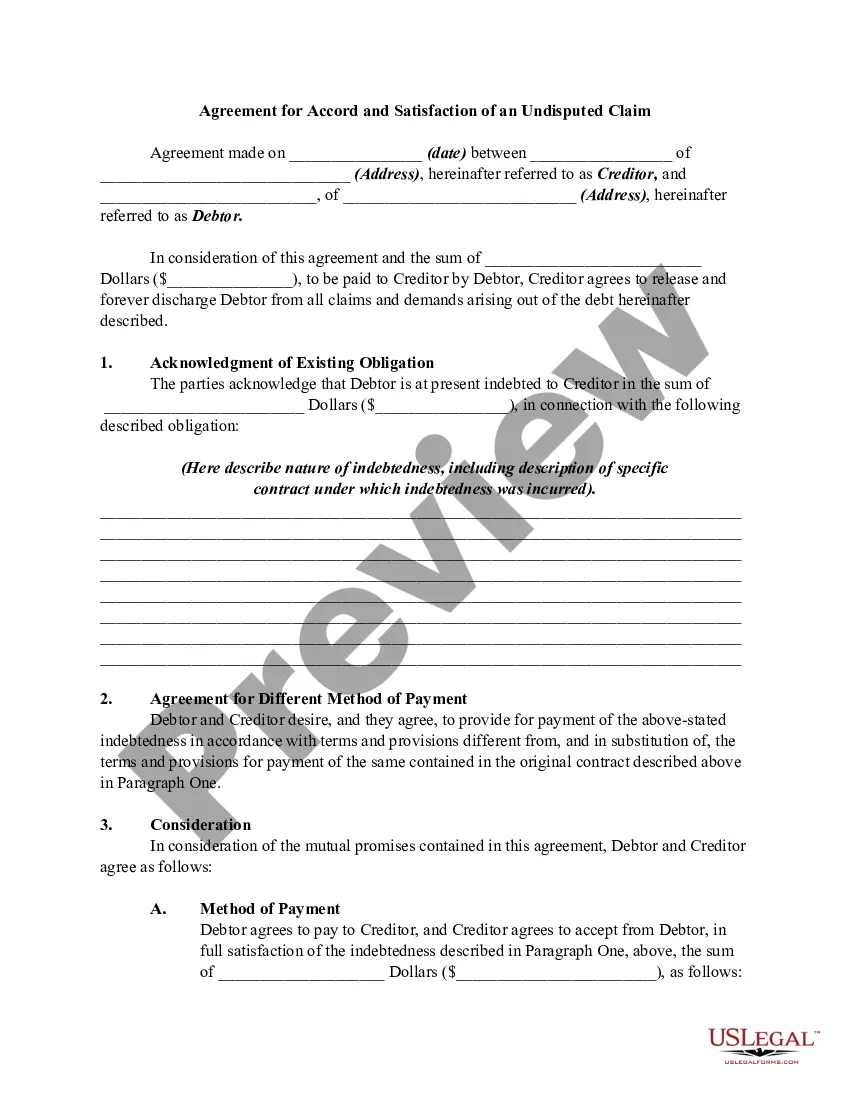

How to fill out Subscription Agreement - 6% Series G Convertible Preferred Stock - Between ObjectSoft Corp. And Investors Regarding Issuance And Sale Of Preferred Stock?

You are able to spend several hours online looking for the legal document web template that fits the federal and state specifications you will need. US Legal Forms offers a large number of legal kinds that happen to be examined by pros. You can actually obtain or print out the Minnesota Subscription Agreement - 6% Series G Convertible Preferred Stock - between ObjectSoft Corp. and Investors regarding issuance and sale of preferred stock from the service.

If you already have a US Legal Forms profile, you are able to log in and then click the Acquire switch. Next, you are able to full, edit, print out, or signal the Minnesota Subscription Agreement - 6% Series G Convertible Preferred Stock - between ObjectSoft Corp. and Investors regarding issuance and sale of preferred stock. Each legal document web template you buy is yours eternally. To have yet another copy for any acquired type, check out the My Forms tab and then click the corresponding switch.

If you work with the US Legal Forms site initially, adhere to the basic recommendations below:

- Very first, make certain you have selected the proper document web template to the region/metropolis of your choice. Read the type description to ensure you have chosen the proper type. If readily available, make use of the Review switch to look from the document web template as well.

- If you wish to get yet another model of the type, make use of the Research industry to obtain the web template that meets your needs and specifications.

- Upon having discovered the web template you desire, click Get now to carry on.

- Find the pricing strategy you desire, type your references, and sign up for a merchant account on US Legal Forms.

- Comprehensive the deal. You may use your charge card or PayPal profile to pay for the legal type.

- Find the file format of the document and obtain it for your product.

- Make modifications for your document if possible. You are able to full, edit and signal and print out Minnesota Subscription Agreement - 6% Series G Convertible Preferred Stock - between ObjectSoft Corp. and Investors regarding issuance and sale of preferred stock.

Acquire and print out a large number of document themes making use of the US Legal Forms Internet site, that provides the largest assortment of legal kinds. Use expert and condition-particular themes to tackle your business or individual requires.

Form popularity

FAQ

Risk of Conversion Convertible preferred stock carries the risk that it may not be converted into common stock. This means that if the company's common stock does not perform well, the value of the preferred stock may not increase. This can lead to lower returns on investment for the investor.

The convertible preferred stock advantages to an investor include high dividend yield, flexibility, and potential for capital appreciation. To the issuer, convertible preferred stock can increase a company's equity or capital.

The convertible preferred stock advantages to an investor include high dividend yield, flexibility, and potential for capital appreciation. To the issuer, convertible preferred stock can increase a company's equity or capital.

The conversion price is calculated by dividing the par value of the preferred stock by the conversion ratio. For example, if the par value of the preferred stock is $50 and the conversion ratio is 5, the conversion price would be $10.

In the last example, the investor made a profit because the common stock price increased. Convertibility benefits investors as it provides more return potential. Therefore, convertible preferred stock is issued with lower dividend rates than non-convertible preferred stock.

Conversion price can be calculated by dividing the convertible preferred stock's par value by the stipulated conversion ratio. Conversion premium: The dollar amount by which the market price of the convertible preferred stock exceeds the current market value of the common shares into which it may be converted.

What Are Convertible Preferred Shares? These shares are corporate fixed-income securities that the investor can choose to turn into a certain number of shares of the company's common stock after a predetermined time span or on a specific date.

Convertible preferred stock can provide significant flexibility to a company because the preferred stock is typically perpetual (i.e., it has no stated maturity) and dividends are often non-cumulative.