Minnesota Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank

Description

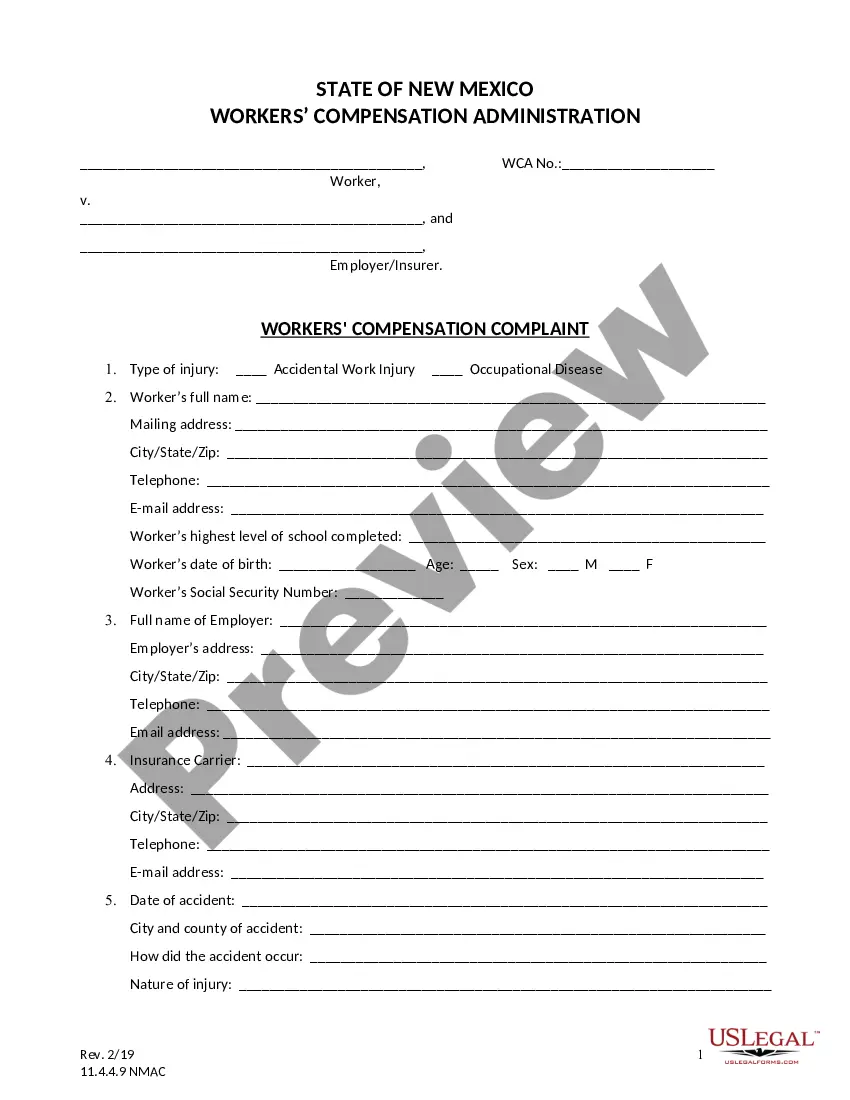

How to fill out Borrower Security Agreement Between ADAC Laboratories And ABN AMRO Bank?

Are you currently inside a placement that you need files for sometimes organization or individual uses virtually every day? There are a lot of lawful record templates available on the net, but finding versions you can trust is not simple. US Legal Forms delivers a huge number of form templates, just like the Minnesota Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank, which can be created to satisfy state and federal demands.

Should you be already acquainted with US Legal Forms website and possess an account, basically log in. Following that, it is possible to download the Minnesota Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank format.

Unless you provide an bank account and want to start using US Legal Forms, adopt these measures:

- Discover the form you want and ensure it is for that appropriate area/area.

- Utilize the Preview button to analyze the form.

- Look at the information to actually have chosen the right form.

- In case the form is not what you`re looking for, make use of the Search area to obtain the form that meets your requirements and demands.

- When you get the appropriate form, click on Purchase now.

- Select the rates plan you need, complete the desired information to generate your bank account, and pay for your order utilizing your PayPal or Visa or Mastercard.

- Pick a handy paper structure and download your duplicate.

Locate all of the record templates you might have bought in the My Forms menu. You can aquire a more duplicate of Minnesota Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank at any time, if needed. Just select the required form to download or print out the record format.

Use US Legal Forms, one of the most comprehensive assortment of lawful types, to save lots of efforts and avoid blunders. The services delivers skillfully manufactured lawful record templates that can be used for a variety of uses. Create an account on US Legal Forms and start creating your way of life easier.