Minnesota Voting Agreement between ID Recap, Inc. and Steven R. Matzkin regarding exchange of shares of capital stock

Description

How to fill out Voting Agreement Between ID Recap, Inc. And Steven R. Matzkin Regarding Exchange Of Shares Of Capital Stock?

Are you inside a situation in which you will need documents for both company or personal functions nearly every time? There are tons of legal file web templates available on the net, but finding versions you can trust is not effortless. US Legal Forms provides thousands of type web templates, such as the Minnesota Voting Agreement between ID Recap, Inc. and Steven R. Matzkin regarding exchange of shares of capital stock, that happen to be written to meet federal and state needs.

In case you are currently acquainted with US Legal Forms internet site and possess an account, basically log in. After that, you may download the Minnesota Voting Agreement between ID Recap, Inc. and Steven R. Matzkin regarding exchange of shares of capital stock web template.

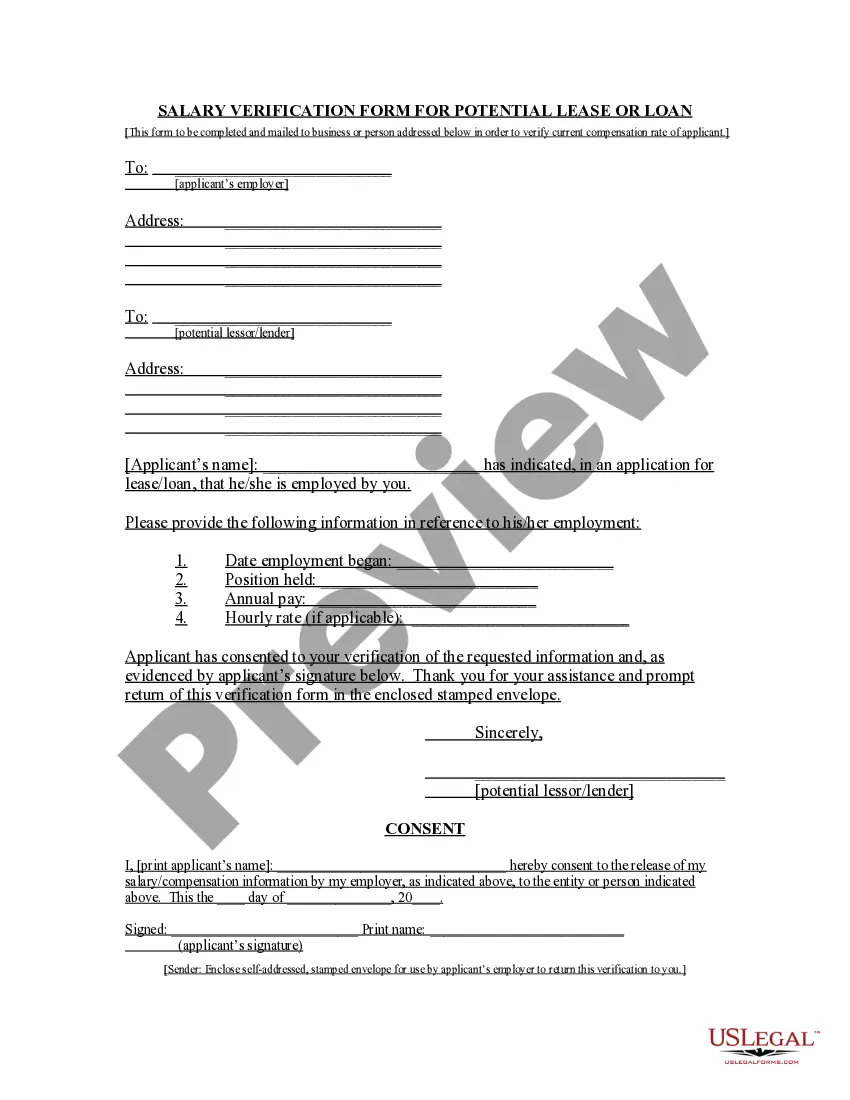

If you do not have an profile and would like to start using US Legal Forms, follow these steps:

- Discover the type you want and make sure it is for your appropriate metropolis/state.

- Take advantage of the Preview option to check the form.

- Look at the outline to actually have selected the right type.

- In the event the type is not what you`re trying to find, use the Look for field to find the type that meets your requirements and needs.

- If you obtain the appropriate type, simply click Acquire now.

- Opt for the rates plan you need, fill in the required info to produce your money, and pay for your order making use of your PayPal or Visa or Mastercard.

- Decide on a hassle-free paper structure and download your backup.

Find every one of the file web templates you possess bought in the My Forms menu. You can obtain a additional backup of Minnesota Voting Agreement between ID Recap, Inc. and Steven R. Matzkin regarding exchange of shares of capital stock whenever, if necessary. Just click on the required type to download or print out the file web template.

Use US Legal Forms, probably the most considerable collection of legal types, to save lots of some time and steer clear of mistakes. The services provides expertly made legal file web templates which you can use for an array of functions. Make an account on US Legal Forms and begin producing your way of life a little easier.

Form popularity

FAQ

Voting Agreements If the agreement is validly executed, any party to the agreement can sue for specific performance of the agreement if another party refuses to abide by the agreement.

For a proxy vote, it is a temporary arrangement for a one-time issue; whereas, for a voting trust, it gives the trustees increased power to make decisions on behalf of all shareholders to control the company, which differs from proxy voting in terms of how much power is allocated.

A shareholder may assign his right to vote to another person by means of a voting trust agreement. A voting trust is created by a written trust agreement whereby the original stockholder transfers his shares to a trustee to be held for his benefit.

A voting trust agreement is a contractual agreement that records the transfer of shares from a shareholder to a trustee. The agreement gives the trustee temporary control of the voting powers of the shareholders.

A voting agreement is a contract in which shareholders agree to vote a certain way on specific issues without giving up their shares or voting rights. Voting trusts are formed for many reasons, including preventing hostile takeovers, retaining majority control, and resolving conflicts of interest.

If the agreement is validly executed, any party to the agreement can sue for specific performance of the agreement if another party refuses to abide by the agreement. If a suit for specific performance is successful, the court will order the parties to vote the shares in ance with the voting agreement.