The Minnesota Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC is a contractual arrangement that outlines the terms and responsibilities of both parties in managing the fund. This agreement is specific to the state of Minnesota and ensures compliance with local regulations and laws. Prudential Tax-Managed Growth Fund is an investment fund designed to provide tax-efficient growth to its investors. It aims to achieve this by employing various strategies, including tax-loss harvesting and maximizing after-tax returns. Prudential Investments Fund Management, LLC serves as the fund's investment manager, responsible for making investment decisions and managing the fund's assets. The Minnesota Management Agreement regulates how Prudential Investments Fund Management, LLC will operate and manage the Prudential Tax-Managed Growth Fund within the state. It covers areas such as investment objectives, portfolio composition, risk management, fee structures, reporting requirements, and compliance with Minnesota-specific regulations. Keywords: Minnesota Management Agreement, Prudential Tax-Managed Growth Fund, Prudential Investments Fund Management, LLC, investment fund, tax-efficient growth, tax-loss harvesting, after-tax returns, investment manager, investment objectives, portfolio composition, risk management, fee structures, reporting requirements, compliance, Minnesota-specific regulations. Different types of Minnesota Management Agreements between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC may include variations based on specific fund strategies, fund types (such as equity, fixed-income, or balanced funds), different investment horizons, and varying fee structures. Each agreement may have unique terms tailored to the specific fund's objectives and the preferences of the investors involved.

Minnesota Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC

Description

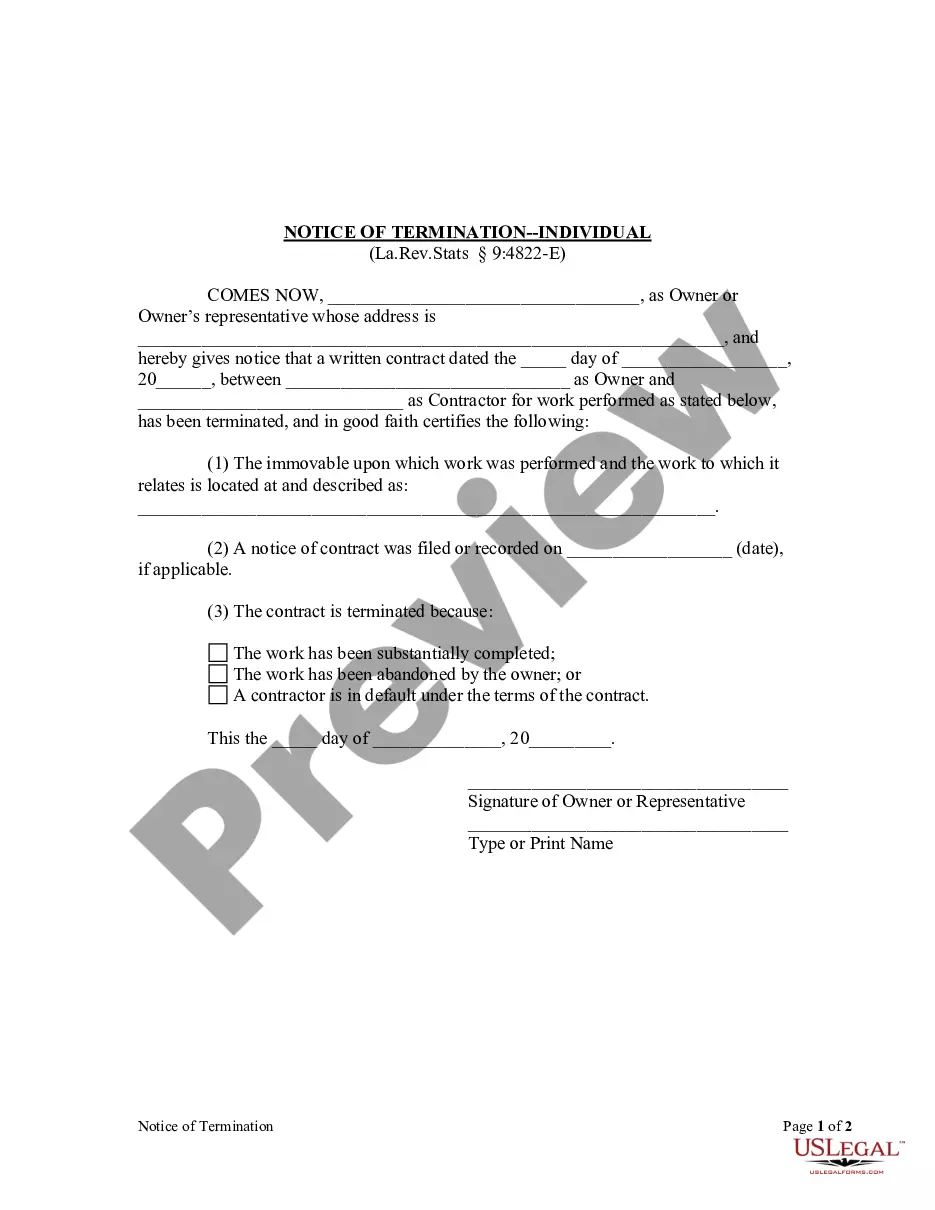

How to fill out Minnesota Management Agreement Between Prudential Tax-Managed Growth Fund And Prudential Investments Fund Management, LLC?

Are you presently in the situation the place you need paperwork for either company or person purposes nearly every day time? There are a variety of legitimate record web templates available on the Internet, but getting versions you can depend on is not simple. US Legal Forms offers a large number of type web templates, like the Minnesota Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC, that are composed to meet state and federal needs.

In case you are presently knowledgeable about US Legal Forms site and get an account, merely log in. Afterward, you are able to download the Minnesota Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC template.

Unless you have an account and need to start using US Legal Forms, abide by these steps:

- Find the type you need and make sure it is for your correct city/region.

- Take advantage of the Review switch to examine the shape.

- Read the description to ensure that you have selected the right type.

- In the event the type is not what you are trying to find, utilize the Look for industry to find the type that suits you and needs.

- Whenever you get the correct type, just click Acquire now.

- Select the prices prepare you would like, fill in the necessary details to produce your money, and pay for the transaction using your PayPal or Visa or Mastercard.

- Decide on a hassle-free paper structure and download your backup.

Get every one of the record web templates you possess bought in the My Forms food list. You can get a additional backup of Minnesota Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC anytime, if necessary. Just go through the required type to download or print the record template.

Use US Legal Forms, one of the most considerable variety of legitimate varieties, to save some time and avoid mistakes. The assistance offers appropriately created legitimate record web templates which you can use for a variety of purposes. Generate an account on US Legal Forms and begin creating your daily life easier.