The Minnesota Executive Change in Control Agreement for The First National Bank of Litchfield is a legal document that outlines the terms and conditions regarding changes in control or ownership of the bank and how it may impact key executives and employees. This agreement is designed to provide protection and reassurance to executives in the event of a change in control, such as a merger, acquisition, or privatization of the bank. Under this agreement, key executives of The First National Bank of Litchfield are offered certain benefits and incentives to ensure their continued dedication and contribution during periods of uncertainty and transition. These benefits may include severance payments, enhanced retirement benefits, continued health and life insurance coverage, and stock options or grants. The Minnesota Executive Change in Control Agreement aims to mitigate any potential negative effects of a change in control on executives' employment and financial security. By providing them with financial safeguards and ensuring their continued employment, the bank aims to retain talented individuals and maintain stability and continuity during times of organizational change. Different types of Minnesota Executive Change in Control Agreements for The First National Bank of Litchfield may include variations in the specific benefits and terms offered to executives based on their level of importance within the organization. For instance, senior executives may receive more substantial severance packages, while middle-level managers may receive relatively fewer benefits. Keywords: Minnesota Executive Change in Control Agreement, The First National Bank of Litchfield, legal document, terms and conditions, changes in control, ownership, executives, employees, protection, reassurance, merger, acquisition, privatization, benefits, incentives, severance payments, enhanced retirement benefits, health insurance, life insurance, stock options, stock grants, employment, financial security, talent retention, stability, continuity, organizational change, senior executives, middle-level managers.

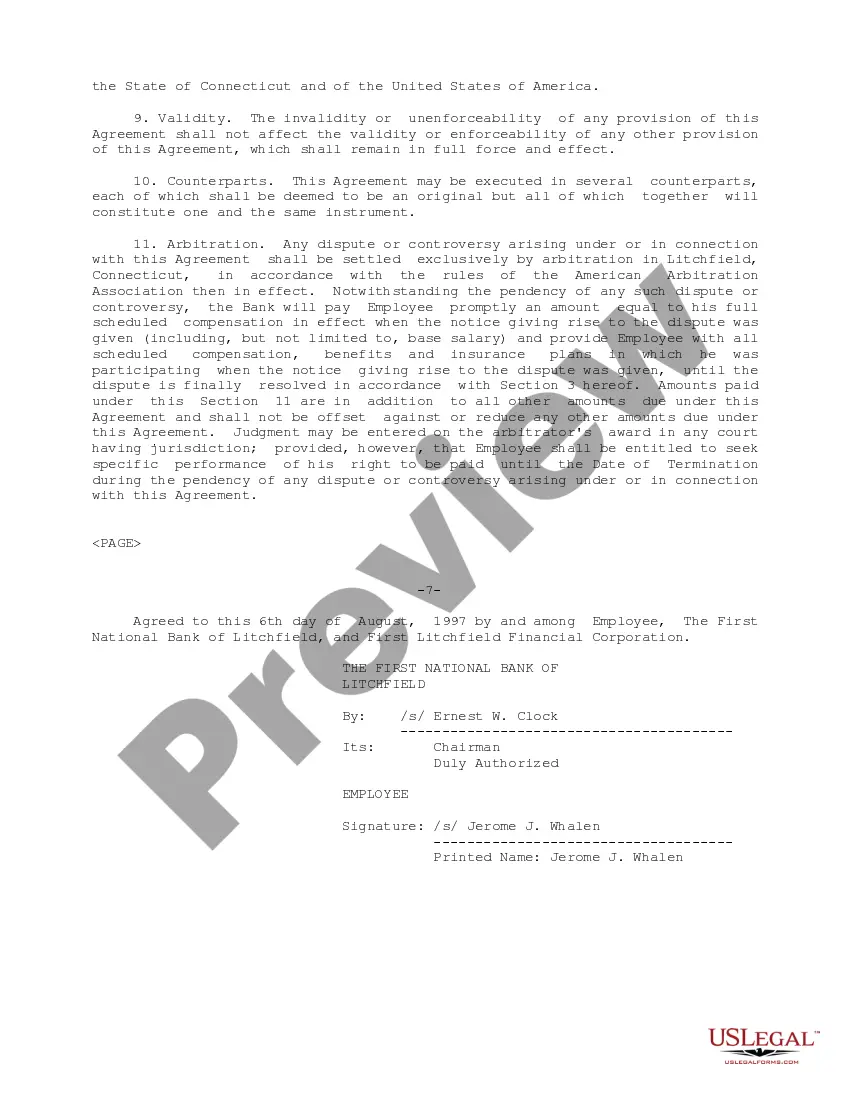

Minnesota Executive Change in Control Agreement for The First National Bank of Litchfield

Description

How to fill out Minnesota Executive Change In Control Agreement For The First National Bank Of Litchfield?

Have you been in the place the place you will need files for sometimes company or individual reasons just about every time? There are a variety of authorized record templates available on the net, but locating kinds you can rely on is not easy. US Legal Forms delivers a large number of develop templates, just like the Minnesota Executive Change in Control Agreement for The First National Bank of Litchfield, which can be created to satisfy federal and state demands.

Should you be presently familiar with US Legal Forms internet site and get an account, basically log in. Following that, you may acquire the Minnesota Executive Change in Control Agreement for The First National Bank of Litchfield format.

If you do not provide an profile and want to begin to use US Legal Forms, adopt these measures:

- Get the develop you will need and ensure it is to the appropriate area/county.

- Utilize the Review button to analyze the form.

- See the explanation to actually have chosen the right develop.

- When the develop is not what you are looking for, use the Research discipline to discover the develop that meets your needs and demands.

- When you obtain the appropriate develop, click on Buy now.

- Select the rates program you need, submit the required information and facts to make your account, and pay money for an order utilizing your PayPal or credit card.

- Choose a practical paper formatting and acquire your copy.

Get all of the record templates you possess bought in the My Forms food selection. You may get a further copy of Minnesota Executive Change in Control Agreement for The First National Bank of Litchfield anytime, if possible. Just click the needed develop to acquire or print out the record format.

Use US Legal Forms, probably the most extensive selection of authorized kinds, to save time as well as avoid faults. The support delivers professionally created authorized record templates that can be used for a range of reasons. Create an account on US Legal Forms and commence producing your daily life a little easier.