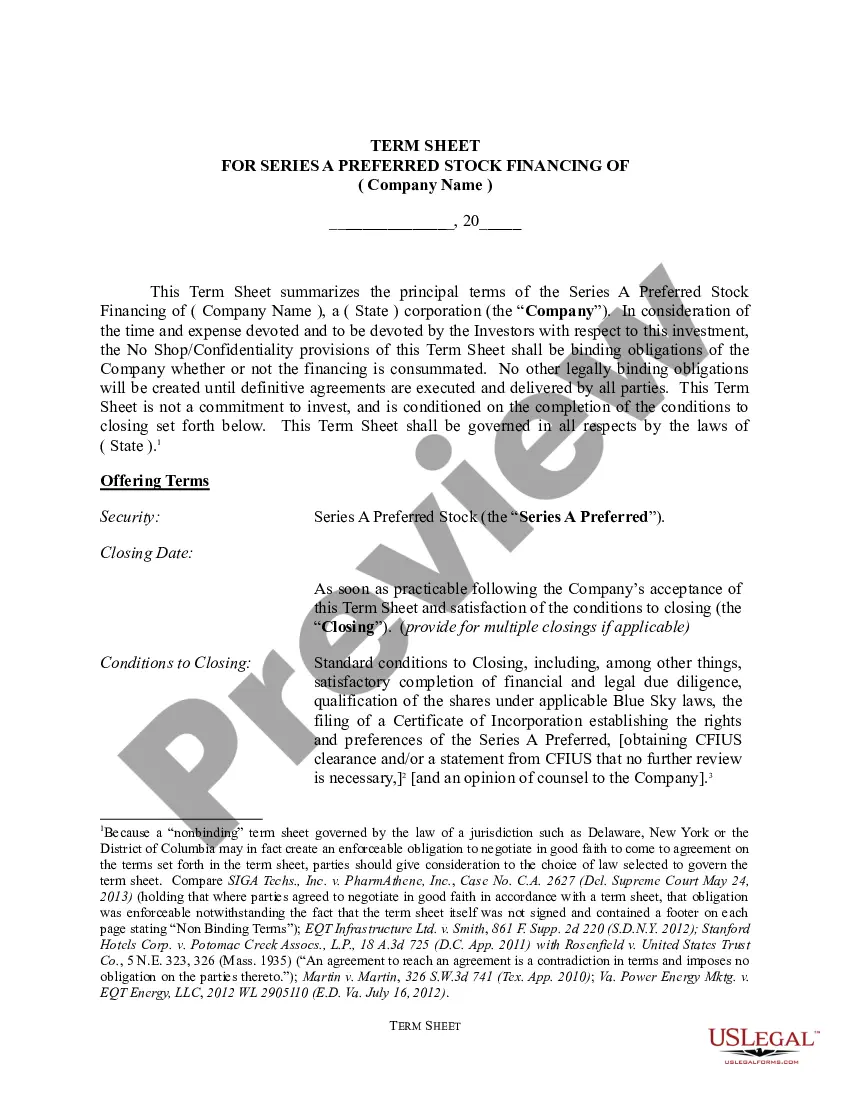

Minnesota Term Sheet - Series A Preferred Stock Financing of a Company

Description

The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth.

How to fill out Term Sheet - Series A Preferred Stock Financing Of A Company?

It is possible to invest time on the web attempting to find the authorized file web template that suits the federal and state specifications you require. US Legal Forms supplies thousands of authorized varieties which are examined by experts. You can actually download or print out the Minnesota Term Sheet - Series A Preferred Stock Financing of a Company from my support.

If you have a US Legal Forms account, you can log in and click on the Down load key. Afterward, you can complete, revise, print out, or signal the Minnesota Term Sheet - Series A Preferred Stock Financing of a Company. Each authorized file web template you acquire is the one you have eternally. To acquire an additional backup of any purchased kind, visit the My Forms tab and click on the related key.

If you use the US Legal Forms website the very first time, keep to the basic directions below:

- Very first, ensure that you have chosen the right file web template for the state/metropolis of your liking. See the kind information to make sure you have selected the right kind. If accessible, make use of the Review key to search through the file web template at the same time.

- In order to find an additional variation from the kind, make use of the Lookup industry to discover the web template that fits your needs and specifications.

- Upon having identified the web template you need, click on Get now to move forward.

- Choose the rates plan you need, type in your qualifications, and sign up for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You can utilize your Visa or Mastercard or PayPal account to cover the authorized kind.

- Choose the file format from the file and download it for your device.

- Make changes for your file if possible. It is possible to complete, revise and signal and print out Minnesota Term Sheet - Series A Preferred Stock Financing of a Company.

Down load and print out thousands of file templates using the US Legal Forms Internet site, which provides the biggest assortment of authorized varieties. Use skilled and condition-specific templates to handle your organization or person demands.

Form popularity

FAQ

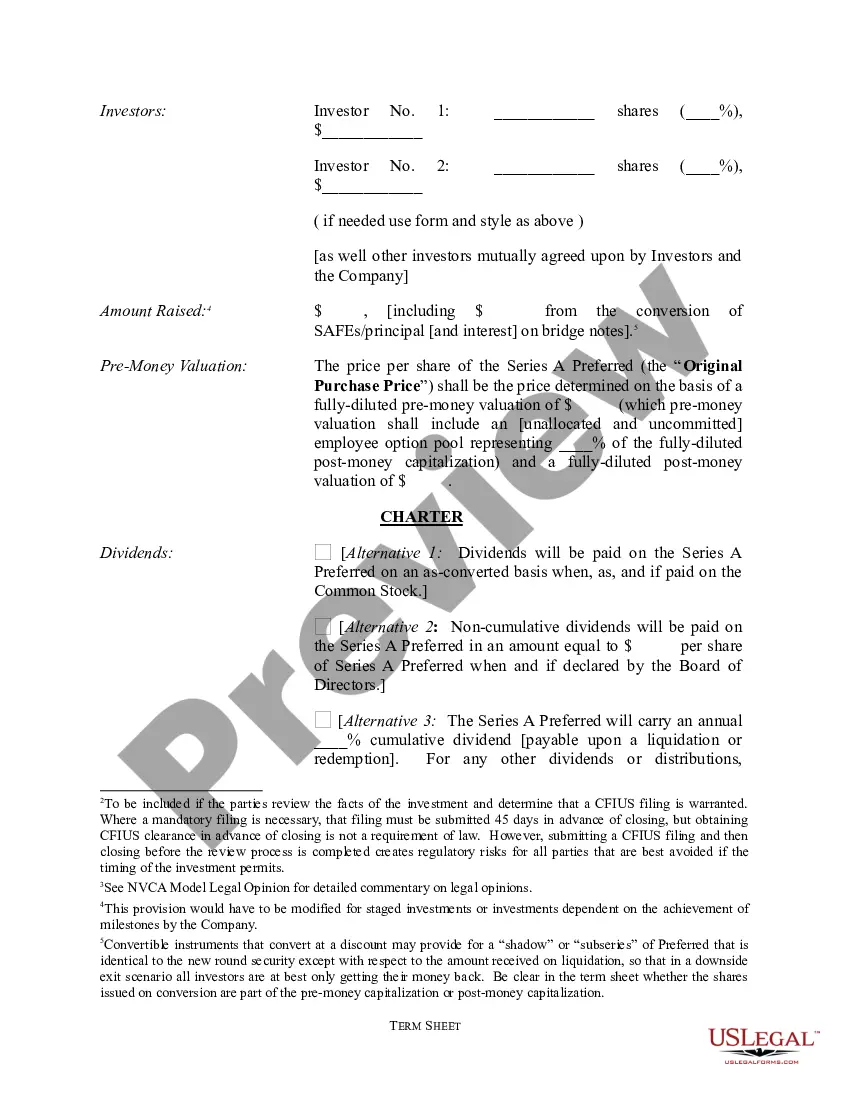

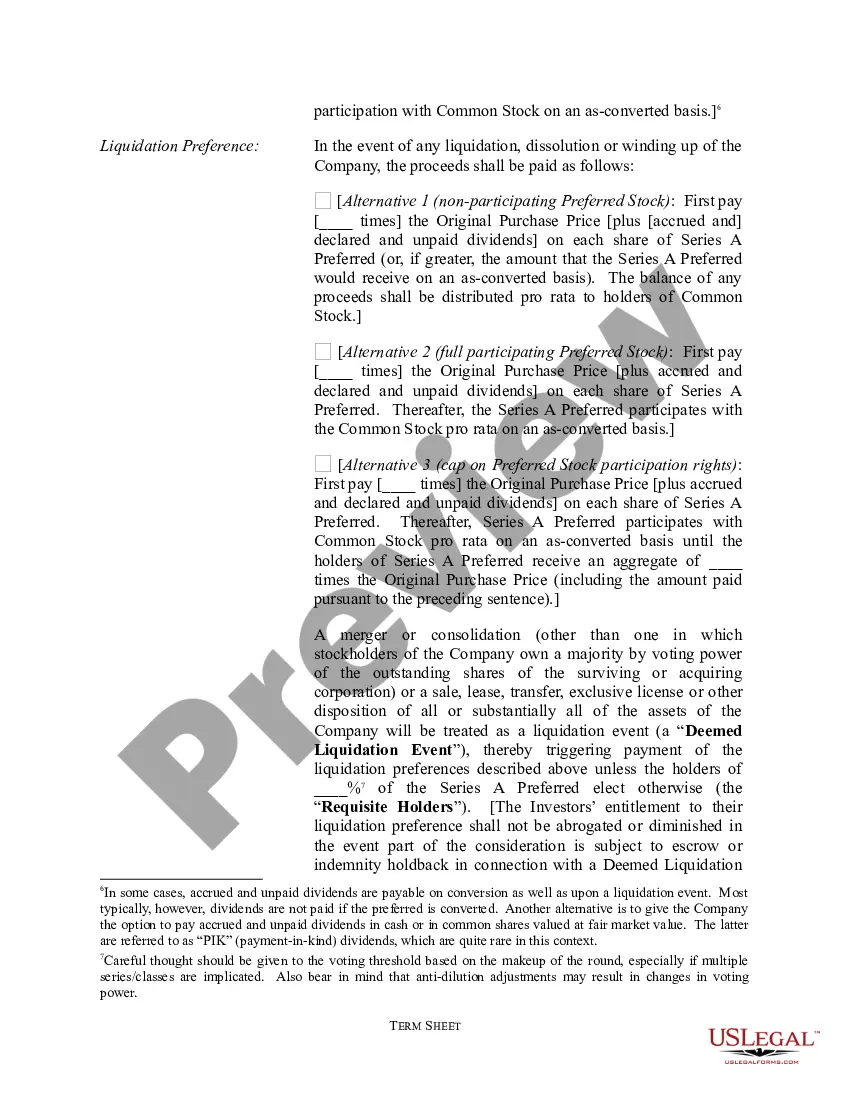

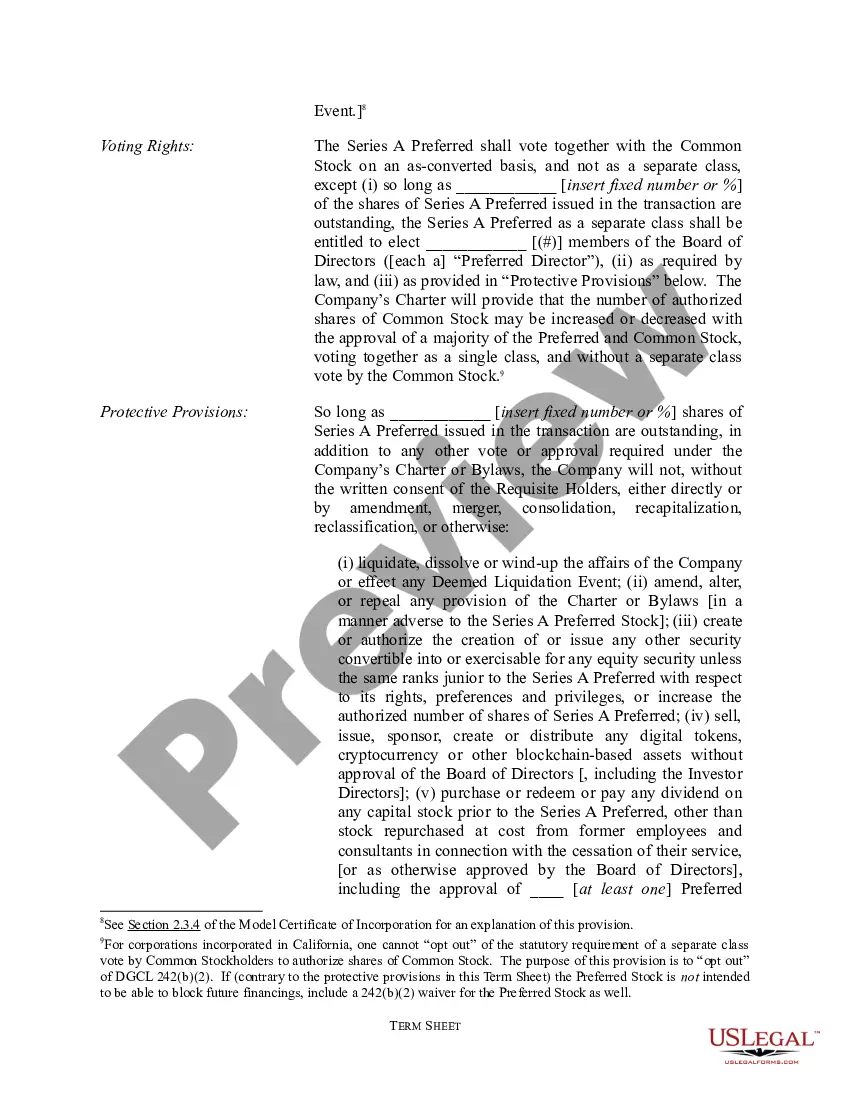

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

Example of Series C Funding An acquisition or expansion of a product or service is required to re-enter the expansion stage. Hedge funds, investment banks, and private equity firms are common contributors to Series-C financing. Several hundred-million-dollar businesses exist.

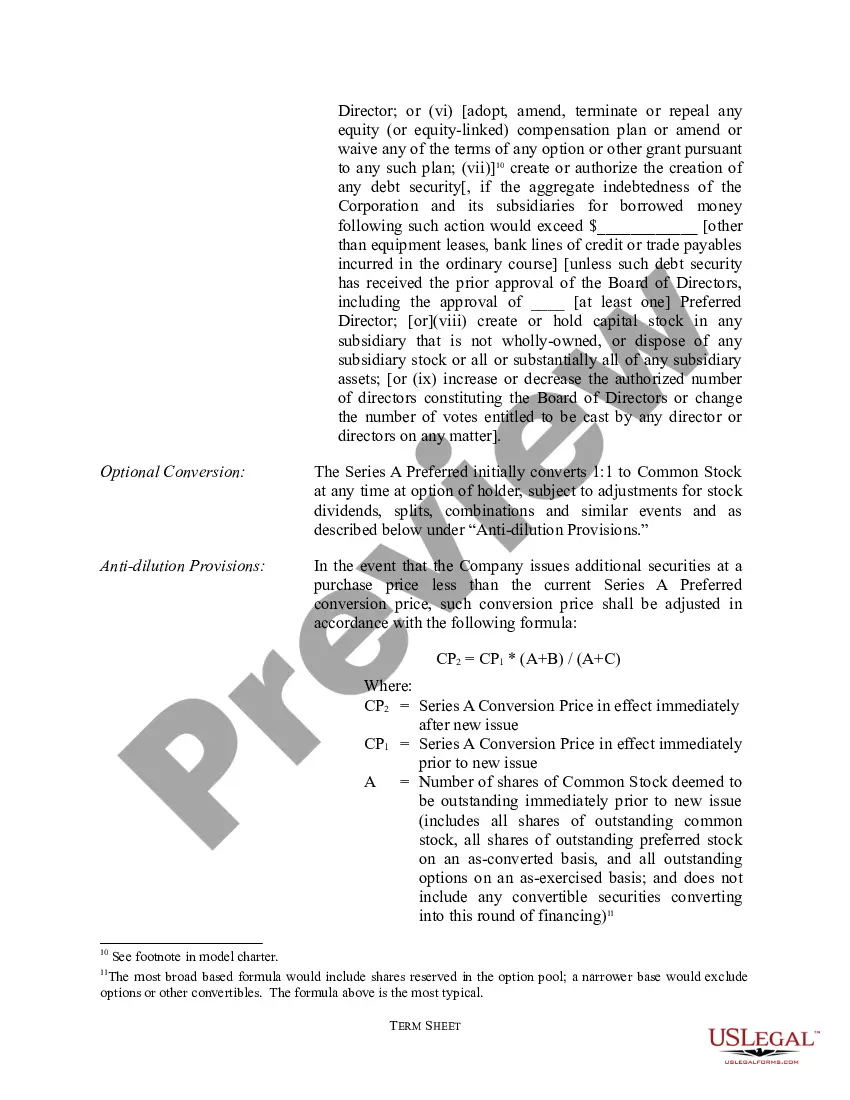

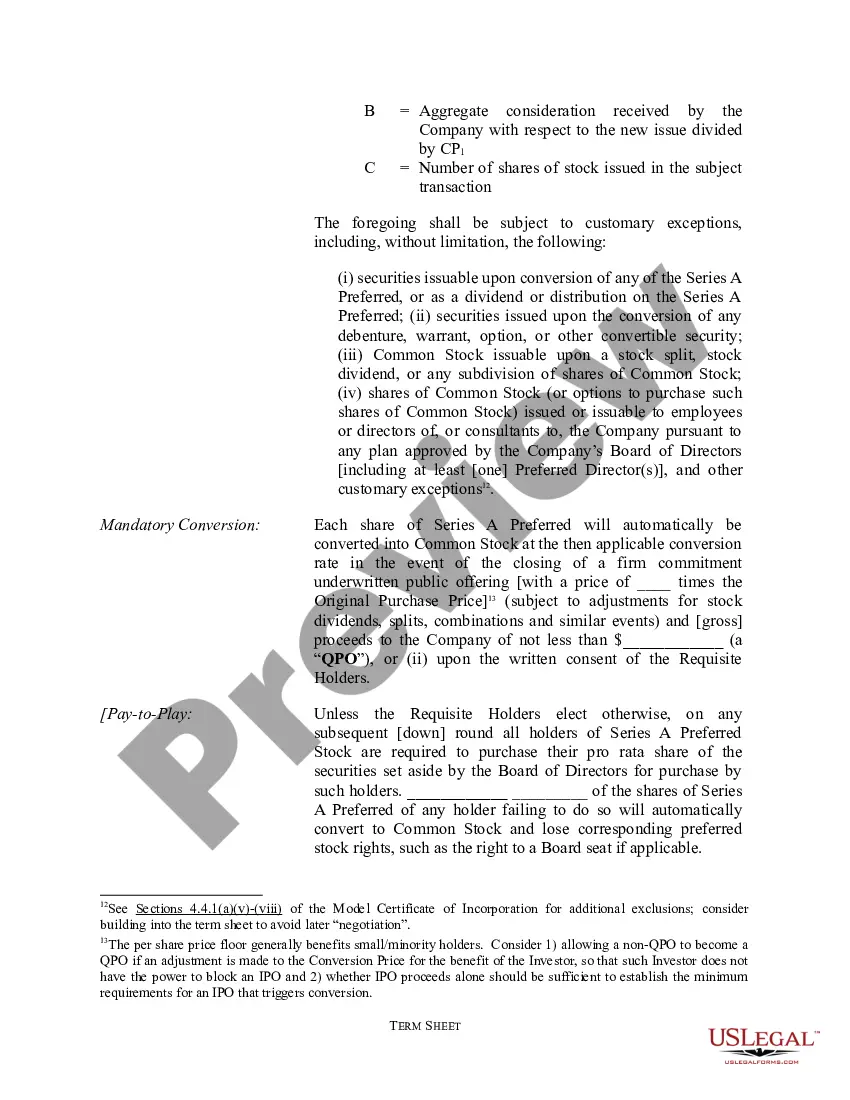

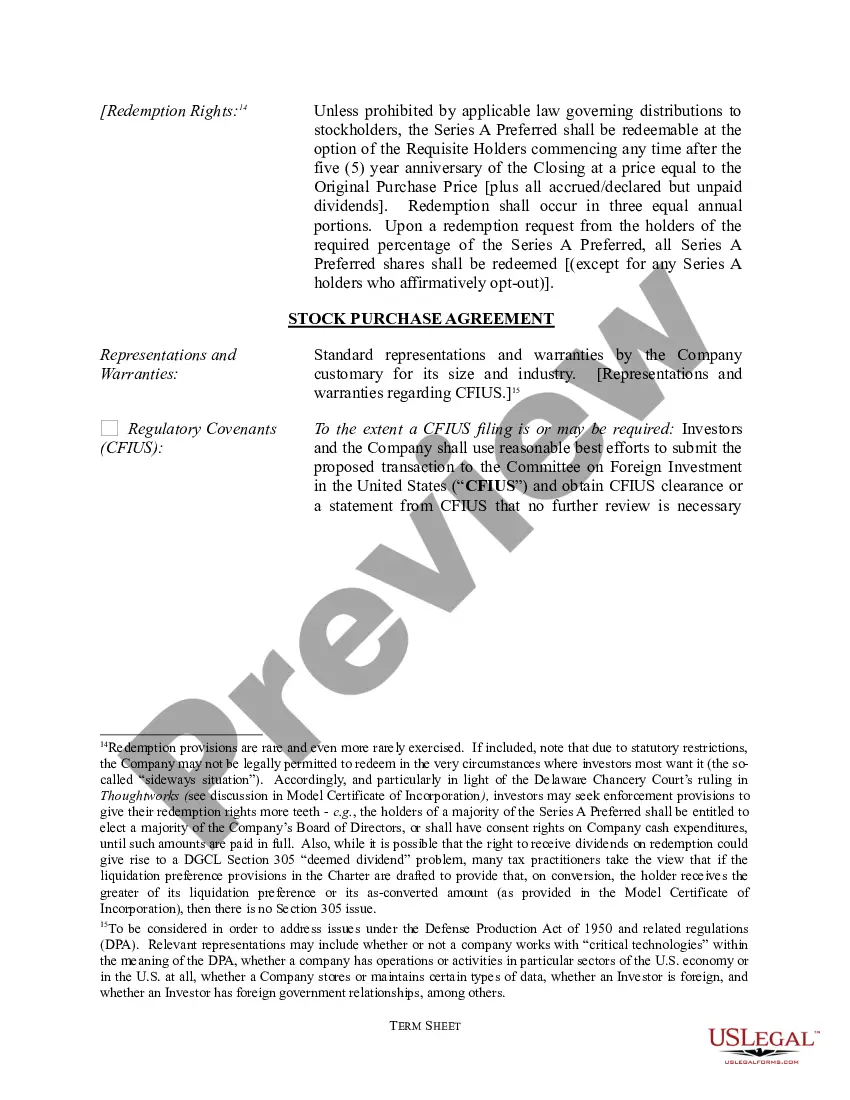

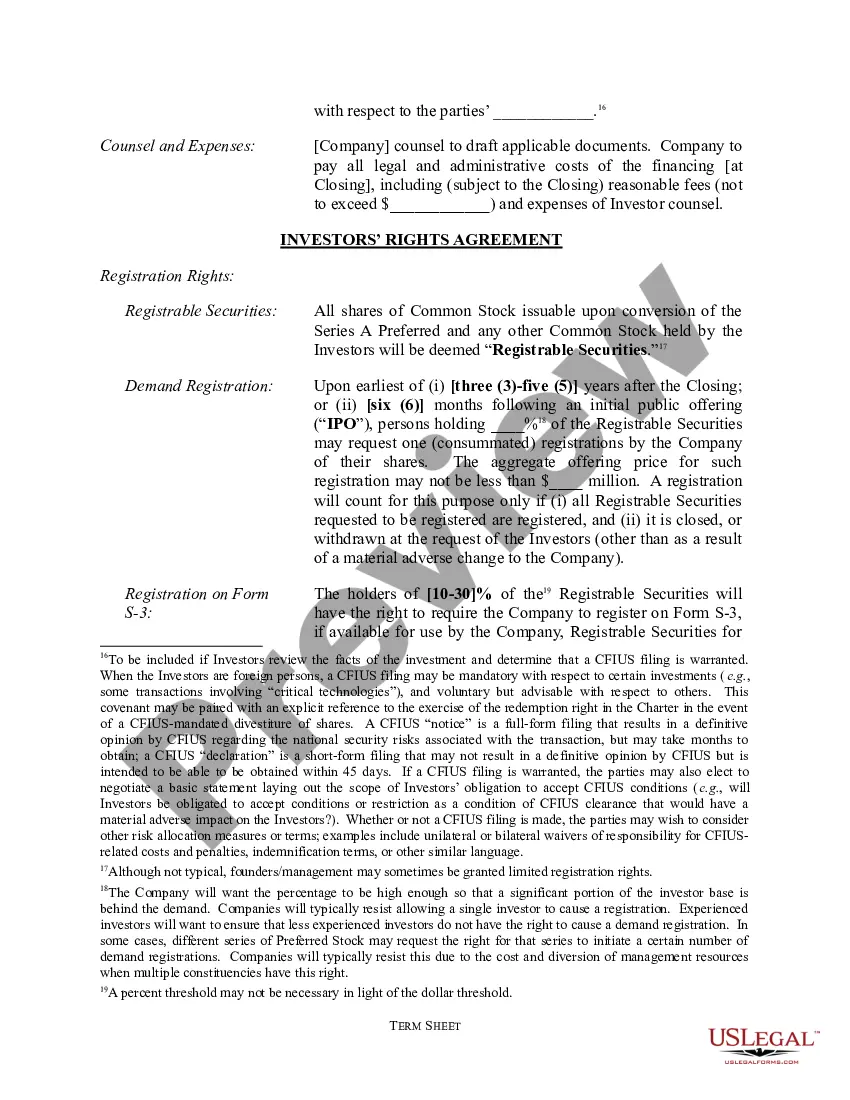

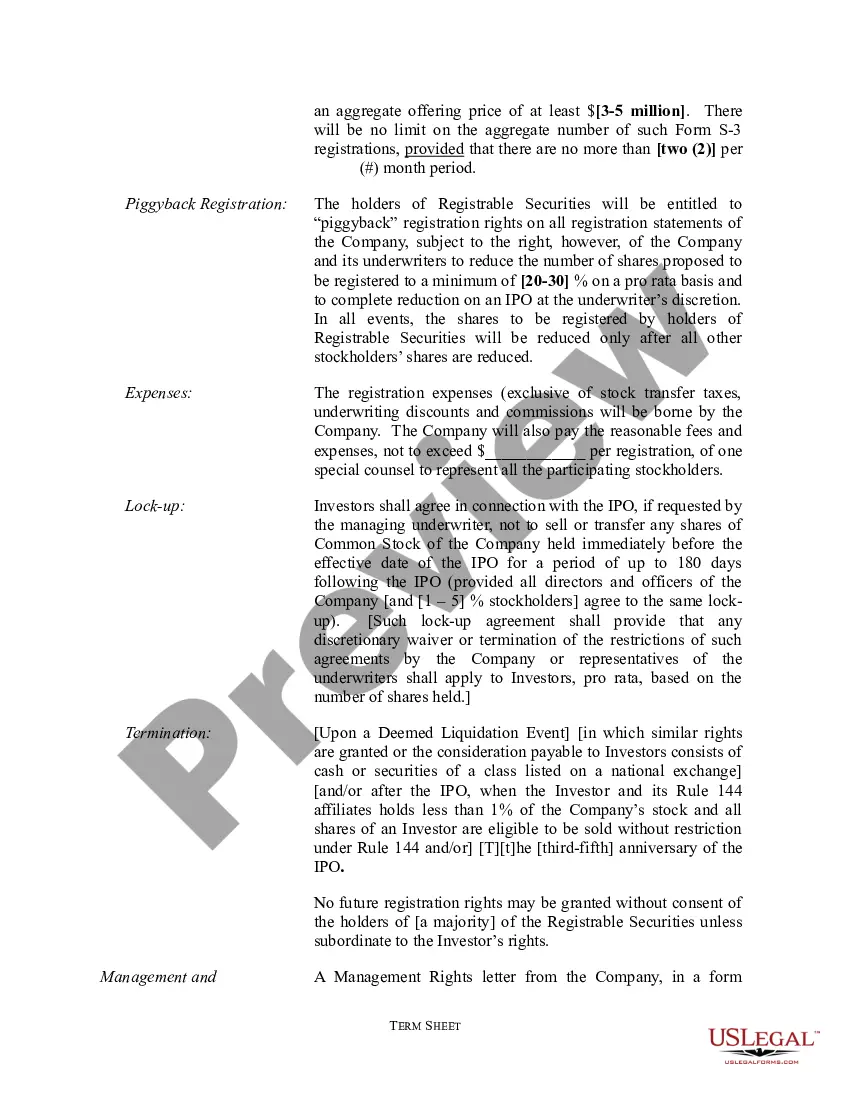

Term sheets for venture capital financings include detailed provisions describing the terms of the preferred stock being issued to investors. Some terms are more important than others. The following brief description of certain material terms divides them into two categories: economic terms and control rights.

During a Series A funding round, a business usually will not yet have a proven track record, and may have a higher level of risk. During a Series A round, investors will usually be able to purchase from 10% to 30% of the business.

What Is Series A Funding? The first round after the seed stage is Series A funding. The term gets its name from the preferred stock sold to investors at this stage. In this round, it's important to have a plan for developing a business model that will generate long-term profit.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.

More recent examples of startups that raised Series A funding include Nearby, aifora, and CoLearn. The first major round of external funding, Series A funding can help a startup to grow. It can be preceded by seed or even pre-seed funding and be followed by several rounds of funding.

Seed and series A funding is designed to establish the startup and secure a market share, series B funding is then used to scale the opportunity. Series B funding can be used by a startup to meet many different costs associated with growth.