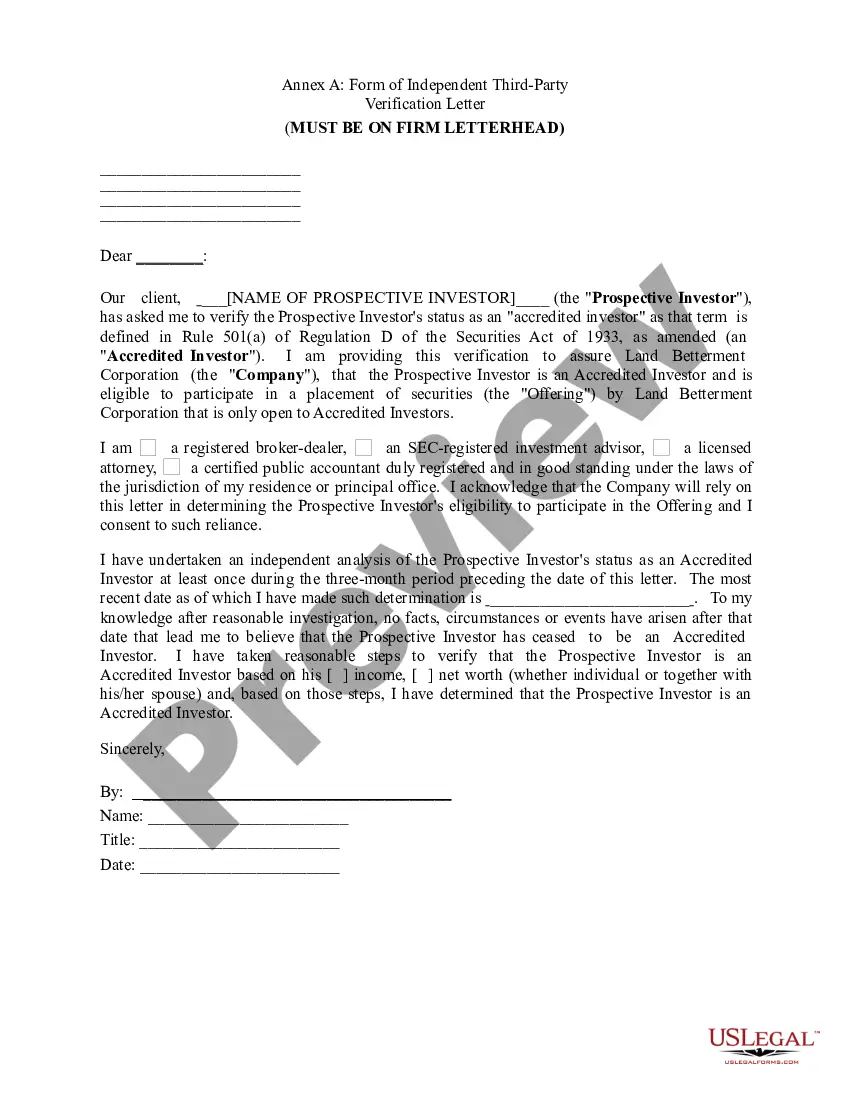

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

The Minnesota Accredited Investor Certification Letter is an official document provided to individuals who meet the criteria to be considered an accredited investor within the state of Minnesota. This certification is crucial for individuals looking to participate in certain private investment opportunities that are limited to accredited investors only. The Minnesota Accredited Investor Certification Letter serves as proof of an individual's financial sophistication and ability to understand the risks associated with investing in private placements. It ensures that these investors have the necessary financial resources and knowledge to make informed investment decisions without requiring the same level of regulatory protection as non-accredited investors. To obtain the Minnesota Accredited Investor Certification Letter, an individual must meet one or more of the following criteria: 1. Income Requirement: The individual has an annual income exceeding $200,000 (or $300,000 combined income with a spouse) for the past two years and expects to meet the same income level in the current year. 2. Net Worth Requirement: The individual has a net worth (or joint net worth with a spouse) exceeding $1 million, excluding the value of their primary residence. Net worth can include assets such as cash, real estate, investments, retirement accounts, and business ownership. It's important to note that the Minnesota Accredited Investor Certification Letter is specific to the state and may have variations or additional requirements compared to federal regulations. Different types of Minnesota Accredited Investor Certification Letters may include: 1. Individual Certification: This is the most common form of certification, where an individual qualifies based on their income or net worth. It is used to certify that the individual meets the necessary financial thresholds to be considered an accredited investor. 2. Entity Certification: In certain cases, an entity such as a corporation, partnership, or limited liability company (LLC) may seek accreditation. The entity's qualification is evaluated based on its total assets, the organization's equity owners, and its organizational purpose. 3. Institutional Certification: In some instances, institutions such as banks, insurance companies, or registered investment advisers may require certification to facilitate investment opportunities restricted to accredited investors. Institutional certification may have additional requirements specific to the nature of the institution seeking accreditation. The Minnesota Accredited Investor Certification Letter is a vital document for individuals and entities seeking to participate in private placement offerings within the state. It allows them to access investments that are not available to non-accredited investors, offering potentially higher returns but also higher risks. By meeting the strict financial criteria, investors can demonstrate their eligibility to engage in these exclusive opportunities.