Minnesota Term Sheet — Convertible Debt Financing is a legal document that outlines the terms and conditions for financing a business through the issuance of convertible debt in the state of Minnesota. This financing option is commonly used by startups and early-stage companies to raise capital while deferring the valuation of the company until a later date. The Minnesota Term Sheet — Convertible Debt Financing contains various key provisions and conditions that both the company seeking funding and the investors must agree upon. This document serves as a preliminary agreement between the parties involved and lays the groundwork for the subsequent negotiation of a formal financing agreement. The main feature of convertible debt financing is the conversion of the debt into equity at a later stage, typically during a future financing round or when certain predefined triggering events occur. This allows the investors to participate in the company's growth and potentially benefit from a higher valuation in the future. Convertible debt provides flexibility for both the company and the investors, as it balances the benefits of debt financing (such as interest payments and repayment terms) with the potential upside of equity ownership. Different types of Minnesota Term Sheet — Convertible Debt Financing may include: 1. Traditional Convertible Debt: This type of financing involves a fixed interest rate and maturity date. The debt is convertible into equity based on specific terms, typically triggered by a subsequent financing round or a liquidity event. 2. SAFE (Simple Agreement for Future Equity): SAFE is an alternative to convertible debt and has gained popularity in recent years. It provides a more founder-friendly approach by deferring the valuation until a later stage, similar to convertible debt. However, SAFE does not carry an interest rate or maturity date. 3. Venture Debt: This type of convertible debt financing is specifically tailored for high-growth startups and early-stage companies with substantial revenue traction. It often comes with more stringent covenants, higher interest rates, and shorter maturities compared to traditional convertible debt. 4. Bridge Financing: Bridge loans are short-term loans that "bridge" the gap between a company's immediate financial needs and a future round of financing. They are often used to provide immediate capital while awaiting a larger funding round or to address temporary cash flow challenges. When negotiating a Minnesota Term Sheet — Convertible Debt Financing, key terms and provisions to consider may include the conversion price, conversion events, interest rate, maturity date, capitalization table, investor rights, and restrictions on the company's ability to borrow additional debt or issue additional securities. In conclusion, the Minnesota Term Sheet — Convertible Debt Financing is a vital legal document that outlines the terms and conditions for financing a business through the issuance of convertible debt. This financing option provides flexibility for both the company and the investors and paves the way for future negotiations and agreements. Startups and early-stage companies in Minnesota can explore various types of convertible debt financing, including traditional convertible debt, SAFE, venture debt, and bridge financing, depending on their specific needs and stage of development.

Minnesota Term Sheet - Convertible Debt Financing

Description

How to fill out Minnesota Term Sheet - Convertible Debt Financing?

Finding the right legitimate record format can be a struggle. Of course, there are plenty of web templates accessible on the Internet, but how do you find the legitimate type you want? Utilize the US Legal Forms site. The support gives 1000s of web templates, for example the Minnesota Term Sheet - Convertible Debt Financing, that you can use for company and private needs. All the varieties are examined by experts and fulfill state and federal needs.

In case you are previously listed, log in in your account and click the Download button to obtain the Minnesota Term Sheet - Convertible Debt Financing. Make use of your account to look throughout the legitimate varieties you may have purchased in the past. Visit the My Forms tab of your respective account and obtain an additional copy of the record you want.

In case you are a whole new customer of US Legal Forms, listed below are basic directions that you should stick to:

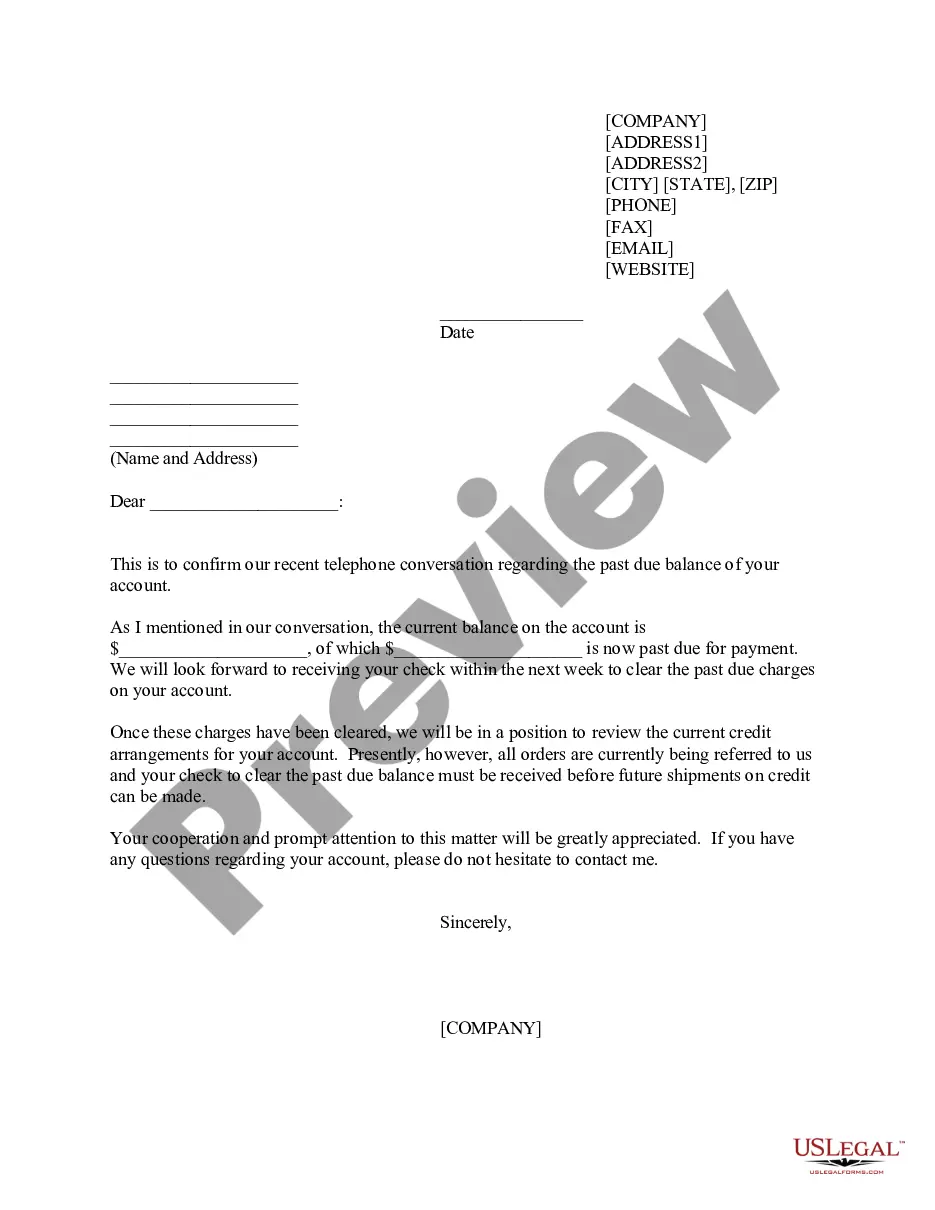

- Initial, make certain you have chosen the correct type to your metropolis/state. You can look through the shape utilizing the Review button and look at the shape explanation to guarantee this is the best for you.

- In the event the type will not fulfill your preferences, utilize the Seach area to find the right type.

- When you are certain that the shape is acceptable, select the Purchase now button to obtain the type.

- Opt for the rates program you need and enter the required details. Design your account and pay for the order utilizing your PayPal account or Visa or Mastercard.

- Pick the file format and down load the legitimate record format in your product.

- Full, edit and print out and indication the received Minnesota Term Sheet - Convertible Debt Financing.

US Legal Forms is the most significant local library of legitimate varieties where you can see a variety of record web templates. Utilize the service to down load expertly-manufactured documents that stick to condition needs.