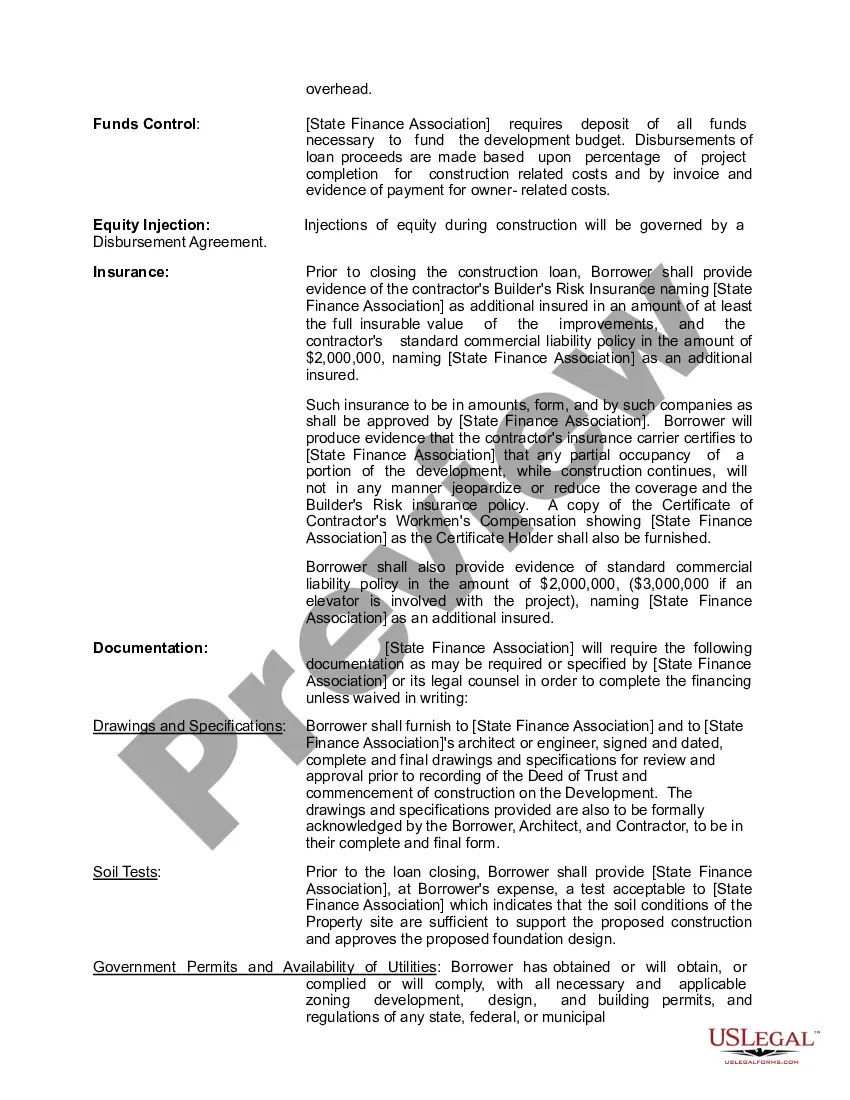

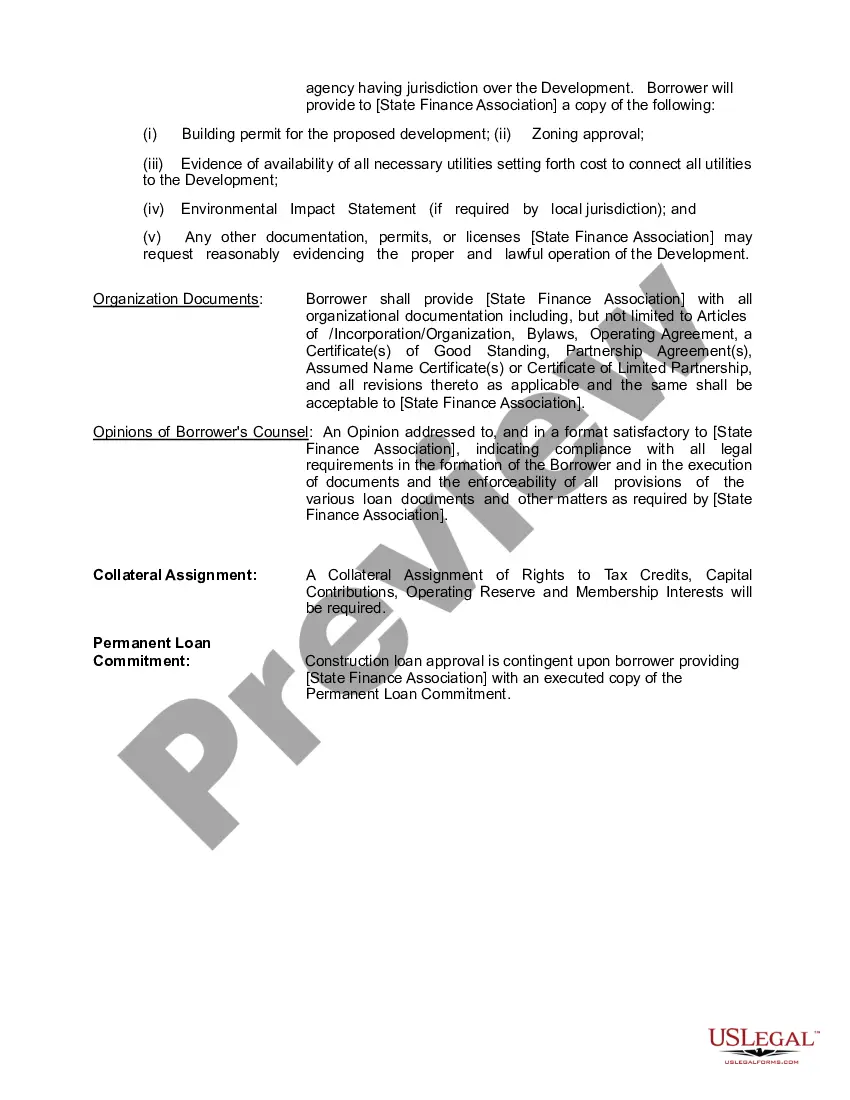

Minnesota Construction Loan Financing Term Sheet is a crucial document outlining the terms and conditions of a construction loan in the state of Minnesota. This term sheet serves as a preliminary agreement between a borrower and a lender, highlighting the key aspects and provisions of the loan. It is often used as a basis for further negotiations and finalizing the loan agreement. The Minnesota Construction Loan Financing Term Sheet typically includes important details such as loan amount, interest rates, repayment terms, collateral requirements, and disbursement conditions. This document ensures that both parties have a clear understanding of the terms and acts as a reference throughout the loan process. There are different types of Minnesota Construction Loan Financing Term Sheets, catering to various construction projects and borrower requirements. Some common types include residential construction loan term sheets, commercial construction loan term sheets, and land development loan term sheets. Residential construction loan term sheets are specifically designed for individuals or companies undertaking the construction or renovation of residential properties. These may include single-family homes, duplexes, or multi-unit buildings. The term sheet would outline the specific terms for residential projects, such as the loan amount, interest rates applicable to residential construction, and the disbursement schedule based on construction milestones. Commercial construction loan term sheets, on the other hand, are tailored for businesses or developers engaged in commercial construction projects. These can be diverse, ranging from office buildings, retail spaces, hotels, or industrial complexes. The term sheet would encompass the specific terms and conditions associated with commercial construction, considering factors such as the loan amount, interest rates specific to commercial construction, and the disbursement schedule based on project milestones. Lastly, land development loan term sheets focus on financing the development of vacant land or subdividing existing land into residential or commercial lots. These term sheets would outline the loan amount, interest rates applicable to land development, and disbursement conditions based on milestones achieved in the development process. In conclusion, the Minnesota Construction Loan Financing Term Sheet is a comprehensive agreement defining the terms and conditions for construction loans in the state. It provides a framework for borrowers and lenders to negotiate and finalize their loan agreement and plays a crucial role in ensuring a transparent and mutually beneficial lending relationship.

Minnesota Construction Loan Financing Term Sheet

Description

How to fill out Minnesota Construction Loan Financing Term Sheet?

If you want to complete, down load, or print lawful document themes, use US Legal Forms, the biggest variety of lawful types, which can be found on-line. Use the site`s easy and handy research to discover the files you want. Different themes for enterprise and individual reasons are sorted by types and states, or key phrases. Use US Legal Forms to discover the Minnesota Construction Loan Financing Term Sheet in a number of click throughs.

If you are previously a US Legal Forms customer, log in for your profile and click on the Download key to have the Minnesota Construction Loan Financing Term Sheet. You can even gain access to types you in the past downloaded from the My Forms tab of your respective profile.

Should you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Make sure you have selected the shape for that right area/region.

- Step 2. Utilize the Review option to look over the form`s articles. Don`t forget about to see the description.

- Step 3. If you are not happy together with the develop, utilize the Search industry near the top of the screen to locate other variations of your lawful develop template.

- Step 4. Upon having located the shape you want, go through the Get now key. Opt for the rates prepare you like and put your credentials to register for an profile.

- Step 5. Method the deal. You can utilize your Мisa or Ьastercard or PayPal profile to complete the deal.

- Step 6. Select the format of your lawful develop and down load it on your device.

- Step 7. Full, edit and print or signal the Minnesota Construction Loan Financing Term Sheet.

Each and every lawful document template you get is the one you have permanently. You have acces to each develop you downloaded inside your acccount. Click on the My Forms area and choose a develop to print or down load once again.

Contend and down load, and print the Minnesota Construction Loan Financing Term Sheet with US Legal Forms. There are thousands of professional and state-particular types you can use for the enterprise or individual needs.

Form popularity

FAQ

In a project finance transaction, a set of conditions a project company must satisfy once the project has achieved substantial completion or final completion to convert a construction loan to a term loan. Failure to satisfy these conditions may result in the immediate repayment of the construction loan.

Construction loans are typically paid out in installments as construction progresses. You will need to calculate the interest charges for each installment period. To do this, you simply multiply the loan amount by the interest rate for each period.

Construction factoring is an increasingly popular financing option among subcontractors. It improves cash flow and provides a financial platform that can be used to grow the business. Most factoring companies finance your invoices by purchasing them rather than offering a loan.

Here are a few potential outcomes: Personal Financial Responsibility: If you are responsible for covering the additional costs, you may need to contribute additional funds from your own pocket to cover the overage. This can strain your personal finances and potentially disrupt your financial plans.

Construction loans are short-term loans funded in increments over the project's construction. The borrower pays interest only on the outstanding balance, so interest charges grow as the project progresses.

This includes the term, loan size, interest rate, and other financial matters common to debt. Risk mitigation preferences. The lender will often require specific conditions be met or specific information be provided on a recurring, timely manner.

As mentioned, construction loans are short-term loans, usually no longer than a year in length. On the other hand, traditional mortgages are long-term loans, with terms typically ranging from 15 ? 30 years. With a mortgage, the borrower receives the money in one lump sum.

A major feature of a construction loan is that the total approved loan amount is not usually given to the borrower right away, in one lump sum. Instead, the construction loan operates more like a line of credit from which the borrower can access funds as needed at various stages of the construction project.