Minnesota Investment - Grade Bond Optional Redemption (without a Par Call)

Description

How to fill out Investment - Grade Bond Optional Redemption (without A Par Call)?

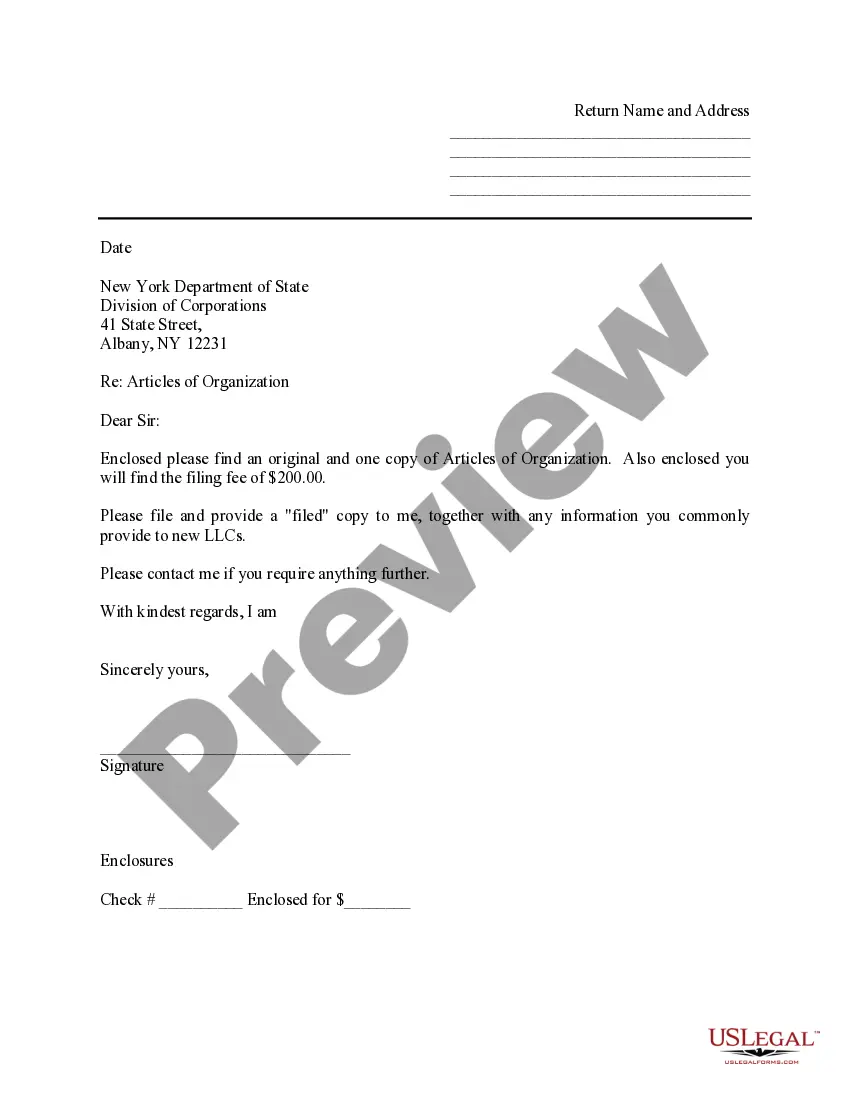

Choosing the best lawful document format can be a have a problem. Of course, there are a variety of templates available on the Internet, but how can you discover the lawful form you require? Make use of the US Legal Forms website. The service provides a large number of templates, for example the Minnesota Investment - Grade Bond Optional Redemption (without a Par Call), that you can use for enterprise and personal requires. Each of the kinds are checked by specialists and fulfill federal and state demands.

Should you be currently registered, log in for your bank account and then click the Acquire option to have the Minnesota Investment - Grade Bond Optional Redemption (without a Par Call). Make use of bank account to appear from the lawful kinds you may have ordered previously. Proceed to the My Forms tab of your own bank account and have one more version from the document you require.

Should you be a new user of US Legal Forms, listed below are easy guidelines that you should comply with:

- First, make sure you have selected the correct form for your personal city/area. It is possible to examine the shape using the Review option and look at the shape description to make certain this is basically the best for you.

- When the form does not fulfill your preferences, utilize the Seach area to obtain the appropriate form.

- Once you are positive that the shape would work, click the Purchase now option to have the form.

- Opt for the rates strategy you want and enter in the necessary info. Create your bank account and pay money for your order with your PayPal bank account or bank card.

- Pick the document formatting and obtain the lawful document format for your gadget.

- Total, modify and produce and indication the obtained Minnesota Investment - Grade Bond Optional Redemption (without a Par Call).

US Legal Forms will be the largest library of lawful kinds that you can discover a variety of document templates. Make use of the company to obtain expertly-created files that comply with condition demands.

Form popularity

FAQ

Optional Redemption On or after the Par Call Date, the Company may redeem the notes, in whole or in part, at any time and from time to time, at a redemption price equal to 100% of the principal amount of the notes being redeemed plus accrued and unpaid interest thereon to the redemption date.

Bond redemption is the process by which a bond issuer repays the principal amount of a bond to the bondholder on the bond's maturity date. When a bond is issued, it has a specified term or maturity date, which is the date when the bond issuer is obligated to pay back the principal amount of the bond to the bondholder.

You can cash in (redeem) your I bond after 12 months. However, if you cash in the bond in less than 5 years, you lose the last 3 months of interest. For example, if you cash in the bond after 18 months, you get the first 15 months of interest. See Cash in (redeem) an EE or I savings bond.

Callable or redeemable bonds are bonds that can be redeemed or paid off by the issuer prior to the bonds' maturity date. When an issuer calls its bonds, it pays investors the call price (usually the face value of the bonds) together with accrued interest to date and, at that point, stops making interest payments.

A bond redemption is the full repayment of the principal amount (the amount you invested) and any interest owed to date.

When you cash your bonds online, the cash generally transfers to your checking or savings account within two business days of the request.

In general, you must report the interest in income in the taxable year in which you redeemed the bonds to the extent you did not include the interest in income in a prior taxable year.