Minnesota Diver Services Contract - Self-Employed

Description

How to fill out Minnesota Diver Services Contract - Self-Employed?

Are you presently inside a situation that you need to have files for possibly company or specific functions almost every working day? There are a variety of legitimate record templates available on the net, but locating ones you can depend on isn`t simple. US Legal Forms provides 1000s of develop templates, like the Minnesota Diver Services Contract - Self-Employed, that happen to be composed to meet state and federal requirements.

If you are already informed about US Legal Forms site and also have a merchant account, basically log in. Next, it is possible to obtain the Minnesota Diver Services Contract - Self-Employed template.

Unless you have an profile and want to start using US Legal Forms, adopt these measures:

- Obtain the develop you need and make sure it is for the right city/area.

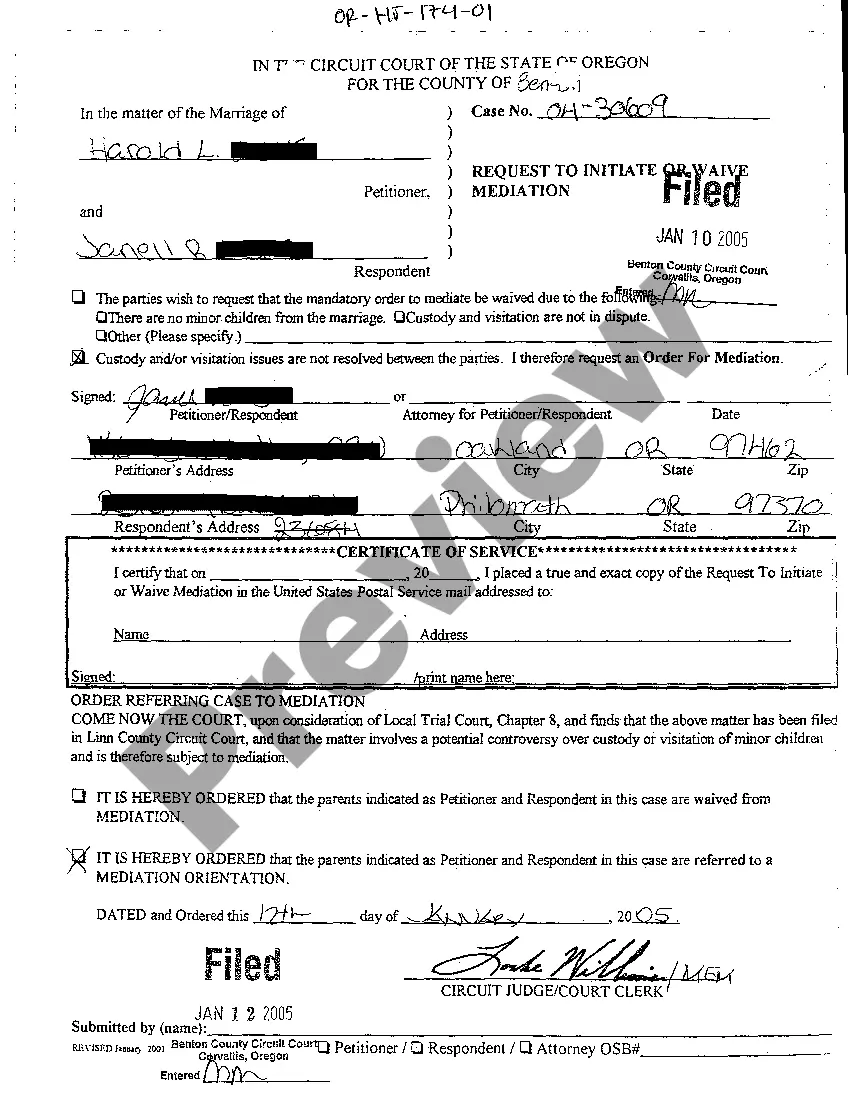

- Use the Review button to analyze the form.

- Look at the outline to actually have chosen the appropriate develop.

- In the event the develop isn`t what you are looking for, take advantage of the Search industry to get the develop that meets your needs and requirements.

- Whenever you obtain the right develop, just click Get now.

- Choose the rates program you want, complete the specified information and facts to generate your account, and pay for an order with your PayPal or Visa or Mastercard.

- Choose a convenient paper file format and obtain your backup.

Get all the record templates you might have purchased in the My Forms menu. You can aquire a additional backup of Minnesota Diver Services Contract - Self-Employed any time, if required. Just select the essential develop to obtain or printing the record template.

Use US Legal Forms, probably the most extensive assortment of legitimate varieties, to save lots of time and avoid faults. The support provides skillfully made legitimate record templates that you can use for an array of functions. Produce a merchant account on US Legal Forms and begin making your way of life a little easier.

Form popularity

FAQ

Self-employed workers and contractors are typically not eligible for unemployment benefits. However, in this unprecedented crisis the State of Minnesota is offering unemployment compensation for the self employed and 1099 workers. This includes those with only part-time employment.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

If you are a business owner or contractor who provides services to other businesses, then you are generally considered self-employed. For more information on your tax obligations if you are self-employed (an independent contractor), see our Self-Employed Individuals Tax Center.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Have a current license, certificate or registration issued by the agency; are an employee of a business performing construction services; have a current residential building contractor or remodeler certificate of exemption; or. are excluded from registration requirements under Minnesota Statutes 326B.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Do you need to register?have a current license, certificate or registration issued by the agency;are an employee of a business performing construction services; or.have a current residential building contractor or remodeler certificate of exemption; or.are excluded from registration requirements under Minn. Stat.

You can obtain permits to do work on your own home. The License Law was written to insure a reasonable degree of protection for you as the consumer of construction services, not to discourage homeowners from doing work on their own property.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.