Minnesota Accounting Agreement - Self-Employed Independent Contractor

Description

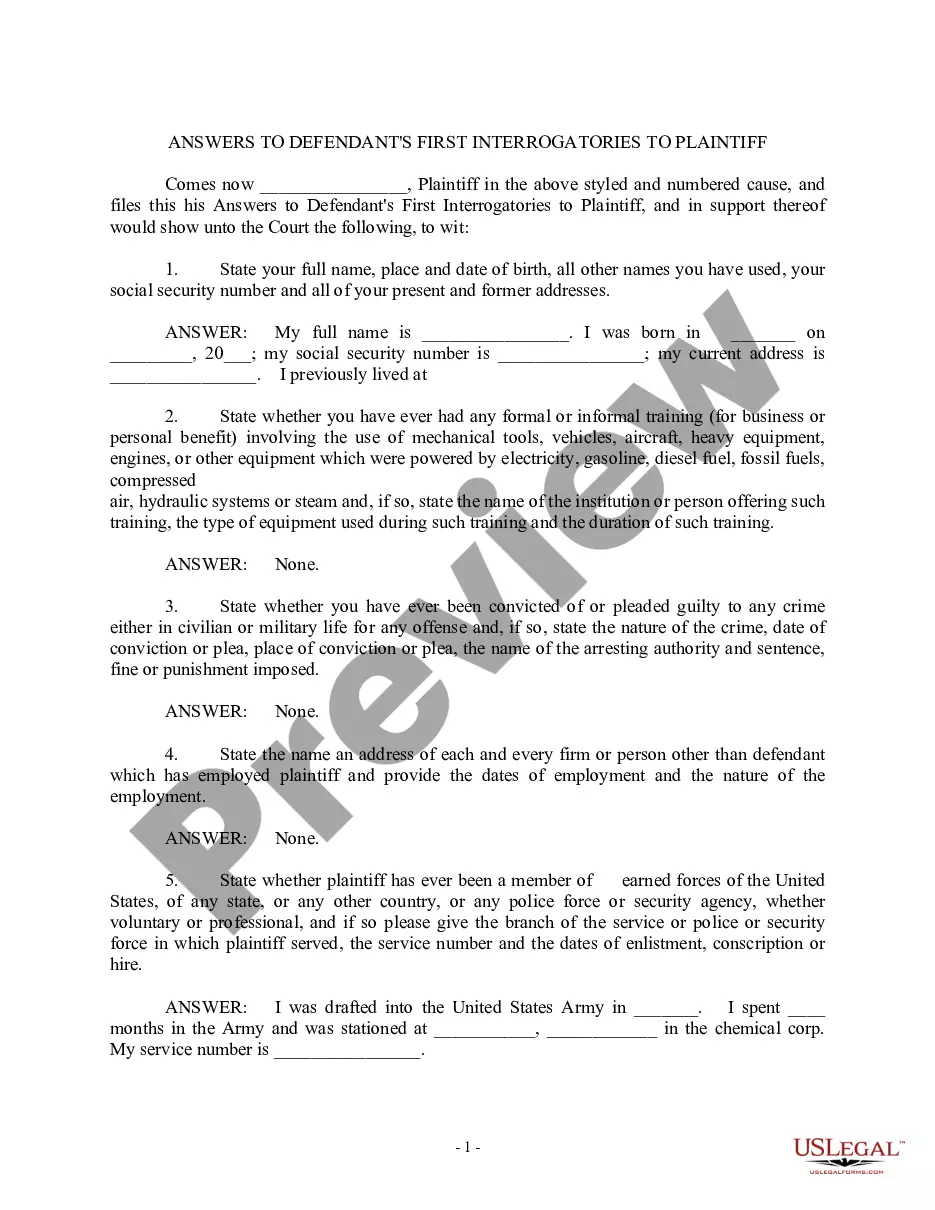

How to fill out Accounting Agreement - Self-Employed Independent Contractor?

Choosing the best authorized papers format can be quite a battle. Needless to say, there are tons of themes available on the net, but how would you discover the authorized develop you require? Take advantage of the US Legal Forms web site. The services provides a huge number of themes, such as the Minnesota Accounting Agreement - Self-Employed Independent Contractor, that you can use for business and private requirements. All of the varieties are checked by pros and meet up with state and federal specifications.

If you are presently registered, log in in your profile and then click the Obtain switch to get the Minnesota Accounting Agreement - Self-Employed Independent Contractor. Make use of your profile to search throughout the authorized varieties you possess purchased earlier. Visit the My Forms tab of your respective profile and acquire one more copy of the papers you require.

If you are a whole new end user of US Legal Forms, listed below are easy guidelines for you to stick to:

- First, make sure you have selected the appropriate develop to your town/state. You may check out the form while using Preview switch and look at the form information to ensure this is basically the right one for you.

- In the event the develop will not meet up with your preferences, make use of the Seach discipline to get the appropriate develop.

- Once you are certain that the form is proper, click on the Acquire now switch to get the develop.

- Select the rates plan you desire and type in the essential information. Build your profile and pay money for the order making use of your PayPal profile or charge card.

- Pick the submit file format and download the authorized papers format in your system.

- Total, revise and produce and indicator the attained Minnesota Accounting Agreement - Self-Employed Independent Contractor.

US Legal Forms may be the largest collection of authorized varieties for which you can see numerous papers themes. Take advantage of the service to download expertly-created files that stick to express specifications.

Form popularity

FAQ

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

The IRS says that someone is self-employed if they meet one of these conditions:Someone who carries on a trade or business as a sole proprietor or independent contractor,A member of a partnership that carries on a trade or business, or.Someone who is otherwise in business for themselves, including part-time business.