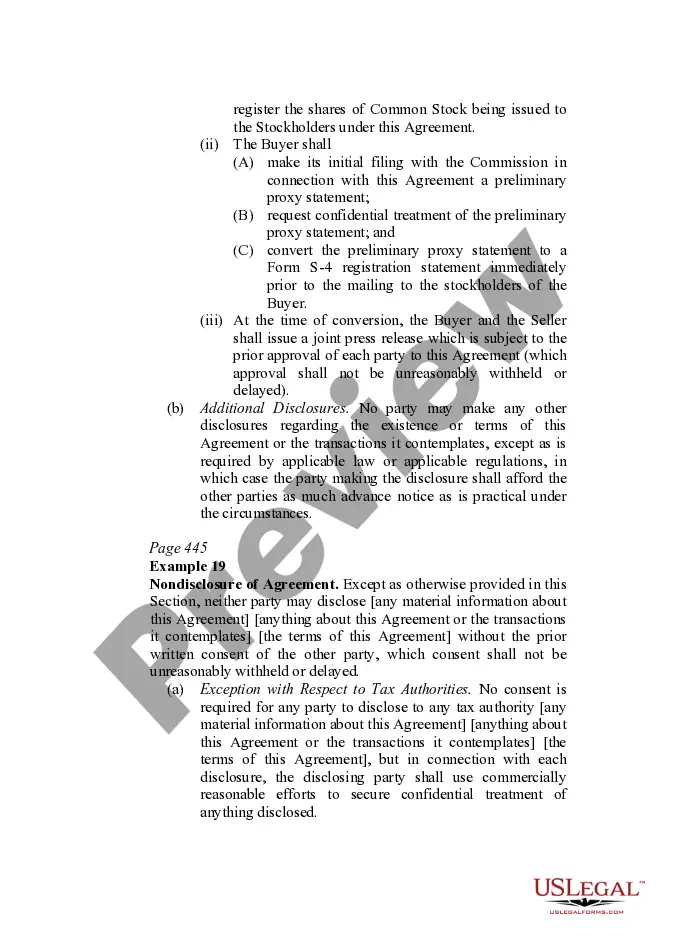

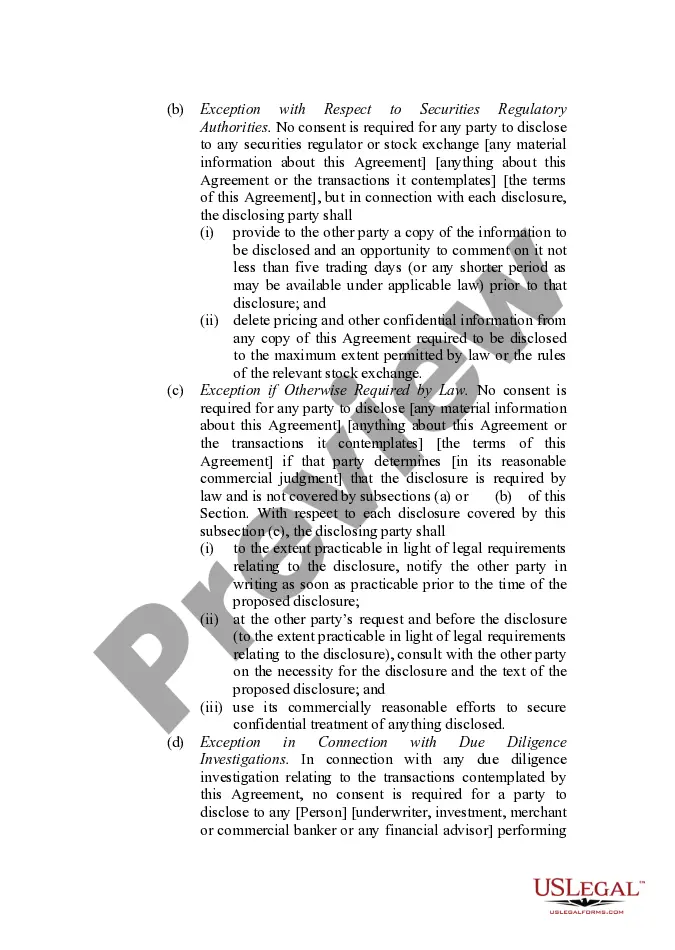

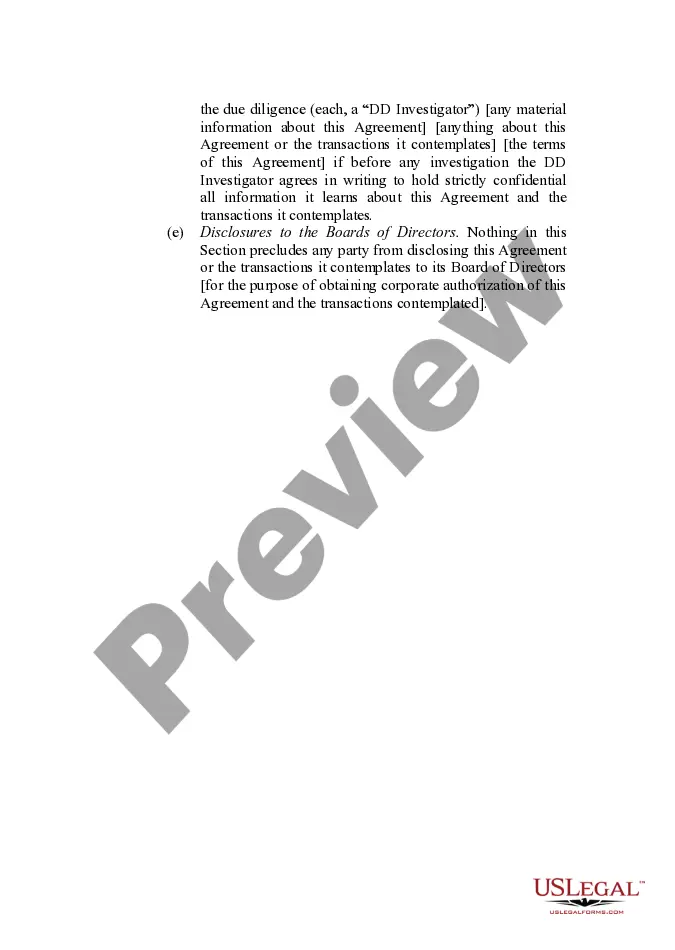

This form provides boilerplate contract clauses that outline the obligations of nondisclosure and the restrictions that apply to public announcements regarding the existence or terms of the contract agreement. Several different language options representing various levels of restriction are included to suit individual needs and circumstances.

Minnesota Announcement Provisions in the Transactional Context refer to legal provisions that are applicable in the state of Minnesota when announcing transactions. These provisions are designed to protect the interests of the parties involved in a transaction and ensure transparency and fairness in the process. There are different types of Minnesota Announcement Provisions that may be applicable, such as: 1. Minnesota Corporate Statutes: The Minnesota Business Corporation Act (Chapter 302A) provides guidelines on how transactions involving corporations should be announced. It specifies the requirements for notifying shareholders, the format of announcements, and the timing of such notifications. 2. Minnesota Limited Liability Company Act: For transactions involving limited liability companies (LCS), the Minnesota Limited Liability Company Act (Chapter 322C) governs the announcement provisions. It outlines the process and requirements for notifying members of an LLC about proposed transactions. 3. Minnesota Partnership Laws: Partnerships in Minnesota are governed by various statutes, such as the Revised Uniform Partnership Act (Chapter 323A). These laws often include requirements for announcement provisions when partnerships undergo transactions. 4. Applicable Securities Laws: Depending on the nature of the transaction, certain securities laws may also come into play. The Minnesota Department of Commerce, Division of Securities, oversees securities transactions in the state and enforces regulations related to the announcement and disclosure of such transactions. The specific requirements and provisions may vary depending on the type of transaction and the legal entity involved. It is crucial for parties involved in a transaction in Minnesota to consult with legal professionals well-versed in these announcement provisions to ensure compliance and avoid any legal complications. Failure to comply with applicable announcement provisions may lead to legal consequences or challenges to the validity of the transaction.

Minnesota Announcement Provisions in the Transactional Context refer to legal provisions that are applicable in the state of Minnesota when announcing transactions. These provisions are designed to protect the interests of the parties involved in a transaction and ensure transparency and fairness in the process. There are different types of Minnesota Announcement Provisions that may be applicable, such as: 1. Minnesota Corporate Statutes: The Minnesota Business Corporation Act (Chapter 302A) provides guidelines on how transactions involving corporations should be announced. It specifies the requirements for notifying shareholders, the format of announcements, and the timing of such notifications. 2. Minnesota Limited Liability Company Act: For transactions involving limited liability companies (LCS), the Minnesota Limited Liability Company Act (Chapter 322C) governs the announcement provisions. It outlines the process and requirements for notifying members of an LLC about proposed transactions. 3. Minnesota Partnership Laws: Partnerships in Minnesota are governed by various statutes, such as the Revised Uniform Partnership Act (Chapter 323A). These laws often include requirements for announcement provisions when partnerships undergo transactions. 4. Applicable Securities Laws: Depending on the nature of the transaction, certain securities laws may also come into play. The Minnesota Department of Commerce, Division of Securities, oversees securities transactions in the state and enforces regulations related to the announcement and disclosure of such transactions. The specific requirements and provisions may vary depending on the type of transaction and the legal entity involved. It is crucial for parties involved in a transaction in Minnesota to consult with legal professionals well-versed in these announcement provisions to ensure compliance and avoid any legal complications. Failure to comply with applicable announcement provisions may lead to legal consequences or challenges to the validity of the transaction.