Minnesota Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes

Description

How to fill out Affidavit That All The Estate Assets Have Been Distributed To Devisees By Executor Or Estate Representative With Statement Concerning Debts And Taxes?

Are you currently in a place the place you need to have papers for both organization or individual purposes virtually every day? There are a lot of legitimate papers web templates accessible on the Internet, but discovering types you can depend on is not straightforward. US Legal Forms delivers thousands of kind web templates, just like the Minnesota Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes, which can be composed to satisfy federal and state specifications.

If you are already informed about US Legal Forms web site and also have a merchant account, merely log in. After that, you can down load the Minnesota Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes design.

Should you not have an profile and want to begin to use US Legal Forms, adopt these measures:

- Find the kind you want and ensure it is for your right city/region.

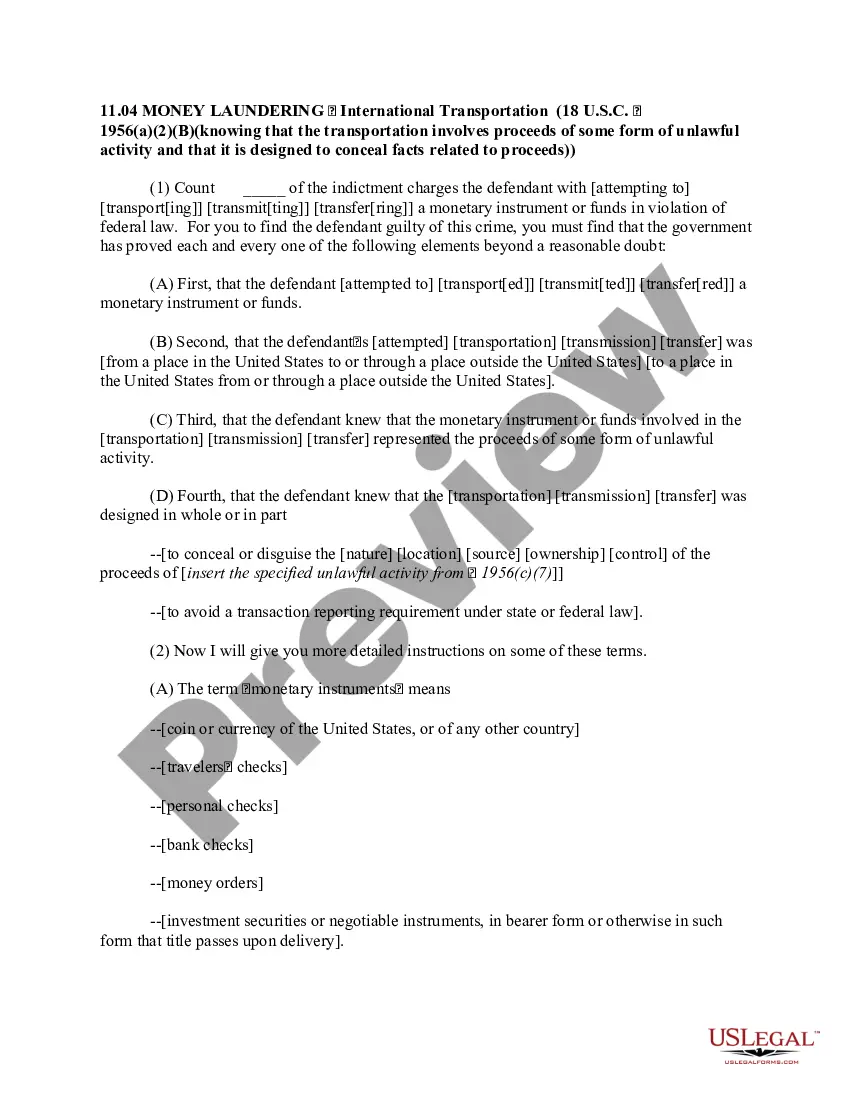

- Make use of the Review button to analyze the form.

- Browse the explanation to ensure that you have chosen the appropriate kind.

- If the kind is not what you are looking for, make use of the Lookup area to obtain the kind that fits your needs and specifications.

- Whenever you get the right kind, click Buy now.

- Opt for the pricing program you desire, submit the necessary info to make your money, and buy an order with your PayPal or Visa or Mastercard.

- Pick a convenient file structure and down load your copy.

Discover all the papers web templates you might have bought in the My Forms menu. You can aquire a extra copy of Minnesota Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes anytime, if possible. Just click the necessary kind to down load or produce the papers design.

Use US Legal Forms, one of the most considerable variety of legitimate types, to conserve some time and stay away from blunders. The assistance delivers expertly created legitimate papers web templates that can be used for a selection of purposes. Make a merchant account on US Legal Forms and begin generating your way of life a little easier.

Form popularity

FAQ

Minnesota small estate affidavit is a legal form used in estates valued and under $75,000. Minnesota statute 524.3-1201 tells us that this dollar amount is the threshold level by which an estate in Minnesota does or does not need to be probated.

Probate court is a specialized type of court that deals with the property and debts of a person who has died. The basic role of the probate court judge is to assure that the deceased person's creditors are paid, and that any remaining assets are distributed to the proper beneficiaries.

The affidavit can collect the decedent's personal property in safe deposit boxes, interests in multiple-party accounts, and debts owed to the decedent. See Minnesota Statutes, sections 524.3-1201, 55.10, and 524.6-207. There are important limitations to affidavits of collection.

An Affidavit of Survivorship is a legal document used in Minnesota to transfer the ownership of real estate from one party to another when one of the parties has died.

Minnesota law does not set a specific timeline for settling an estate, but it generally should be done as "expeditiously and efficiently as is compatible with the best interests of the estate." Delays can result in additional expenses and even legal repercussions for the executor.

Affidavit of No-Probate (PS2071) is used by one or more heirs at law (adult children, parents, siblings), who affirm they have the authority to represent all heirs and that the estate is not subject to probate.

In Minnesota, you must wait at least 30 days after the person's death to file a Small Estate Affidavit. This waiting period allows time for discovering all assets and debts and gives potential creditors an opportunity to come forward.