Minnesota Lessor's Notice of Election to Take Royalty in Kind

Description

How to fill out Lessor's Notice Of Election To Take Royalty In Kind?

You are able to spend time on the Internet trying to find the authorized file format which fits the federal and state needs you need. US Legal Forms provides a huge number of authorized varieties that are evaluated by professionals. You can easily download or print the Minnesota Lessor's Notice of Election to Take Royalty in Kind from the assistance.

If you have a US Legal Forms account, you are able to log in and then click the Down load button. After that, you are able to total, modify, print, or sign the Minnesota Lessor's Notice of Election to Take Royalty in Kind. Every single authorized file format you buy is your own property forever. To acquire another duplicate for any acquired kind, proceed to the My Forms tab and then click the corresponding button.

If you work with the US Legal Forms website the very first time, follow the simple directions listed below:

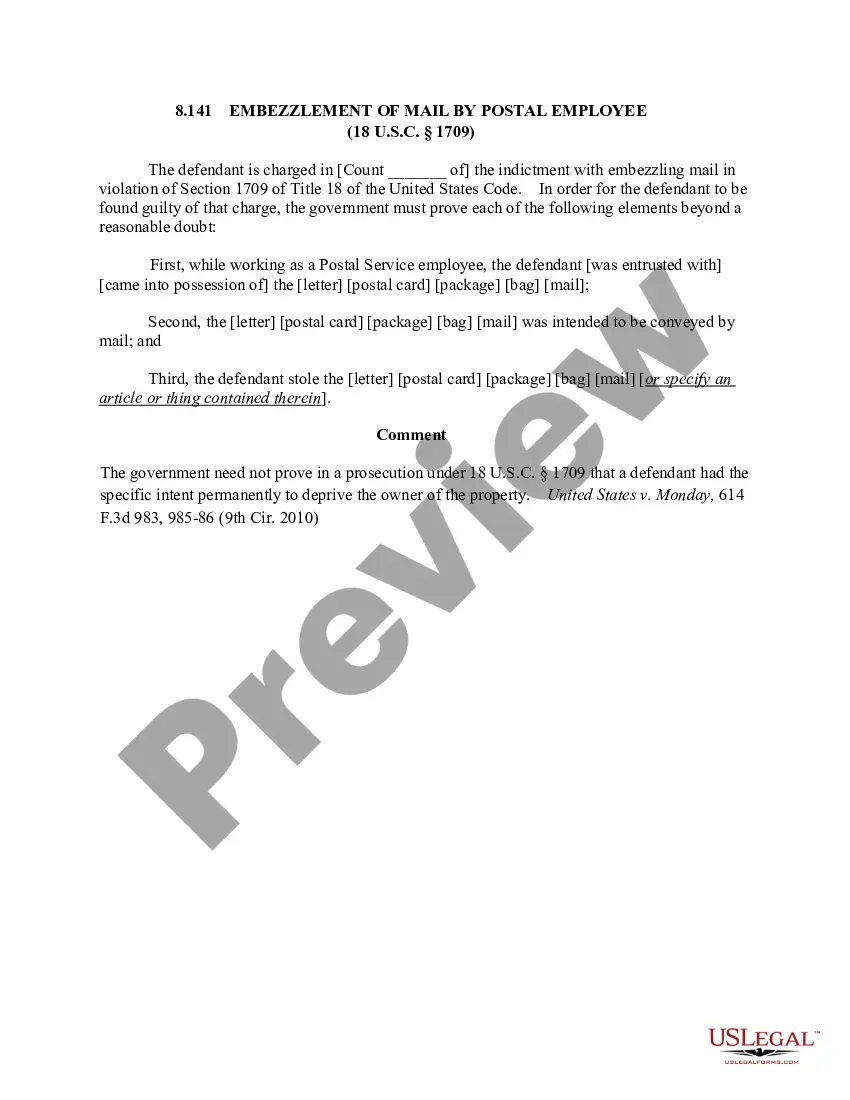

- Initial, make certain you have chosen the right file format for the region/town of your choice. Browse the kind outline to make sure you have picked out the appropriate kind. If offered, utilize the Preview button to check with the file format also.

- If you want to find another version of your kind, utilize the Research discipline to obtain the format that meets your requirements and needs.

- After you have discovered the format you want, click Acquire now to continue.

- Pick the rates prepare you want, enter your credentials, and sign up for your account on US Legal Forms.

- Complete the financial transaction. You may use your charge card or PayPal account to pay for the authorized kind.

- Pick the structure of your file and download it for your gadget.

- Make alterations for your file if required. You are able to total, modify and sign and print Minnesota Lessor's Notice of Election to Take Royalty in Kind.

Down load and print a huge number of file web templates using the US Legal Forms website, which provides the largest variety of authorized varieties. Use expert and condition-distinct web templates to take on your organization or person requires.