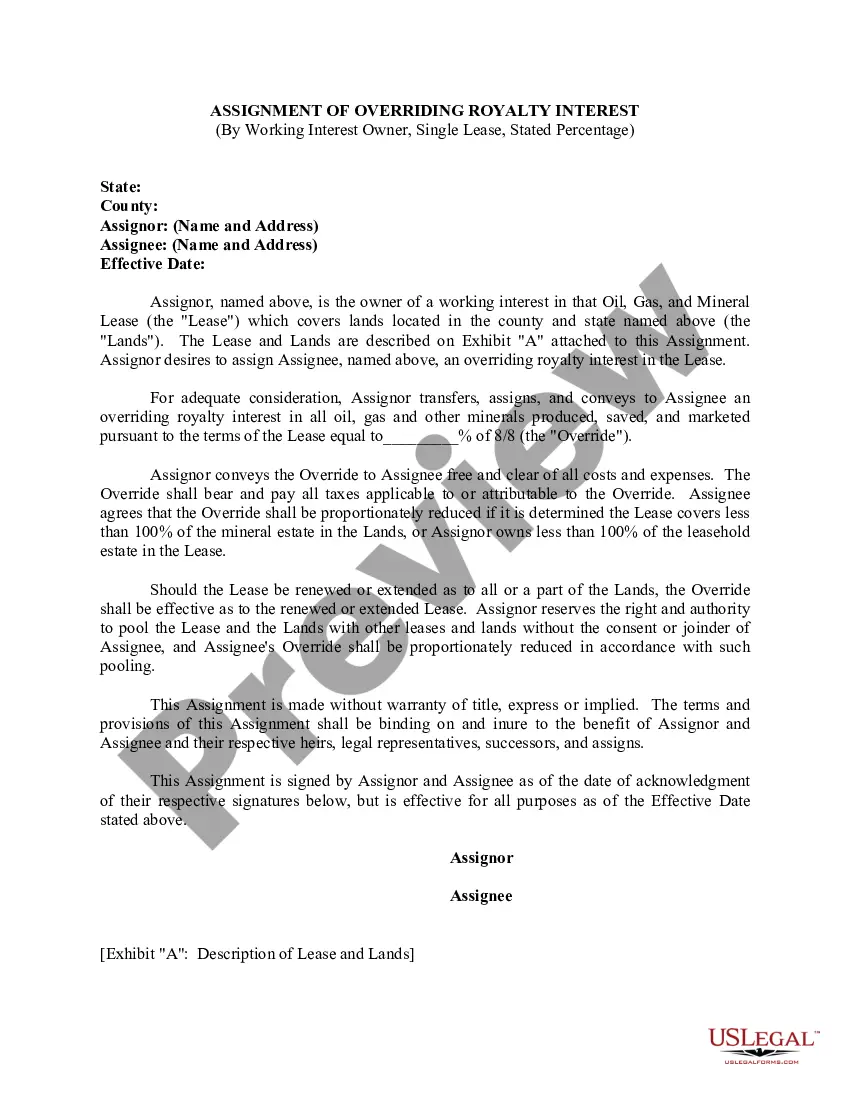

Title: Understanding the Minnesota Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Stated Percentage Introduction: In the realm of oil and gas leases, the Minnesota Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Stated Percentage holds prominent significance. This legal mechanism plays a crucial role in determining the distribution of proceeds between working interest owners and overriding royalty interest owners within the state of Minnesota. This article aims to provide a comprehensive understanding of this arrangement, highlighting its key features, variations, and implications for both parties involved. Keywords: Minnesota Assignment of Overriding Royalty Interest, Working Interest Owner, Single Lease, Stated Percentage, Distribution of Proceeds, Oil and Gas Lease, Key Features, Variations, Implications. 1. Key Features of the Minnesota Assignment of Overriding Royalty Interest: The Minnesota Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Stated Percentage encompasses various characteristics that shape its functionality and impact. These key features include: a. Ownership Distribution: The assignment determines the proportionate distribution of both the working interest and overriding royalty interest among participating parties. b. Stated Percentage: The assignment specifies the exact percentage of overriding royalty interest that will be assigned to the working interest owner. c. Single Lease Consideration: The assignment solely applies to a specific lease agreement, ensuring clarity and a dedicated scope of application. 2. Variations in Minnesota Assignment of Overriding Royalty Interest: While the basic framework remains consistent, there can be specific variations depending on circumstances and desired agreements. The following are a few significant types of Minnesota Assignment of Overriding Royalty Interest: a. Percentage Variation: The stated percentage assigned to the working interest owner may vary depending on negotiations and contractual agreements. b. Multiple Assignments: In cases where there are multiple working interest owners, each owner's assignment of overriding royalty interest might differ, reflecting the complexity of the overall arrangement. c. Lease-Specific Terms: The terms and stipulations of the single lease can influence the assignment, leading to tailored adjustments to meet the requirements of the specific lease agreement. 3. Implications of Minnesota Assignment of Overriding Royalty Interest: Understanding the implications of this assignment is crucial for both working interest owners and overriding royalty interest owners. a. Financial Impact: The assignment impacts the finances of both parties involved, as it determines the portion of proceeds they will receive from the oil and gas production within the leased land. b. Investment Decisions: The assigned percentage influences working interest owners' decisions concerning further investment, as it defines their share of future profits and the potential return on investment. c. Rights and Obligations: The assignment establishes the rights and obligations of both parties in regard to the leased property, ensuring clarity in terms of royalty interests and working interests. Conclusion: In conclusion, the Minnesota Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Stated Percentage is a vital component of the oil and gas industry in Minnesota. Its key features, variations, and implications create a framework that governs the distribution of proceeds and outlines the responsibilities of working interest owners and overriding royalty interest owners. By understanding this assignment, parties involved can make informed decisions, ensuring a fair and mutually beneficial arrangement. Keywords: Minnesota Assignment of Overriding Royalty Interest, Working Interest Owner, Single Lease, Stated Percentage, Distribution of Proceeds, Oil and Gas Lease, Key Features, Variations, Implications.

Minnesota Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage

Description

How to fill out Minnesota Assignment Of Overriding Royalty Interest By Working Interest Owner, Single Lease, Stated Percentage?

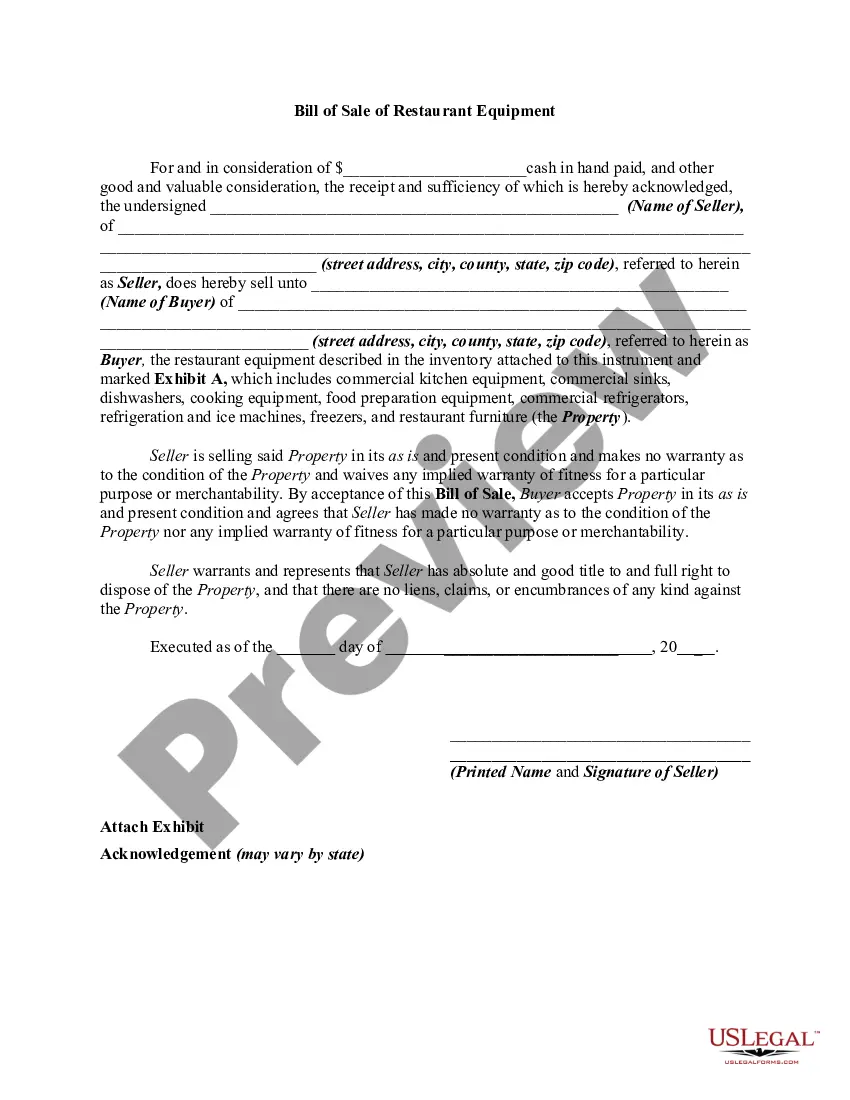

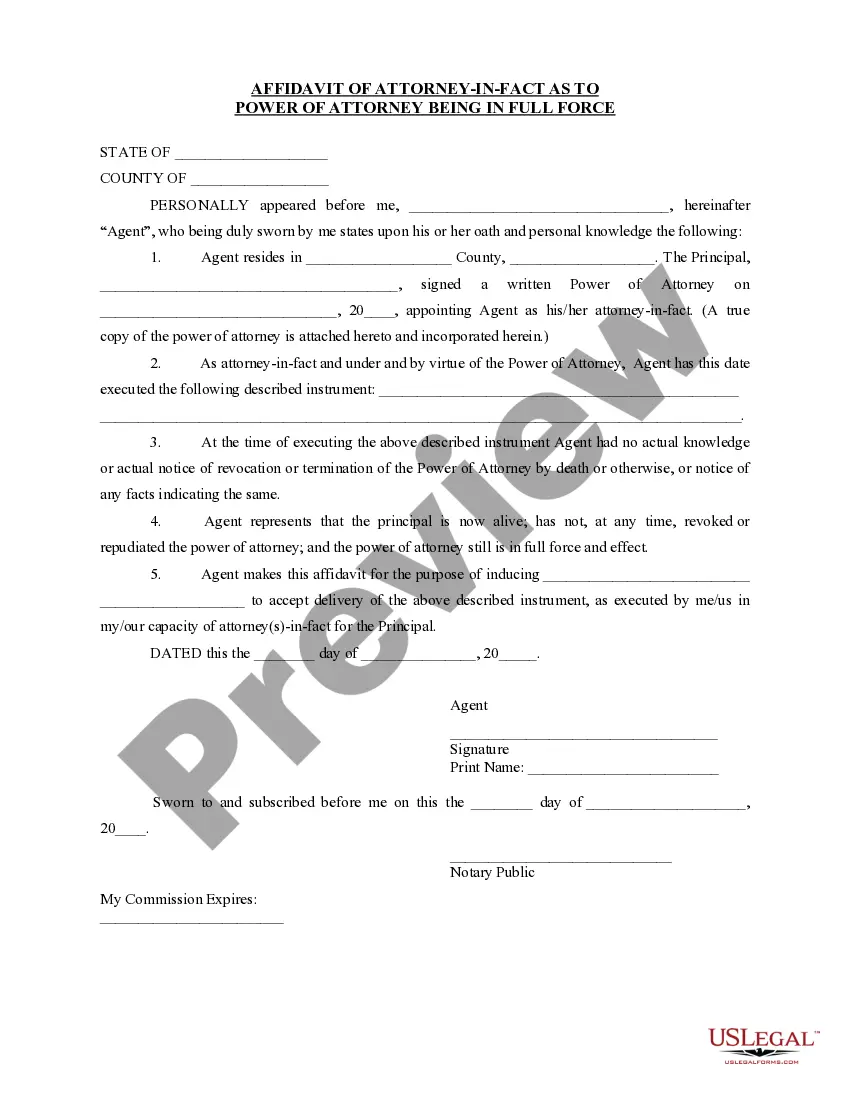

Choosing the best legal document design can be quite a have difficulties. Needless to say, there are a variety of web templates available on the Internet, but how can you discover the legal kind you need? Use the US Legal Forms site. The services offers a huge number of web templates, including the Minnesota Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage, that can be used for company and private needs. All of the forms are checked out by specialists and fulfill state and federal needs.

In case you are already authorized, log in to the profile and click on the Down load option to have the Minnesota Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage. Use your profile to check from the legal forms you may have ordered in the past. Check out the My Forms tab of your own profile and get another copy from the document you need.

In case you are a new consumer of US Legal Forms, here are easy directions that you can stick to:

- First, make certain you have selected the proper kind for your personal city/region. You can examine the shape utilizing the Preview option and look at the shape outline to make sure it will be the right one for you.

- In the event the kind does not fulfill your needs, take advantage of the Seach discipline to find the right kind.

- When you are positive that the shape is suitable, click the Purchase now option to have the kind.

- Choose the costs strategy you want and enter the required information. Build your profile and pay for the transaction with your PayPal profile or charge card.

- Pick the submit formatting and download the legal document design to the gadget.

- Full, modify and print out and indicator the received Minnesota Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage.

US Legal Forms is the most significant catalogue of legal forms where you can discover numerous document web templates. Use the service to download expertly-made paperwork that stick to status needs.

Form popularity

FAQ

To calculate the NMA, you need the gross number of acres and the percentage of your mineral interest. To complete the calculation, simply multiply the gross acreage by your mineral interest. For example, if you owned 25% interest on the minerals under a 400-acre tract of land, you would have 100 NMA.

How Do Overriding Royalty Interest Payments Work? The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

NRA = 40.00 net mineral acres x ([1/5] Lease Royalty Rate / [1/8] Standard Royalty Rate) NRA = 40.00 x (0.20 / 0.125) NRA = 40.00 x 1.60 NRA = 64.00 Net Royalty Acres This mathematical concept can also be used inversely to calculate your net mineral acres in a parcel based on the Net Revenue Interest (NRI) you are ...

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

If there is an NPRI that exists, you would have to determine the # of net royalty acres by taking your royalty rate and subtracting the NPRI from it and then dividing by 12.5%.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.