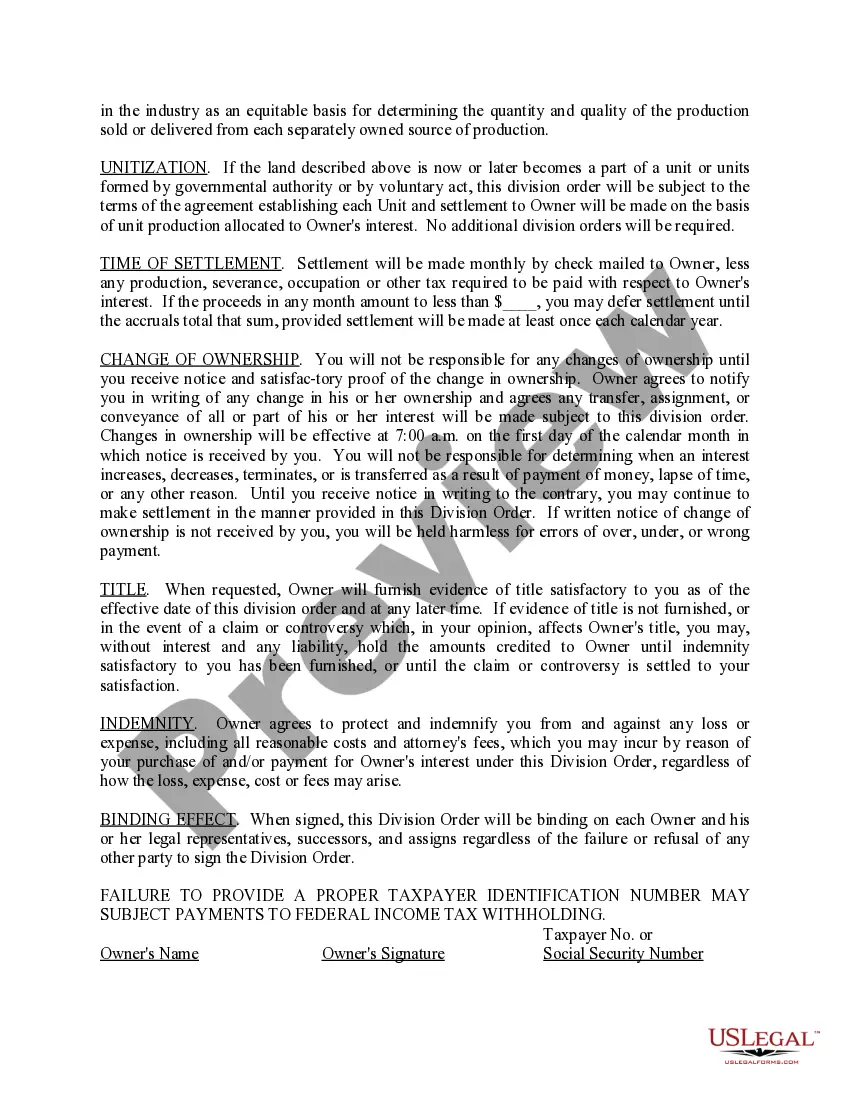

The Minnesota Oil and Gas Division Order is a legal document used to govern the distribution of proceeds from oil and gas production in the state of Minnesota. It outlines the rights and responsibilities of the working interest owners, royalty owners, and other parties involved in the extraction and sale of oil and gas resources. Keyword: Minnesota Oil and Gas Division Order The division order serves as a contractual agreement between the mineral rights owners and the operator or producer, establishing the terms and conditions for the distribution of revenue derived from the production of oil and gas wells. It specifies the percentage or fraction of the production revenues that each owner is entitled to receive. The Minnesota Oil and Gas Division Order is a crucial document as it ensures accuracy and transparency in the distribution of proceeds, preventing any disputes or discrepancies among the parties involved. It typically includes information such as the legal description of the property, the names of the interest owners, the decimal interest owned by each party, the payment terms, and any applicable deductions or costs associated with the production. Different types of Minnesota Oil and Gas Division Orders may include: 1. Working Interest Division Order: This type of division order pertains to the owners who bear the costs and risks associated with the drilling and operation of the wells. They are entitled to a share of the revenue generated from the sale of oil and gas, in proportion to their working interest percentage. 2. Royalty Interest Division Order: Royalty owners are those who own a percentage of the revenue obtained from the production without having to bear any operational expenses. Typically, these owners are the original owners of the mineral rights who leased or sold their rights to the operator or producer in exchange for a royalty payment. 3. Overriding Royalty Interest Division Order: In some cases, there may be parties who hold an overriding royalty interest over the working interest owners. These entities or individuals have the right to a specific percentage of the revenue derived from the production, often associated with specific terms outlined in the division order. Regardless of the type of division order, its purpose is to maintain transparency, establish the rightful interests of each party, and facilitate the accurate and fair distribution of proceeds from oil and gas production in Minnesota. It helps create a clear understanding and harmony among the working interest owners, royalty owners, and overriding royalty interest holders.

Minnesota Oil and Gas Division Order

Description

How to fill out Minnesota Oil And Gas Division Order?

You may spend hrs on the web attempting to find the legal document web template which fits the federal and state specifications you will need. US Legal Forms supplies thousands of legal types that happen to be analyzed by experts. It is possible to download or printing the Minnesota Oil and Gas Division Order from our assistance.

If you already possess a US Legal Forms accounts, it is possible to log in and click on the Down load key. Following that, it is possible to total, change, printing, or indicator the Minnesota Oil and Gas Division Order. Every single legal document web template you get is the one you have forever. To acquire yet another copy for any acquired type, proceed to the My Forms tab and click on the related key.

If you are using the US Legal Forms internet site the first time, stick to the simple guidelines under:

- First, be sure that you have chosen the right document web template for the state/area of your choice. Look at the type explanation to make sure you have picked out the proper type. If accessible, utilize the Preview key to search throughout the document web template as well.

- If you want to discover yet another edition from the type, utilize the Look for industry to discover the web template that meets your needs and specifications.

- After you have found the web template you desire, click on Acquire now to continue.

- Select the rates prepare you desire, type your references, and sign up for a free account on US Legal Forms.

- Full the financial transaction. You may use your Visa or Mastercard or PayPal accounts to pay for the legal type.

- Select the structure from the document and download it for your device.

- Make adjustments for your document if needed. You may total, change and indicator and printing Minnesota Oil and Gas Division Order.

Down load and printing thousands of document web templates making use of the US Legal Forms site, which offers the greatest collection of legal types. Use skilled and condition-particular web templates to handle your business or specific requires.