A Minnesota Subscription Agreement is a legal document used in the context of a Section 3C1 Fund, which relates to certain exemptions from the Investment Company Act of 1940. This agreement sets out the terms and conditions under which an investor can subscribe to invest in the fund. In simple terms, a Section 3C1 Fund is an investment fund that qualifies for an exemption under Section 3(c)(1) of the Investment Company Act. This exemption allows the fund to avoid some of the regulatory requirements that apply to regular investment funds, provided certain conditions are met. The Minnesota Subscription Agreement outlines essential information, including: 1. Parties Involved: The agreement states the names and contact details of the parties involved, such as the fund manager or general partner, and the subscribing investor(s). 2. Subscription Details: It provides a clear description of the investment terms, including the fund's name, objective, investment strategy, and minimum investment requirements. It may also specify the targeted investor type, such as accredited investors or qualified purchasers. 3. Subscription Process: The agreement outlines the steps and procedures to be followed when submitting a subscription, including deadlines for submitting completed documentation and funding the investment. 4. Representations and Warranties: Investors are required to make certain representations and warranties regarding their financial status, experience, and eligibility for investing in the fund. These representations assure the fund manager that the investor meets the necessary criteria. 5. Risk Disclosures: The agreement includes detailed disclosures regarding the risks associated with investing in the fund. This ensures the investor acknowledges and understands the potential risks involved, such as market volatility, liquidity, and the possibility of loss of capital. 6. Subscription Acceptance and Redemption: The agreement describes the fund manager's right to accept or reject subscriptions, usually subject to certain conditions. It may also outline the terms for investor redemptions, such as notice periods and redemption restrictions. Different types of Minnesota Subscription Agreement — A Section 3C1 Fund may include: 1. Hedge Funds: These are investment funds that typically employ various strategies to generate returns, including leveraging, short-selling, and derivatives. Hedge funds often target sophisticated and accredited investors due to their higher-risk investment strategies. 2. Private Equity Funds: These funds invest in private companies through various stages, such as startups, growth phases, or distressed companies. Private equity funds aim to generate higher returns over longer investment horizons, typically targeting institutional and high-net-worth investors. 3. Venture Capital Funds: Venture capital funds specifically focus on providing financing and support to innovative startups or early-stage companies. Investors in venture capital funds seek high potential returns, but also face higher risks due to the nature of investing in unproven companies. In conclusion, a Minnesota Subscription Agreement — A Section 3C1 Fund is a legally binding document that outlines the terms and conditions for investors to subscribe and invest in a fund that qualifies for exemption under Section 3(c)(1) of the Investment Company Act. This agreement is crucial in establishing the expectations, rights, and obligations of both the fund manager and the subscribing investor(s), ensuring a transparent and legally compliant investment process.

Minnesota Subscription Agreement - A Section 3C1 Fund

Description

How to fill out Minnesota Subscription Agreement - A Section 3C1 Fund?

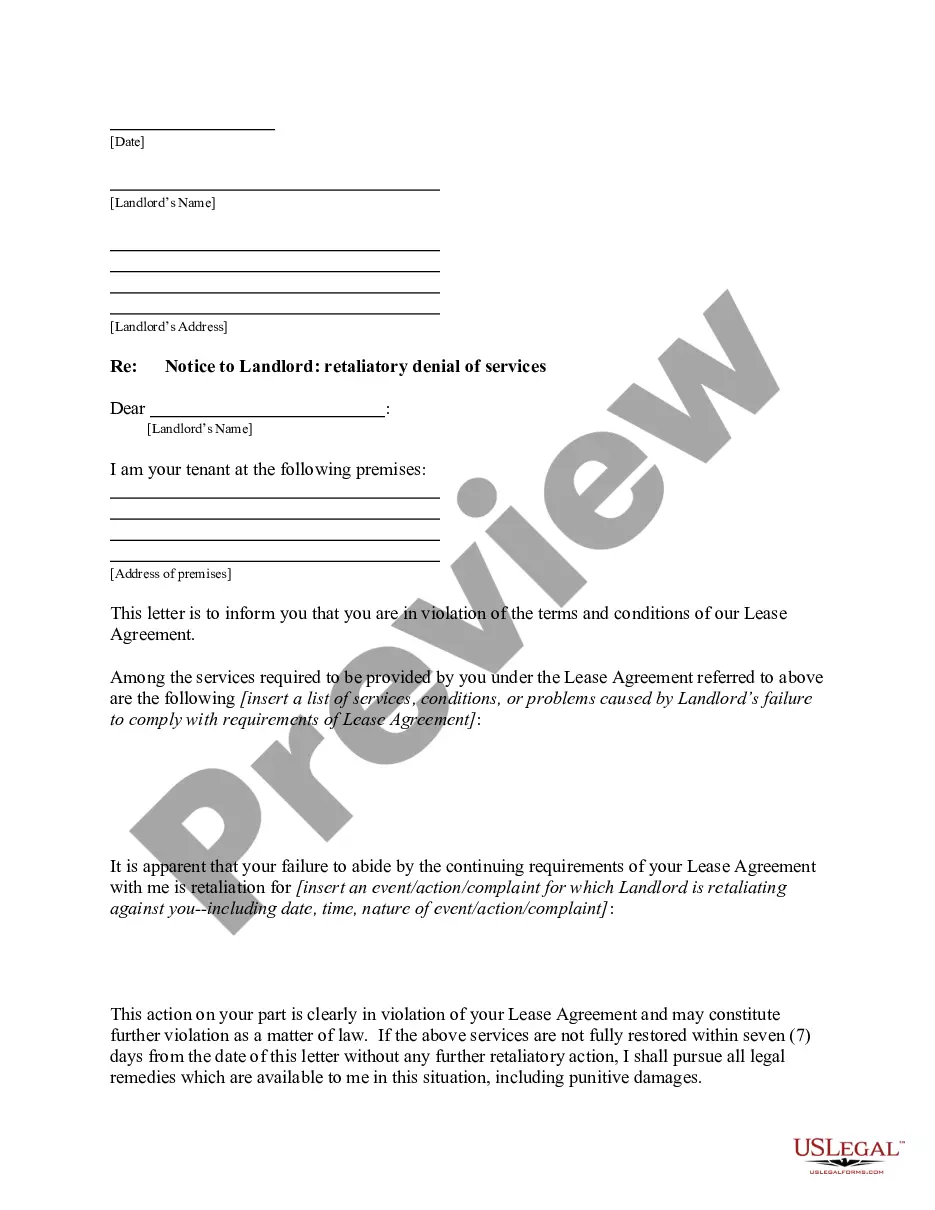

You may commit time on-line looking for the authorized file template that fits the state and federal requirements you need. US Legal Forms gives thousands of authorized types which can be examined by specialists. You can actually download or print the Minnesota Subscription Agreement - A Section 3C1 Fund from your services.

If you have a US Legal Forms profile, it is possible to log in and click the Obtain option. After that, it is possible to comprehensive, change, print, or indicator the Minnesota Subscription Agreement - A Section 3C1 Fund. Every authorized file template you get is your own property forever. To get another backup associated with a bought type, proceed to the My Forms tab and click the corresponding option.

If you are using the US Legal Forms web site the very first time, adhere to the easy instructions below:

- Initial, make sure that you have chosen the best file template for your region/area of your liking. Look at the type explanation to ensure you have picked the appropriate type. If accessible, make use of the Review option to look with the file template also.

- If you would like find another variation of the type, make use of the Lookup field to obtain the template that suits you and requirements.

- When you have identified the template you desire, click Get now to move forward.

- Pick the costs plan you desire, enter your references, and register for your account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal profile to cover the authorized type.

- Pick the file format of the file and download it for your device.

- Make adjustments for your file if needed. You may comprehensive, change and indicator and print Minnesota Subscription Agreement - A Section 3C1 Fund.

Obtain and print thousands of file layouts using the US Legal Forms Internet site, which provides the greatest collection of authorized types. Use skilled and condition-particular layouts to take on your company or individual requires.