Title: Minnesota Request for Copy of Tax Form or Individual Income Tax Account Information Introduction: In Minnesota, individuals and businesses may need to request copies of their tax forms or obtain their income tax account information for various purposes. This comprehensive guide provides a detailed description of Minnesota's Request for Copy of Tax Form or Individual Income Tax Account Information process, including different types of requests and relevant keywords to facilitate your search. 1. Minnesota Copy of Tax Form Request: Individuals or businesses often require copies of their filed tax forms for personal records, loan applications, verification of income, or other official purposes. To obtain a copy of their tax form, taxpayers can follow these steps: — Complete the Minnesota Request for Copy of Tax Form, available on the official website of the Minnesota Department of Revenue. — Ensure all required fields, such as name, Social Security number, tax year, and address, are accurately filled out. — Indicate the specific form(s) you need, such as Form M1 Individual Income Tax, Form M1PR Property Tax Refund, or Form M1NR Nonresident/Part-Year Resident. — Include any additional information or explanations required to process your request effectively. — Submit the completed request form through mail, fax, or online submission, as instructed by the Minnesota Department of Revenue. 2. Minnesota Individual Income Tax Account Information Request: In certain situations, individuals or businesses may need detailed information regarding their individual income tax account, such as payment history, credits, deductions, or adjustments. To request this information, taxpayers can follow these steps: — Complete the Minnesota Request for Individual Income Tax Account Information form, which can be found on the official Minnesota Department of Revenue website. — Provide accurate personal or business identification details, including name, Social Security number (SSN)/Federal Employer Identification Number (VEIN), and address. — Specify the nature of the information needed, such as payment history, credits, deductions, or adjustments. — Clearly state the tax years for which you require the information. — Include any relevant explanations or additional details to assist the Department of Revenue in processing your request efficiently. — Submit the completed request form via mail, fax, or online submission, following the instructions provided by the Minnesota Department of Revenue. Key terms and phrases: 1. Minnesota Request for Copy of Tax Form 2. Minnesota Individual Income Tax Account Information 3. Minnesota Department of Revenue 4. Requesting tax form copies in Minnesota 5. Individual income tax account information in Minnesota 6. How to request Minnesota tax form copies 7. Minnesota Request for Copy of Tax Form guidelines 8. Minnesota Individual Income Tax Account Information request process 9. Minnesota tax form photocopy request 10. Minnesota's income tax account information request form Conclusion: Obtaining copies of tax forms or individual income tax account information is crucial for individuals and businesses in Minnesota. By following the provided guidelines and using the relevant keywords mentioned above, taxpayers can effectively request and receive the necessary documentation or information from the Minnesota Department of Revenue. Remember to consult the official Minnesota Department of Revenue website for updated forms, instructions, and guidelines specific to your requirements.

Minnesota Request for Copy of Tax Form or Individual Income Tax Account Information

Description

How to fill out Minnesota Request For Copy Of Tax Form Or Individual Income Tax Account Information?

You may devote hrs on the Internet searching for the legal papers web template that fits the federal and state requirements you need. US Legal Forms offers thousands of legal varieties which can be reviewed by experts. It is simple to down load or printing the Minnesota Request for Copy of Tax Form or Individual Income Tax Account Information from the services.

If you already possess a US Legal Forms profile, it is possible to log in and then click the Down load option. Following that, it is possible to total, edit, printing, or signal the Minnesota Request for Copy of Tax Form or Individual Income Tax Account Information. Every single legal papers web template you acquire is your own for a long time. To get one more duplicate for any acquired develop, visit the My Forms tab and then click the corresponding option.

Should you use the US Legal Forms site initially, stick to the basic instructions listed below:

- Very first, make sure that you have chosen the correct papers web template for that state/metropolis that you pick. Look at the develop description to ensure you have picked the appropriate develop. If readily available, utilize the Review option to appear through the papers web template also.

- In order to find one more version in the develop, utilize the Research industry to get the web template that suits you and requirements.

- Upon having identified the web template you want, click Acquire now to move forward.

- Pick the rates strategy you want, enter your references, and sign up for a merchant account on US Legal Forms.

- Full the transaction. You should use your credit card or PayPal profile to pay for the legal develop.

- Pick the formatting in the papers and down load it for your product.

- Make alterations for your papers if possible. You may total, edit and signal and printing Minnesota Request for Copy of Tax Form or Individual Income Tax Account Information.

Down load and printing thousands of papers templates while using US Legal Forms Internet site, that offers the greatest selection of legal varieties. Use professional and condition-specific templates to tackle your company or personal needs.

Form popularity

FAQ

Get federal tax forms Download them from IRS.gov. Order online and have them delivered by U.S. mail. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

Minnesota State Income Tax Forms If you need Minnesota income tax forms: Download forms from the Minnesota Department of Revenue. Photocopy the forms you need at a library. Call 800-657-3676 or 651-296-4444 to place an order.

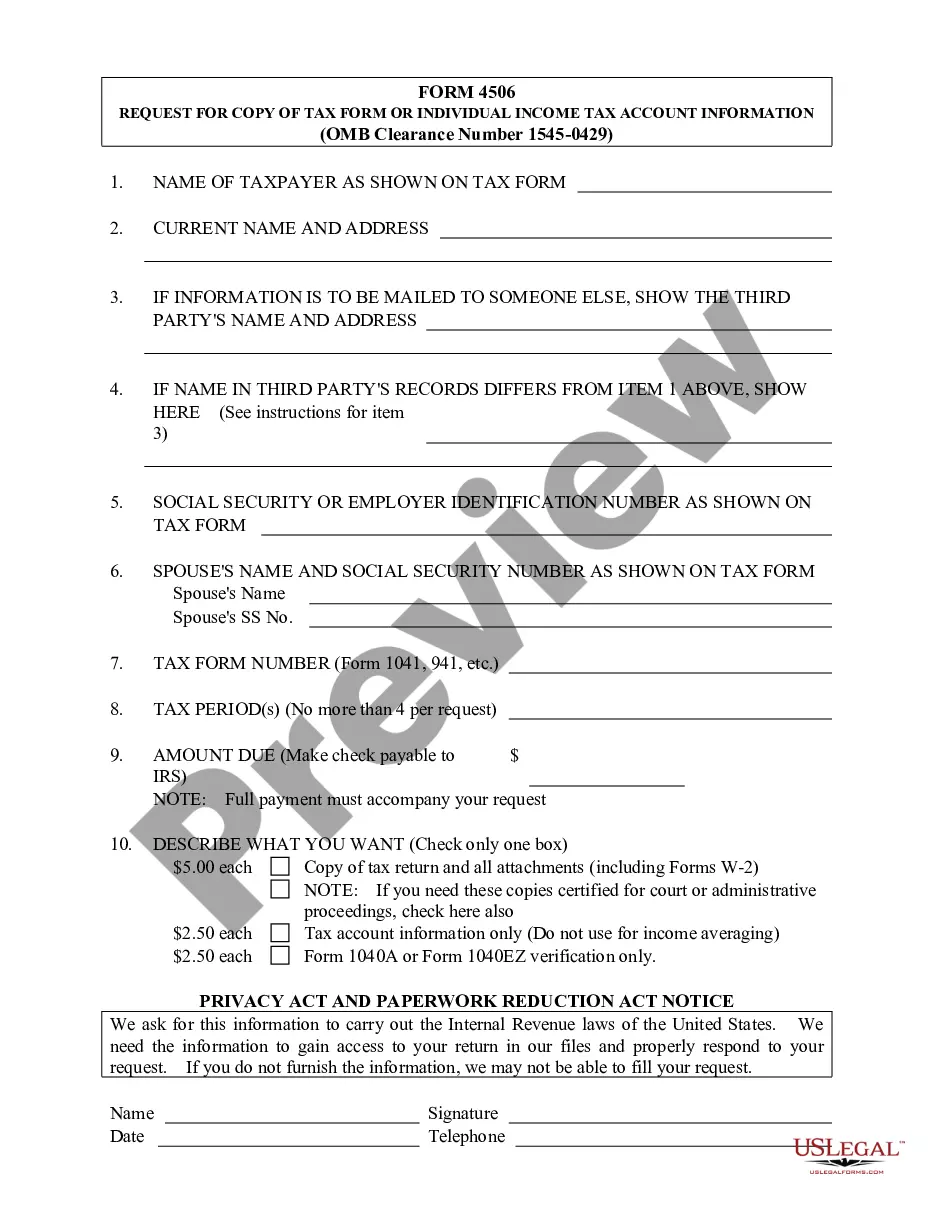

Use Form 4506 to request a copy of your tax return. You can also designate (on line 5) a third party to receive the tax return.

Request transcripts by calling 1-800-829-1040, or order by mail using IRS Form 4506-T, ?Request for Transcript of Tax Form.? Specify the type of transcript you are requesting. The IRS does not charge a fee for transcripts, which are available for the current and three prior calendar years. Allow two weeks for delivery.

Get federal tax forms Download them from IRS.gov. Order online and have them delivered by U.S. mail. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

You can request copies of your IRS tax returns from the most recent seven tax years. To obtain copies of your tax return from the IRS, download file Form 4506 from the IRS website, complete it, sign it, and mail it to the appropriate IRS address. As of 2023, the IRS charges $43 for each return you request.

A copy of the tax return can also be printed from within the return. The print location from inside the return is located on the Submission page under the e-File section. After all required information has been entered on the e-file page, select Save. The program will display the Submission page.

Use Form 4506 to: Request a copy of your tax return, or. Designate a third party to receive the tax return.