Minnesota New Client Questionnaire

Description

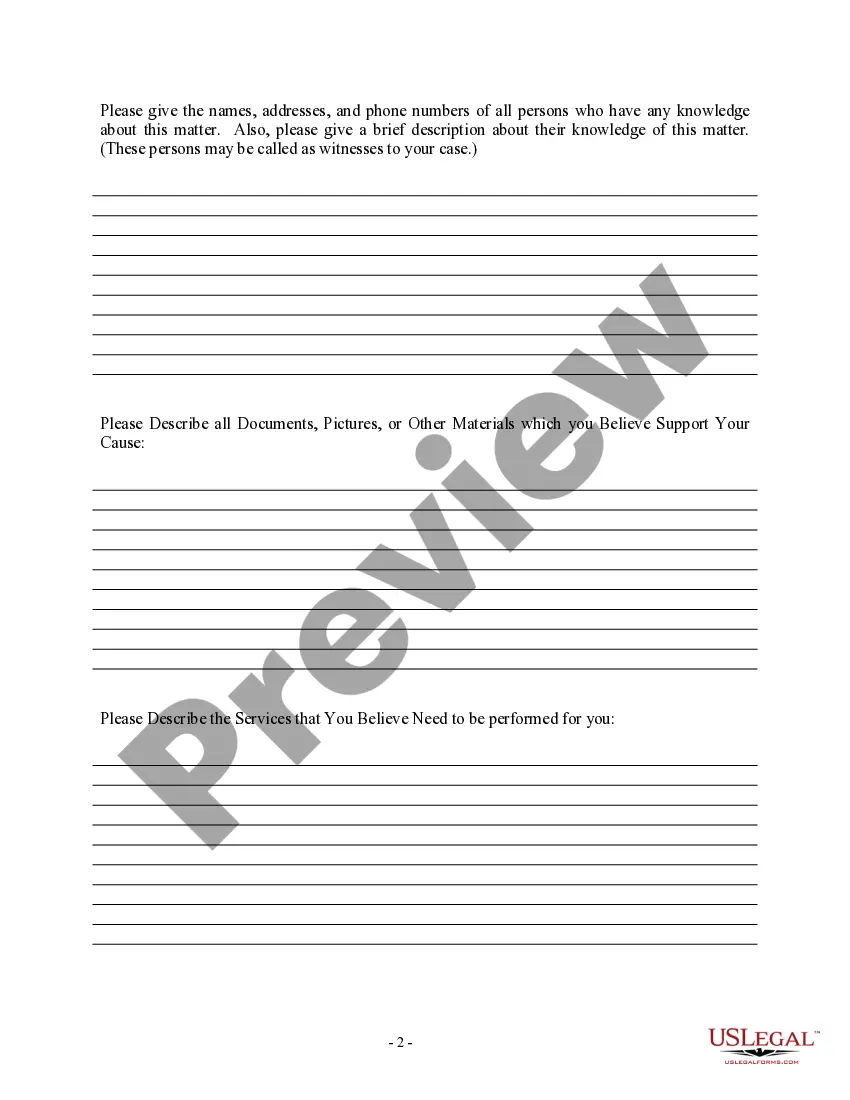

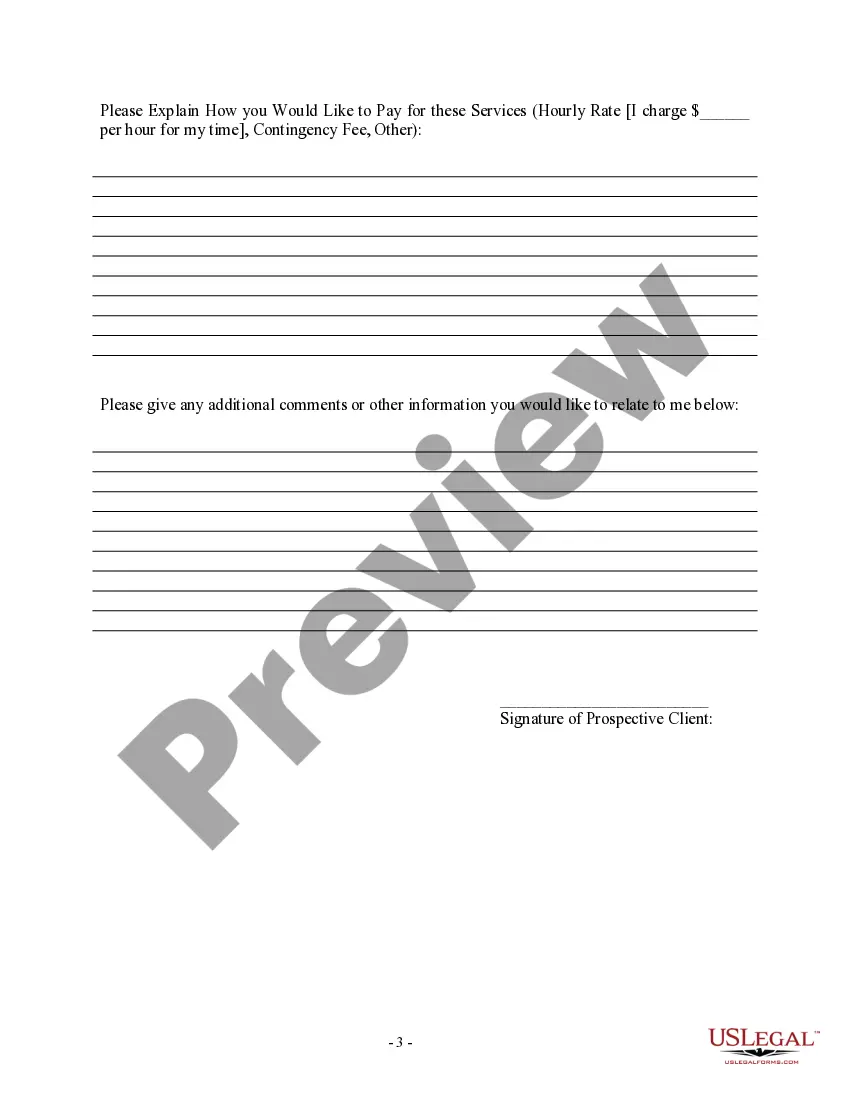

How to fill out New Client Questionnaire?

US Legal Forms - one of the greatest libraries of authorized forms in the USA - provides an array of authorized document web templates you may download or printing. Using the website, you may get 1000s of forms for company and person purposes, categorized by categories, claims, or key phrases.You can find the most recent types of forms much like the Minnesota New Client Questionnaire in seconds.

If you already have a registration, log in and download Minnesota New Client Questionnaire through the US Legal Forms catalogue. The Acquire key will appear on every form you view. You have access to all in the past acquired forms from the My Forms tab of the profile.

If you wish to use US Legal Forms initially, here are simple guidelines to help you get began:

- Make sure you have selected the proper form to your area/county. Click the Review key to analyze the form`s content. Read the form description to ensure that you have selected the appropriate form.

- If the form doesn`t suit your specifications, make use of the Search area near the top of the display to get the one who does.

- When you are happy with the form, verify your choice by visiting the Buy now key. Then, choose the rates program you favor and supply your credentials to sign up to have an profile.

- Procedure the financial transaction. Make use of your bank card or PayPal profile to finish the financial transaction.

- Find the file format and download the form on your gadget.

- Make adjustments. Fill up, edit and printing and indication the acquired Minnesota New Client Questionnaire.

Each and every format you added to your money does not have an expiration time which is your own property for a long time. So, if you wish to download or printing another version, just check out the My Forms area and then click on the form you will need.

Get access to the Minnesota New Client Questionnaire with US Legal Forms, by far the most substantial catalogue of authorized document web templates. Use 1000s of expert and state-specific web templates that fulfill your business or person requires and specifications.

Form popularity

FAQ

Report New Hires (Be sure that boxes 8 and 10 are completed with the employer's information.) Fax the W-4 to 1-800-692-4473, or mail a copy to the Minnesota New Hire Reporting Center, P. O. Box 64212, St. Paul, MN 55164-0212. Other reporting methods include printed lists or new hire reporting forms.

Legal requirements Employers must report newly hired and rehired employees to a state directory, whether the employees owe child support or not. This requirement is authorized under Minnesota Statutes, section 256.998 and the federal Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA).

New hire forms checklist Form I-9. W-4. State new hire tax forms. New hire reporting. Offer letter. Employment agreement. Employee handbook acknowledgment. Direct deposit authorization.

New Hire Paperwork and Compliance for Minnesota W-4. W-4MN. Wage Theft Notice. Notice of Review of Personnel Records. Notice of Drug and Alcohol Policy. I-9. New Hire Reporting. W-2.

As a new employer, you must apply for a Minnesota ID number and register for a withholding tax account before you withhold tax from your employees' wages. We can assess a $100 penalty if you fail to do so. To register for a Minnesota tax ID number, apply online or call 651-282-5225 or 1-800-657-3605.