This is a checklist of considerations for a mergers and acquisitions transaction term sheet. It is a point-by-point reminder to consider whether it is a stock or asset sale, points on closing and warranties, covenants, indemnification, and other areas.

Minnesota M&A Transaction Term Sheet Guideline

Description

How to fill out M&A Transaction Term Sheet Guideline?

Choosing the right authorized record format can be quite a have difficulties. Needless to say, there are tons of themes available on the Internet, but how do you find the authorized type you require? Use the US Legal Forms site. The support gives 1000s of themes, such as the Minnesota M&A Transaction Term Sheet Guideline, which can be used for business and personal requires. All of the kinds are checked out by specialists and meet federal and state specifications.

Should you be previously listed, log in in your profile and then click the Obtain key to find the Minnesota M&A Transaction Term Sheet Guideline. Use your profile to check with the authorized kinds you might have ordered in the past. Proceed to the My Forms tab of your respective profile and get an additional version of the record you require.

Should you be a whole new consumer of US Legal Forms, listed here are simple instructions that you should adhere to:

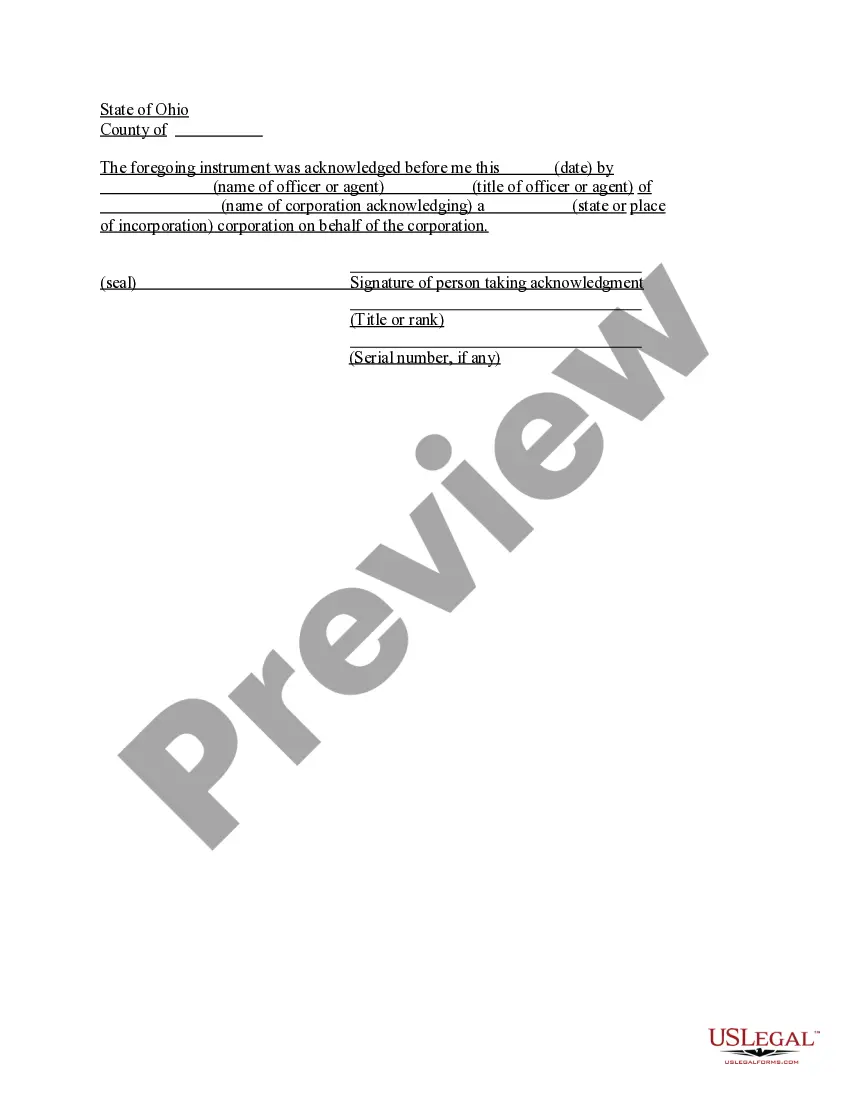

- Initial, make certain you have selected the correct type to your town/county. You can check out the form while using Preview key and browse the form information to guarantee it is the best for you.

- In case the type fails to meet your preferences, take advantage of the Seach discipline to get the correct type.

- When you are sure that the form is suitable, go through the Get now key to find the type.

- Pick the pricing prepare you desire and enter in the essential information and facts. Build your profile and purchase the order using your PayPal profile or Visa or Mastercard.

- Select the submit structure and download the authorized record format in your gadget.

- Complete, edit and printing and sign the attained Minnesota M&A Transaction Term Sheet Guideline.

US Legal Forms is definitely the biggest collection of authorized kinds where you can discover various record themes. Use the service to download expertly-created documents that adhere to state specifications.

Form popularity

FAQ

Minn. Minnesota, which gets its name from the Dakota language, has been inhabited by various indigenous peoples since the Woodland period of the 11th century BCE.

Minneapolis is the largest city in the U.S. state of Minnesota. It lies on both banks of the Mississippi River, just north of the river's confluence with the Minnesota River, and adjoins Saint Paul, the state's capital. Known as the Twin Cities, these two form the core of Minneapolis-St.

Sl. No.State/ UTAbbreviation15.MaharashtraMH16.ManipurMN17.MeghalayaML18.MizoramMZ33 more rows

Diversity. From rolling hills to flat plains, big cities to small towns, and people from all walks of life, Minnesota is incredibly diverse. Numerous festivals and attractions celebrate the many cultures found here, including Native Americans, Europeans and the largest Hmong population in the country.

The state is part of the U.S. region known as the Upper Midwest and part of North America's Great Lakes region. It shares a Lake Superior water border with Michigan and a land and water border with Wisconsin to the east.

Minnesota is one of the north-central states. It is bounded by the Canadian provinces of Manitoba and Ontario to the north, by Lake Superior and the state of Wisconsin to the east, and by the states of Iowa to the south and South Dakota and North Dakota to the west.