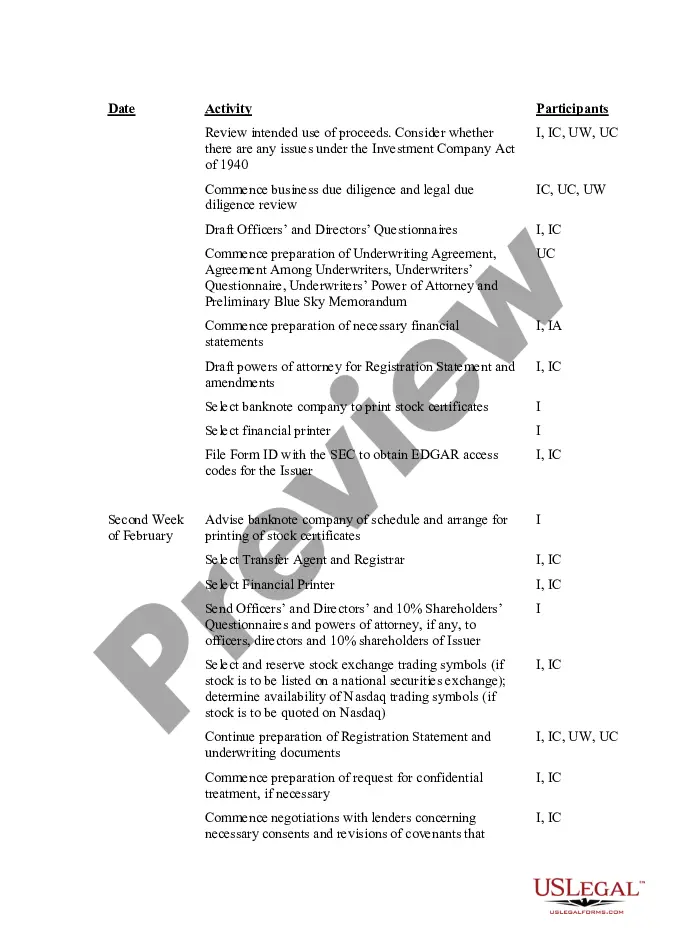

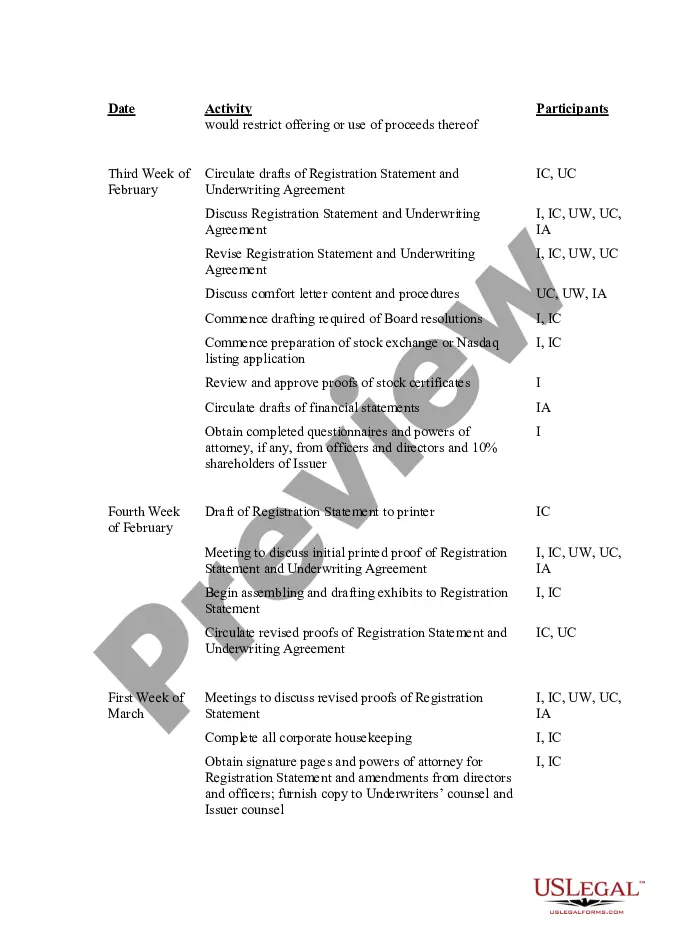

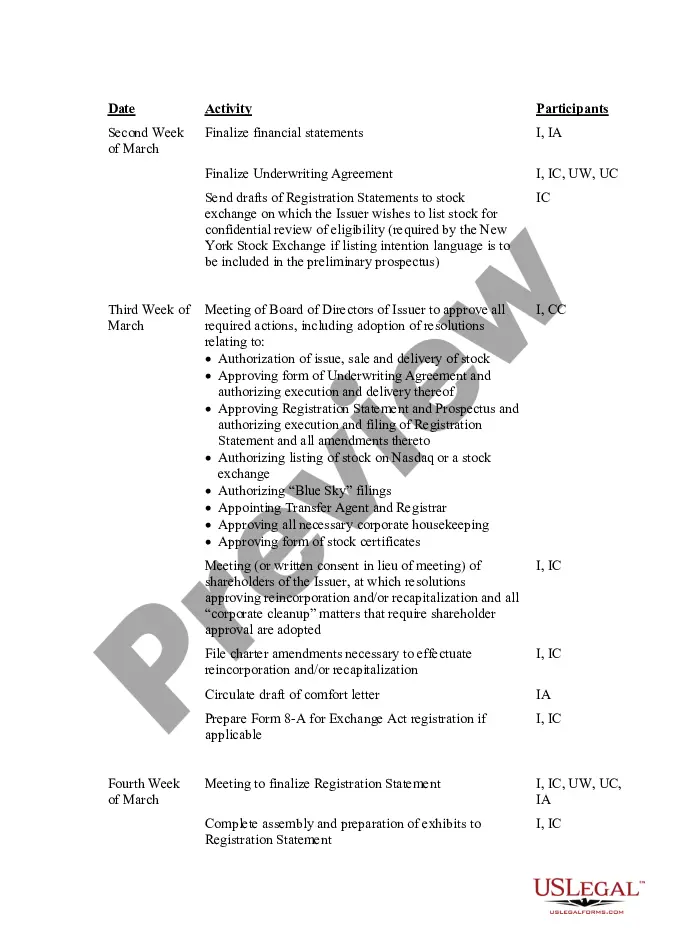

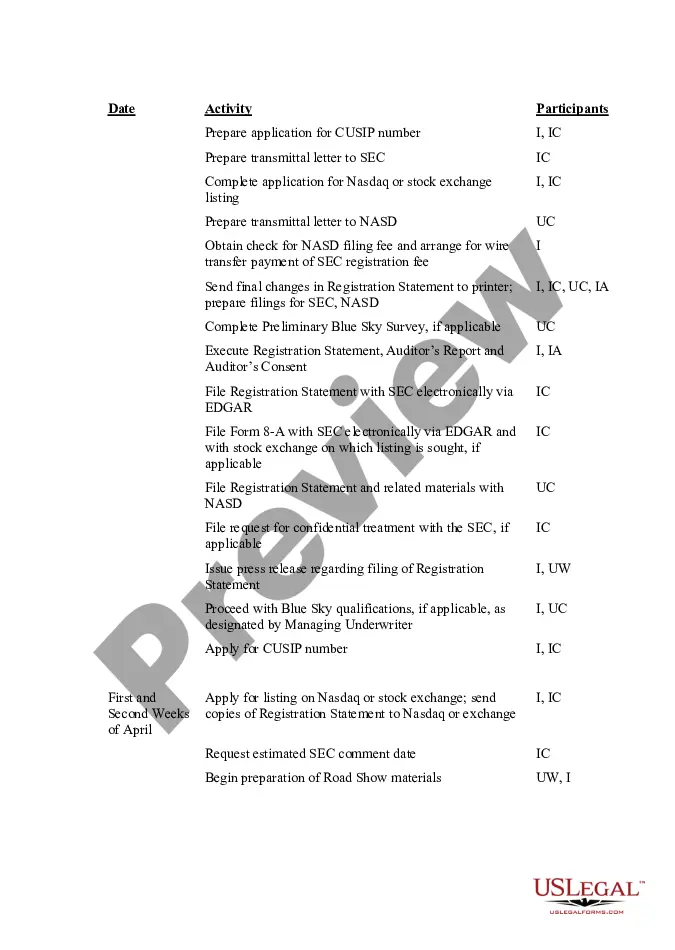

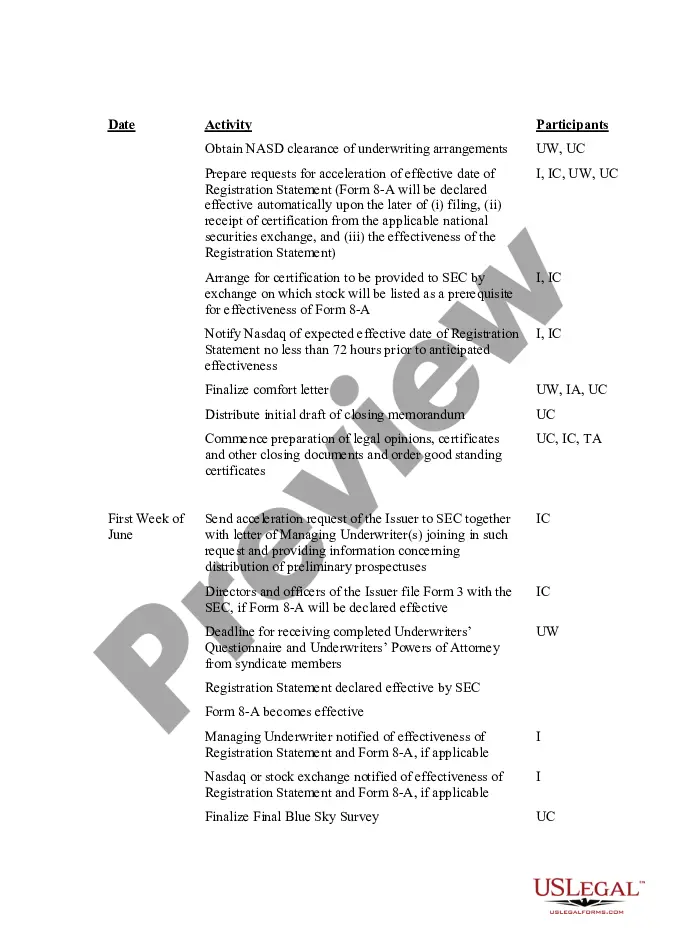

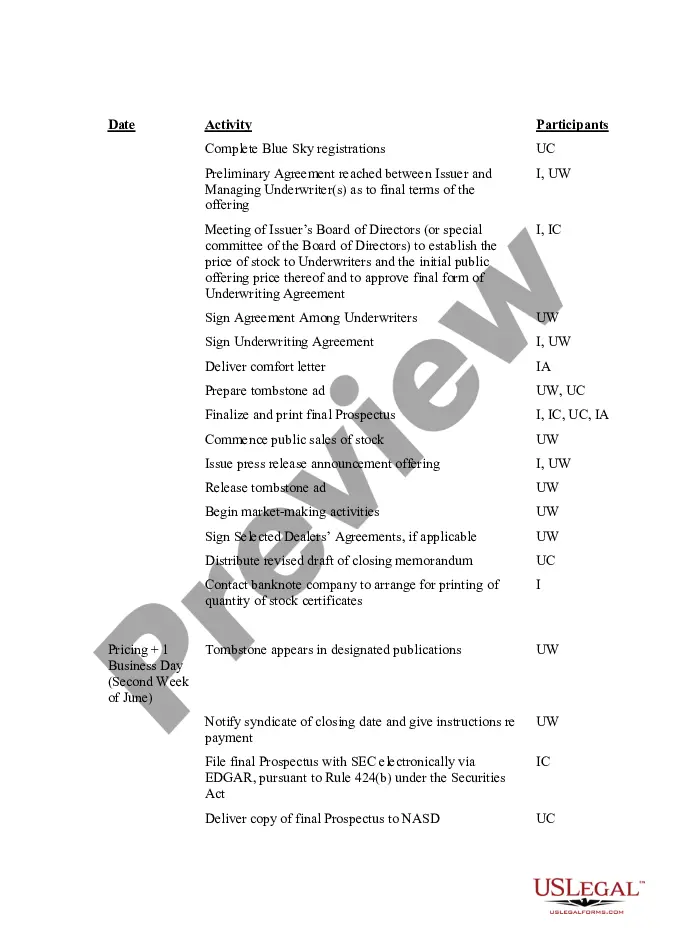

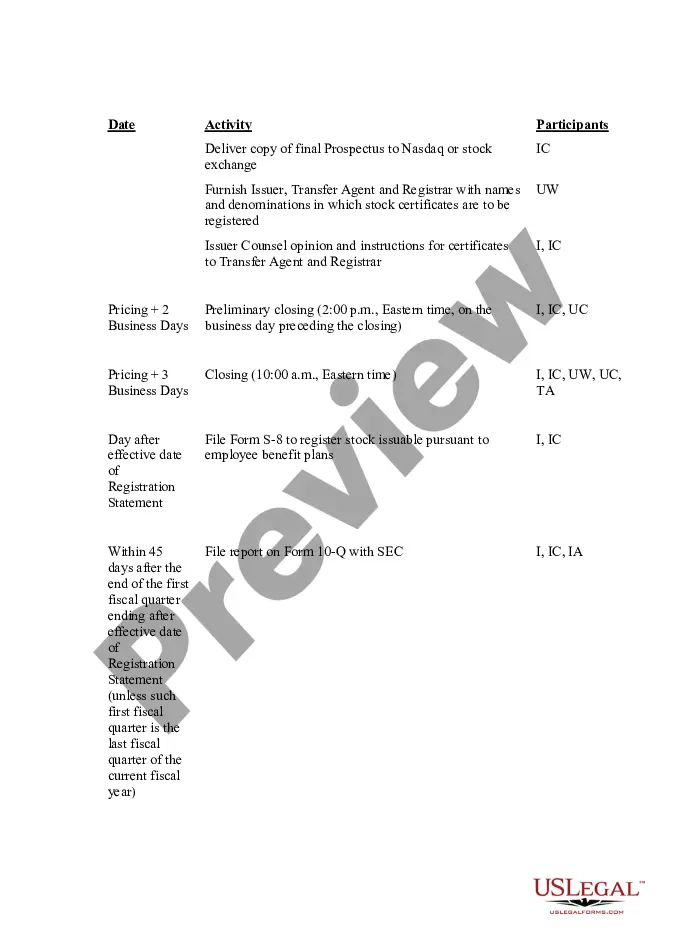

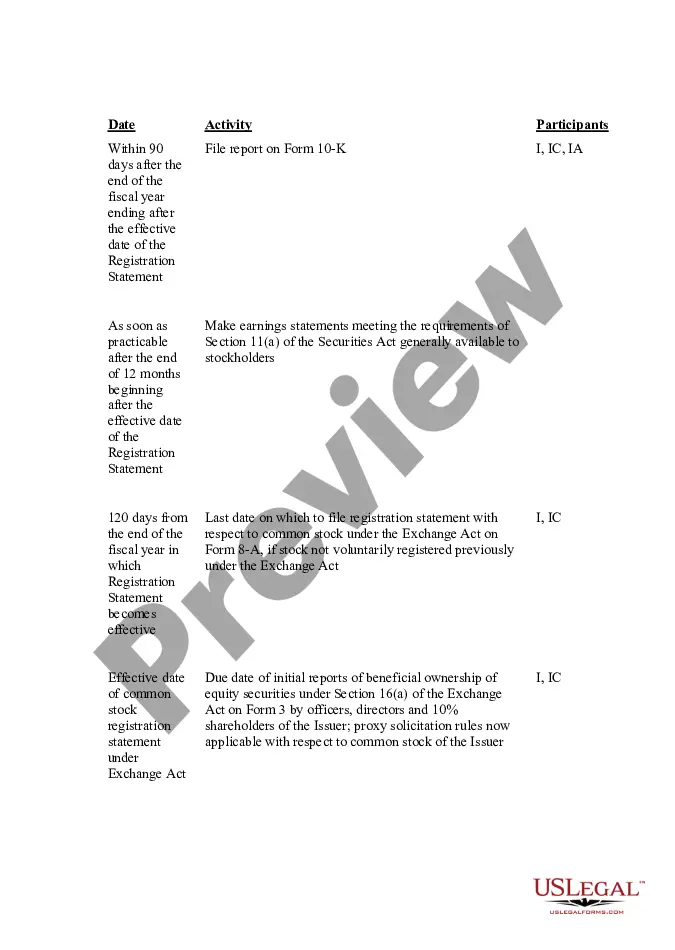

This IPO Time and Responsibility Schedule details, week by week, the tasks to be performed in the months leading up to the IPO. It lists the activities to be undertaken and the participants assigned to each task.

Minnesota IPO Time and Responsibility Schedule: A Comprehensive Guide The Minnesota IPO Time and Responsibility Schedule is a vital document that outlines the detailed timeline and associated responsibilities involved in the Initial Public Offering (IPO) process in the state of Minnesota. This schedule serves as a valuable resource for companies seeking to go public, ensuring that they comply with regulatory requirements and properly execute all necessary steps leading up to the IPO. The Minnesota IPO Time and Responsibility Schedule encompasses various crucial stages, each with its associated timelines and obligations. These stages include but are not limited to: 1. pre-IPO Planning: This phase involves extensive planning and preparation before initiating the IPO process. It includes assessing the company's readiness, completing necessary financial audits, and evaluating regulatory compliance. Companies need to carefully set financial goals and establish a comprehensive roadmap to meet IPO requirements. 2. Drafting the Registration Statement: Once the planning phase is complete, the registration statement is compiled. This statement encompasses vital information about the company's financial health, operations, and corporate governance. Detailed financials, risk factors, and management profiles are included to provide potential investors with transparency and facilitate informed decision-making. 3. SEC Review and Filing: After drafting the registration statement, it must be submitted to the U.S. Securities and Exchange Commission (SEC) for review and approval. The timeline may vary based on SEC workload and the complexity of the offering. The document will undergo meticulous scrutiny to ensure compliance with federal securities laws. 4. Roadshow Preparation: Simultaneously as the SEC review takes place, companies must prepare for the roadshow. The roadshow involves marketing and pitching the company's IPO to potential investors. It includes creating presentations, refining pitch materials, and organizing investor meetings. Well-coordinated logistics are crucial to maximize investment interest. 5. Roadshow Implementation: This phase involves actually conducting the roadshow, typically lasting 1-2 weeks. Company representatives travel to various cities, meeting potential investors and delivering persuasive presentations. Timely execution is vital as it sets the tone for investor confidence and market perception. 6. Pricing and IPO Execution: After the roadshow, the company, in collaboration with underwriters, determines the offering price for its shares. This decision considers market demand, financial projections, and valuation, all within the framework of regulatory guidelines. Once the price is established, the shares are sold to investors, marking the IPO execution. 7. Post-IPO Compliance: Following the successful IPO, companies must fulfill their ongoing compliance obligations, which include timely financial reporting, shareholder disclosures, and adherence to regulatory guidelines. Post-IPO compliance ensures transparency, accountability, and sustained investor confidence. Types of Minnesota IPO Time and Responsibility Schedule: 1. Technology Sector IPO Schedule: Specifically tailored to companies operating in the technology sector, this schedule takes into account industry-specific challenges and opportunities. It provides additional guidelines that companies within this sector must follow to streamline the IPO process. 2. Medical and Healthcare Sector IPO Schedule: Designed for companies in the medical and healthcare sector, this schedule addresses the unique regulatory requirements and specialized disclosures necessary for companies operating within this space. 3. Consumer Goods Sector IPO Schedule: Companies in the consumer goods sector may find specific guidelines in this schedule, focusing on aspects related to customer reach, brand prominence, and market dynamics pertinent to this industry. The Minnesota IPO Time and Responsibility Schedule, whether it is sector-specific or general, serves as a roadmap for companies throughout the complex IPO journey. By adhering to these timelines and fulfilling associated responsibilities, companies can navigate the IPO process efficiently, minimizing risks and maximizing opportunities for success.Minnesota IPO Time and Responsibility Schedule: A Comprehensive Guide The Minnesota IPO Time and Responsibility Schedule is a vital document that outlines the detailed timeline and associated responsibilities involved in the Initial Public Offering (IPO) process in the state of Minnesota. This schedule serves as a valuable resource for companies seeking to go public, ensuring that they comply with regulatory requirements and properly execute all necessary steps leading up to the IPO. The Minnesota IPO Time and Responsibility Schedule encompasses various crucial stages, each with its associated timelines and obligations. These stages include but are not limited to: 1. pre-IPO Planning: This phase involves extensive planning and preparation before initiating the IPO process. It includes assessing the company's readiness, completing necessary financial audits, and evaluating regulatory compliance. Companies need to carefully set financial goals and establish a comprehensive roadmap to meet IPO requirements. 2. Drafting the Registration Statement: Once the planning phase is complete, the registration statement is compiled. This statement encompasses vital information about the company's financial health, operations, and corporate governance. Detailed financials, risk factors, and management profiles are included to provide potential investors with transparency and facilitate informed decision-making. 3. SEC Review and Filing: After drafting the registration statement, it must be submitted to the U.S. Securities and Exchange Commission (SEC) for review and approval. The timeline may vary based on SEC workload and the complexity of the offering. The document will undergo meticulous scrutiny to ensure compliance with federal securities laws. 4. Roadshow Preparation: Simultaneously as the SEC review takes place, companies must prepare for the roadshow. The roadshow involves marketing and pitching the company's IPO to potential investors. It includes creating presentations, refining pitch materials, and organizing investor meetings. Well-coordinated logistics are crucial to maximize investment interest. 5. Roadshow Implementation: This phase involves actually conducting the roadshow, typically lasting 1-2 weeks. Company representatives travel to various cities, meeting potential investors and delivering persuasive presentations. Timely execution is vital as it sets the tone for investor confidence and market perception. 6. Pricing and IPO Execution: After the roadshow, the company, in collaboration with underwriters, determines the offering price for its shares. This decision considers market demand, financial projections, and valuation, all within the framework of regulatory guidelines. Once the price is established, the shares are sold to investors, marking the IPO execution. 7. Post-IPO Compliance: Following the successful IPO, companies must fulfill their ongoing compliance obligations, which include timely financial reporting, shareholder disclosures, and adherence to regulatory guidelines. Post-IPO compliance ensures transparency, accountability, and sustained investor confidence. Types of Minnesota IPO Time and Responsibility Schedule: 1. Technology Sector IPO Schedule: Specifically tailored to companies operating in the technology sector, this schedule takes into account industry-specific challenges and opportunities. It provides additional guidelines that companies within this sector must follow to streamline the IPO process. 2. Medical and Healthcare Sector IPO Schedule: Designed for companies in the medical and healthcare sector, this schedule addresses the unique regulatory requirements and specialized disclosures necessary for companies operating within this space. 3. Consumer Goods Sector IPO Schedule: Companies in the consumer goods sector may find specific guidelines in this schedule, focusing on aspects related to customer reach, brand prominence, and market dynamics pertinent to this industry. The Minnesota IPO Time and Responsibility Schedule, whether it is sector-specific or general, serves as a roadmap for companies throughout the complex IPO journey. By adhering to these timelines and fulfilling associated responsibilities, companies can navigate the IPO process efficiently, minimizing risks and maximizing opportunities for success.