This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

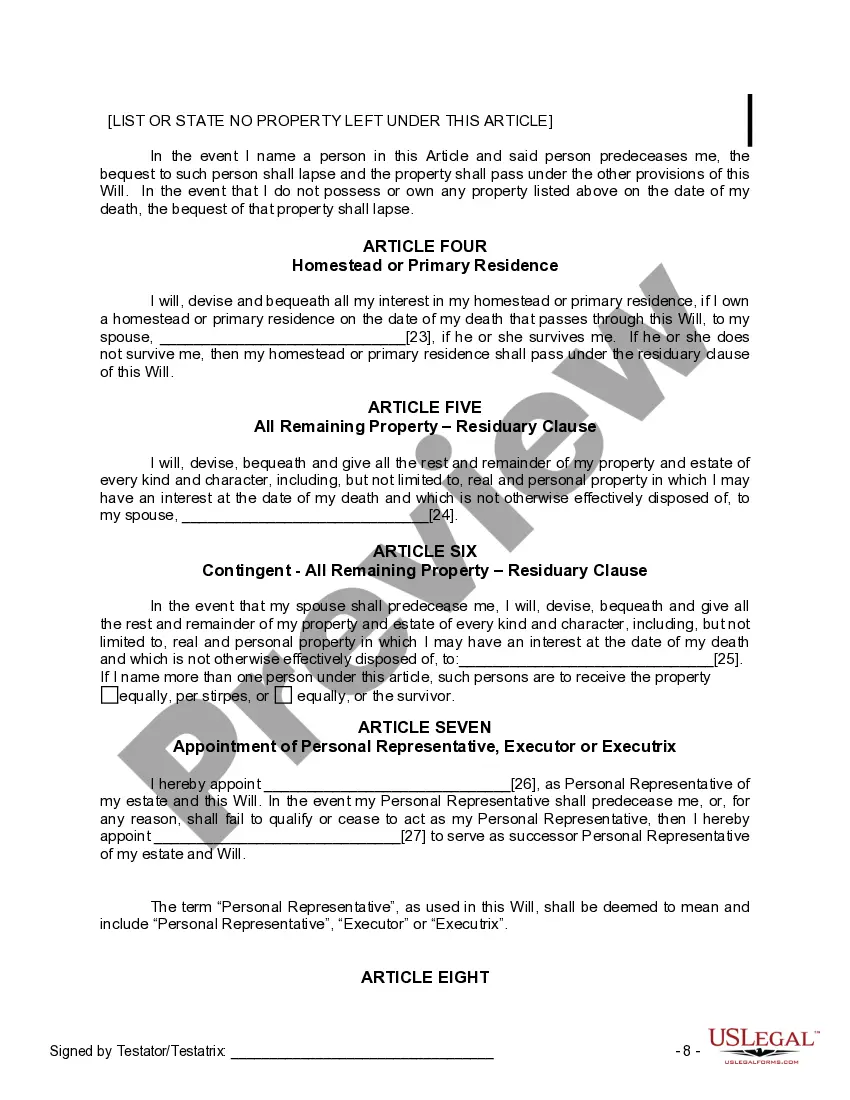

Minnesota Last Will and Testament for a Married Person with No Children

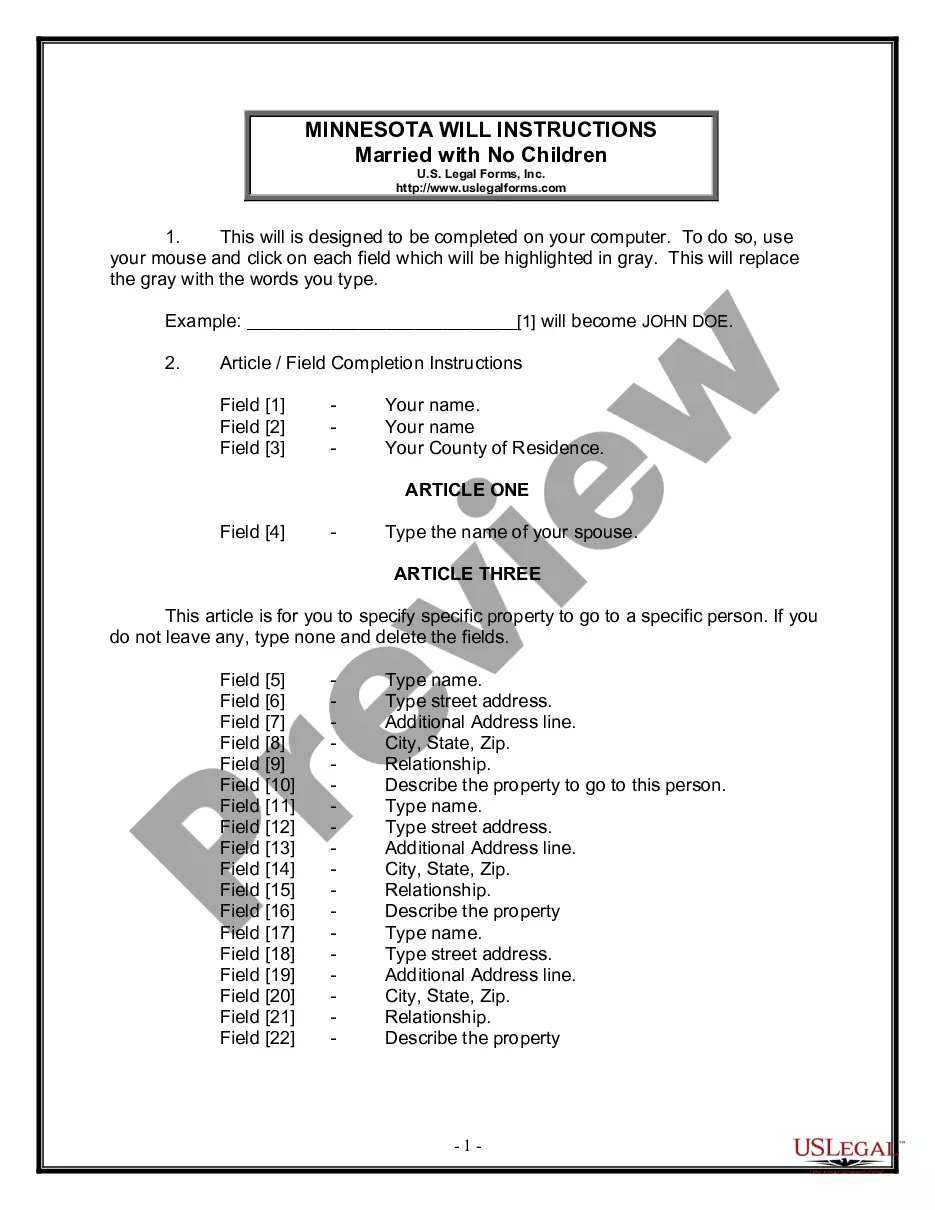

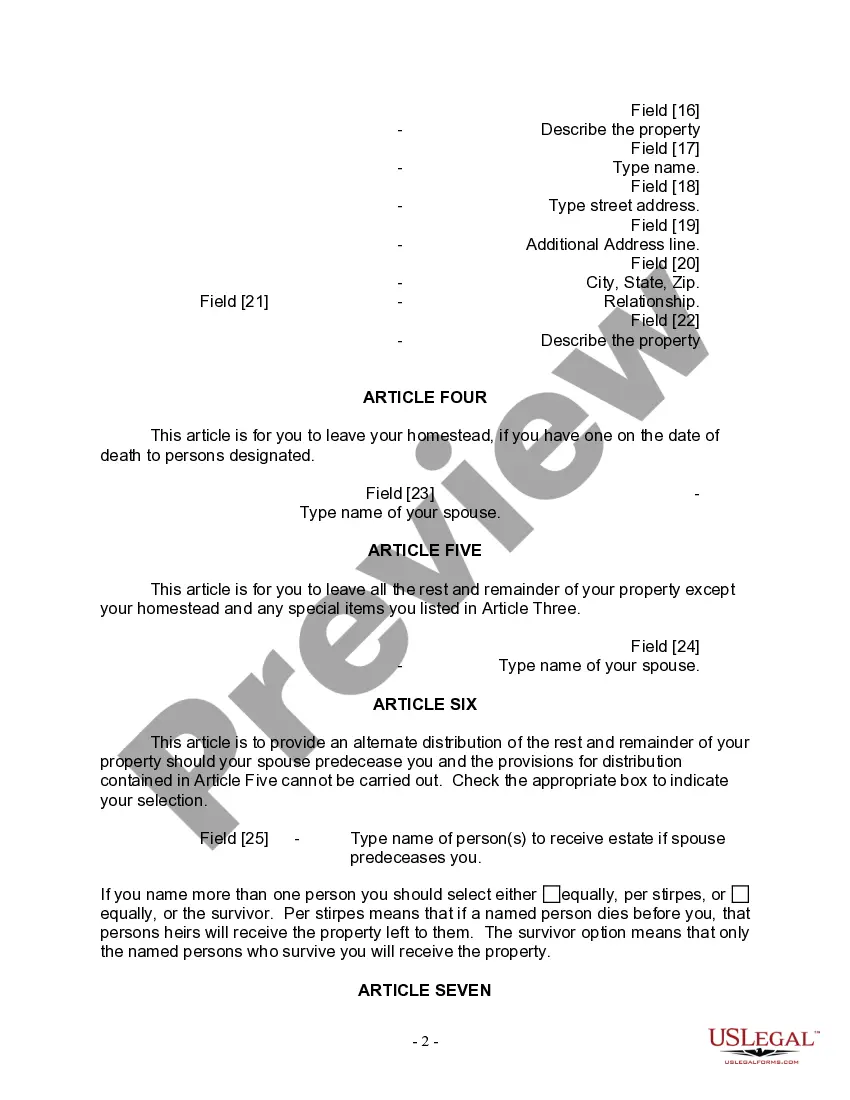

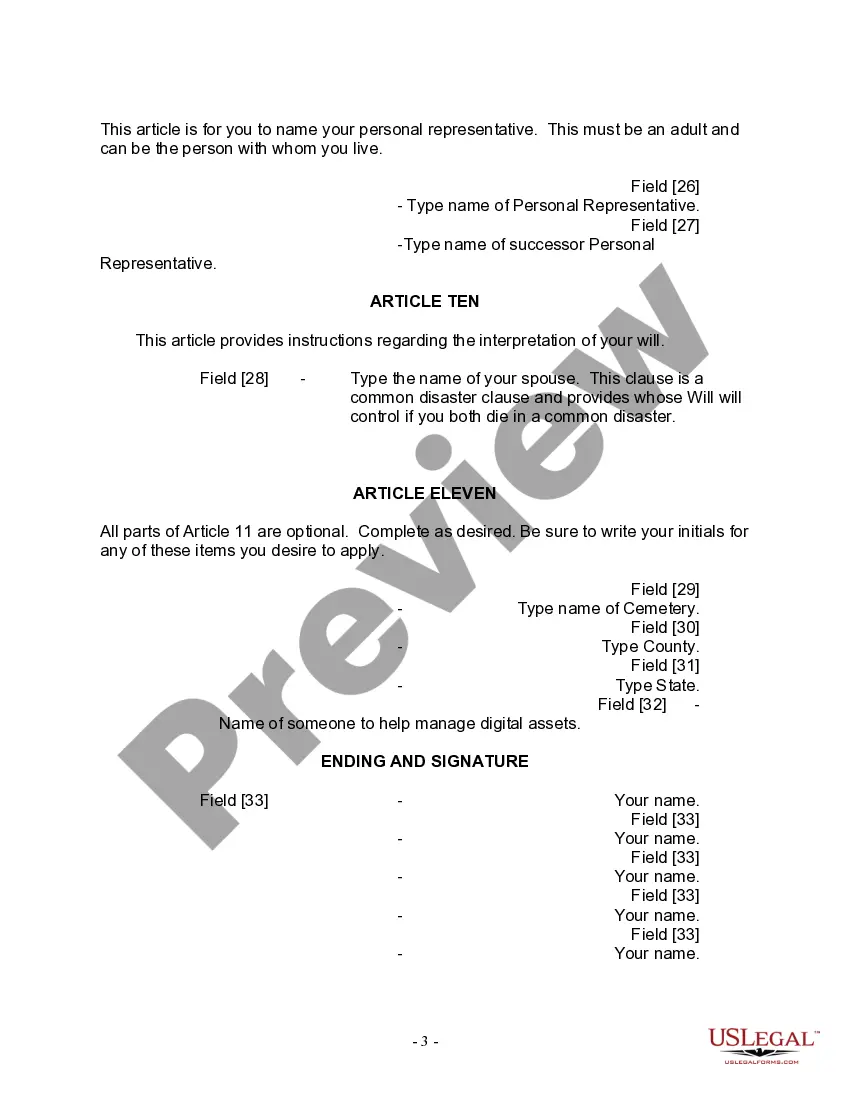

Description Last Testament Instructions

How to fill out Legal Last Instructions?

Have any template from 85,000 legal documents such as Minnesota Legal Last Will and Testament Form for a Married Person with No Children on-line with US Legal Forms. Every template is prepared and updated by state-certified attorneys.

If you have already a subscription, log in. Once you are on the form’s page, click on the Download button and go to My Forms to get access to it.

In case you have not subscribed yet, follow the tips listed below:

- Check the state-specific requirements for the Minnesota Legal Last Will and Testament Form for a Married Person with No Children you need to use.

- Read through description and preview the template.

- Once you are sure the template is what you need, simply click Buy Now.

- Choose a subscription plan that works well for your budget.

- Create a personal account.

- Pay out in just one of two suitable ways: by card or via PayPal.

- Pick a format to download the document in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- When your reusable form is downloaded, print it out or save it to your gadget.

With US Legal Forms, you will always have immediate access to the proper downloadable sample. The platform will give you access to documents and divides them into groups to streamline your search. Use US Legal Forms to obtain your Minnesota Legal Last Will and Testament Form for a Married Person with No Children easy and fast.

Legal Last Testament Form popularity

Last Will Testament Document Other Form Names

Last Will Form FAQ

Download them from IRS.gov. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

If you're planning to file electronically through e-file, you won't be able to e-file your state taxes before you e-file your federal taxes. Generally, e-file programs require you to file your federal return first, then file any state returns.

You do not need to send copies of your state returns with your Federal return. Many states require that you send a copy of your Federal return with your state return. TT will usually print out the Federal return with the state return if this is needed. Yes, you can staple your W-2 to your return.

You can file your Minnesota Individual Income Tax return electronically or by mail.You may qualify for free electronic filing if your income is $72,000 or less.

Am I required to include my federal tax return with my state of Illinois return? Yes, you need to send a copy of your federal tax return with your state return.

These states are Alaska, Florida, Nevada, South Dakota, Texas, Wyoming and Washington. If you are a resident in any of these states, you can ignore the process of filing state income tax and focus solely on your federal return.

You would have to report the state income tax refund you received last year on your federal income tax return if you itemized your deductions on your federal return last year, and if you claimed a deduction for state and local income taxes.

Call 651-296-3781 or 1-800-652-9094 (toll-free) to have forms mailed to you.

Online Go to e-Services. Help for e-Services. By phone Call 1-800-570-3329 (toll-free) Note: Revenue's telephone file and pay system will be discontinued after April 20, 2021. Learn more at Options to File and Pay.