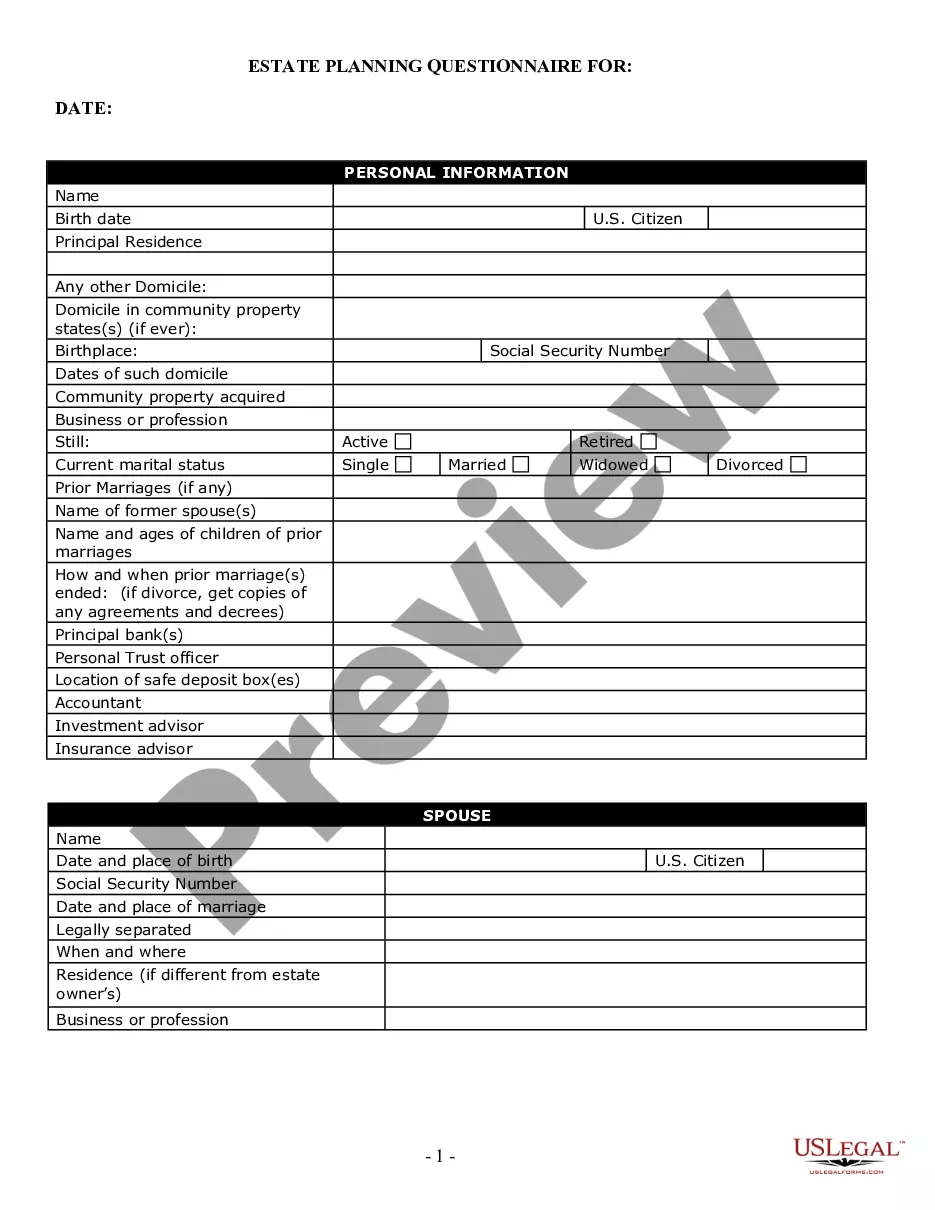

Minnesota Estate Planning Questionnaire and Worksheets

Description

How to fill out Minnesota Estate Planning Questionnaire And Worksheets?

Get any form from 85,000 legal documents including Minnesota Estate Planning Questionnaire and Worksheets on-line with US Legal Forms. Every template is prepared and updated by state-licensed legal professionals.

If you have a subscription, log in. Once you are on the form’s page, click on the Download button and go to My Forms to get access to it.

In case you haven’t subscribed yet, follow the tips below:

- Check the state-specific requirements for the Minnesota Estate Planning Questionnaire and Worksheets you would like to use.

- Read description and preview the template.

- As soon as you’re confident the sample is what you need, click on Buy Now.

- Select a subscription plan that really works for your budget.

- Create a personal account.

- Pay in just one of two suitable ways: by credit card or via PayPal.

- Pick a format to download the document in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- After your reusable template is downloaded, print it out or save it to your device.

With US Legal Forms, you will always have immediate access to the right downloadable sample. The service will give you access to forms and divides them into categories to simplify your search. Use US Legal Forms to obtain your Minnesota Estate Planning Questionnaire and Worksheets fast and easy.

Form popularity

FAQ

There are four main elements of an estate plan; these include a will, a living will and healthcare power of attorney, a financial power of attorney, and a trust.

A Last Will and Testament. When it comes to estate planning, having a last will and testament is likely the first thing that will come to mind. A Document Granting Power of Attorney. An Advance Medical Directive. Revocable Living Trust.

A Last Will and Testament. When it comes to estate planning, having a last will and testament is likely the first thing that will come to mind. A Document Granting Power of Attorney. An Advance Medical Directive. Revocable Living Trust.

More Than a Last Will. Itemize Your Inventory. Follow with Non-Physical Assets. Assemble a List of Debts. Make a Memberships List. Make Copies of Your Lists. Review Your Retirement Account. Update Your Insurance.

Creating an estate plan is a lot like getting into better shape. Step 1: Sign a will. Step 2: Name beneficiaries. Step 3: Dodge estate taxes. Step 4: Leave a letter. Step 5: Draw up a durable power of attorney. Step 6: Create an advance health care directive.

Quicken WillMaker & Trust by Nolo, is the best-selling gold standard for do-it-yourself estate planning software. Just download the software to your computer, answer questions about your family and your property, and create an entire estate plan for yourself and all of your family members.

Liquidity. This refers to assets that can be easily converted into cash, with minimum impact on the price. Sentiment. These are assets that have sentimental value, like personal properties and vacation homes. Tax Planning. Taxes come into play in estate planning as well, adding complications and expenses.

Estate planning is all about protecting your loved ones, which means in part giving them protection from the Internal Revenue Service (IRS). Essential to estate planning is transferring assets to heirs with an eye toward creating the smallest possible tax burden for them.

Proposal, directives, power of attorney, trusts.