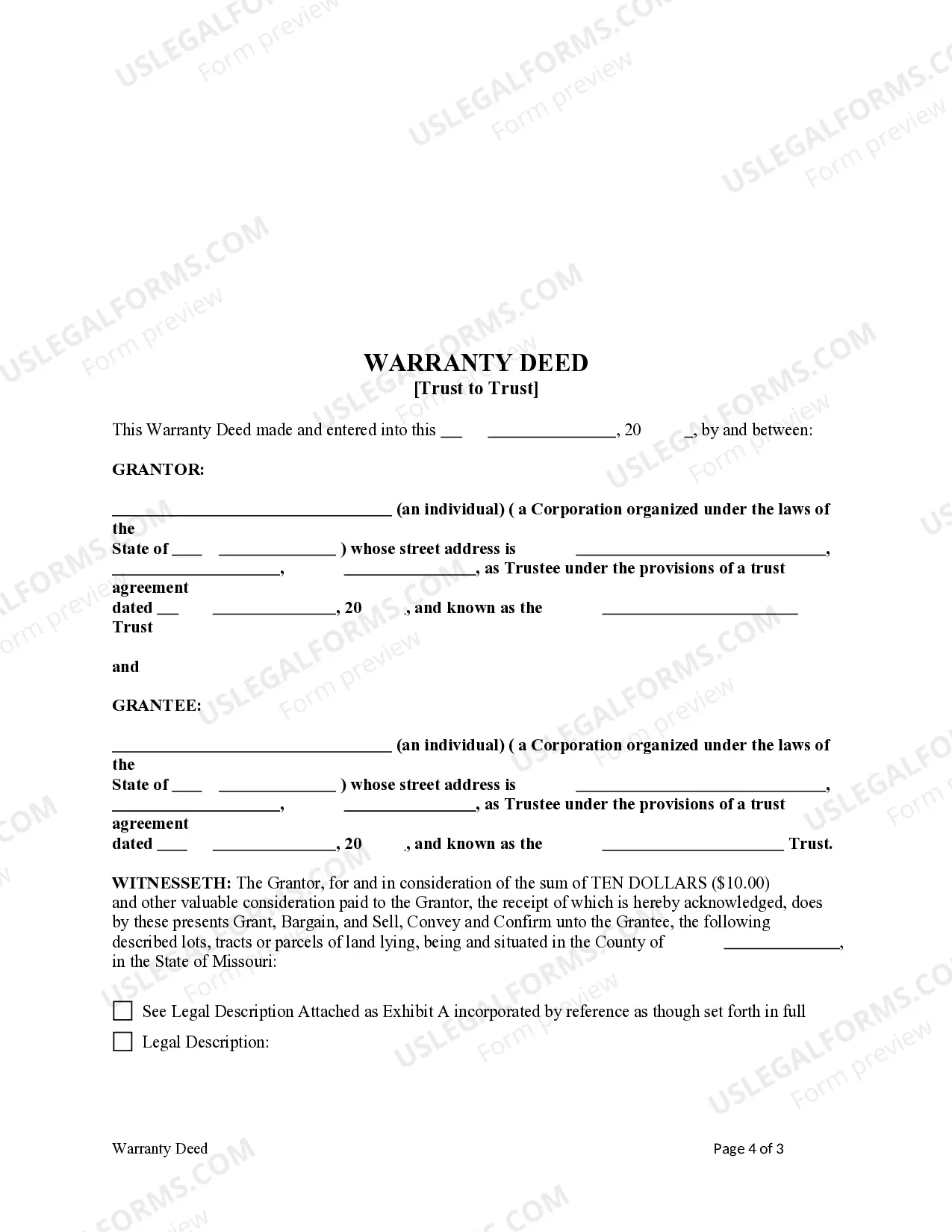

This form is a Warranty Deed where the Grantor is a Trust and the Grantee is also a Trust. Grantor conveys and warrants the described property to Trustee of the Grantee. This deed complies with all state statutory laws.

Missouri Warranty Deed - Trust to Trust

Description Warranty Deed In Trust

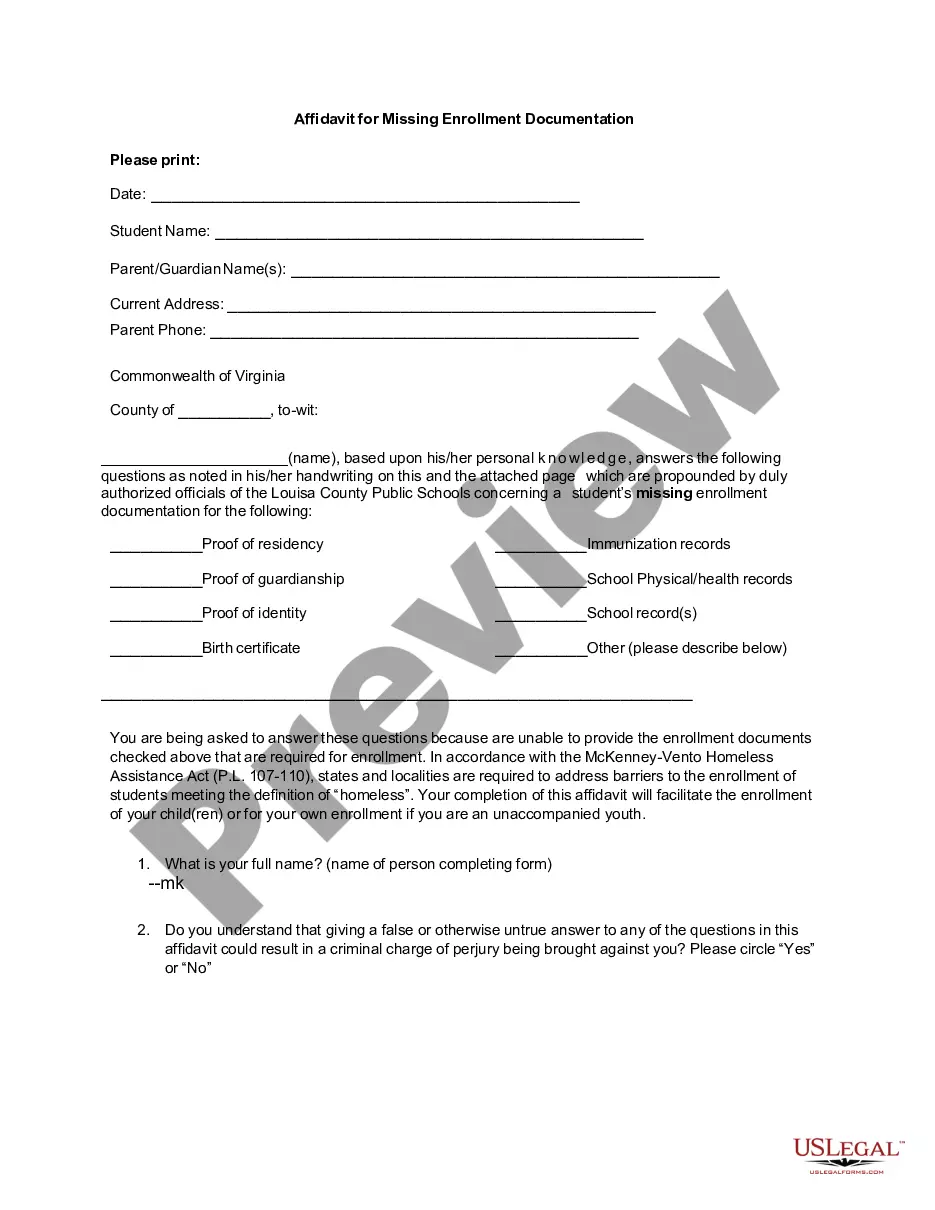

How to fill out Missouri Warranty Deed - Trust To Trust?

Get any form from 85,000 legal documents such as Missouri Warranty Deed - Trust to Trust on-line with US Legal Forms. Every template is drafted and updated by state-certified legal professionals.

If you have a subscription, log in. When you are on the form’s page, click the Download button and go to My Forms to get access to it.

If you haven’t subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Missouri Warranty Deed - Trust to Trust you want to use.

- Read description and preview the sample.

- Once you are sure the template is what you need, simply click Buy Now.

- Select a subscription plan that works for your budget.

- Create a personal account.

- Pay out in one of two appropriate ways: by card or via PayPal.

- Choose a format to download the file in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- Once your reusable form is downloaded, print it out or save it to your gadget.

With US Legal Forms, you’ll always have quick access to the appropriate downloadable template. The platform will give you access to forms and divides them into groups to streamline your search. Use US Legal Forms to get your Missouri Warranty Deed - Trust to Trust easy and fast.

Form popularity

FAQ

How To Establish A Trust. You will need to retain an estate attorney to draft and execute your trust document. For a simple revocable or irrevocable trust, it may cost anywhere from $2,000 $5,000.

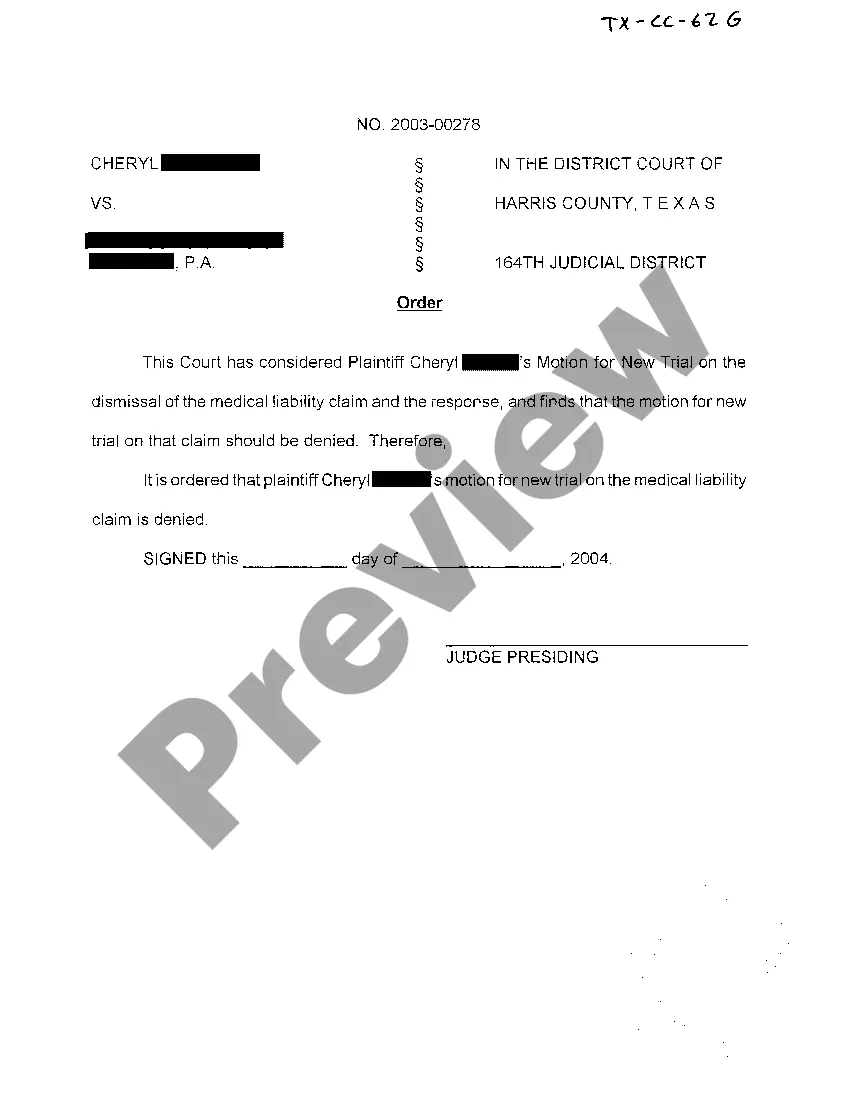

Yes, there are key differences between the two. With a deed, you transfer the ownership of the property to one party. In contrast, a deed of trust does not mean the holder owns the property. In an arrangement involving a deed of trust, the borrower signs a contract with the lender with details regarding the loan.

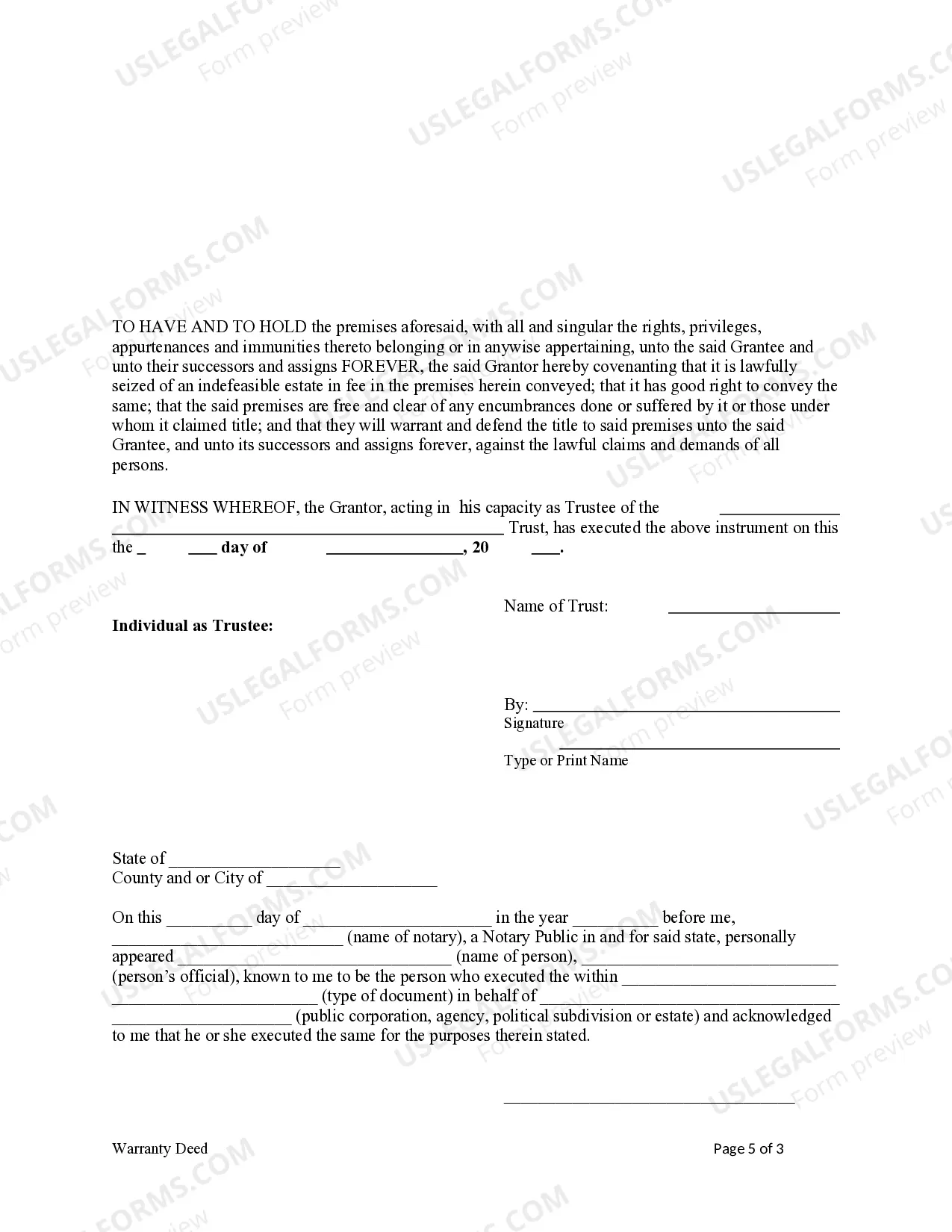

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

The advantages of placing your house in a trust include avoiding probate court, saving on estate taxes and possibly protecting your home from certain creditors. Disadvantages include the cost of creating the trust and the paperwork.

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).

A trustee deed offers no such warranties about the title.

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.