This form is a Warranty Deed where the Grantor is a limited liability company and the Grantee is a limited liability company. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Missouri Warranty Deed from an Limited Liability Company to a Limited Liability Company

Description Missouri Special Warranty Deed Form

How to fill out Missouri Warranty Deed From An Limited Liability Company To A Limited Liability Company?

Have any template from 85,000 legal documents such as Missouri Warranty Deed from an Limited Liability Company to a Limited Liability Company online with US Legal Forms. Every template is prepared and updated by state-accredited attorneys.

If you have a subscription, log in. Once you are on the form’s page, click the Download button and go to My Forms to get access to it.

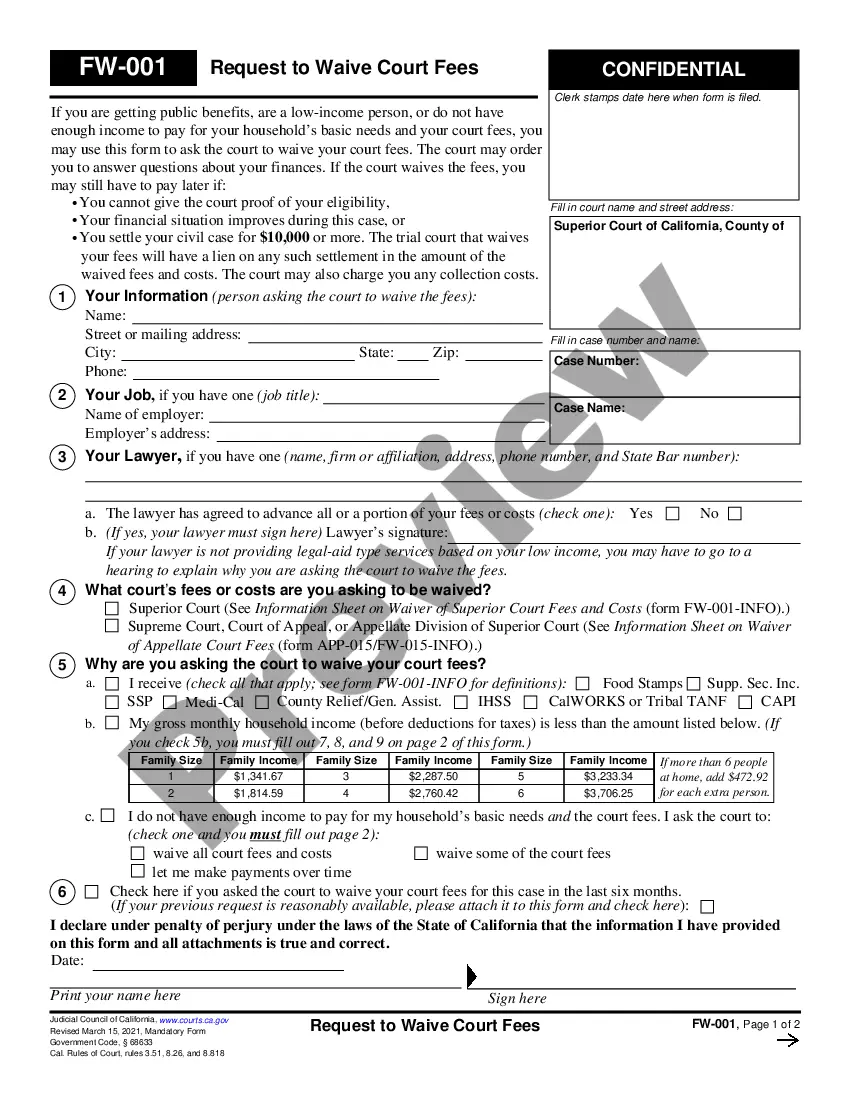

If you have not subscribed yet, follow the tips listed below:

- Check the state-specific requirements for the Missouri Warranty Deed from an Limited Liability Company to a Limited Liability Company you need to use.

- Look through description and preview the template.

- When you’re confident the template is what you need, just click Buy Now.

- Select a subscription plan that really works for your budget.

- Create a personal account.

- Pay in one of two appropriate ways: by card or via PayPal.

- Choose a format to download the document in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- Once your reusable template is downloaded, print it out or save it to your gadget.

With US Legal Forms, you’ll always have instant access to the right downloadable template. The service gives you access to documents and divides them into categories to simplify your search. Use US Legal Forms to obtain your Missouri Warranty Deed from an Limited Liability Company to a Limited Liability Company fast and easy.

Form popularity

FAQ

Step 1: Form an LLC or Corporation. You can't transfer your real estate property, or any other personal property, into your LLC or corporation until you've actually formed a new legal entity. Step 2: Complete a Quitclaim Deed. Step 3: Record Your Quitclaim Deed.

LLC ownership can be expressed in two ways: (1) by percentage; and (2) by membership units, which are similar to shares of stock in a corporation. In either case, ownership confers the right to vote and the right to share in profits.

A special warranty deed includes a covenant that the land is free of any encumbrances done or suffered by the grantor and that the grantor will defend the title against the claims and demands of those claiming by, through, or under the grantor.

Since LLCs are more like partnerships, you cannot force partnerships between people without their agreement. You can only transfer an LLC's ownership interests if all the other LLC owners agree, and even then, only if the state law allows for it.

You can't transfer your real estate property, or any other personal property, into your LLC or corporation until you've actually formed a new legal entity.Typically you'll need to register a business name and file the LLC or corporation paperwork with your secretary of state's office.

A Missouri (MO) quitclaim deed represents a means to transfer real property in Missouri. The name comes from actually quitting or transferring away your interest in a property. A quitclaim deed allows you to transfer whatever rights you may have in the property to another person or entity.

Missouri has no transfer tax.

A special warranty deed to real estate offers protection to the buyer through the seller's guarantee that the title has been free and clear of encumbrances during their ownership of the property. It does not guarantee clear title beyond their ownership.

No you can't. A single member LLC is just you as far as the IRS is concerned. You're just living in your own property. You can't rent your own house to yourself.